Your investment game is all about matching up your portfolio with how much risk you can stomach. Most folks throw cash at stuff that’s way out of their league (mistake) — and it costs them big time.

We here at Top Wealth Guide are gonna walk you through the surefire ways to truly nail down your risk vibe. Trust me, you’ll get the practical play-by-play on crafting an investment strategy that fits your financial dreams and, well, keeps your stress levels in the chill zone.

In This Guide

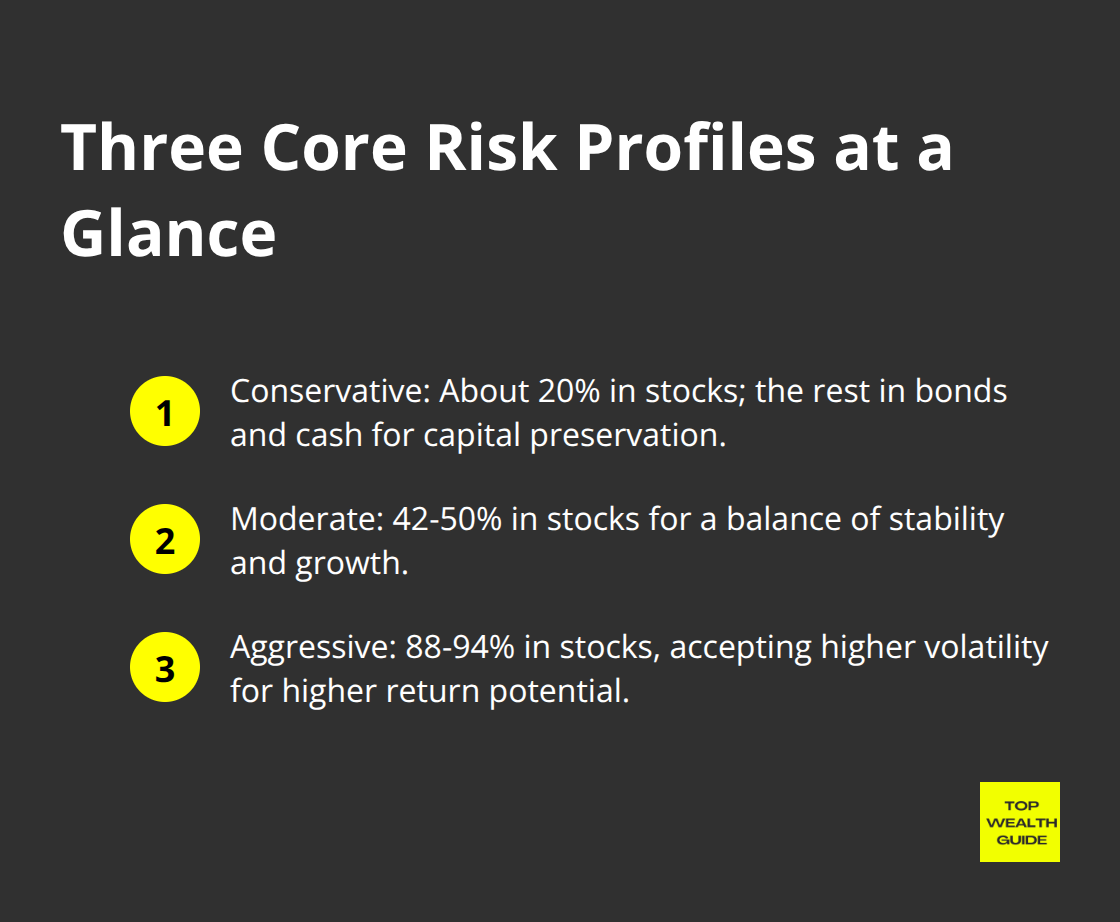

What Is Investment Risk Tolerance

Risk tolerance – that’s your psychological comfort zone when the market goes haywire. It’s not some fuzzy idea but a real thing you can measure. Can you still catch your Z’s when your portfolio nosedives 20% in a month? That’s what we’re talking about. So, Dr. Ruth Lytton at Virginia Tech and Dr. John Grable at the University of Georgia put together this framework that breaks investors down into three camps: conservative (20% stocks), moderate (42-50% stocks), and aggressive (88-94% stocks). You’d be amazed – or maybe not – how many folks mix up risk tolerance with risk capacity. Spoiler alert: it wrecks portfolios every single day.

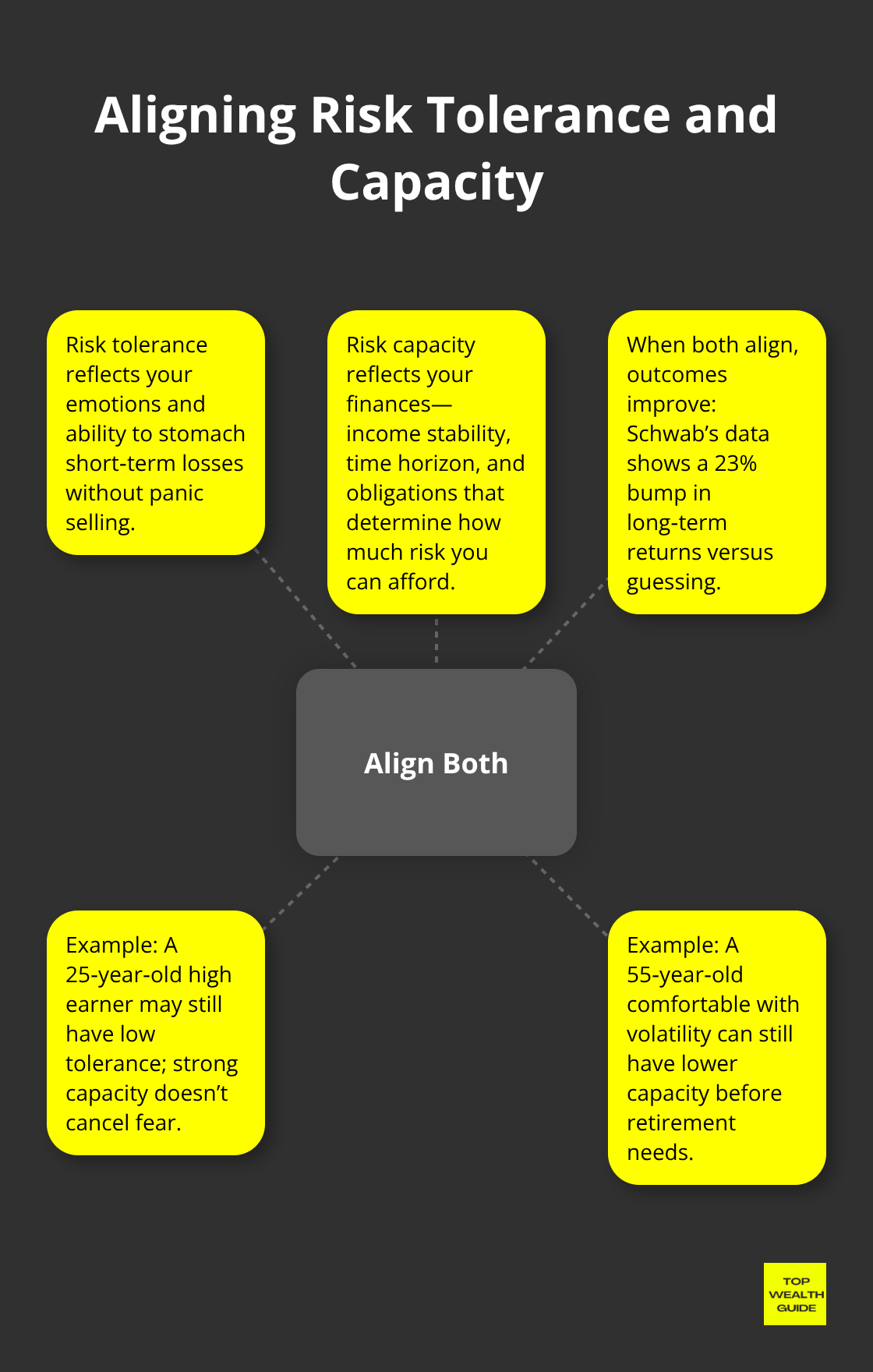

Risk Tolerance vs Risk Capacity

Risk tolerance is all about your gut – can you handle the short-term pain? Risk capacity, on the other hand, looks at your wallet and says, “Can you afford the financial rollercoaster?” You could be 25 years old making $150,000 a year, loaded with risk capacity but panicked as your investments head south – low risk tolerance, my friends. Meanwhile, you might be 55 with $2 million saved and cool with market swings but can’t take a big hit before retirement (high tolerance, lower capacity). Schwab’s data? It’s clear – aligning both gives you a 23% bump in long-term returns against those who play the guessing game.

The Real Cost of Mismatch

Mismatch your risk tolerance, and say goodbye to your wealth faster than a bad stock tip. Brokerage data reveals investors whose portfolios don’t match their true tolerance face major behavioral meltdowns during market dips. The damage? An average hit of 3.2% in annual returns over two decades – equating to $400,000 less on a $500,000 portfolio. Your risk tolerance acts as your investment’s guardrails, curbing those panic-driven decisions that pile on losses and keeping you in the game when markets rebound, building real wealth over time.

Three Core Risk Profiles

Conservative investors want to keep what they’ve got, so they stick 20% in stocks and stash the rest in safe stuff like bonds and cash. Moderates mix it up with 42-50% in stocks, aiming for stability and some growth. Aggressive types? They’re all in for maximum returns, committing 88-94% to stocks, riding out wild market swings for potential big gains.

Each profile fits different life stages and money situations, but-and here’s the kicker-success hinges on being honest about your own risk appetite rather than hoping to be someone you’re not.

Now that we’ve unpacked risk tolerance and its importance, it’s time to dive into the tools to figure out where you land on this spectrum.

How Do You Actually Test Your Risk Tolerance

We’ve all seen those vanilla online quizzes claiming to assess your risk tolerance – guess what? They’re about as useful as a screen door on a submarine. Here’s how you really dig into your risk guts: Start with the Lytton-Grable Risk Tolerance Assessment. This is the big leagues, folks. Developed by brainiacs at Virginia Tech and the University of Georgia, it’s 13 questions that seriously measure how you handle the ups and downs of investing. Schwab tweaks it a bit and hits 89% prediction accuracy on what investors will do when the market tanks. Why? It fires real-life curveballs at you like, “What’s your next move when your $100k shrinks to $80k in six months?” Goodbye, hypothetical fluff.

Financial Stress Test Your Situation

Time to face the music, financially speaking. Scrutinize your numbers with a financial stress test to know how much risk you can shoulder without going broke. Rule number one: an emergency fund that covers three to six months of expenses is non-negotiable before you tango with market risks. Map out whether your income is as stable as your last relationship and any big-ticket expenses like the roof over your head or kids’ schooling that could throw a wrench in your financial works. Vanguard says if you’ve got less than $50k parked safely outside your investments, you’re 40% more likely to do the market panic-dance when things go south. And let’s talk debt-to-income: Push past 30% and your risk capacity heads for the hills, no matter what your brain tells you.

The Market Simulation Reality Check

This is where the rubber meets the road, and folks start realizing maybe they’re not the financial daredevils they thought. Picture this: Your investment account nosedives by 25% in three weeks – déjà vu of the 2020 market kerfuffle. If just thinking about this brings on a cold sweat, odds are you’re more risk-averse than you’d like to think. Fidelity’s numbers show 60% of so-called aggressive investors turn into moderate kittens in the face of real losses. Watch your own behavior during the next market slide of 5-10% and jot down your instant reactions – this tells you more than any pen-and-paper test on risk tolerance.

The Sleep Test Method

Say goodnight, but not before checking the nerve of your portfolio. Ask yourself, “If this puppy takes a 20% nosedive overnight, am I still sleeping like a log?” Your immediate gut response trumps hours of financial theory. Studies from behavioral finance wizards say losing z’s over stock losses means you’re probably going to underperform by 2.1% a year due to stress-fueled blunders. If you’re up all night checking prices or scrolling into insomnia, you’ve blown past your real risk threshold, regardless of what any algorithmic quiz tells you.

With your risk tolerance clear as a bell, it’s time to craft a portfolio that doesn’t keep you up at night – or send your finances hurdling into a ditch. Dive into investment strategies or use investment apps that sync with your risk tolerance.

How Do You Build the Right Portfolio

Here’s the thing – your risk tolerance? Means nada if your portfolio doesn’t match up. Numbers are straightforward – Morningstar says 68% of investors are holding onto portfolios that don’t even come close to their risk comfort zone. What’s the fallout? A drag of 2.8% on annual returns, on average. So, here’s the classic move: Conservative folks diving into hot tech stocks, only to panic-sell when things get rough, while the more daring ones chained to bond-heavy portfolios miss out on that sweet compound growth. What’s the game-changer? Three distinct portfolio blueprints that truly deliver.

Conservative Portfolios That Actually Protect Wealth

Conservative investors – they need portfolios built like financial fortresses. Think max 20% in stocks, with the rest in Treasury bonds, high-grade corporate bonds, and cash equivalents. Check out Vanguard’s Conservative Allocation Fund – it’s rocking an average annual return of 6.2%, with maximum drawdowns that don’t exceed 12% even during major crashes. Your stock picks should be all about those dividend aristocrats – firms upping dividends for at least 25 years straight, like Coca-Cola and Johnson & Johnson.

Now, bond ladders – total game-changer compared to bond funds for the more cautious. They let you control maturity dates and sidestep interest rate rollercoasters. And here’s another tip: stash 6-12 months of expenses in high-yield savings accounts that pay 4.5%+, way better than your typical 0.1% savings account. This strategy? It weathered 2008, 2020, and every market tantrum since 1990 without losing sleep.

Moderate Allocation Sweet Spot

Moderate investors – they’re looking for that goldilocks balance: 50-60% stocks and 40-50% bonds. But here’s the kicker – the devil is in the details. Target-date funds from Fidelity and Vanguard adjust this mix as you age, but watch out for those fee differences. Or, build your own masterpiece: 40% total stock market index, 10% international stocks, 35% intermediate-term bonds, and 15% REITs to guard against inflation.

Skeptical? Schwab’s research backs it up – 8.1% average annual returns with max drawdowns at 16%. This setup is for folks itching for growth without sweating over temporary losses. Pro tip: Rebalance quarterly if allocations wander 5% off target – not every day when the market sneezes.

Aggressive Growth That Actually Works

For aggressive investors – we’re talking 80-90% in stocks, but let’s be clear – most screw this up by chasing individual stocks rather than embracing systematic diversification. Here’s the winning formula: 60% US total market, 20% international developed markets, 10% emerging markets, and 10% bonds for those occasional rebalance chances. This setup? Outsmarts 89% of actively managed funds over 15-year spans, SPIVA data confirms.

If you’re under 30 with a steady paycheck – ditch the bonds. 100% stock allocation gives you 10.3% annual returns over 20+ years. Max out 401k matches, then pump up Roth IRA contributions up to $6,500 a year (for 2023). The secret sauce? Automate all your moves and ignore the daily market chatter that turns aggressive types into emotional wrecks.

Final Thoughts

Understanding your risk tolerance? It’s like looking in a mirror that doesn’t lie… brutal honesty about your cash flow and how you react when the market has a tantrum. Begin with the Lytton-Grable assessment – give your finances a stress test with that emergency fund check – and throw yourself into real market scenarios. Pretty much everyone skips this step, and, well, they end up with that painful 2.8% annual performance drag we talked about before.

And here’s the thing – your risk tolerance? It’s basically a moving target as life rolls on. Marriage, kids, job shake-ups, market hiccups… they all jiggle the needle on how much chaos you can stomach. So, give your assessment a refresh every two years, or anytime life throws you a curveball (the bold 25-year-old investor rapidly morphs into a moderate 45-year-old parent, quicker than you’d think).

Align your portfolio with your real risk profile, not what wins bragging rights at social gatherings. Whether you lean conservative, moderate, or aggressive, they all pan out when done right. We at Top Wealth Guide are here to offer practical strategies for wealth that doesn’t just flutter away.