Let's be real—life happens. Whether it's a surprise layoff, a medical bill that comes out of nowhere, or a home repair you just can't ignore, unexpected expenses are a guarantee. An emergency fund is what stands between you and a major financial setback. It's not just a savings account; it's your personal safety net, built by you, for you.

In This Guide

- 1 Your First Line of Defense: The Emergency Fund

- 2 Figuring Out Your Personal Emergency Fund Goal

- 3 Finding the Money: Real-World Tactics for Saving

- 4 Choosing the Right Home for Your Emergency Fund

- 5 Automating Your Savings to Stay on Track

- 6 Frequently Asked Questions (FAQ)

- 6.1 1. Should I save for an emergency fund or pay off debt first?

- 6.2 2. What really counts as an emergency?

- 6.3 3. Are high-yield savings accounts (HYSAs) safe?

- 6.4 4. How much should I actually save? 3 months or 6 months?

- 6.5 5. What if I have to use my emergency fund?

- 6.6 6. Can I use a Roth IRA as my emergency fund?

- 6.7 7. What's the fastest way to build my fund?

- 6.8 8. My income is irregular. How do I save?

- 6.9 9. Should I keep my emergency fund at a separate bank?

- 6.10 10. Does inflation affect my emergency fund?

Your First Line of Defense: The Emergency Fund

So, what is this fund, really? At its core, it’s a stash of cash, typically 3 to 6 months' worth of essential living expenses, set aside in a separate, easy-to-access account. This isn't your vacation fund or your down payment savings. This money has one job: to protect you from the financial chaos that life can throw your way.

Think of it as your personal insurance policy against high-interest debt. Without this buffer, a simple $1,000 car repair can easily spiral into a credit card balance that haunts you for months, costing you hundreds more in interest. With an emergency fund, you handle the problem, pay the bill, and get back on track without derailing your bigger financial goals, like saving for retirement or a home.

Why This Financial Buffer Is So Powerful

Having an emergency fund fundamentally changes your relationship with money and stress. It gives you the breathing room to think clearly during a crisis instead of making desperate, panicked decisions.

This kind of financial stability isn't just a personal win; it reflects a broader economic reality. We're seeing more and more how large-scale events can impact individual households. The UNDRR’s Global Assessment Report (GAR) 2025 highlights this, noting that direct annual disaster losses jumped from an average of $70–$80 billion between 1970–2000 to a staggering $180–$200 billion from 2001–2020. When external shocks hit, a personal safety net is what keeps you afloat.

An emergency fund is the ultimate tool for financial peace of mind. It's the difference between being a victim of circumstance and being prepared for whatever comes next.

Let’s look at how this plays out in the real world:

-

Scenario A (Without a Fund): Maria is a freelance designer, and her laptop—her primary tool for work—suddenly dies. Without savings, her only option is to put a new $2,000 computer on her credit card, which has a 22% APR. The unexpected debt messes up her budget and will end up costing her hundreds in interest payments.

-

Scenario B (With a Fund): David, an office manager, gets a surprise $1,500 dental bill. It stings, but he’s prepared. He simply transfers the money from his high-yield savings account, pays the dentist, and then sets up a plan to build his fund back up over the next few months. No drama, no debt.

David's story is exactly what an emergency fund is for. It absorbs the shock, allowing you to maintain your financial footing without taking on debt. Building this cushion is one of the most empowering things you can do for your future.

Figuring Out Your Personal Emergency Fund Goal

You’ve probably heard the old rule of thumb: save three to six months of living expenses. It’s a decent starting point, but let's be honest—it’s far too generic. A one-size-fits-all approach just doesn't work here. Your personal target needs to be built around your life and your finances.

To get to a number that actually makes sense for you, the first thing you have to do is get brutally honest about what it costs to run your life each month.

Nailing Down Your Essential Expenses

This is where you become a bit of a detective. Your mission is to figure out your "bare-bones" budget—the absolute minimum you need to get by if your income suddenly stopped. These are the non-negotiable costs you'd have to cover no matter what.

Grab your bank and credit card statements from the last two or three months and start tallying up only the true necessities.

Here’s what you should be looking for:

- Housing: Your mortgage or rent payment.

- Utilities: The basics like electricity, water, gas, and internet.

- Food: Your average monthly grocery bill (not restaurants!).

- Transportation: Car payments, insurance, fuel, or public transit passes.

- Insurance: Health, life, or disability insurance premiums.

- Debt Payments: Any minimum payments you can't defer, like student loans.

What you're leaving out is just as important. For now, cut all the discretionary spending—the stuff you could pause in a real emergency. We’re talking about streaming services, gym memberships, that daily coffee, and eating out. The goal of an emergency fund is survival, not maintaining your current lifestyle. Getting a handle on these numbers is a key part of understanding your overall financial health, much like when you calculate your net worth.

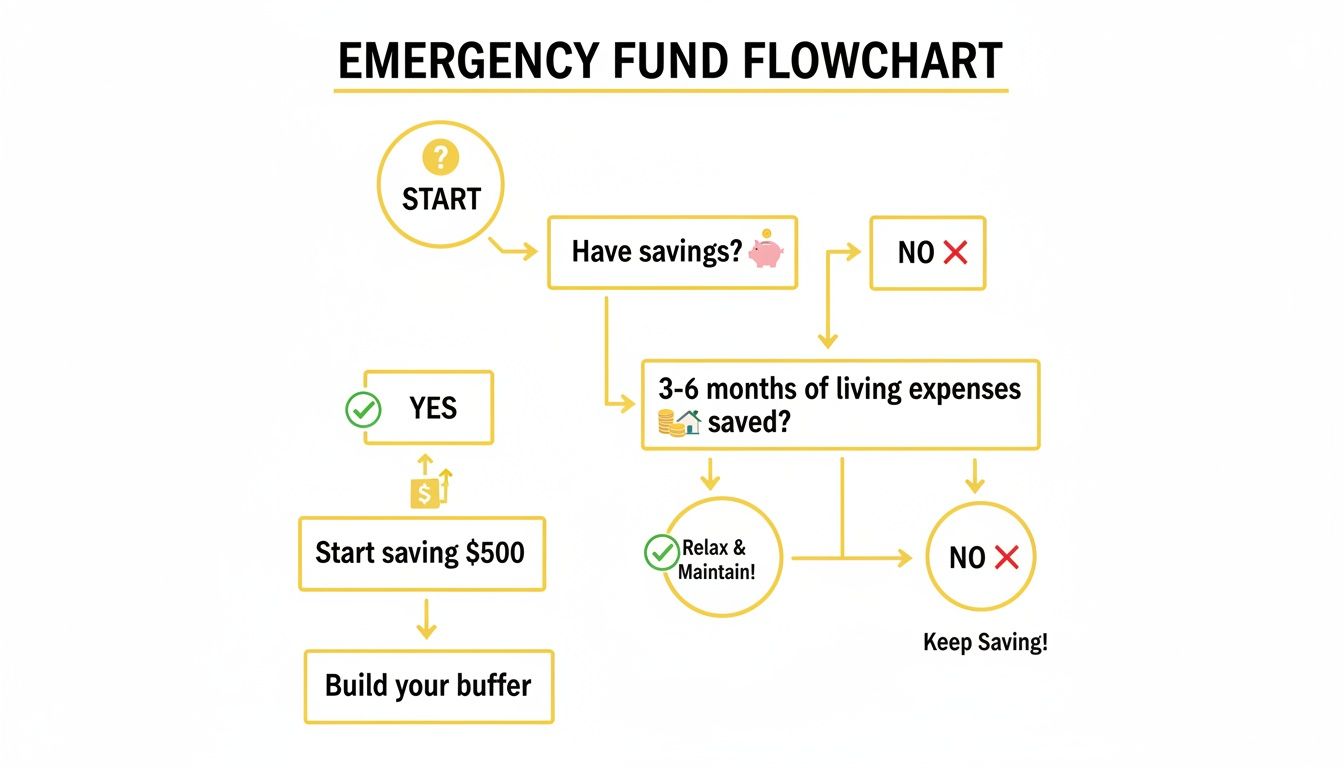

This flowchart gives you a simple visual to start thinking through the process.

It all starts with that first, critical question: do you have any savings right now? Answering that sets the stage for defining a realistic goal.

Customizing Your Goal to Your Life

Once you have that magic number—your monthly essential spending—it's time to decide on your coverage multiplier. Should you save for three months? Six? Maybe even twelve? This is where your personal circumstances really come into play.

Think about these factors:

- Job Stability: Are you a salaried employee in a stable industry, or a freelancer with an income that swings wildly from month to month? Gig workers and entrepreneurs should aim for a much bigger cushion.

- Household Income: A dual-income household might get by with a smaller, three-month fund since they have a backup. But if you’re a single-income family, you're the sole provider, and a six-month fund should be your absolute minimum.

- Dependents: Supporting children or other family members adds a huge layer of financial responsibility. The more people who rely on you, the larger your safety net needs to be.

The reality is, a lot of people are flying without a net. Recent data from Bankrate’s 2025 Annual Emergency Savings Report is pretty sobering: 34% of Gen Z adults and 28% of millennials reported having no emergency savings at all. If you want to dive deeper, you can find more details in the full Bankrate report.

Let's put it in perspective. A single person with $2,500 in monthly essentials would need a fund somewhere between $7,500 (three months) and $30,000 (twelve months). The right number depends entirely on their risk factors.

Your emergency fund target isn't just a number—it's a reflection of your personal risk tolerance and life circumstances. The more financial dependents and income volatility you have, the larger your safety net should be.

To see how this plays out in the real world, let's look at a few different scenarios. The table below uses a baseline of $3,000 in monthly essential expenses to show how the final savings goal can change dramatically.

Emergency Fund Target Based on Household Type

| Household Scenario | Risk Factor | Recommended Coverage | Target Savings Goal |

|---|---|---|---|

| Single Renter, Stable Job | Low | 3-4 Months | $9,000 – $12,000 |

| Dual Income, Mortgage | Moderate | 4-6 Months | $12,000 – $18,000 |

| Freelancer, Single | High | 6-9 Months | $18,000 – $27,000 |

| Single Income Family | Very High | 9-12 Months | $27,000 – $36,000 |

As you can see, the risk level directly impacts the goal. A single renter with a steady paycheck has less to worry about than a freelancer or a single-income family.

By taking the time to analyze your own expenses and risk factors, you can finally move past that vague "3-6 months" advice and set a concrete, achievable savings goal—one that will give you genuine peace of mind.

Finding the Money: Real-World Tactics for Saving

Knowing your target number is one thing. Actually finding the cash to hit it is the real challenge.

This isn't about guilt-tripping yourself over a daily coffee. Forget that tired advice. We’re talking about making smart, high-impact adjustments that free up serious money without making you miserable.

The first step? You have to know exactly where your money is going right now. A simple, honest spending audit is the best tool I know for finding cash you didn't even realize you had.

Conduct a No-Judgment Spending Audit

Before you can redirect your money, you need a clear map of where it’s headed. For just one month, track every single dollar that leaves your account.

You can use a budgeting app, a basic spreadsheet, or even a small notebook. The tool doesn't matter, but the habit does. The point isn't to feel bad about what you find—it’s just about collecting the data. You might be shocked to discover how much those forgotten subscriptions or multiple streaming services are actually costing you.

In fact, a 2022 survey found that most people underestimate what they spend on subscriptions by an average of $133 every month. That’s a huge leak. Once you have a month of real data, you can spot these leaks and make informed choices.

Go After Your Recurring Bills

One of the quickest ways to free up cash without changing your lifestyle is to lower your fixed monthly bills. A lot of people just assume these costs are set in stone, but trust me, they're often negotiable.

Set aside an afternoon and make a few calls. Here’s where to focus:

- Cable and Internet: Don't just pay the bill. Call and ask for the "retention department." Mentioning a competitor's offer can magically unlock a new discount.

- Cell Phone Plan: Take a hard look at your data usage. Are you paying for an unlimited plan when you only use a few gigs? A simple plan change could save a bundle.

- Car Insurance: Rates change all the time based on your driving record, age, and even credit score. It's worth shopping around for a better premium at least once a year.

Just by successfully negotiating two or three of these, you could easily find an extra $50 to $100+ per month. That's money that can go straight into your emergency fund.

Rework Your Budget to Prioritize Savings

Standard budgets are fine, but for a goal like this, you need to get a little more aggressive. The trick is to completely flip your mindset from "saving what's left" to "saving first."

Pay yourself first. It’s a classic for a reason—it’s the single most effective savings strategy out there. Treat your emergency fund contribution like you treat your rent or mortgage. It’s a non-negotiable bill that gets paid on time, every time.

Let's see how this works by adapting a popular framework, the 50/30/20 rule, to really accelerate your progress.

Tweaking the 50/30/20 Rule for Emergency Savings

| Category | Standard 50/30/20 Rule | Adapted for Aggressive Saving | Real-Life Example (Net Income $4,000/month) |

|---|---|---|---|

| Needs (50%) | Essential living costs—housing, utilities, groceries, etc. | Stays the same. These are your non-negotiables. | $2,000 for rent, utilities, food, and transport. |

| Wants (30%) | Discretionary spending—dining out, hobbies, entertainment. | Temporarily shrink this category. Redirect the difference to savings. | Cut wants from $1,200 down to $800. |

| Savings (20%) | Retirement contributions, investments, and other goals. | Beef this up with the money you trimmed from "wants." | Boost savings from $800 to $1,200. |

Look at that—in this example, a temporary pullback on non-essentials increases your monthly savings by 50%. A small change like this can drastically slash the time it takes to build your fund. For more on hitting those big savings goals, our guide on how to save your first $100k dives even deeper.

When you combine a clear spending audit, some strategic negotiations, and a reframed budget, you create a powerful system for finding the money. This isn't about luck; it's about being proactive. You'll build momentum and hit your emergency fund goal much faster than you thought possible.

Choosing the Right Home for Your Emergency Fund

Deciding where to stash your emergency cash is just as important as saving it in the first place. Picking the wrong spot can make your money hard to get when you’re in a real bind or, even worse, expose it to risks you can't afford. The goal here is to nail the perfect balance of three key things.

When you're choosing an account, it absolutely must be:

- Liquid: You need to get your hands on that money fast, without jumping through hoops or paying penalties. Emergencies don’t wait.

- Safe: The account must be federally insured. That means FDIC protection at a bank or NCUA at a credit union, which covers your money up to $250,000. Non-negotiable.

- Separate: Keep it out of your everyday checking account. The less you see it, the less tempted you'll be to raid it for a pizza night or a weekend sale.

This simple checklist immediately eliminates a few common but bad ideas. Hiding cash under the mattress is risky, and letting it sit in your checking account is just asking for it to get spent.

Comparing Your Top Account Options

You could just open a basic savings account at your regular bank, but you'd be leaving a lot of money on the table. Their interest rates are usually abysmal. The good news is, you can do much better without giving up an ounce of safety or convenience.

The two best options for most people are High-Yield Savings Accounts (HYSAs) and Money Market Accounts (MMAs). Both are safe, easy to access, and offer far better interest rates than what you'll find at a traditional brick-and-mortar bank.

A clear picture emerges when you compare the top contenders for your emergency fund's home. Each has its place, but one typically stands out for this specific job.

Comparison of Emergency Fund Account Options

| Account Type | Typical APY | Accessibility | Best For |

|---|---|---|---|

| High-Yield Savings (HYSA) | 4.00% – 5.00%+ | High (Online transfers) | Maximizing interest earnings with excellent safety and liquidity. |

| Money Market (MMA) | 3.50% – 4.50%+ | Very High (Transfers, checks, debit card) | Those who want slightly more access than an HYSA, like check-writing. |

| Standard Savings Account | ~0.45% | High (ATM, branch access) | Convenience if you prefer keeping all accounts at one physical bank. |

As you can see, the HYSA is the undisputed champion for most people. The Annual Percentage Yield (APY) is significantly higher, meaning your money actually grows while it sits there, helping to fight off the effects of inflation.

The Critical Mistake to Avoid

You might be tempted to invest your emergency fund in the stock market to chase bigger returns. I've seen people consider it, and I always give the same advice: don't do it. This is a massive mistake. The stock market is for your long-term wealth-building goals, not your short-term safety net.

Investing your emergency fund is like removing the airbags from your car to save a little weight. It might seem fine when things are going smoothly, but it leaves you completely exposed in a crash.

The market is volatile by nature. Your $10,000 emergency fund could easily shrink to $7,000 right when a recession hits and you need that money the most. This is precisely why it's crucial to separate your emergency cash from your investment portfolio. For a deeper look at your long-term strategy, you can explore which investment accounts you should prioritize in 2025.

Remember, the number one job of your emergency fund is to be stable and available. Growth is a bonus, not the goal. A federally insured HYSA gives you the best of both worlds: rock-solid safety and a competitive interest rate that puts your money to work.

Automating Your Savings to Stay on Track

Here’s the real secret to building a serious emergency fund: it’s not about willpower. It’s about building a smart system that does the heavy lifting for you. The single most powerful tool in your savings arsenal is automation.

When you put your savings on autopilot, you take the daily decision-making—and the temptation to skip a contribution—completely out of the equation. You're essentially treating your savings like any other bill. It just happens. This "pay yourself first" strategy is how you guarantee your emergency fund grows steadily in the background.

Setting Up Your Autopilot Savings Plan

Getting your automated savings pipeline flowing is surprisingly easy. You can usually have it running in just a few minutes from your bank's website or app. The idea is to schedule a recurring transfer from your checking account straight into your separate, high-yield savings account.

Here’s how to make it happen:

- Align it with your paycheck. The most effective way to save is to move the money the same day you get paid. If you’re paid bi-weekly, set up a bi-weekly transfer. This way, the money is gone before you even miss it.

- Set the amount. Using the number you figured out from your budget, tell your bank exactly how much to move with each transfer.

- Point it to the right place. Make sure you’re sending the funds to your dedicated emergency savings account.

Once it's set, you're done. Your fund will now grow without you having to lift a finger. It's a foundational habit for financial health. In fact, many of the best investment apps for beginners use this exact same principle of automation to help people build long-term wealth.

Staying Motivated on Your Journey

Let's be honest: watching your account balance creep up can feel slow, especially at the beginning. That's why keeping yourself motivated is so important.

Here are a few tricks to stay engaged:

- Create a visual tracker. Find a simple "savings thermometer" graphic online, print it out, and stick it on your fridge. Coloring in a new section every time you hit a milestone is incredibly satisfying.

- Break it down. Instead of staring at a huge final number, focus on smaller, achievable mini-goals. Your first target could be saving $1,000. The next could be reaching one full month of expenses.

- Celebrate the wins. When you hit one of your mini-goals, give yourself a small reward that won't derail your budget—maybe a nice coffee, a movie night, or that book you’ve been eyeing.

Making your progress tangible and celebrating small victories transforms saving from a chore into a rewarding journey. It builds positive momentum that makes it easier to stick with your long-term goal.

What to Do After a Setback

Sooner or later, you'll probably have to dip into your emergency fund. That’s okay! It’s not a failure; it’s the system working exactly as designed. That money was there to protect you from a financial hit, and it did its job. The key is what you do next.

After using your fund, take a deep breath and follow these steps to rebuild:

- Hit pause on other goals. After the crisis is over, it’s a good idea to temporarily divert money from other savings goals (like extra retirement contributions, beyond your employer match) to quickly replenish your emergency fund.

- Get back on the horse. Your number one priority is refilling that safety net. Make sure your automatic transfers are still active or restart them right away.

- Be patient with yourself. Don't get discouraged. Rebuilding is a normal and expected part of the process.

Because you already have an automated system in place, getting back on track will feel like a familiar habit, not a monumental task.

Frequently Asked Questions (FAQ)

1. Should I save for an emergency fund or pay off debt first?

This is a classic dilemma. The most effective strategy is a hybrid approach:

- Save a starter fund first: Focus intensely on saving $1,000. This small cushion prevents you from going into more debt for minor emergencies.

- Attack high-interest debt: Once you have $1,000 saved, shift your focus to aggressively paying down high-interest debt like credit cards.

- Build your full fund: After the high-interest debt is gone, redirect that cash flow to building your emergency fund to a full 3-6 months of expenses. If you're weighing other options, it's also helpful to think through if you should sell stocks to pay off debt.

2. What really counts as an emergency?

A true emergency is an expense that is both unexpected and essential. Examples include a job loss, an urgent medical bill, a major car repair that prevents you from getting to work, or a critical home repair like a burst pipe. It is not for planned expenses like vacations, holiday gifts, or a down payment on a car.

3. Are high-yield savings accounts (HYSAs) safe?

Yes, they are extremely safe. As long as the account is at an FDIC-insured bank or an NCUA-insured credit union, your money is protected by the federal government up to $250,000 per depositor, per institution. They offer the same security as a traditional savings account but with much higher interest rates.

4. How much should I actually save? 3 months or 6 months?

It depends entirely on your personal situation:

- 3 months: A good starting point for dual-income households with stable jobs.

- 6 months: A safer target for single-income households, freelancers, or anyone with less predictable income.

- 9-12 months: The gold standard for business owners, commission-based workers, or anyone with dependents and high financial risk.

5. What if I have to use my emergency fund?

Using your fund is a success, not a failure! It means the system worked. Once the emergency is resolved, make replenishing the fund your top financial priority. Pause other savings goals (except for your employer's 401(k) match) and reactivate your automatic transfers to build it back up.

6. Can I use a Roth IRA as my emergency fund?

While you can withdraw your contributions from a Roth IRA tax-free and penalty-free at any time, it's not ideal. The primary purpose of a Roth IRA is long-term retirement growth. Using it for emergencies means you lose out on potential compound growth that you can never get back. It's best used as a last resort, not a primary emergency fund.

7. What's the fastest way to build my fund?

Combine several strategies:

- Automate: Set up automatic transfers from your checking to your savings account on payday.

- Trim aggressively (temporarily): Drastically cut discretionary spending (eating out, subscriptions) for a few months and redirect that money to savings.

- Increase income: Consider a side hustle or selling items you no longer need for a quick cash injection.

8. My income is irregular. How do I save?

For freelancers or those with variable income, the "pay yourself first" method is crucial. When you have a good month, save a larger percentage. A common strategy is to save a fixed percentage (e.g., 20-30%) of every single paycheck, no matter the size. This ensures you're always building your fund, even if the amounts vary.

9. Should I keep my emergency fund at a separate bank?

Yes, this is a highly effective psychological trick. Keeping the money at a different bank than your primary checking account creates a "friction barrier." The one-to-three-day transfer time gives you a cooling-off period to decide if a purchase is a true emergency, preventing impulsive spending.

10. Does inflation affect my emergency fund?

Yes, inflation erodes the purchasing power of your cash over time. This is why a High-Yield Savings Account (HYSA) is so important. While its interest rate may not always beat inflation, it significantly reduces the loss of value compared to a standard savings or checking account, keeping your fund's value much more stable.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.