When it comes to smart investing, the most important rule is often the simplest: time in the market beats timing the market. The single most powerful decision you can make for your financial future is to start now, even with a small amount. This is all thanks to the incredible power of compounding interest.

In This Guide

- 1 Your First Steps in the World of Investing

- 2 Decoding Core Investment Strategies for New Investors

- 3 How to Build Your First Diversified Portfolio

- 4 Navigating Market Swings and Avoiding Rookie Mistakes

- 5 The Best Tools and Platforms for Beginner Investors

- 6 Frequently Asked Questions About Beginner Investing Strategies

- 6.1 1. How much money do I really need to start investing?

- 6.2 2. Is investing the same as gambling?

- 6.3 3. What is the single best investment for a beginner?

- 6.4 4. Should I wait for the market to crash before I invest?

- 6.5 5. What's the difference between a stock and a bond?

- 6.6 6. What are dividends?

- 6.7 7. Do I need a financial advisor to start investing?

- 6.8 8. How often should I check my investments?

- 6.9 9. What are ETFs and mutual funds?

- 6.10 10. What is a "robo-advisor"?

Your First Steps in the World of Investing

Dipping your toes into investing can feel intimidating, like learning a new language filled with strange terms and charts. But here’s the secret: you don't need a finance degree to succeed. The first step is a mental one—shifting your perspective from seeing investing as a high-stakes, complex game to viewing it as a practical tool for building long-term wealth.

Your greatest ally in this journey is time. The sooner you start, the longer your money has to work for you. It grows through a process called compounding, where your earnings start to generate their own earnings. It's a slow-building snowball effect that can turn small, consistent contributions into a significant nest egg over the years.

The Power of an Early Start: A Real-Life Example

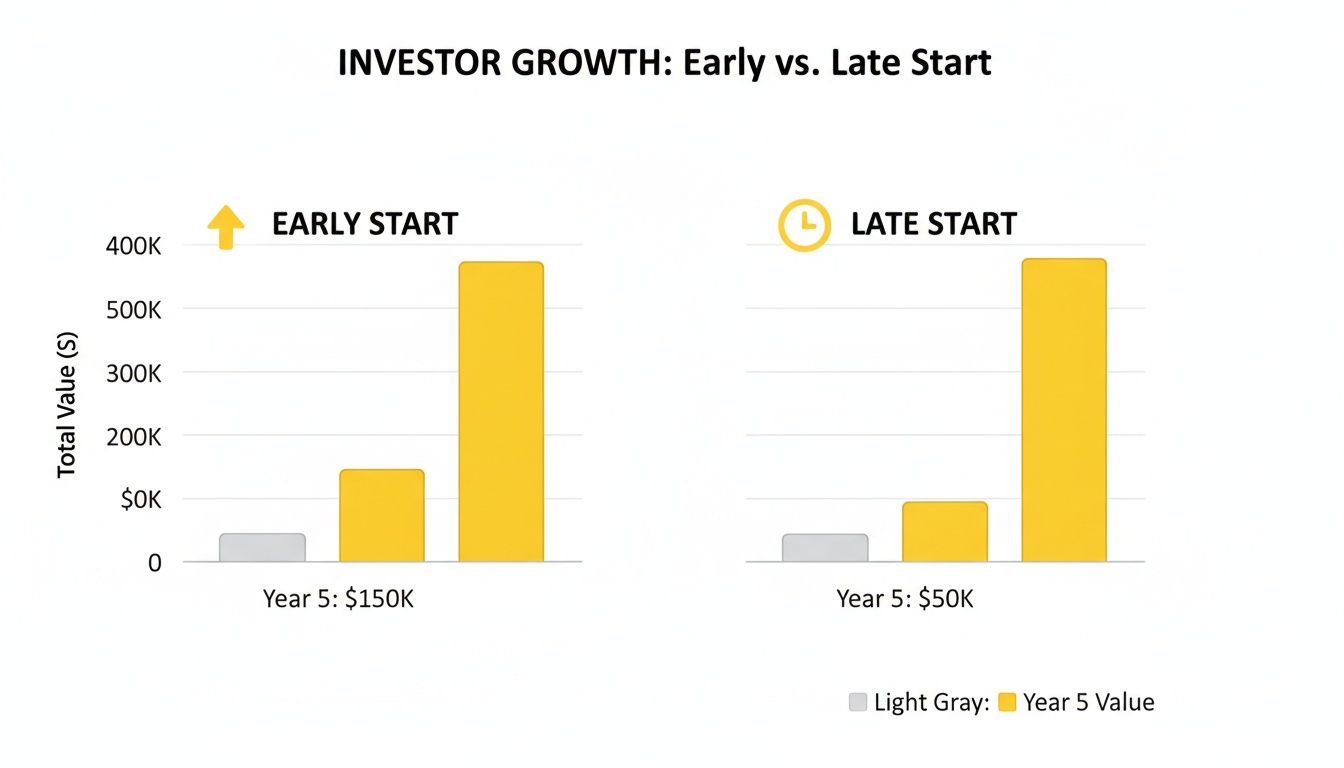

Let's look at a classic example to see compounding in action. Imagine two friends, Sarah and Ben, both want to save for retirement.

- Sarah starts investing $200 a month at age 25.

- Ben waits until he's 35 to start investing the exact same amount, $200 a month.

Assuming a standard 8% average annual return, that ten-year head start makes a staggering difference. By age 65, Sarah's portfolio would be worth over $700,000, while Ben's would be just over $300,000—even though Ben only invested $24,000 less of his own money over the years.

This chart drives the point home, showing just how much of a lead an early starter gets.

The takeaway is crystal clear. Sarah’s portfolio doesn't just grow bigger because she invested more over time; it grows exponentially larger because her initial investments had an extra decade to compound.

If you're ready to get the ball rolling, you can learn more about how to start investing for beginners in our in-depth guide. The core principle of building wealth is this: starting now is always the best move you can make.

Decoding Core Investment Strategies for New Investors

Alright, you're ready to put your money to work. Now comes the big question: which path should you take? Think of it like picking a vehicle for a road trip. There's no single "best" car, just the one that’s right for your journey, your comfort level, and your destination.

Let's explore three of the most common investment strategies that most people start with.

Growth Investing: The Sports Car

This strategy is all about speed and potential. Growth investing means buying into companies you believe will grow much faster than the overall market. We're often talking about innovative companies in high-potential sectors like technology or biotechnology.

These companies typically reinvest every dollar of profit back into the business to fuel that growth, so they rarely pay dividends. The game here is capital appreciation—you’re betting the company's value will skyrocket so you can sell for a significant profit down the line. It's an exciting ride, but like any high-performance machine, it comes with more volatility and risk. A real-life example would be investing in a company like Tesla in its early days, betting on the future of electric vehicles.

Value Investing: The Reliable Truck

Value investing is the antithesis of chasing hype. It's a strategy made famous by legends like Warren Buffett, and it's all about finding solid, established companies that the market is currently overlooking or underappreciating.

You’re essentially on a treasure hunt for hidden gems—stocks trading for less than their real, or "intrinsic," value. These are the sturdy, dependable trucks of the investing world. They aren't flashy, but they’re built on strong fundamentals, often pay dividends, and are designed for steady, long-term performance. An example would be buying stock in a well-established bank or consumer goods company during a temporary market downturn when its price is lower than its financial health suggests.

Index Fund Investing: The All-Purpose SUV

What if you don't have the time or desire to research individual companies? That's where index fund investing comes in. It’s a wonderfully simple, hands-off strategy where you buy a single fund that holds small pieces of an entire market index, like the S&P 500.

This approach gives you instant diversification and aims to simply match the market's performance, not beat it. It's the comfortable, all-purpose SUV that gets you where you're going with minimal fuss. For many beginners, this is the perfect starting point for building wealth effectively and at a very low cost. To learn more about how they work, check out this simple guide on what index funds are.

Recent data shows where new investors are gravitating. For those starting around the average age of 33.3 years, a surprising 43% jump into growth investing. That's a huge number compared to the less than 14% who start with a value approach. You can dig into more of these fascinating beginner investor trends on Bankrate.com.

Comparing Core Investment Strategies for Beginners

This table breaks down the three fundamental investment strategies to help you see which one might be the right fit for your goals, personality, and risk tolerance.

| Strategy | Primary Goal | Typical Risk Level | Best For Investors Who… | Real-World Example |

|---|---|---|---|---|

| Growth Investing | Rapid capital appreciation | High | …are comfortable with volatility and have a long time horizon. | Buying shares in an emerging tech company. |

| Value Investing | Long-term, steady growth from undervalued companies | Medium | …are patient, research-oriented, and prefer stable businesses. | Investing in a stable utility company after a market dip. |

| Index Fund Investing | Match the market's return through broad diversification | Low-to-Medium | …want a simple, low-cost, hands-off approach. | Buying an S&P 500 ETF to own a piece of 500 top U.S. companies. |

Each path has its own merits. The most important thing is to pick one that aligns with your risk tolerance today so you can begin your journey with confidence.

Key Takeaway: Remember, the strategy you start with isn't a life sentence. Many savvy investors actually use a blend of these approaches. The goal is to choose a starting point that feels comfortable and sustainable for you.

How to Build Your First Diversified Portfolio

Now, let's get down to actually building your first portfolio. If there’s one golden rule to remember, it’s diversification. We’ve all heard the old saying about not putting all your eggs in one basket, and in investing, that wisdom is your financial safety net.

True diversification means spreading your money across different types of investments, or asset classes. This is your best defense against the market's inevitable ups and downs. The point is that when one part of your portfolio is having a bad month, another part might be doing just fine, which helps smooth out your overall returns and lets you sleep better at night.

Your Asset Allocation Blueprint

When you're starting out, it's easy to think just in terms of stocks and bonds. And while they are the foundation, a truly well-rounded portfolio can include other key players to add both stability and growth.

- Stocks (Equities): These are your engine for growth. By buying stocks, you’re buying a small piece of a company. They carry more risk, but historically, they also offer the best potential for significant long-term returns.

- Bonds (Fixed Income): Think of bonds as loans you make to a government or a corporation. They are generally much safer than stocks and act as a stabilizing force in your portfolio, especially when the stock market gets choppy.

- Real Estate (through REITs): Want to invest in property without the headache of being a landlord? Real Estate Investment Trusts (REITs) let you do just that. They bundle together portfolios of properties, offering a mix of steady income and potential appreciation.

A Sample Portfolio for the Long Haul

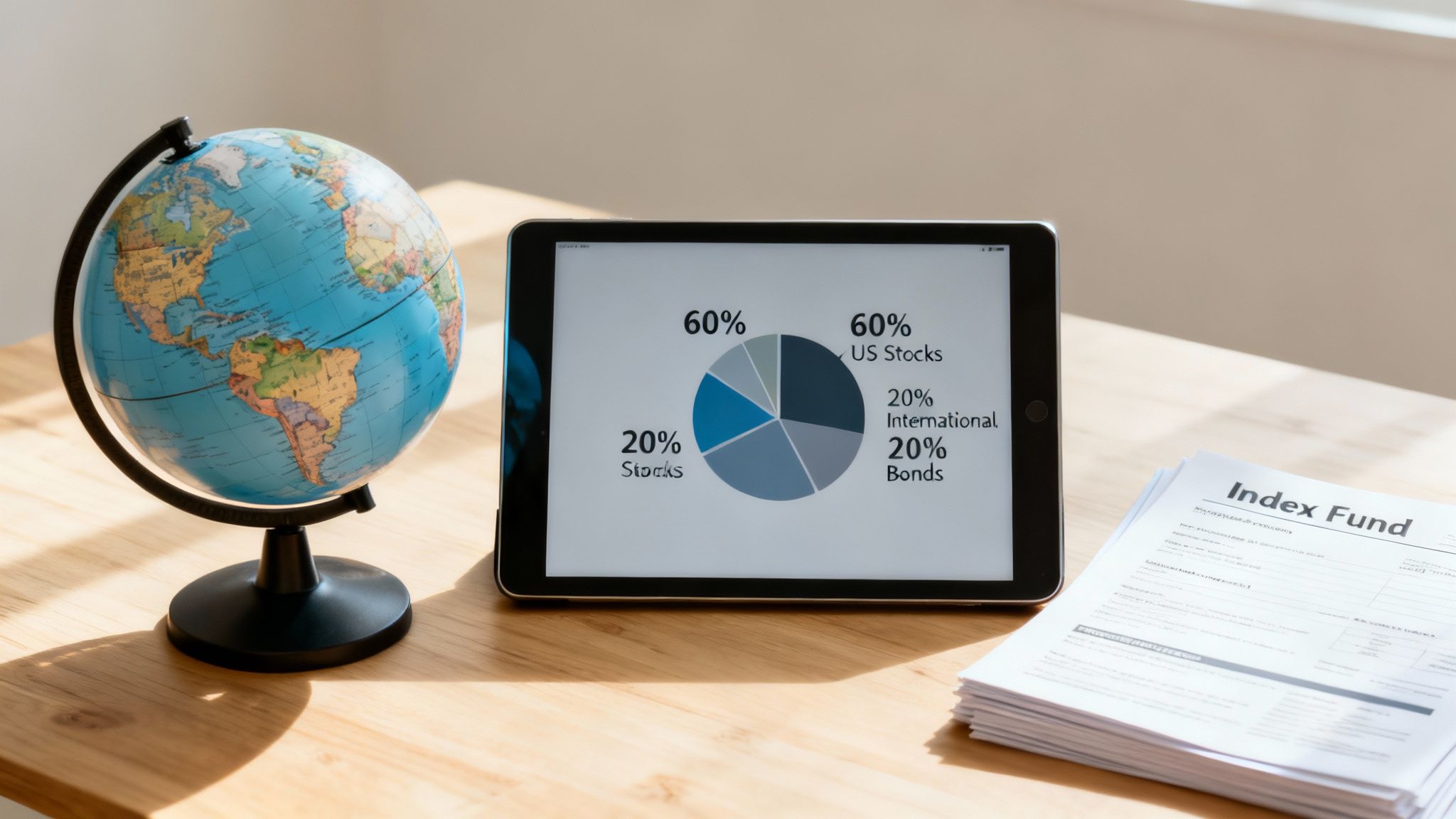

So what does this look like in practice? Here’s a classic, no-fuss portfolio model that has served long-term investors well for decades. It's simple, effective, and easy to implement using low-cost index funds or ETFs.

| Asset Class | Allocation | Why It's In Your Portfolio |

|---|---|---|

| U.S. Stock Index Fund | 60% | Gives you broad exposure to the largest companies in the U.S. economy. |

| International Stock Fund | 20% | Diversifies your holdings beyond one country's economy. |

| Total Bond Market Fund | 20% | Acts as an anchor, adding stability and lowering overall portfolio risk. |

This "80/20" stock-to-bond split is a fantastic starting point for a younger investor with a long time horizon. It's built for growth but has enough of a bond cushion to handle market turbulence. This time-tested, low-cost structure is designed to capture long-term gains. If you want to explore this topic further, our guide to optimize your portfolio with smart asset allocation is a great next step.

Let's get one thing straight: the market will go up, and it will go down. That’s a fact of investing. Your success over the long haul isn't about perfectly timing the market to avoid downturns—it’s about how you react when they inevitably arrive.

A perfect example is the steep market drop in early 2020. Investors who let fear take over and sold everything locked in massive losses. Meanwhile, those who stayed the course not only recovered but rode the powerful wave back up. This brings us to the most important lesson for a new investor: emotional discipline is your greatest asset.

The Rookie Mistakes Checklist

A huge part of a solid beginner's strategy is simply avoiding the classic traps. I’ve seen countless new investors stumble over the same hurdles.

- Chasing Hype Stocks: Just because a stock is all over social media doesn't make it a sound investment. That’s speculation, not a strategy.

- Letting Emotions Call the Shots: Fear and greed will wreck your portfolio. You need a plan, and you need to stick to it, especially when it gets uncomfortable.

- Ignoring Fees: Seemingly small fees can quietly eat away a massive chunk of your returns over decades. Always prioritize low-cost funds.

Here’s some perspective: market pullbacks are normal. The market has shown incredible resilience over the years. Since 1980, the S&P 500 has ended the year in the green 75% of the time, despite experiencing average drops of 14% within those same years.

Think about this: even if you had the worst possible timing and invested at the market's peak in October 2007, right before the financial crisis, your investment would have still averaged a 9.5% annual return through today.

Instead of panicking during a downturn, try to see it as a sale. It’s an opportunity to buy into great companies or funds at a discount. Shifting your mindset this way turns volatility from a threat into an advantage.

Pro Tip: One of the best tools for navigating these swings is dollar-cost averaging. You simply invest a fixed amount of money on a regular schedule (e.g., $100 every two weeks). This simple trick forces you to buy more shares when prices are low and fewer when they’re high, which smooths out your average cost over time.

Learning to manage the emotional rollercoaster of investing is half the battle. To better understand the mechanics behind these market moves, take a look at our guide on what is market volatility and how you can prepare for it.

The Best Tools and Platforms for Beginner Investors

Knowing your strategy is a huge first step, but you'll need the right tools to put your money to work. This really boils down to choosing the right kind of investment account for your goals.

You'll generally encounter two main types.

A standard brokerage account offers maximum flexibility. You can deposit and withdraw money as needed and invest in stocks, bonds, and ETFs. This makes it a great choice for goals that aren't retirement-focused, like saving for a house down payment.

Then you have retirement accounts, like a Roth or Traditional IRA. These come with powerful tax advantages designed to help your money grow for the long haul. The purpose is to let your investments compound for decades without taking a tax hit every year.

Choosing Your First Platform

Once you've figured out which account you need, it's time to pick a platform. Honestly, this is the easy part. Modern brokerage firms have made it unbelievably simple for new investors to get started.

When you're just starting out, you can ignore many of the fancy bells and whistles. The key is to focus on what will make your life easier and your costs lower.

Key Insight: Don't get bogged down by analysis paralysis. For your first platform, focus on three things: zero-commission trades, no account minimums, and a simple-to-use mobile app. Nailing these will make your initial experience smooth and keep more of your money working for you.

Of course, not all platforms are built the same. To help you sort through the options, here's a quick look at what really matters for a beginner.

| Feature to Consider | Why It Matters for Beginners | Ideal Scenario |

|---|---|---|

| Account Minimums | Lets you get started with whatever you have, even just a few dollars. | $0 |

| Trading Fees | Fees are a direct drag on your returns, so avoiding them is a must. | Commission-free stock and ETF trades |

| Fractional Shares | Allows you to own a slice of pricey stocks (like Amazon) for as little as $1. | Yes |

| Ease of Use | A clean, simple interface helps you avoid costly mistakes and builds confidence. | Intuitive mobile and web platforms |

Picking the right platform is the final hurdle between learning and actually doing. For a more detailed breakdown, take a look at our guide on the best investment apps for beginners to find the one that feels right for you.

Frequently Asked Questions About Beginner Investing Strategies

1. How much money do I really need to start investing?

You can start with as little as $1. Modern brokerage platforms have eliminated account minimums, and features like fractional shares allow you to buy a small piece of any company, no matter the full share price.

2. Is investing the same as gambling?

No, they are fundamentally different. Gambling is a short-term, high-risk bet on an uncertain outcome. Investing, when done with a sound strategy like diversification, is a long-term plan to participate in the growth of the economy by owning assets like stocks and bonds.

3. What is the single best investment for a beginner?

For most beginners, a low-cost, broad-market index fund (like an S&P 500 ETF) is a fantastic starting point. It provides instant diversification across hundreds of top companies, requires minimal management, and has a strong historical track record of growth.

4. Should I wait for the market to crash before I invest?

Trying to "time the market" is a common and costly mistake. No one can consistently predict market peaks and valleys. A more reliable strategy is "time in the market." By investing regularly through dollar-cost averaging, you can build wealth steadily regardless of market conditions.

5. What's the difference between a stock and a bond?

A stock represents a share of ownership in a company (equity), offering growth potential but higher risk. A bond is essentially a loan to a government or corporation (debt), offering more stability and fixed interest payments but typically lower returns.

6. What are dividends?

Dividends are a portion of a company's profits paid out to its shareholders. They provide a regular income stream and are a common feature of more established, value-oriented companies.

7. Do I need a financial advisor to start investing?

While an advisor can be very helpful, you don't need one to start. Modern platforms and robo-advisors make it easy to build a diversified portfolio on your own. As your financial situation becomes more complex, consulting a professional can be a wise decision.

8. How often should I check my investments?

For long-term investors, checking too often can lead to emotional decisions. A good approach is to review your portfolio once or twice a year to ensure your asset allocation is still aligned with your goals, but avoid daily monitoring.

9. What are ETFs and mutual funds?

Both are collections of investments (like stocks and bonds) bundled into a single fund. Exchange-Traded Funds (ETFs) trade like stocks throughout the day, while mutual funds are priced once per day. Both are excellent tools for diversification.

10. What is a "robo-advisor"?

A robo-advisor is an automated online platform that uses algorithms to build and manage a diversified investment portfolio for you based on your goals and risk tolerance. They are a popular, low-cost option for beginners who want a hands-off approach.

At Top Wealth Guide, our goal is to give you the tools and confidence to build your financial future. We have a ton of resources full of actionable tips to help you on your wealth-building journey.

Discover more at https://topwealthguide.com

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.