So, you think you need a small fortune to start investing? That's a myth I hear all the time. For decades, Wall Street felt like an exclusive club, a place where you needed thousands of dollars just to get a seat at the table. That idea created a huge mental block for millions of people, stopping them before they even started.

Thankfully, that world is ancient history.

Today, you can absolutely start investing with whatever you have, even if it’s just $5. As a financial writer who started my own journey with just $50 a month, I can tell you firsthand that the real key isn't how much money you start with. It's about choosing the right tools—like micro-investing apps, fractional shares, or robo-advisors—and building the habit of putting your money to work, consistently.

In This Guide

- 1 The Myth of Needing a Fortune to Invest

- 2 Finding the Right Platform for Small Investments

- 3 What Should You Invest In With Little Money?

- 4 Turn Investing Into a Habit You Can't Break

- 5 Three Starter Portfolios You Can Build Under $100

- 6 So, What's Next on Your Wealth-Building Journey?

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. How much money do I actually need to start investing?

- 7.2 2. Are investing apps like Acorns or Betterment safe?

- 7.3 3. What's better for a beginner: a robo-advisor or picking my own stocks?

- 7.4 4. Should I invest or pay off debt first?

- 7.5 5. What are the most common fees I should watch out for?

- 7.6 6. Can I really lose all my money?

- 7.7 7. What is the easiest investment for a total beginner?

- 7.8 8. How long does it take to see returns on my investment?

- 7.9 9. How do I handle taxes on my investments?

- 7.10 10. What's the difference between a stock and an ETF?

The Myth of Needing a Fortune to Invest

Let's be clear: the old rules no longer apply. You don't need a fat bank account or a fancy broker to buy your first piece of a company. You can literally start your investment journey with the spare change from your morning coffee.

The Real Power is in Starting Small

The most important step you'll ever take in building wealth isn't dropping a huge lump sum into the market. It's starting. It's the simple act of beginning to invest regularly, no matter how small the amount feels at first.

Putting a little bit aside consistently does two incredibly powerful things:

- It builds discipline. Investing becomes a routine, like paying your phone bill. It just becomes a natural part of your financial life.

- It kicks compounding into gear. The sooner you start, the more time your money has to grow and, more importantly, for your earnings to start generating their own earnings.

This entire shift is thanks to modern financial tech. Digital platforms have torn down the old barriers, making it ridiculously easy to invest small sums. The global market for micro-investing apps—the kind that let you invest with as little as $1—was valued at USD 1.12 billion in 2024 and is expected to rocket to USD 3.36 billion by 2033. That explosive growth isn't coming from Wall Street bigwigs; it's driven by everyday people who finally have access to simple, user-friendly tools. You can discover more insights about the investment platform market and see just how big this trend has become.

A Quick Look at Your Options

Before we get into the nitty-gritty, let's take a quick flyover of the most popular ways to start investing with a small amount of cash. Each one has its own vibe, whether you want to set it and forget it or get your hands dirty picking individual stocks.

Here's a quick cheat sheet to help you see how these different approaches stack up.

Top Ways to Start Investing with Little Money

| Investment Method | Minimum Investment | Best For | Key Feature |

|---|---|---|---|

| Micro-Investing Apps | Often $1 – $5 | Absolute beginners who want to automate savings and investing effortlessly. | Automatically invests spare change from your daily purchases. |

| Robo-Advisors | $0 – $100 | Investors who prefer a hands-off, professionally managed portfolio. | Uses algorithms to build and manage a diversified portfolio for you. |

| Fractional Shares | As little as $1 | People who want to own shares of big-name companies without the high price. | Allows you to buy a small piece of a stock instead of a full share. |

| ETFs & Index Funds | The price of one share | Beginners seeking instant diversification and low-cost market exposure. | A single fund that holds hundreds or thousands of different stocks or bonds. |

Each of these paths is a fantastic starting point, and we'll break them down in more detail soon.

Key Takeaway: The single most important factor for success when you invest with little money is not the amount you start with, but the consistency you maintain. Starting with $5 per week is far more powerful than waiting years to invest $500.

Finding the Right Platform for Small Investments

So you've decided to start investing. That's a huge first step. The next question is a big one: where do you actually put your money? Picking the right platform is just as critical as choosing what to invest in, especially when you're starting with a smaller amount. You need a home for your money that fits your budget, your goals, and frankly, your comfort level.

The good news is, you've got more great options now than ever before. It's really as simple as taking the cash you have, finding a place to put it, and letting it get to work for your future.

Let's dive into the most popular types of platforms that make this process easy for new investors.

Micro-Investing Apps: The "Spare Change" Method

If you're looking for the easiest entry point imaginable, micro-investing apps are it. Platforms like Acorns and Stash were built from the ground up for beginners. Their most popular feature is "round-ups," which automatically invests the spare change from your everyday purchases.

Real-Life Example: Let's say you buy a coffee for $4.50. The app rounds this up to $5.00 and automatically invests the $0.50 difference for you. It might not feel like much, but when this happens with every transaction, you could easily be investing an extra $30-50 per month without even noticing the money is gone.

Robo-Advisors: Automated Investing Made Simple

Maybe you like the idea of investing but feel completely lost on what to actually buy. If that's you, a robo-advisor is probably your best bet. Services like Betterment and Wealthfront take all the guesswork out of it.

You just answer a few simple questions about your goals and how much risk you’re comfortable with. From there, their technology builds a diversified, professionally managed portfolio for you. They handle all the complicated stuff like rebalancing and tax-loss harvesting automatically. It’s a true "set it and forget it" approach that was once only available to the ultra-wealthy.

Traditional Brokers: Now Welcoming Small Investors

Don't overlook the big names like Fidelity, Charles Schwab, and Vanguard. For a long time, these traditional brokerage firms felt out of reach for beginners, but they've completely changed their tune. Their secret weapon? Fractional shares.

Fractional shares are a total game-changer. They let you buy a small slice of a company's stock instead of a full, expensive share. Want to own a piece of a powerhouse like Amazon or Google but can't afford $1,000+ for a single share? No problem. With fractional shares, you can invest as little as $1 or $5 and still get in the game. This opens up a whole world of possibilities for building a portfolio of companies you truly believe in, even on a tiny budget.

Platform Comparison For Small Investors

Feeling a bit overwhelmed by the options? That's normal. Your choice really comes down to your personality and how involved you want to be. This table breaks down the key differences to help you decide.

| Platform Type | Example | Typical Fees | Minimum Investment | Ideal Investor |

|---|---|---|---|---|

| Micro-Investing Apps | Acorns, Stash | Flat monthly fee ($3-$9) | $0 – $5 | Someone who wants to automate investing spare change and build habits effortlessly. |

| Robo-Advisors | Betterment, Wealthfront | Annual fee (~0.25% of assets) | $0 – $10 | An investor who prefers a hands-off, managed portfolio tailored to their goals. |

| Traditional Brokers | Fidelity, Schwab | Often $0 for stock/ETF trades | $0 | A DIY investor who wants to pick their own stocks and ETFs using fractional shares. |

Ultimately, there's no single "best" platform—only the one that’s best for you.

If you're still not sure, a robo-advisor is an excellent, low-stress place to start. If the idea of turning your spare change into an investment portfolio sounds exciting, a micro-investing app could be the perfect motivator.

For a deeper look at specific apps and their features, check out our complete guide to the best investment apps for beginners.

What Should You Invest In With Little Money?

Alright, you've picked a platform. Now for the million-dollar question—or maybe the ten-dollar question—what do you actually buy? The sheer number of choices can feel overwhelming, but when you're just starting out, keeping things simple is your secret weapon. Let's break down a few investment types that are perfect for a small budget.

ETFs: The Foundation of Your First Portfolio

For most people dipping their toes into investing, Exchange-Traded Funds (ETFs) are the absolute best place to start. Think of an ETF as a big shopping basket that holds hundreds, sometimes thousands, of different stocks or bonds. When you buy just one share of that ETF, you're buying a tiny piece of everything inside.

A classic example is an S&P 500 ETF (like VOO or IVV). One purchase gives you a sliver of ownership in the 500 largest U.S. companies. Instead of gambling on finding the next big thing, you’re basically betting on the American economy as a whole. This simple move massively cuts down your risk compared to putting all your cash into a single company's stock.

My Personal Tip: When I first started investing, my very first purchase was a total stock market ETF. That one investment gave me a piece of thousands of U.S. companies, from the giants down to small, up-and-coming businesses. It's a low-stress, low-cost way to get your money in the game without the headache of picking individual stocks.

So, what if you really believe in a company like Apple or Amazon, but a single share costs a fortune? This is where fractional shares completely change the game for new investors.

Fractional shares let you buy a small slice of a stock for as little as $1. You don't need $1,000+ sitting around to own a piece of a powerhouse company. You can start with whatever you have, whether it's $5 or $10. This finally makes it possible to build a small portfolio of companies you genuinely believe in, even on a shoestring budget.

Comparing Your Main Options

The choice between ETFs and fractional shares really comes down to what you're trying to accomplish. Are you aiming for broad, diversified safety, or do you want to bet on a specific company you think has a bright future?

Here’s a quick breakdown to help you decide.

| Investment Type | Best For | Key Advantage | Potential Downside |

|---|---|---|---|

| ETFs / Index Funds | Building a stable, diversified core portfolio. | Instant diversification. Your money is spread across many assets, which lowers your risk. | You won't see the explosive growth a single successful stock can deliver. |

| Fractional Shares | Owning specific companies you know and use. | Accessibility. You can own expensive stocks without needing the full share price. | Higher risk. Your investment's fate is tied to the performance of just one company. |

This kind of accessibility is what’s powering a huge market shift. The U.S. online trading platform market is expected to hit $3.41 billion in 2025, with mobile apps driving a whopping 54% of that activity. This growth is being fueled by everyday investors using these exact tools—ETFs and fractional shares—to build wealth, often with less than $10 at a time. You can learn more about stock trading demographics to see just how big this trend has become.

A smart approach for most beginners is to make a broad-market ETF the core of your portfolio. Then, you can use fractional shares to add small positions in a handful of companies you’re passionate about. This strategy gives you a solid, diversified foundation with a little room for more targeted bets. To get more ideas on building that foundation, check out our guide on the best investments for beginners.

Turn Investing Into a Habit You Can't Break

Forget the idea that you need a huge pile of cash to get started. The real magic in building wealth isn't about one big, dramatic investment; it's about the small, consistent actions you take over and over again. This is how you build a powerful investing habit that becomes a natural part of your financial life.

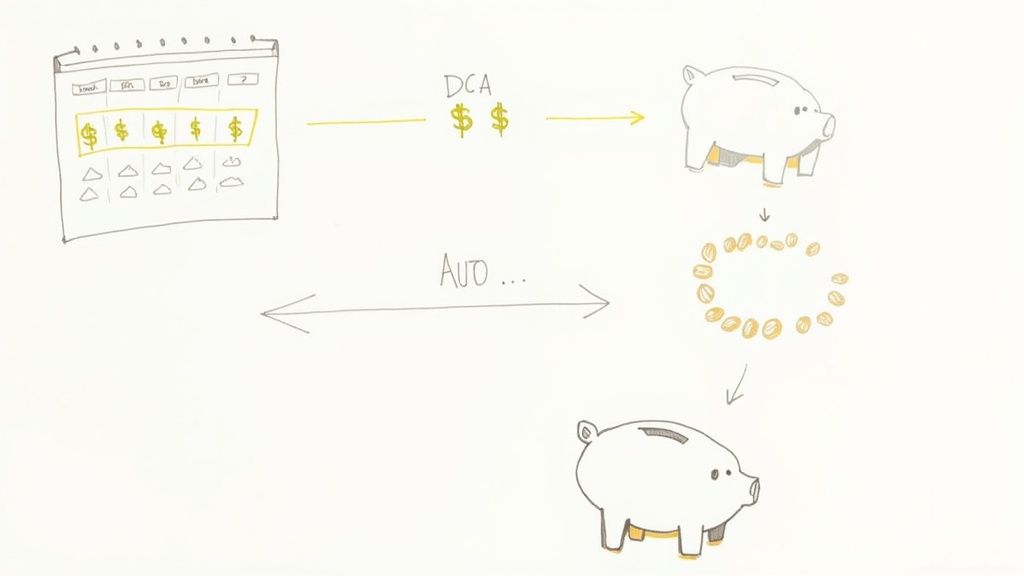

The best way to do this is with a strategy called Dollar-Cost Averaging (DCA). It sounds complicated, but it's incredibly simple. Instead of trying to be a market genius who buys at the perfect moment (spoiler: nobody is), you just invest a fixed amount of money on a regular schedule.

Maybe it's $25 every Friday, come rain or shine. When the market is up, your $25 buys a little less. When the market dips, that same $25 gets you more shares for your money. Over the long haul, this approach smooths out the bumps and takes the emotion out of the equation. If you want to build a solid foundation, you need to master Dollar-Cost Averaging for steady wealth growth.

Put It on Autopilot and Outsmart Yourself

Let's be honest: the biggest thing that gets in the way of consistent investing is life itself. We get busy, we forget, or we second-guess ourselves. The only surefire way to beat this is to take your own willpower out of the process. Automate it.

Here's how you can set it and forget it:

- Schedule Recurring Transfers: Go to your bank's website right now and set up an automatic transfer from your checking to your brokerage account. It could be $10 every Monday or $50 on payday. Treat it like your Netflix bill—it just happens.

- Adopt the "Pay Yourself First" Mindset: This is a game-changer. The moment your paycheck hits, the very first "bill" you pay is the one to your future self. That transfer to your investment account should happen before you even think about groceries or subscriptions.

- Use "Round-Up" Apps: Many modern investing apps can round up your debit card purchases to the nearest dollar and invest the difference. That $0.75 left over from your morning coffee seems like nothing, but you'd be shocked at how quickly it adds up.

Here’s what that looks like in the real world: Sarah, a recent college grad, sets up an automatic investment of $25 every Friday into a low-cost S&P 500 index fund. That's $100 a month, or $1,200 a year. Assuming a historical average market return of 10% per year, Sarah's small, consistent habit could grow to over $20,000 in 10 years and potentially over $75,000 in 20 years. The power wasn't in having a lot of money; it was in her consistency and starting early.

Making Investing a Background Noise

The ultimate goal is to make investing so seamless you don't even think about it. The more you can integrate it into your routine, the easier it is to stick with it for decades.

Seriously, start small. Even $5 a week is a massive win because you're building the habit. You're teaching yourself to be a consistent investor. Once that becomes second nature, you can slowly bump up the amount as you get a raise or trim other expenses. This is exactly how you turn pocket change into real, lasting wealth.

Three Starter Portfolios You Can Build Under $100

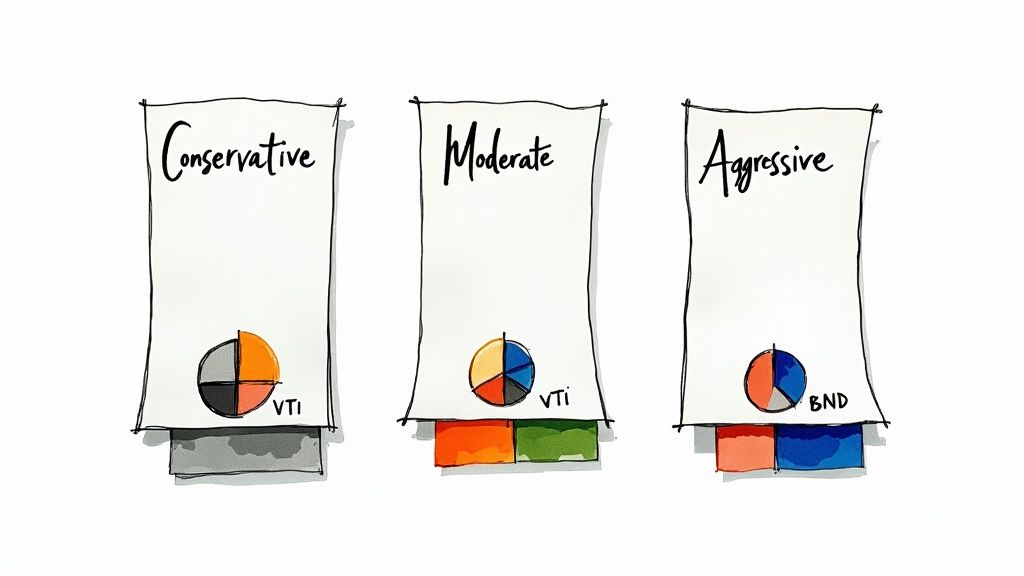

Talking about investing in theory is one thing, but seeing how it works in practice is where it really clicks. So, let's get practical. Here are three different portfolios you can start with less than $100, each built for a different risk appetite.

We'll use a couple of real-world Exchange-Traded Funds (ETFs) that you can find on pretty much any brokerage. The magic ingredient here is fractional shares, which let you buy a small slice of an ETF for just a few dollars, rather than needing hundreds to buy a full share. This is what makes building a diversified portfolio with little money possible.

The Conservative Starter Portfolio

Is your main goal to protect what you have while still earning more than a high-yield savings account? This one's for you. It's heavy on bonds, which tend to be much more stable than stocks.

- $70 into a Total U.S. Bond Market ETF (like Vanguard's BND)

- $30 into a Total U.S. Stock Market ETF (like Vanguard's VTI)

This 70/30 split between bonds and stocks is designed for stability. The bond chunk acts as a steady anchor, while the smaller stock portion gives you just enough exposure to capture some market growth.

The Moderate Growth Portfolio

This is the classic "set it and forget it" approach that works well for most people investing for the long haul. It's a balanced mix that gives you a solid shot at growth without taking on a stomach-churning amount of risk.

- $60 into a Total U.S. Stock Market ETF (e.g., VTI)

- $40 into a Total U.S. Bond Market ETF (e.g., BND)

Often called a "60/40" portfolio, this allocation is a time-tested strategy. You're putting 60% into stocks to capture more upside, but that 40% in bonds provides a nice cushion when the market gets choppy.

The Aggressive Growth Portfolio

Got a long time before you need this money—say, 10 years or more? If you're okay with the market's ups and downs for a chance at higher returns, this is a great starting point. It’s all-in on stocks.

- $80 into a Total U.S. Stock Market ETF (e.g., VTI)

- $20 into an International Stock Market ETF (e.g., VXUS)

This 80/20 split goes all-in on growth. The U.S. stock market (VTI) is your engine, and adding some international stocks (VXUS) spreads your investment across thousands of companies around the globe. There are no bonds here, so expect more volatility, but the potential for higher long-term gains is the trade-off.

My Two Cents: You don't need a dozen different funds to build a solid portfolio. Honestly, a simple two-fund strategy using low-cost, broad-market ETFs is one of the most effective ways to invest, especially when you're just getting your feet wet.

Figuring out which of these fits you best comes down to your personal situation. If you want to go a bit deeper on this, we've got a great guide to help you optimize your portfolio with smart asset allocation. Just remember, the best plan is the one you can actually stick with.

So, What's Next on Your Wealth-Building Journey?

Let’s pull this all together. The path to growing your money doesn't start with some grand, complicated gesture. It starts with a single, small step forward.

Forget the noise and the overwhelming feeling of "getting it perfect." Right now, all you need to remember are three core ideas: start today, stay consistent, and keep it simple.

Here's your game plan, broken down into a few simple actions:

- Find Your Number: First, figure out what small amount you can comfortably set aside each week or month. Is it $25? $50? Whatever it is, commit to it.

- Pick Your Platform: Go back through the options we discussed—a robo-advisor, a micro-investing app, a brokerage with fractional shares—and open your account. This takes minutes.

- Set It and Forget It: As soon as your account is open, set up that recurring transfer. Automating this is the single best trick to ensure you actually stick with it.

- Make Your First Move: Buy into one simple, diversified investment. A total stock market ETF is a fantastic place to start.

And just like that, you're an investor. Seriously, that's it. By taking these few concrete steps, you've put yourself ahead of so many others and are on your way to discovering some of the best ways to build wealth that will serve you for years to come.

Here at Top Wealth Guide, our goal is to give you the clarity and tools you need to build a better financial future. Explore our guides and resources to get started.

Frequently Asked Questions (FAQ)

1. How much money do I actually need to start investing?

You can genuinely start with as little as $1 to $5. Thanks to platforms offering fractional shares, like Fidelity or Schwab, and micro-investing apps like Acorns, the barrier to entry has been eliminated. The key is not the starting amount but the consistency of your contributions.

2. Are investing apps like Acorns or Betterment safe?

Yes, reputable investing apps are very safe. They are regulated by the Securities and Exchange Commission (SEC) and are members of the Securities Investor Protection Corporation (SIPC), which protects your investments up to $500,000 against the failure of the brokerage firm. This does not protect against market losses, which are a natural part of investing.

3. What's better for a beginner: a robo-advisor or picking my own stocks?

For 99% of beginners, a robo-advisor like Betterment is the superior choice. It removes the guesswork and emotion by building a diversified portfolio for you based on your goals and risk tolerance. Picking individual stocks requires significant research and carries higher risk.

4. Should I invest or pay off debt first?

Prioritize paying off high-interest debt (like credit cards with 15%+ APR) before investing. The interest you pay on that debt is a guaranteed loss that will almost always be higher than any potential investment gain. For lower-interest debt (like some student loans or mortgages), a hybrid approach of paying the minimums and investing the rest can be effective.

5. What are the most common fees I should watch out for?

Watch for three main types of fees: monthly subscription fees (common on micro-investing apps), expense ratios (the annual cost of owning an ETF or mutual fund), and management fees (charged by robo-advisors). Aim for platforms with low or no subscription fees and funds with expense ratios below 0.10%.

6. Can I really lose all my money?

If you put all your money into a single, speculative stock, yes, it's possible. However, if you invest in a diversified, low-cost ETF that tracks the entire stock market, it is virtually impossible to lose everything. For that to happen, every major company in the economy would have to go bankrupt simultaneously.

7. What is the easiest investment for a total beginner?

A broad-market index fund or ETF, such as one that tracks the S&P 500 (like VOO) or the total stock market (like VTI), is the simplest and most effective starting point. A single purchase gives you instant diversification across hundreds or thousands of companies.

8. How long does it take to see returns on my investment?

Investing is a long-term game. While you might see positive returns in the short term, you should be prepared for market fluctuations. Real wealth is built over years and decades, not days or months. A patient, long-term mindset (5+ years) is crucial for success.

9. How do I handle taxes on my investments?

In a standard brokerage account, you pay capital gains tax on profits when you sell an investment. If you hold an investment for over a year, you pay a lower long-term capital gains rate. To simplify taxes and maximize growth, consider starting with a tax-advantaged retirement account like a Roth IRA, where your investments can grow completely tax-free.

10. What's the difference between a stock and an ETF?

A stock represents ownership in a single company (e.g., one share of Apple). An ETF (Exchange-Traded Fund) is a basket containing many different stocks (or other assets) bundled into one investment. For beginners, ETFs are recommended because they provide instant diversification and lower risk.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.