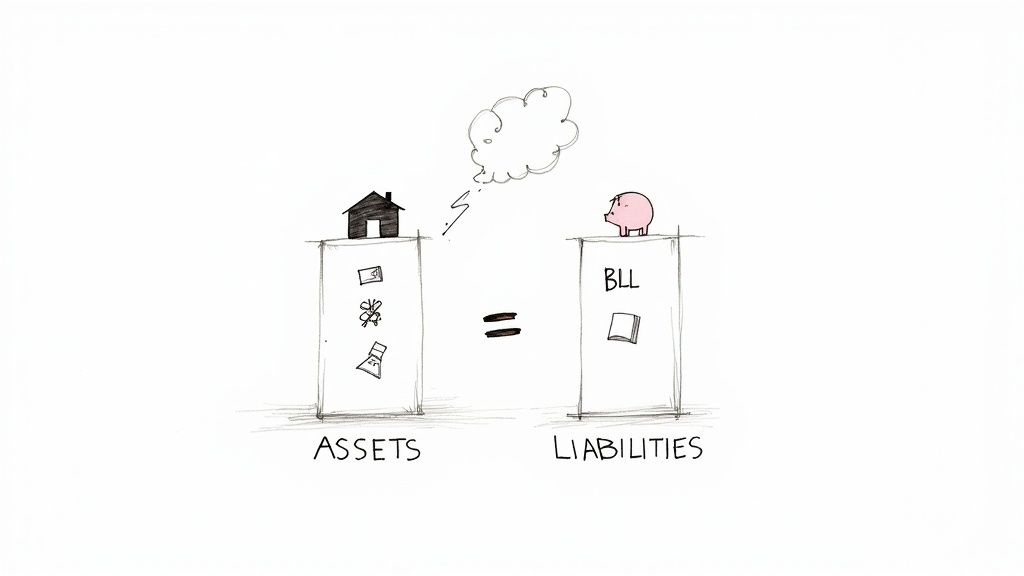

Ready to figure out your net worth? It all boils down to one simple, yet powerful, formula: what you own minus what you owe. That’s it.

The equation is straightforward: Assets – Liabilities = Net Worth. This single number is the clearest indicator of your financial health—think of it as your personal financial report card.

In This Guide

- 1 Your Financial Snapshot: What Net Worth Really Means

- 2 Tallying Up What You Own: Your Assets

- 3 Facing the Numbers: What You Owe (Your Liabilities)

- 4 Putting It All Together With A Real-World Example

- 5 What Your Net Worth Number Actually Tells You

- 6 Frequently Asked Questions About Calculating Net Worth

- 6.1 1. How often should I calculate my net worth?

- 6.2 2. Is it bad to have a negative net worth?

- 6.3 3. How do I determine the value of my house or car?

- 6.4 4. Should I include my salary as an asset?

- 6.5 5. What about my furniture, electronics, and personal belongings?

- 6.6 6. Does my credit score affect my net worth?

- 6.7 7. Should I include my 401(k) and other retirement accounts?

- 6.8 8. Why did my net worth go down even though I was saving money?

- 6.9 9. If I have a loan on an asset (like a mortgage on my house), how do I list it?

- 6.10 10. How do I value a small business I own?

Your Financial Snapshot: What Net Worth Really Means

Knowing how to calculate your net worth is the first real step in smart financial planning. But what does that number actually tell you? It's more than just a figure on a spreadsheet; it’s an honest look at where you stand financially at this very moment.

This calculation is what takes you from fuzzy financial dreams to concrete, trackable goals. Whether your target is buying a home, launching a business, or retiring without a worry, your net worth is the starting line that lets you draw a realistic map to get there.

Why This Number Matters

When you start tracking your net worth consistently, it stops being a static number and becomes a dynamic tool for making better decisions. You can literally see the results of your financial habits. Are you building wealth or digging a deeper hole? This feedback loop is incredibly powerful, helping you fine-tune your strategy and stay on track.

Let’s run through a quick example. Imagine someone owns a $300,000 home, has $50,000 in savings, and another $20,000 in investments. Their total assets add up to $370,000. On the flip side, they have a mortgage, a car loan, and some credit card debt totaling $165,000. So, their net worth is $205,000 ($370,000 – $165,000). This figure is a vital benchmark, especially when you consider broader trends—for instance, the median net worth for an adult in North America was recently reported at $107,790. You can see the full analysis of global wealth trends from UBS for more context.

Your net worth is your financial story told in numbers. It reflects your past decisions, captures your present situation, and helps you write a better future.

While it’s a crucial metric, remember that this number is a measure of financial progress, not personal worth. True prosperity goes beyond what’s on a balance sheet. To dig deeper into this idea, take a look at our guide on how to define wealth beyond money and possessions.

The Net Worth Formula at a Glance

To make it even clearer, let's break down the components of the net worth calculation. This table simplifies the core elements you'll be working with.

| Component | Definition | Example |

|---|---|---|

| Assets | Anything you own that has monetary value. | Cash, investments, real estate, vehicles, valuables. |

| Liabilities | Any debt or financial obligation you owe. | Mortgages, student loans, car loans, credit card debt. |

| Net Worth | The difference between your total assets and total liabilities. | $370,000 (Assets) – $165,000 (Liabilities) = $205,000. |

With these pieces in hand, you have everything you need to calculate your own number and start taking control of your financial story.

Tallying Up What You Own: Your Assets

Before you can figure out your net worth, you have to get a handle on what you own. We call these your assets, and they're anything with monetary value, from the money in your savings account to the home you live in.

Think of it like taking a financial inventory. The key is to be realistic and precise. A common pitfall is to value things based on what you paid for them. Instead, you need to find their current market value—what they’re actually worth if you were to sell them today.

Breaking Down Your Assets

I find it’s easiest to tackle this by breaking things down into four main categories. This approach keeps you organized and makes it less likely you'll overlook something important.

- Cash and Equivalents: This is your most liquid money. Tally up the balances in your checking and savings accounts, plus any money market funds. It’s the easy stuff.

- Investments: Now, pull up the statements for your retirement and brokerage accounts. This includes your 401(k), IRAs, and any other investment portfolios. If this is new territory for you, our guide explains in detail what an investment account is and how it all works.

- Real Estate: For homeowners, this is probably your biggest number. Find a recent property appraisal or check online estimators like Zillow to get a solid idea of its current market value.

- Personal Property: Be selective here. We're only looking for big-ticket items with real resale value, mainly your car. A quick search on Kelley Blue Book will give you an accurate, up-to-date value.

Expert Tip: Don't waste time trying to assign a value to your couch, TV, or laptop. The resale value of most household goods is minimal, and including them just clutters up your calculation. Focus on what truly moves the needle.

Getting these values right is crucial. Here’s a quick guide on where to look and what to avoid for your most significant assets.

| Asset Type | How to Find Its Value | Mistake to Avoid |

|---|---|---|

| Home | Use a recent appraisal or Zillow/Redfin estimate. | Using the original purchase price or tax assessment value. |

| Vehicle | Check its current resale value on Kelley Blue Book (KBB). | Guessing based on its age or original sticker price. |

| Investments | Log into your accounts to get the current balance. | Using the amount you originally contributed. |

By taking the time to carefully list and value what you own, you’re building the first, and most positive, side of the net worth equation. This step alone gives you a powerful snapshot of the financial resources you have at your disposal.

Facing the Numbers: What You Owe (Your Liabilities)

Alright, let's turn our attention to the other side of the net worth equation: your liabilities. Honestly, this part can feel a little intimidating, but getting a complete and brutally honest picture of what you owe is non-negotiable for an accurate calculation.

Liabilities are simply any debts or financial obligations tied to your name. To do this right, you need the exact current balance for each one. It's so easy to want to round down or use last month's numbers, but precision is what makes this exercise truly powerful.

Finding Your True Debt Totals

Time to roll up your sleeves. Start gathering all your recent statements or logging into your online accounts. Don't guess—pull the real, up-to-the-minute numbers.

Here are the usual suspects you'll want to track down:

- Mortgage: This is often the biggest number on the list. Find the current principal balance, not what you originally borrowed.

- Student Loans: Log in to your federal and any private loan servicer websites. Get the total payoff amount for each.

- Auto Loans: Check your latest statement for the current payoff amount. Your regular monthly payment amount isn't what we need here.

- Credit Card Debt: This is a big one. List the outstanding balance on every single card, even the ones with small balances that you plan to pay off soon. They all add up.

Tackling debt head-on is one of the most effective ways to boost your net worth. Every dollar you shave off your liabilities directly increases your net worth by a dollar.

Don’t forget to include other common debts, like personal loans, outstanding medical bills, or any back taxes you might owe. The goal is to be thorough, leaving no stone unturned. If you're looking for a game plan to start shrinking these numbers, our guide on crushing debt with the debt snowball method is a fantastic place to start.

Real-Life Comparison: Two Debt Scenarios

Let's compare two individuals to see how liabilities dramatically impact net worth, even when assets are similar.

| Profile | Maya (Recent Grad) | David (Mid-Career) |

|---|---|---|

| Assets | ||

| Savings Account | $8,000 | $25,000 |

| Used Car | $12,000 | $20,000 |

| 401(k) | $5,000 | $150,000 |

| Total Assets | $25,000 | $195,000 |

| Liabilities | ||

| Student Loans | ($40,000) | ($0) |

| Auto Loan | ($9,000) | ($5,000) |

| Credit Card Debt | ($2,000) | ($1,000) |

| Total Liabilities | ($51,000) | ($6,000) |

| Net Worth | -$26,000 | $189,000 |

Maya's student loan debt results in a negative net worth, which is very common early in a career. David has paid off his student loans and built his investments, resulting in a strong positive net worth. Both snapshots are valid and useful for future planning.

Putting It All Together With A Real-World Example

Abstract concepts are fine, but nothing makes financial planning click like seeing it done with real numbers. Let's walk through an example to see how this works in practice.

Meet "the Millers," a couple in their late 30s. They decided it was time to stop guessing and get a truly clear picture of where they stand financially.

They dedicated a Saturday afternoon to the task, gathering all their financial documents—mortgage statements, 401(k) balances, auto loan paperwork, you name it. To avoid getting overwhelmed, they organized everything into a simple table. I always recommend this approach; it turns what feels like a messy pile of paper into a clean, understandable snapshot.

Case Study: The Millers' Net Worth Calculation

Here’s the detailed breakdown of what the Millers own and what they owe. One key detail to notice is that they used the current market values for their home and cars, not the price they originally paid. That’s a crucial step for accuracy.

| Item | Category | Value |

|---|---|---|

| Primary Residence | Asset | $450,000 |

| 401(k) Accounts | Asset | $185,000 |

| Savings Account | Asset | $35,000 |

| Vehicles (2) | Asset | $28,000 |

| Brokerage Account | Asset | $22,000 |

| Total Assets | — | $720,000 |

| Mortgage Balance | Liability | ($310,000) |

| Student Loans | Liability | ($45,000) |

| Auto Loans | Liability | ($18,000) |

| Credit Card Debt | Liability | ($7,000) |

| Total Liabilities | — | ($380,000) |

With all their numbers neatly laid out, the final calculation was just a bit of simple math.

$720,000 (Total Assets) – $380,000 (Total Liabilities) = $340,000 (Net Worth)

After running the numbers, the Millers discovered their net worth is $340,000. This figure is now their financial baseline—a starting point they can use to track their progress and make smarter decisions year after year.

This example really highlights that the calculation itself isn't the hard part. The real work is in the prep—taking the time to hunt down the statements and accurately value everything you own and owe.

For anyone juggling multiple investment accounts, some of the best portfolio tracking tools every smart investor uses can make this data-gathering process much easier by pulling in values automatically.

What Your Net Worth Number Actually Tells You

So, you've done the math and now you have your net worth figure staring back at you. What does it actually mean? It's easy to look at it as a final grade on your financial report card, but that's not the right way to think about it. This number is your starting line, giving you powerful context for where you stand right now.

If you landed on a negative number, don't panic. A negative net worth is a totally normal, and often temporary, phase for many people. Think about a recent graduate with a mountain of student loans or a first-time homebuyer with a brand-new mortgage. In these common scenarios, liabilities often outweigh assets. What truly matters isn't this initial number, but the direction it's headed.

Turning Your Number into a Plan

The real magic happens when you start tracking your net worth over time. A single calculation is just a snapshot, but checking in quarterly or even annually creates a moving picture of your financial journey. This transforms a static number into your most important personal finance metric. It tells you, point-blank, if what you're doing with your money is actually working.

This same principle is used to measure the financial health of entire countries. On a global scale, total financial assets have soared to record highs, but this growth isn't spread evenly. The average net financial assets in wealthier nations are a staggering 24 times higher than in poorer ones. If you're curious, you can read the full research on global wealth trends to see how these big-picture calculations offer crucial economic insights.

Your net worth is your financial progress report. A single calculation is a snapshot, but tracking it over time creates a movie of your financial growth.

When you're ready to start improving your number, there are really only two levers you can pull. It's that simple.

- Grow Your Assets: This is your offense. Make consistent saving and investing a non-negotiable part of your financial life. This is the engine that drives long-term wealth.

- Shrink Your Liabilities: This is your defense. Attack your high-interest debt with a clear strategy. Every dollar of debt you wipe out is another dollar added directly to your net worth.

By focusing your energy on these two simple goals, you can take control and actively steer your financial future where you want it to go.

Frequently Asked Questions About Calculating Net Worth

Even with the steps laid out, a few questions always pop up when you're calculating your net worth for the first time. It's completely normal. Let's tackle the 10 most common ones I hear from people.

1. How often should I calculate my net worth?

Most financial experts recommend calculating your net worth at least once a year. This provides a consistent, year-over-year picture of your progress. However, if you're actively working toward a specific goal like paying off debt, checking in quarterly can be a great motivator.

2. Is it bad to have a negative net worth?

Not at all, and it's far more common than you might think. A negative net worth simply means your liabilities currently outweigh your assets. This is a typical starting point for recent graduates with student loans or new homeowners with a large mortgage. See it as your baseline—the point from which you’ll build.

3. How do I determine the value of my house or car?

Always use the current fair market value, not what you originally paid.

- For your home: A recent professional appraisal is the most accurate. For a good estimate, you can use online tools from sites like Zillow or Redfin.

- For your car: I always recommend Kelley Blue Book (KBB). Use the "Private Party" value, which reflects what you could realistically sell it for today.

4. Should I include my salary as an asset?

No. Your net worth is a snapshot of your financial position on a specific day. Your salary is income—a flow of money over time. While your income is the primary tool for increasing your net worth, it isn't part of the calculation itself.

Your income is the fuel for your financial journey, but your net worth is the GPS telling you exactly where you are.

5. What about my furniture, electronics, and personal belongings?

Generally, it's best to leave everyday household items out of the calculation. Most personal belongings depreciate quickly and have low resale value. Including them can inflate your number without reflecting true financial substance. The only exception is for high-value, professionally appraised items like fine art, collectibles, or significant jewelry.

6. Does my credit score affect my net worth?

Not directly. Your credit score measures your creditworthiness, while your net worth measures your accumulated wealth. However, they are related. A higher credit score can lead to lower interest rates on loans, making it cheaper and faster to pay down debt (liabilities), which in turn increases your net worth.

7. Should I include my 401(k) and other retirement accounts?

Absolutely. For many people, retirement savings are their largest asset. You should include the current vested balance of all retirement accounts, including 401(k)s, 403(b)s, IRAs, and Roth IRAs. You can find this value on your most recent account statement.

8. Why did my net worth go down even though I was saving money?

This can be surprising, but it's often due to market fluctuations. If the stock market experiences a downturn, the value of your investments (like your 401(k) or brokerage account) will decrease, which can cause your overall net worth to drop temporarily, even if you're saving diligently. This is a normal part of long-term investing.

9. If I have a loan on an asset (like a mortgage on my house), how do I list it?

You must list both. The full, current market value of your home is an asset. The remaining balance on your mortgage is a liability. Both are required for an accurate calculation. The difference between the two is your home equity. Deciding whether to selling stocks to pay off debt is a separate strategic decision.

10. How do I value a small business I own?

Valuing a private business can be complex. For a straightforward net worth calculation, you can use the "book value" from your business's balance sheet (its assets minus its liabilities). For a more accurate figure required for financial planning or a sale, you would need a professional business valuation.

At Top Wealth Guide, our mission is to give you the clear, actionable knowledge you need to build and manage your wealth. From core concepts like net worth to advanced strategies, we're here to help you on your financial journey.

1 Comment

Pingback: What Is Financial Independence: A Practical Guide to Reclaiming Your Time