Cryptocurrency… the wild, wild west of the financial world, and it’s got everyone—yes, everyone—buzzing. Over at Top Wealth Guide, we’ve been swamped by rookies itching to dive into this digital gold rush. Why? Because FOMO is real, and nobody wants to be the last one to the party.

So, here’s the deal. We’ll break it down for you—nice and easy. From wrapping your head around the basic stuff (think Crypto 101) to picking the right exchanges… and, of course, crafting those sharp, one-step-ahead investment strategies. Buckle up. Your crypto adventure is about to start with a potent mix of smarts and swagger.

In This Guide

What Is Cryptocurrency and How Does It Work?

The Basics of Cryptocurrency

Cryptocurrency – digital cash – operates on this buzzword called blockchain. (Which no one actually understands, but we’ll give it a shot.) It’s the tech that lets you trade directly without banks poking their noses in. Bitcoin, born in 2009, still wears the crown as the top crypto.

Blockchain: The Engine Behind Crypto

Think of blockchain as this futuristic, super-resistant ledger spread across a network – not held hostage by any one authority. Picture it like a digital bouncer, guarding transactions from hackers. Stuff gets added to a block, then piggybacks on previous blocks, turning into a chain of trust.

Popular Cryptocurrencies and Their Features

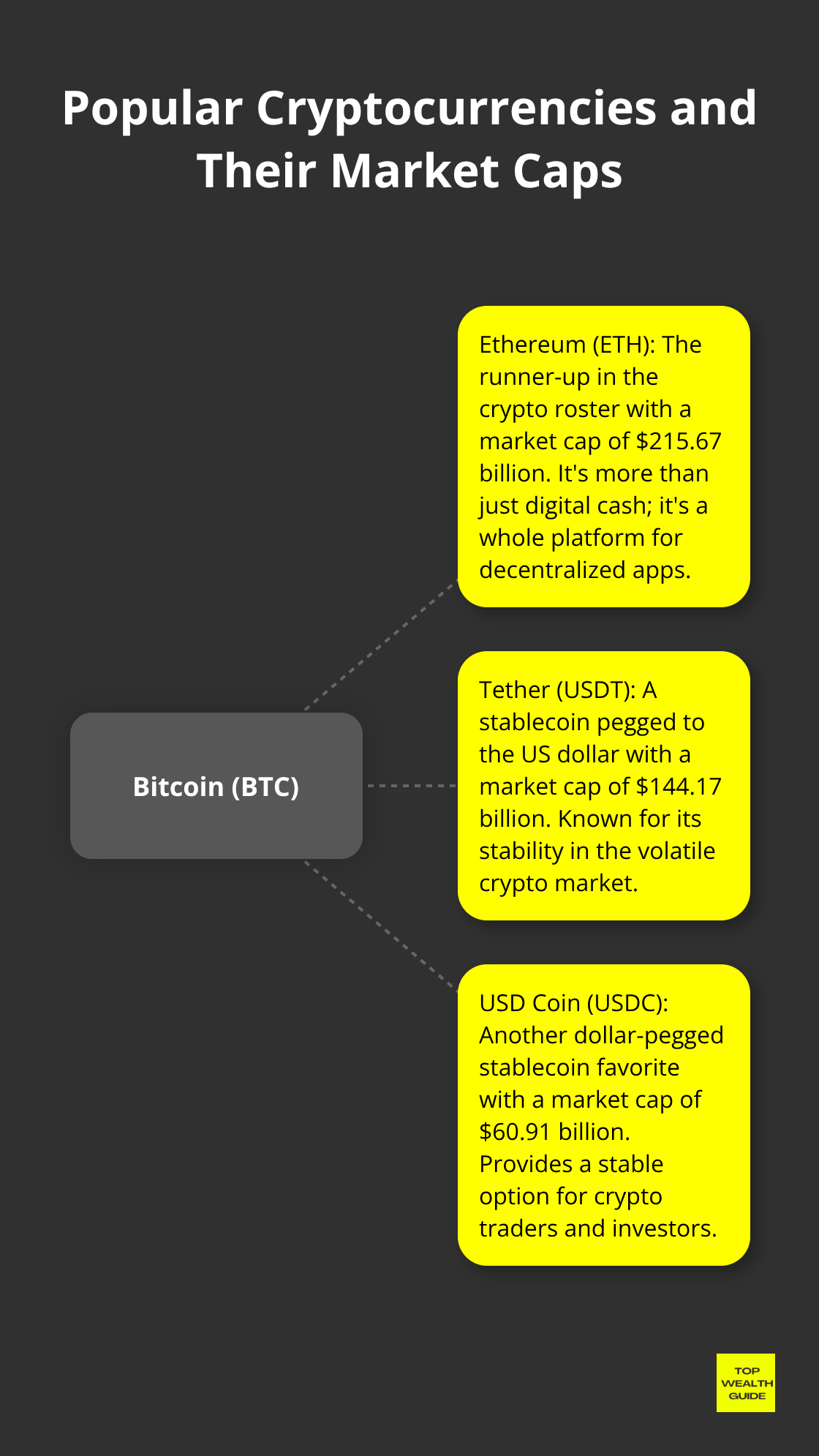

Bitcoin’s the big dog – no question. But, thousands more are strutting around with their own quirks:

- Ethereum (ETH): The runner-up in the crypto roster ($215.67 billion market vibe). More than just digital cash; it’s a whole platform for apps nobody can control (neeerds).

- Tether (USDT): Steady-Eddie stablecoin, glued to the dollar (market cap: $144.17 billion).

- USD Coin (USDC): Another Dollar-dupe favorite (market cap: $60.91 billion).

Understanding Cryptocurrency Market Dynamics

This market – it’s a rollercoaster, folks. Prices swing hard, powered by headlines, tech tweaks, and Twitter rants. Case in point: Bitcoin crashes from $65K to $20K in less than two years… ouch.

With great volatility comes great opportunity – and danger too. Don’t put in more than you’re ready to wave goodbye to.

Practical Tips for Newcomers

- Dip your toes in: Start small. (Yep, you can own just a slice of the big pie.)

- Stick with the good guys: Platforms like Coinbase or Gemini make decent gateways for noobs.

- Guard your digital moolah: Lock it tight in a digital wallet. (Cold wallets are your Fort Knox against those cyber bandits.)

- Stay sharp: The crypto landscape? It changes faster than my mind after two espressos. Get the scoop from solid news outlets and project sources.

- Mind Uncle Sam: Yup, crypto gains? Taxable. Keep track of your every move.

In the crypto cosmos, knowledge is the new currency. Get your head around this stuff, and you’ll glide through the financial maze like a pro. Ready for the next leg of the journey? Let’s talk crypto exchanges. Buckle up.

Where to Buy Crypto Safely: Choosing the Right Exchange

The Big Players in the Crypto Exchange Game

Okay, so here we’ve got the giants – Coinbase, Binance, Kraken. These aren’t just names; they’re the poster children of crypto exchanges. Why? Their history, security, and liquidity make them no-brainers for folks diving into crypto. Coinbase? User-friendly, but oh boy, those fees might sting. Binance? A cornucopia of coins but could put off the rookies. Kraken? It’s the Goldilocks option – not too hot, not too cold.

But, hey, don’t just run with the pack. (Really.) Dig a little, do your homework to see which suits your needs.

Key Factors in Selecting an Exchange

Fees. Yeah, right at the top. You need transparency here, folks. Some exchanges dangle low trading fees like a worm on a hook only to smack you with high withdrawal charges. Don’t fall for it.

Security – non-negotiable. If an exchange isn’t rocking two-factor authentication, keep scrolling. Cold storage for funds? That’s the lock-tight safety you want. It’s like moving valuables into a safe and not just leaving them on the coffee table for burglars to marvel at.

Liquidity, folks, is crucial. More liquidity, more flexibility in buying and selling without prices jumping all over the place. Bigger platforms usually have the upper hand.

Customer support – ever had a problem and felt like shouting into the void? You don’t want that here. Trust me, when things go sideways (they can), you want someone on the other end who’s actually helpful.

Setting Up Your Account: The Basics

Got your exchange picked? Let’s get you set up. Be ready for paperwork. Know Your Customer (KYC) – it’s like crypto’s version of showing your ID at the bar. Name, DOB, address, and a peek into where your funds originate.

(Pro tip: Strong, unique password. Enable that two-factor authentication right away. It’s your new BFF.)

Safeguarding Your Cryptocurrency

Folks, rule number one: your exchange account isn’t your piggy bank for life. Storing crypto there long-term? It’s like stashing your life savings under the mattress.

Go get yourself a personal wallet. Hardware like Ledger or Trezor? These are the Fort Knox of crypto protection – keeping your nerd money offline. For daily trades, look at a trusted software wallet.

(Remember: Personal wallets mean you’re holding the keys. Lose ’em, and you might as well kiss your crypto goodbye.)

Stay sharp. Those phishing scams? Like mushrooms in the crypto wild – they pop up everywhere. Don’t trust surprise messages begging for funds; legit businesses aren’t sending you love notes like that.

Choosing the right exchange and locking down security measures gives you a rock-solid start in crypto. Nail these basics, and you’re on your way to mastering crypto investments. Let’s dive into this wild world and figure out how to make those digital dollars work for you.

How to Invest in Crypto Smartly

Crypto investing-spoiler alert-is not your golden ticket to instant riches. Nope, gotta play the long game here, folks. We’re talking patience, research, and, you guessed it, a solid plan. So let’s steer clear of that dramatic nosedive into chaos without a strategy.

The Power of Dollar-Cost Averaging

Timing the market? More like trying to catch lightning in a bottle. Even the veterans can’t do it consistently. Instead, let’s cozy up to dollar-cost averaging (DCA). Just invest a fixed amount regularly, rain or shine. This style? It tamps down those rollercoaster crypto price swings.

Picture this: plunking down $100 in Bitcoin every week. One week you’re buying at a high, the next at a low. Over time, it evens out, potentially trimming your overall risk.

Diversify Your Portfolio

All your crypto eggs in one basket? Let’s not. Spread them nice and wide across different cryptos. But here’s the clincher-don’t just throw darts and pick random coins. Dive deep, do the homework.

Crypto portfolio diversification is about spreading out tightly across various crypto assets, categories, and strategies.

A savvy portfolio mix? Think something like:

- 50% in solid coins like Bitcoin and Ethereum

- 30% riding on mid-cap altcoins with solid foundations

- 20% in smaller, riskier projects with some oomph

This trifecta gives you the stability of big players while sniffing out growth from the up-and-comers.

HODL Strategy vs. Active Trading

HODL-yes, the meme, but, oh, so much more. It’s a bone fide strategy. Long-term holding has generally left short-term trading in the dust for most folks. Price trends are volatile, sure, but over time? They tend to climb.

If trading calls your name, lay down the law: no risking more than 1-2% of your pot on one trade. Stop-loss orders? A must for capping potential nosedives. And leverage trading? Treat it like handling dynamite-you might just walk away with nothing (spoiler: it’s risky stuff).

Crypto’s open round-the-clock. Tempting to dive in with your emotions dictating moves. So, pencil in specific trading hours and swear by them.

Risk Management Is Your Best Friend

Crypto’s a rollercoaster. Know it. Love it. Plan for it. Here’s your playbook:

- Only gamble with funds you can kiss goodbye. (Don’t brush this off.)

- Lock long-term holdings in hardware wallets. Keep the rest you’re trading actively on exchanges.

- Set crystal clear profit points. When a coin reaches your mark, offload some to secure those gains.

- Stay enlightened but don’t spiral. Peek at prices daily, not every minute.

Set Realistic Goals

Chasing those pie-in-the-sky 1000x returns? Time to get real. Plot out realistic, feasible objectives based on your timeframe and appetite for risk.

Short-term (3-6 months): Aim for 20-30% returnsMedium-term (6-18 months): Set sights on 50-100% growthLong-term (2+ years): Go for 200%+ gains

Are these iron-clad? Nope, but they’re a heck of a lot more attainable than chasing that overnight millionaire’s dream.

Don’t skimp on your exit blueprint. Know the cues to sell-be it a set price target or a life event that demands cash. Adhere to your plan, no matter the market buzz or FUD (Fear, Uncertainty, and Doubt).

Final Thoughts

So, you’re thinking about diving into crypto, huh? Let’s talk real talk. Investing in cryptocurrency-it’s not your typical walk in the park. It demands patience… research… and yep, a solid strategy. Here’s the playbook: start small and let your portfolio grow like a snowball rolling downhill. Never put more on the line than you can kiss goodbye. Wanna smooth out those wild market swings? Dollar-cost averaging, people. It’s your friend. And diversify-spread it like peanut butter over different cryptocurrencies.

Risk management? It’s the unsung hero in this game of digital coin flips. Set clear profit targets, slap on those stop-loss orders, and keep emotions out of this. Let’s face it, emotional trading is like texting the ex-it never ends well. Your long-term holdings? Lock ’em up in secure hardware wallets and play fast and loose with only a small slice of your crypto pie (protect those assets, folks).

This crypto world? It’s a roller coaster that never stops. Continuous learning-it’s not optional, my friends. It’s essential for making moves that aren’t foolish. For more deep dives into personal finance, investing, and strategies to stack those coins, take a peek at Top Wealth Guide. We’re in your corner, ready to help you make those smart money decisions and crush your long-term wealth goals.

1 Comment

Pingback: Top 10 Best Investment Apps for Beginners in 2025