Inflation is quietly eroding your wealth right now. If your money sits in a savings account earning 4% while inflation runs at 3%, you’re only gaining 1% in real purchasing power-and that’s if you’re lucky.

At Top Wealth Guide, we’ve seen too many investors ignore inflation hedging until it’s too late. The strategies in this guide show you exactly how to protect your portfolio and actually grow your wealth in real terms.

In This Guide

How Inflation Silently Destroys Your Wealth

Inflation doesn’t announce itself. It works quietly, eroding the purchasing power of every dollar you hold. In December 2024, the Consumer Price Index reached 2.9% year-over-year, the highest level since July, according to data from the U.S. Bureau of Labor Statistics. That means if you held $100,000 in cash, it lost roughly $2,900 in buying power that year alone. The damage compounds. Over a decade at 3% inflation, that same $100,000 becomes worth only $74,000 in today’s dollars.

Most investors don’t feel this loss because they’re not comparing their account balance to inflation-they’re just watching the nominal number stay flat or grow slightly. This is a critical mistake. Real wealth isn’t measured by purchasing power, not nominal dollars.

The Natural Hedge That Disappears at Retirement

Historical data from the Federal Reserve and University of Michigan Panel Study of Income Dynamics shows that wage growth by age cohorts has historically outpaced inflation across four decades. This sounds reassuring until you realize this applies only to active workers earning income. Once you retire or hold significant assets in cash, you lose this natural hedge. That’s when inflation becomes dangerous. Your paycheck no longer rises with prices, and your savings face the full force of purchasing power erosion.

Why Your Savings Account Is Losing the Race

A 4% savings account rate sounds decent until you account for inflation running at 2.9% or higher. Your real return-the amount your purchasing power actually grows-drops to roughly 1% or less. Worse, most savings accounts offer far less. The average savings account rate in early 2025 hovers around 4.3%, but many banks still offer rates below 1%. If you earn 0.5% while inflation sits at 2.9%, you lose 2.4% in real purchasing power every single year.

After five years, your $50,000 has the buying power of roughly $44,000. The math is brutal, and it’s why you should hold excess cash only beyond a 3-6 month emergency fund. Your money doesn’t just sit idle-it actively shrinks in value. Cash should serve one purpose: covering immediate expenses and unexpected emergencies. Anything beyond that belongs in assets that can outpace inflation.

Historical Markets Show What Outpacing Inflation Actually Requires

The S&P 500 has historically delivered roughly 10% annual returns over the past century, according to Bloomberg data. Equities have consistently beaten inflation by wide margins over long time horizons. From 1926 to 2024, stocks outpaced inflation by approximately 6-7% annually on average, even accounting for major downturns.

Commodities tell a different story. Gold, often marketed as the ultimate inflation hedge, has shown mixed results. Harvey and Erb’s research demonstrates that gold’s effectiveness as an inflation hedge is strongest over very long horizons spanning centuries, not the 5-10 year periods most investors care about. Year-to-year, gold’s correlation with inflation is weak and unreliable.

Treasury Inflation-Protected Securities TIPS adjust their principal with the Consumer Price Index and currently offer positive real yields. The 5-year real yield closed at 1.82%, the 10-year at 2.28%, and the 30-year at 2.68%. This means if you buy a five-year TIPS today and hold it to maturity, you’re guaranteed to beat inflation plus earn that real return. However, TIPS carry a critical drawback: their prices fall when interest rates rise, which often happens during inflationary periods. The Bloomberg US TIPS Index posted negative total returns in 2022-2023 during the Federal Reserve’s rate-hike cycle. This is why you should hold TIPS to maturity rather than watch daily prices.

Real Estate and the Time Horizon Problem

Real estate provides another avenue, with property values and rents typically rising alongside inflation. REITs offer liquid exposure without requiring property management. The fundamental truth across all assets: inflation hedging requires you to match your time horizon to your strategy. Younger investors with decades until retirement can rely on wage growth and equity exposure to naturally outpace inflation. Investors nearing retirement need different tools-and the next section shows you exactly which ones work best.

Which Assets Actually Beat Inflation

Real Estate: The Inflation-Responsive Income Machine

Real estate remains one of the most straightforward inflation hedges because rental income and property values rise alongside inflation. When rents increase with inflation, your cash flow grows automatically without additional effort. The challenge lies in access and liquidity. Direct property ownership requires substantial capital, ongoing maintenance costs, and significant time commitment. REITs solve this problem by offering liquid exposure through the stock market. VNQ tracks U.S. real estate and VNQI covers global properties ex-U.S., giving you instant diversification across hundreds of properties. A REIT holding in your portfolio captures rising rents and property appreciation without the headaches of tenant management. The real return comes from cash flow that scales with inflation, not just price appreciation.

Commodities: Separating Hype from Reality

Commodities present a harder case than most investors realize. Gold, often recommended as an inflation hedge, fails to deliver for typical investment timeframes. Over short to medium periods of 5-10 years, gold shows weak correlation with inflation and volatile year-to-year performance. Its effectiveness only emerges over centuries, which doesn’t help your portfolio this decade. Energy stocks and industrial commodities offer better near-term inflation protection because they’re inputs in consumer prices. When inflation rises, energy and materials become more valuable. You gain exposure through sector ETFs or commodity-focused funds, but these require active monitoring since commodity markets swing sharply based on supply shocks and economic cycles.

TIPS: Government-Backed Inflation Insurance

TIPS and I Bonds deserve serious attention because they’re government-backed guarantees against inflation. A five-year TIPS purchased today with a real yield means you beat inflation by that amount annually, locked in by the U.S. government. The catch matters: TIPS prices fall when interest rates rise, which often happens during inflationary periods. The Bloomberg US TIPS Index lost money in 2022-2023 as the Federal Reserve raised rates aggressively. This only matters if you sell early. Hold TIPS to maturity and you receive the inflation-adjusted principal plus that real return regardless of interim price moves.

I Bonds: Automatic Rate Adjustments

I Bonds work differently, with rates that adjust every six months based on inflation. Current rates sit around 5.27% for new purchases, though rates reset downward when inflation moderates. You cannot touch I Bond money for one year, and early withdrawal after one year costs three months of interest. For money you won’t need for 5-10 years, I Bonds eliminate timing risk since the rate adjusts automatically with inflation.

Building Your Multi-Asset Inflation Defense

The practical approach combines these assets strategically. Allocate 10-15% to TIPS or I Bonds as insurance against inflation shocks. Add 5-10% to REITs for income that rises with prices. Avoid chasing gold unless it represents less than 5% of your portfolio as a volatility hedge. Instead, focus capital on equities with pricing power and real assets that generate inflation-adjusted cash flows. This combination covers multiple inflation scenarios without sacrificing long-term growth. The next chapter shows you how to construct this portfolio in your actual accounts and adjust it as your life circumstances change.

Build Your Inflation Defense Portfolio Today

Start With Your Time Horizon

The gap between theory and action stops here. Most investors understand inflation is a problem but freeze when allocating actual dollars. The math changes dramatically based on how long you have until retirement. If you have 20+ years ahead, equities should dominate your allocation because wage growth and earnings expansion historically outpace inflation. Allocate 70-80% to a diversified stock portfolio split between U.S. and international equities using broad ETFs like VTI and VXUS. Add 15-20% to bonds through BND for domestic exposure and BNDX for international bonds with currency hedging. This leaves 5-10% for tactical inflation hedges-TIPS, REITs, or commodities depending on current inflation readings.

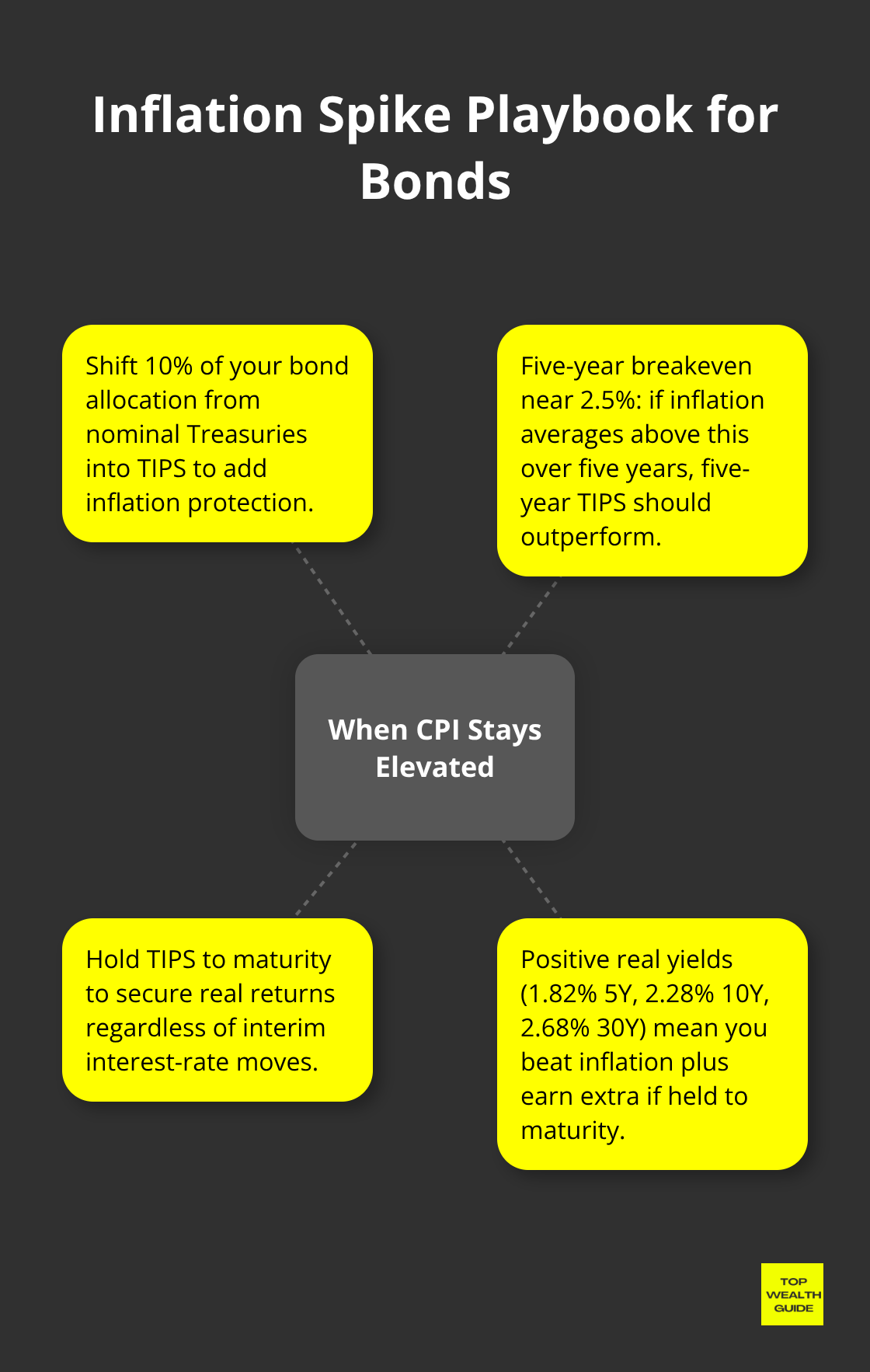

Adjust Your Bond Mix When Inflation Spikes

When December’s 2.9% CPI rate persists or climbs, shift 10% of your bond allocation from traditional Treasuries into TIPS. The five-year breakeven inflation rate sits around 2.5%, meaning if inflation averages above this rate over five years, five-year TIPS outperform nominal Treasuries. This isn’t speculation-it’s mathematical. Hold those TIPS to maturity and you lock in real returns regardless of what happens to interest rates in the interim. The five-year real yield currently stands at 1.82%, the 10-year at 2.28%, and the 30-year at 2.68%.

These positive real yields guarantee you beat inflation plus earn that additional return if you hold to maturity.

Restructure Your Portfolio as Retirement Approaches

As you approach retirement, your human capital-the income you’ll earn from working-shrinks to zero, so that natural inflation hedge disappears. Shift your allocation to 50-60% stocks, 30-40% bonds, and 10-15% inflation-protected assets. Real estate through REITs generates rents that climb with inflation, providing cash flow that grows automatically. Preferred stocks and utility stocks offer higher yields than traditional bonds while providing some price stability during inflationary periods. If you own individual stocks, focus on companies with pricing power-those that can raise prices without losing customers. Energy stocks, industrials, and consumer staples historically perform better during inflationary episodes than growth stocks.

Create Income Streams That Rise With Prices

The practical advantage lies in not guessing which direction inflation will move. Structure your portfolio so multiple asset classes benefit simultaneously if inflation resurges. A 60-year-old holding 12% in REITs through VNQ, 8% in TIPS, and 40% in dividend-focused stocks creates a portfolio where rising inflation actually helps rather than hurts. When December CPI hit 2.9%, that portfolio benefited from higher energy prices, rising rents from REIT holdings, and TIPS principal adjustments. The investor didn’t panic about inflation-they profited from it. This is the practical difference between understanding inflation and actually hedging against it.

Execute Your Plan With Low-Cost Tools

Build inflation hedges with low-cost ETFs and mutual funds to maintain liquidity and cost efficiency rather than chasing niche or high-fee plays. Access many hedges via broad funds that hold hundreds or thousands of holdings. VTI tracks the entire investable U.S. stock market and historically offers strong potential to outpace inflation, albeit with higher risk. VXUS offers broad exposure to international equities for additional growth and diversification. BND provides broad exposure to the U.S. bond market and helps offset stock market volatility over medium to long horizons. BNDX provides international bond exposure with currency hedging to reduce foreign exchange volatility. These four ETFs together hold 39,000+ individual securities, giving you instant diversification across bonds and stocks. Monitor macro developments-inflation trajectory and Federal Reserve policy-as they influence TIPS performance and breakeven dynamics. Revisit your portfolio goals annually and adjust the mix based on evolving inflation trends and economic conditions.

Final Thoughts

Inflation hedging works best when you match your strategy to your time horizon rather than chase perfect market timing. If you’re decades from retirement, equities and wage growth naturally protect you since your paycheck rises with inflation and stock earnings expand over time. If you’re within ten years of retirement, your human capital disappears, so you need real assets that generate inflation-adjusted income like REITs, TIPS, and dividend stocks.

The practical execution separates successful investors from those who understand inflation but never act. Start by calculating your actual emergency fund needs-three to six months of expenses in cash-then allocate everything beyond that to broad ETFs covering U.S. stocks, international stocks, and bonds. When inflation readings climb above 2.5%, shift a portion of bond holdings into TIPS, and as you approach retirement, gradually increase allocations to real estate and inflation-protected securities.

The biggest mistake investors make is waiting for perfect conditions before acting on inflation hedging strategies. You don’t need to time inflation peaks or predict Federal Reserve decisions-you need a framework that works across multiple scenarios. Top Wealth Guide provides the tools and strategies to build that framework, so identify your time horizon, calculate your current allocation, and make one adjustment this week.