Estate taxes can wipe out 40% or more of your wealth if left unplanned. The good news is that proven strategies exist to significantly reduce what your heirs owe to the government.

At Top Wealth Guide, we’ve seen families preserve millions by taking action before it’s too late. This guide walks you through the most effective approaches to protect your family’s financial legacy.

In This Guide

What Estate Taxes Actually Cost You

Estate taxes represent a direct reduction in the wealth transferred to your heirs, calculated on the fair market value of all assets in your estate at death. Federal estate tax applies a 40% tax rate to estates exceeding the exemption threshold. For 2025, the federal exemption sits at $13.99 million for individuals and $27.98 million for married couples filing jointly. This sounds generous until you consider that rising property values and home equity push estates past these limits faster than most families realize.

The real problem emerges after 2025: the Tax Cuts and Jobs Act changes sunset at the end of 2025, potentially reverting the exemption to approximately $7 million per individual after inflation unless Congress acts. This reduction would nearly double the number of estates subject to federal taxation. Waiting to plan means accepting that your heirs could lose hundreds of thousands or millions to unnecessary taxes when straightforward strategies exist to prevent it.

Federal Exemptions Are Temporary, Not Permanent

The 2025 exemption amounts are unusually high and temporary. If you have an estate approaching $7 million or higher, treating the current exemption as permanent is a serious mistake. Fidelity Viewpoints emphasizes that many families need to act now to lock in gifting strategies before exemption levels drop. The annual gift tax exclusion for 2025 is $19,000 per recipient for individuals, or $38,000 per couple using gift splitting. Married couples can gift up to $38,000 annually to each child, grandchild, or other beneficiary without triggering gift taxes or reducing lifetime exemptions. Gifts above this annual limit reduce your lifetime exemption dollar-for-dollar, which is why timing matters enormously right now. If your estate exceeds $7 million, you should gift strategically every single year before the exemption shrinks.

State Taxes Create a Second Layer of Liability

Federal estate taxes are only part of the problem. More than a dozen states impose their own estate or inheritance taxes with thresholds often far lower than federal limits. Oregon, for example, taxes estates at just $1 million. New York, Massachusetts, Connecticut, and Washington state all have their own estate taxes with exemptions between $2 million and $6 million. A $5 million estate in New York faces no federal tax but owes state estate tax on amounts above the state exemption. This means your effective tax rate jumps dramatically depending on where you live and hold assets. If you own real estate or business interests in multiple states, you face potential tax exposure in each state where property is located.

How Your Location Affects Your Tax Burden

Your state of residence and asset location determine whether you owe state estate taxes in addition to federal taxes. A family living in a state with no estate tax can structure their plan differently than a family in New York or Massachusetts. Real estate holdings in multiple states create additional complexity because each state taxes property located within its borders. The solution requires understanding your state’s specific rules and structuring assets accordingly, which is why generic estate planning fails. Your plan must account for both federal and state implications simultaneously.

Understanding these tax layers sets the stage for the strategies that actually work. The exemptions and rates you face today will shape which approaches make sense for your situation.

Strategies That Actually Reduce What Your Heirs Owe

Gifting Money During Your Lifetime

Gifting money away during your lifetime shrinks your taxable estate, and the math works in your favor right now. You can gift $19,000 per person annually without filing paperwork or touching your lifetime exemption, or $38,000 per couple using gift splitting. A married couple gifts $38,000 to each child, grandchild, or other beneficiary every single year tax-free. Over a decade, that strategy moves $380,000 per beneficiary out of your estate with zero tax consequences. The IRS annual gift tax exclusion resets every January 1st, so unused 2025 limits represent money left on the table.

Gifts above the annual limit reduce your lifetime exemption dollar-for-dollar, which matters because that exemption drops from $13.99 million to roughly $7 million after 2025 unless Congress acts. Direct payments for education or medical expenses don’t count toward the annual limit at all, meaning you can pay a grandchild’s tuition or cover a child’s surgery and gift them an additional $19,000 the same year. This creates a powerful window right now to transfer substantial wealth before the exemption shrinks.

Track all gifts above the annual limit using IRS Form 709 even though you won’t owe tax today, because those excess amounts reduce what you can transfer tax-free later. The form documents your intentions and protects you from future disputes with the IRS about whether gifts were intentional or accidental.

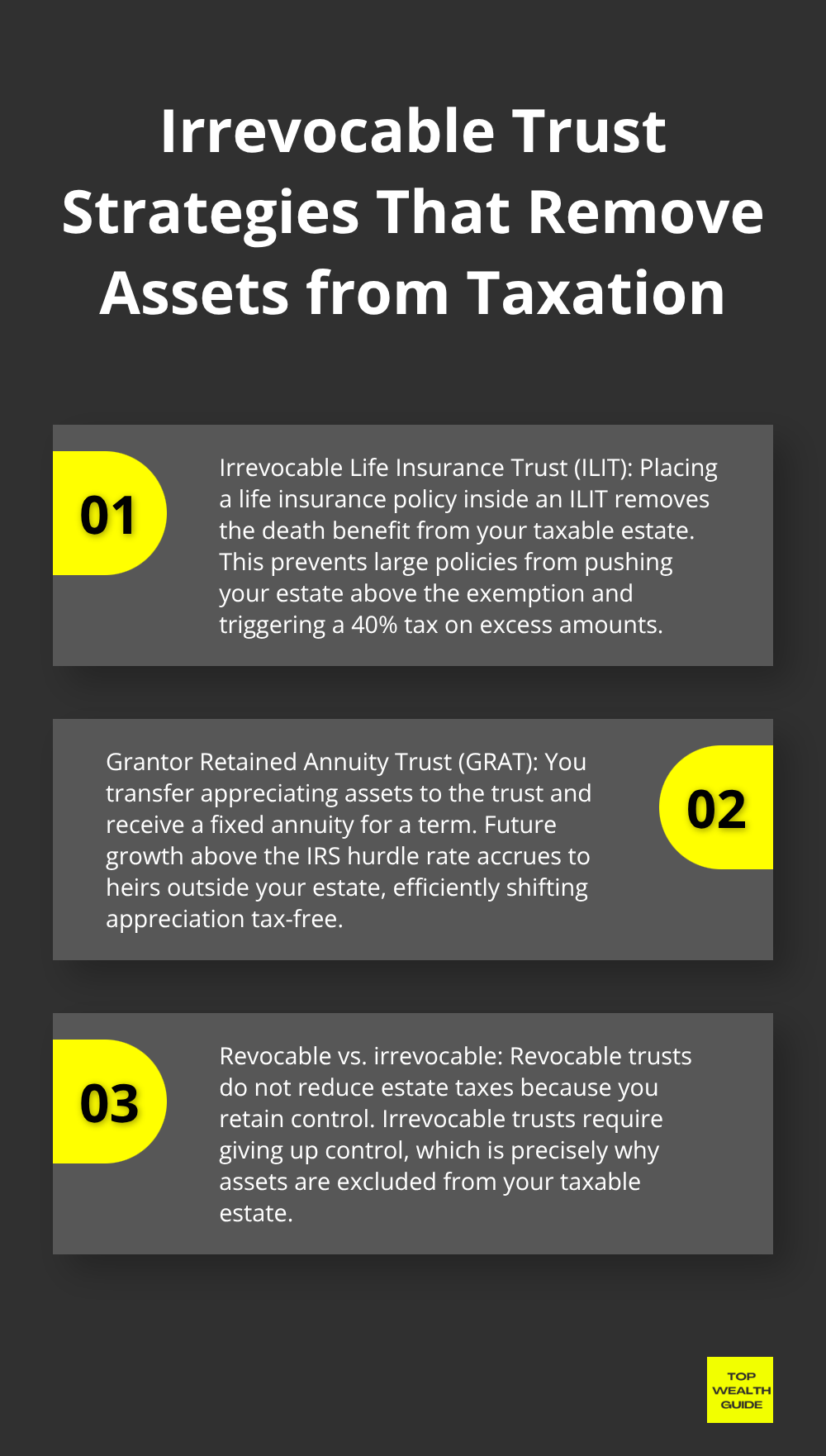

Using Irrevocable Trusts to Remove Assets from Taxation

Trusts offer control that simple gifting cannot provide, and they form the backbone of every serious estate plan. An irrevocable life insurance trust removes life insurance proceeds from your taxable estate entirely, which matters because life insurance death benefits would otherwise be included in full. If your estate is $10 million and you carry $2 million in life insurance, that policy pushes you $2 million over the federal exemption, creating an unnecessary $800,000 tax bill for your heirs.

A grantor retained annuity trust lets assets grow outside your taxable estate while you receive income for a set period, then the remainder passes to heirs tax-free.

These structures work because they remove future growth from taxation-if you fund a trust with $1 million that grows to $3 million over ten years, only the original $1 million counts against your exemption. The key difference between revocable and irrevocable trusts is that irrevocable trusts require you to give up control permanently, which frightens many people, but that loss of control is precisely what removes assets from taxation.

Funding Trusts Properly to Avoid Tax Problems

Setting up a trust with an attorney typically costs $1,500 to $3,000 depending on complexity, which pays for itself many times over if it saves your heirs even $50,000 in taxes. The critical mistake families make is creating trusts but failing to fund them properly. An unfunded trust sits empty while your assets pass through probate anyway, defeating the entire purpose.

Work with your attorney to obtain a funding letter that confirms which assets have been properly transferred into the trust, because vague or incomplete funding creates tax problems and litigation risks later. A revocable living trust avoids probate and keeps your affairs private, though it doesn’t reduce estate taxes since you retain control. Once you understand how trusts function and the difference between revocable and irrevocable structures, the next critical step involves selecting the right trustee and determining how your assets will actually transfer to your heirs.

Protecting Your Wealth Plan from Common Failures

A comprehensive estate plan requires more than trusts and gifting strategies sitting on paper. The plan must actually work when it matters, which means addressing the specific assets you own, the beneficiaries who depend on you, and the exact mechanics of how wealth transfers after death. Start by listing every asset you control: bank accounts, investment accounts, real estate in multiple states, business interests, life insurance policies, retirement accounts, and personal property with significant value. Next to each asset, write down the current titling and beneficiary designations. This exercise reveals gaps that most families discover too late. A retirement account with an outdated beneficiary designation passes to an ex-spouse instead of your current family, or a business interest with no succession plan forces your heirs to sell at a loss. These mistakes happen constantly because people create estate documents without coordinating them with how their actual assets are titled and designated.

Essential Documents That Form Your Foundation

Essential documents create the foundation of any working plan. You need a will that names an executor and specifies who receives what, a durable power of attorney designating someone to handle finances if you become incapacitated, a healthcare proxy authorizing medical decisions, and a living will stating your end-of-life wishes.

If you own real estate or significant assets, add a revocable living trust that avoids probate and keeps your affairs private after death. For business owners, a buy-sell agreement funded with life insurance ensures the business transfers smoothly to remaining owners or your heirs without forcing a fire sale. The cost of preparing these documents through an attorney ranges from $1,500 to $3,000 for a straightforward plan, significantly less than what probate and unnecessary taxes will cost your family. Your attorney must provide a funding letter confirming which assets have been properly transferred into any trust you create, because an unfunded trust provides zero protection and zero tax benefits.

Selecting the Right Executor or Trustee

Selecting an executor or trustee requires choosing someone who understands financial responsibility and can manage conflict among family members. Many families appoint the oldest child out of tradition, even when that child lacks financial competence or has poor judgment about money. A professional trustee such as a bank, trust company, or estate attorney costs money but brings expertise and removes family drama from asset management. If you appoint a family member, ensure they understand the role before they inherit it. Walk them through your accounts, explain your intentions for distributions, and provide clear written instructions about what you want. A trustee who must guess your intentions will make mistakes that cost your beneficiaries money and create resentment. Some families use a co-trustee arrangement (pairing a professional with a family member) to balance expertise with personal knowledge and reduce the risk of isolation or poor decisions.

Business Succession Planning Protects Your Life’s Work

If you own a business, your estate plan must address what happens when you die or become unable to work. A business with no succession plan often loses value rapidly after the owner’s death because clients, employees, and suppliers lose confidence. A buy-sell agreement establishes a predetermined price for the business and identifies who will purchase it if you die, retire, or become disabled. This agreement, funded with life insurance, ensures your heirs receive cash equal to the business value rather than inheriting a struggling enterprise they must sell quickly at a discount. If multiple owners exist, a cross-purchase agreement lets remaining owners buy out your share using insurance proceeds, keeping the business intact. If you have no co-owners, a redemption agreement lets the business itself purchase your interest from your estate. The specific structure depends on your ownership situation, but the principle remains constant: plan now or force your heirs to make desperate decisions later.

Family Communication Prevents Disputes and Protects Wealth

Document your intentions explicitly so your heirs understand why you structured things the way you did. Vague language in estate documents creates litigation, and litigation destroys wealth through legal fees and delays. If you want distributions to occur at specific ages or milestones, state that clearly. If certain assets should go to certain people, explain your reasoning. If some beneficiaries receive less than others, acknowledge that reality and explain it. Families who have these conversations before death settle estates smoothly. Families who leave beneficiaries guessing about intentions spend years in conflict and pay tens of thousands in legal fees fighting over your money. Hold a family meeting with your heirs and your attorney or financial advisor present. Walk through your plan, explain your strategies, and answer questions. This transparency builds trust and prevents surprises that turn siblings into enemies and your estate into a legal battlefield.

Final Thoughts

Estate tax minimization requires action before 2025 ends, not after exemptions shrink and opportunities vanish. Federal exemptions drop dramatically after 2025 unless Congress extends current law, which means a married couple with a $15 million estate faces zero federal tax today but would owe approximately $3.2 million if exemptions revert to $7 million per person. That difference represents real money your heirs either keep or surrender to the government based on decisions you make right now.

Start by listing your assets, reviewing beneficiary designations, and scheduling a conversation with a tax attorney and financial advisor who understand both federal and state implications. These professionals cost money upfront but save your family far more through proper planning. Work with qualified advisors who know your complete financial picture, because your specific situation requires personalized guidance that generic strategies cannot provide.

We at Top Wealth Guide provide frameworks and strategies to guide your thinking, but your family’s financial legacy depends on decisions you make today. Contact a qualified estate planning professional to implement the strategies that protect your wealth and preserve your legacy for the next generation.