Your brain is basically an investment oracle—making decisions before you’re even clued in. Crazy, right? Money psychology is the puppet master here, yanking the strings on 90% of your financial moves, and it’s often those sneaky little mistakes that send your wealth-building train off the rails.

Now, over at Top Wealth Guide, we’ve put thousands of investment patterns under the microscope, and here’s the tea: getting a grip on your psychological triggers is the secret sauce that separates ho-hum returns from serious wealth expansion.

It’s not a knowledge drought that’s tanking most investors—it’s the emotional typhoon that sweeps away logic when the market starts doing its dance.

In This Guide

What Drives Your Financial Brain

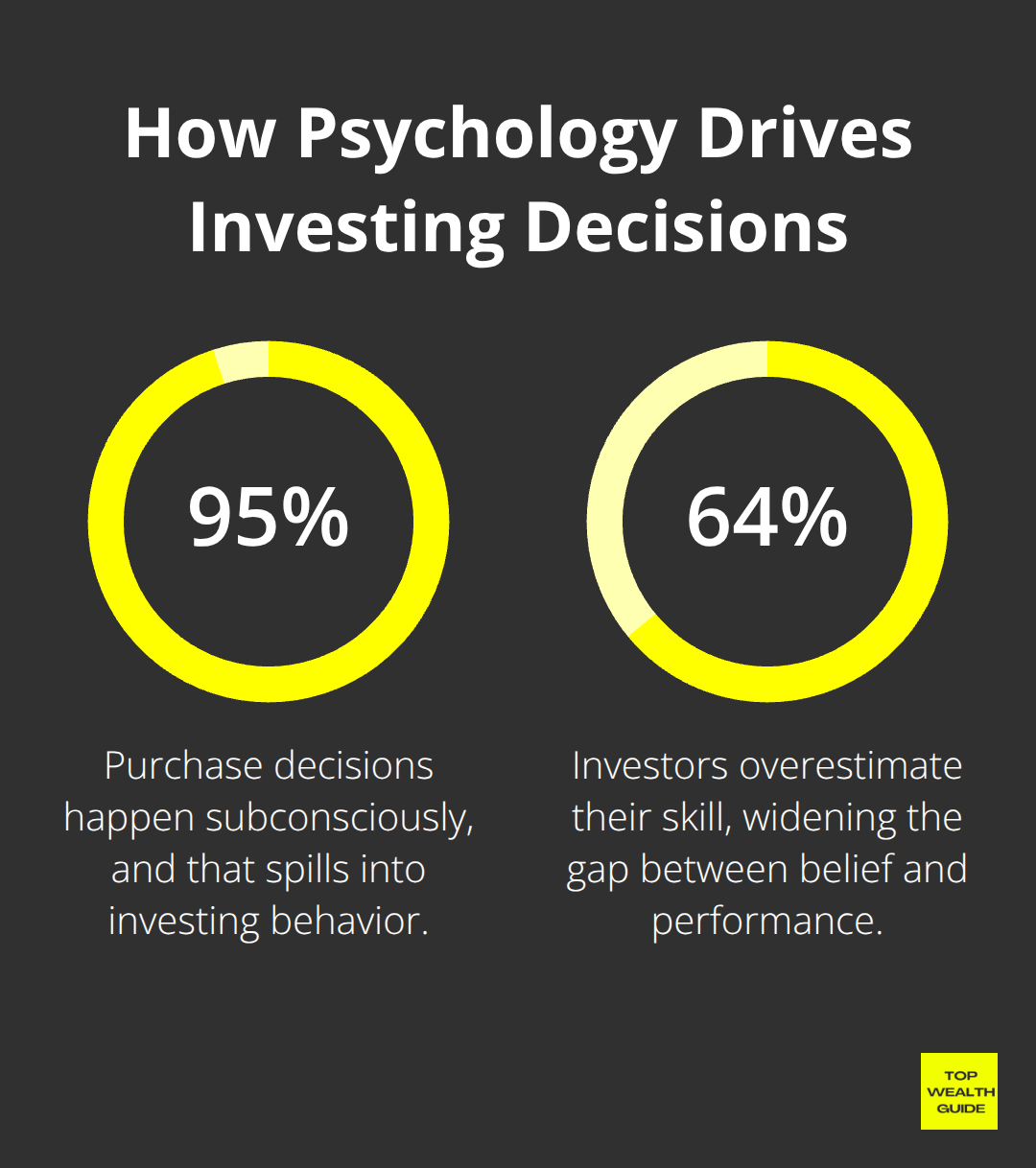

Your financial decisions-happen in milliseconds, often before logic even shows up to the party. Research from Duke University tells us that a whopping 95% of purchase decisions occur subconsciously… and yes, that spills over to our investment choices. Fear? It hits the sell button faster than any rational analysis can raise its hand, while greed hammers on ‘buy’ just as the market peaks and prices start shouting “overvalued.”

The Emotional Hijack Effect

Market ups and downs? They’re like stress hormones-cortisol, for example-zipping through your system, shrinking the prefrontal cortex where, ideally, rational thoughts originate. FINRA data shows 64% of investors believe they’re investment wizards, yet there remains this behavioral chasm between what they think and how they actually perform. Why? Because when money’s on the line, emotions elbow expertise right out of the room.

Take March 2020-panic sellers missed out on returns that those who stayed cool pocketed. Your brain thinks financial losses are saber-tooth tigers, hence why normally rational investors take a left turn towards irrational when portfolios flash red.

How Your Money History Controls Today’s Choices

Your money story? It started way back when. Those early money memories dictate how you play the investment game decades later. Grew up witnessing financial stress? You’re likely dodging losses more than a rational analysis would advise. If your family took a hit in 2008, stocks probably look like a “Do Not Touch” zone-even when data says “Go for it.”

Raised during a bull market? You might be riding the overconfidence wave, chasing trends without a blink towards risk assessment. These patterns? They run on auto-pilot unless you step in and reprogram the lot through systematic awareness and a disciplined framework.

The Subconscious Money Filter

Here’s the kicker-your brain runs financial info through an emotional sieve before logic gets a crack at it. Hear good news about stocks you own? Welcome aboard! But negative data? Your mind does a quick shuffle-it’s either tossed aside or smoothed over. This confirmation bias costs investors significant returns every single year, as per Morningstar research.

The psychological tools that kept our ancestors alive? They’re now tripping us up in the investment arena, churning out patterns that smart investors learn to spot and smartly sidestep.

Common Psychological Traps in Investing

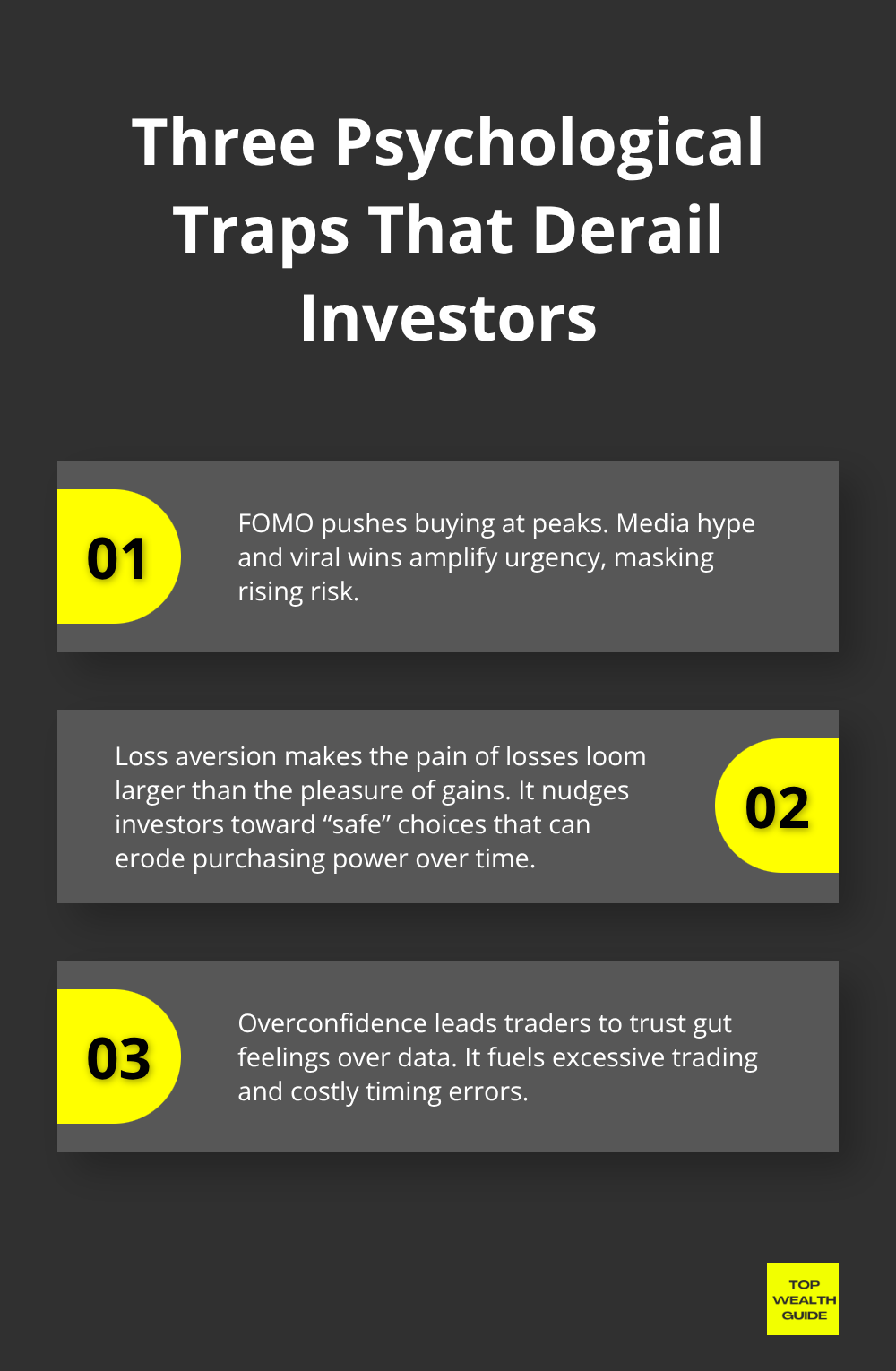

Your investment mindset-picture it as this quirky computer program-keeps running these repetitive, self-destructive scripts and, surprise, surprise, wipes out returns year after year. FOMO… the great motivator… drives retail investors to panic-buy momentum stocks right when they’re soaring at peak prices. Meanwhile, herd mentality? Yeah, it’s busy nudging entire markets into those glorious bubbles bound to burst. Remember when GameStop hit $400 back in January 2021?

Millions jumped in because, hey, everyone else was doing it-primo herd behavior that burnt billions when the music stopped.

The FOMO Epidemic That Empties Accounts

Fear of missing out… transforms cool-headed investors into frantic buyers snapping up assets at their priciest. Cryptocurrency markets? The ultimate FOMO playground: Bitcoin skyrocketed to just under $69,000 in November 2021, and as media went into overdrive, FOMO fever hit retail investors hard, leaving portfolios to nosedive 70% the following year.

This playbook has been around forever-tech stocks in 2000, housing in 2007, meme stocks in 2021. Savvy investors? They see FOMO signals as red flags and go against the grain: sell into the frenzy, don’t buy into it. Social media amps up this quagmire by creating echo chambers where wins go viral, but cautionary tales? Not so much.

Loss Aversion Paralyzes Profit Potential

Loss aversion… that intense feeling of pain from losses hitting twice as hard as gains-drives risk-averse behavior that kneecaps long-term wealth. While active trading scores a measly 11.4% compared to the market’s 17.9%, loss-averse folks are busy parking cash in savings accounts earning a pitiful 0.5% while inflation saunters along at 3.2%.

This mental snare traps millions of Americans, preventing them from building real wealth. They watch with dismay as purchasing power dwindles in “safe” accounts, all the while missing out on decades of compound growth in well-diversified portfolios.

Overconfidence Breeds Expensive Mistakes

Overconfidence… just adds fuel to the fire-study after study shows only 25% of active funds beat the market over a decade, yet traders persist, going with gut over systematic strategies. Enter day traders: 80% end up losing money in their first year, yet fresh faces keep marching in, sure they’ll beat the odds.

The antidote? It’s all about lock-step entry and exit rules that take the emotions out of the equation entirely. Pros rely on stop-loss orders and smart position sizing to mitigate damage when overconfidence leads them astray. These systematic defenses are critical as you arm yourself with the insight and tools to break free from these mental shackles.

How Do You Rewire Your Investment Brain

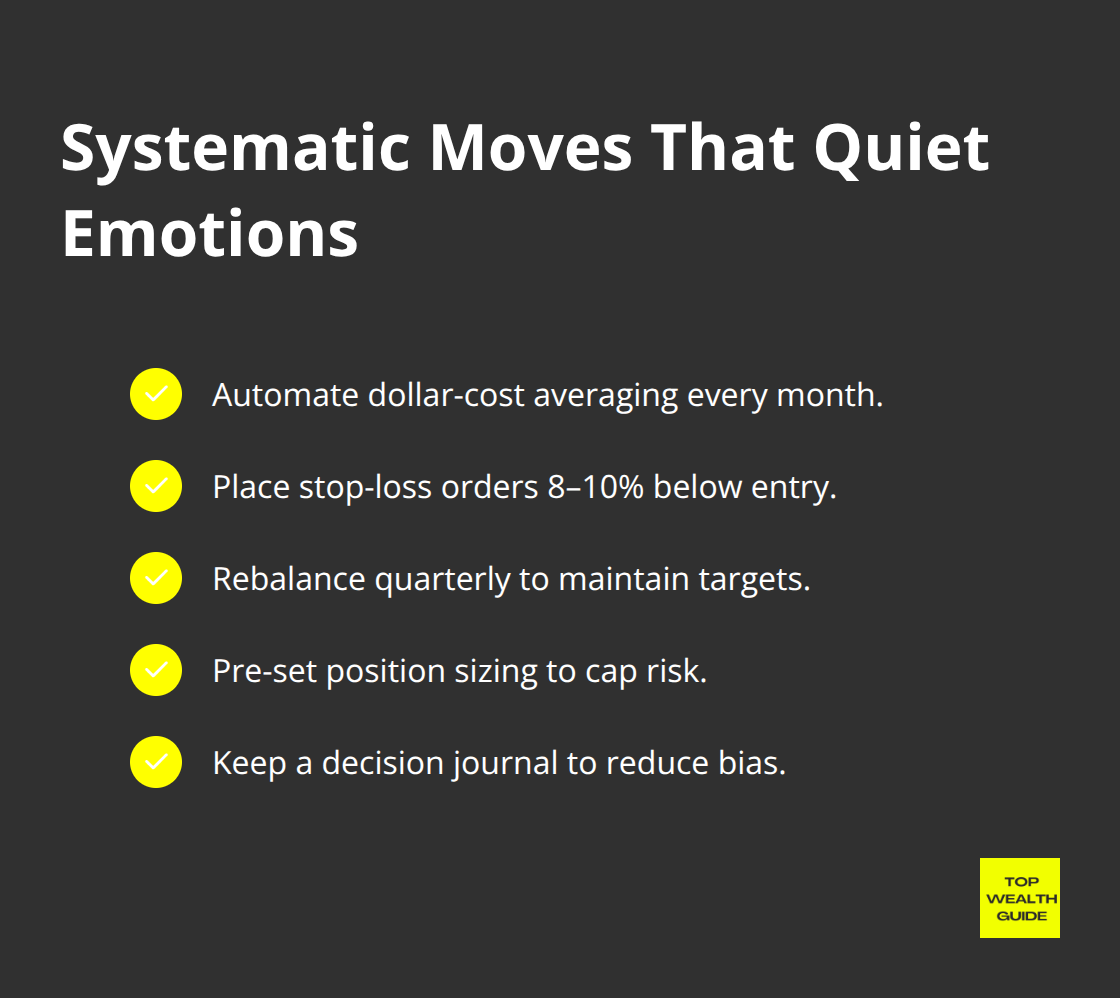

First things first-you gotta get real with yourself about your money mindset. It’s time for an audit, folks. Jot down every investment decision you make over 30 days and dig into what emotional gremlin whispered in your ear to prompt that move. Was it fear? A rush of adrenaline? Peer pressure, maybe? Vanguard research shows there’s juice in this squeeze-keeping a decision journal can bump up your returns by 1.5% annually. That’s your psyche in ink, revealing all those pesky patterns that mess with your wealth mojo.

Systematic Rules Beat Emotional Reactions

If you want to swim with the big fish, start thinking like a machine-not like someone riding an emotional rollercoaster. Dollar-cost averaging? Genius. You just set a fixed amount, $500 a month, let’s say, into index funds come rain or shine, and-poof!-suddenly all that emotional static is out the window. And those stop-loss orders? Set them 8-10% under your purchase price.

It’s the psychological safety net you need to fess up to mistakes without the sting. Those quarterly rebalance sessions? They nudge you to sell your high-flyers and snatch up underperformers-because going against your gut is often the smart play. Keep systematic, keep cool, and your portfolio will thank you.

Technology Tools That Enforce Discipline

Enter stage left: technology. These slick modern investment apps are your best allies, cutting out the human error with automation and a nudge here and there. Betterment and Wealthfront are your robo-buddies, handling the nitty-gritty while sidestepping the drama. Set up automatic transfers to sneak your cash from checking into investments before you even get the itch to spend. Personal Capital’s got your back too-track your net worth and let the long-term story unfold, no hair-pulling over daily blips.

Cold Storage Prevents Panic Decisions

The name of the game is friction, my friends-especially when crypto gets choppy. Cold storage for cryptocurrencies means no panic selling when the market’s doing the cha-cha; plus, commitment devices like retirement accounts shove your funds far away from daily meddling until age 59.5. Those hardware wallets? They erect speed bumps, making you jump through hoops-so when the market’s in a tizzy, you’ve got a buffer before doing something rash.

Final Thoughts

Here’s the deal – money psychology, it’s like an invisible puppeteer pulling the strings on every investment decision you make. Whether you want to admit it or not, those sneaky emotional triggers, those pesky cognitive biases, all those past experiences – they don’t just nudge your choices; they steer the whole ship. It’s why you cling to cash while inflation sneaks up like a thief in the night (goodbye purchasing power). It’s the FOMO monster pushing you to buy at those high market peaks – oh, hello overconfidence making you execute those oh-so-costly trades that bulldoze your long-term wealth.

The way out? It’s all about staring those psychological demons in the face. Get brutally honest about your patterns. How? Start tracking your investment moves for a month – spot when fear or greed is grabbing the steering wheel. Develop systematic strategies to kick emotions out of the equation – think dollar-cost averaging, automatic rebalances, and stop-loss orders (your new psychological suit of armor). Technology can be your best buddy here – robo-advisors to keep your emotions in check, cold storage to block those panic sales.

Your road to investment success? Spoiler: it’s not about timing the market or being a stock-picking wizard. It’s about recognizing and sidestepping those psychological landmines that blow up your wealth-building journey. We at Top Wealth Guide are armed with the tools and insights to help you conquer your money psychology and stack up that enduring financial success. Remember, the market’s a wild beast – unpredictable and volatile – but your reaction? That, my friend, is controllable.