Your investment returns depend less on market timing and more on what happens inside your head. At Top Wealth Guide, we’ve seen countless investors sabotage their own wealth by letting emotions override strategy.

Market psychology isn’t some abstract concept-it’s the difference between building real wealth and watching opportunities slip away. This post shows you exactly which psychological traps catch most investors and how to escape them.

In This Guide

How Emotions Impact Investment Choices

Fear and Panic Selling During Market Downturns

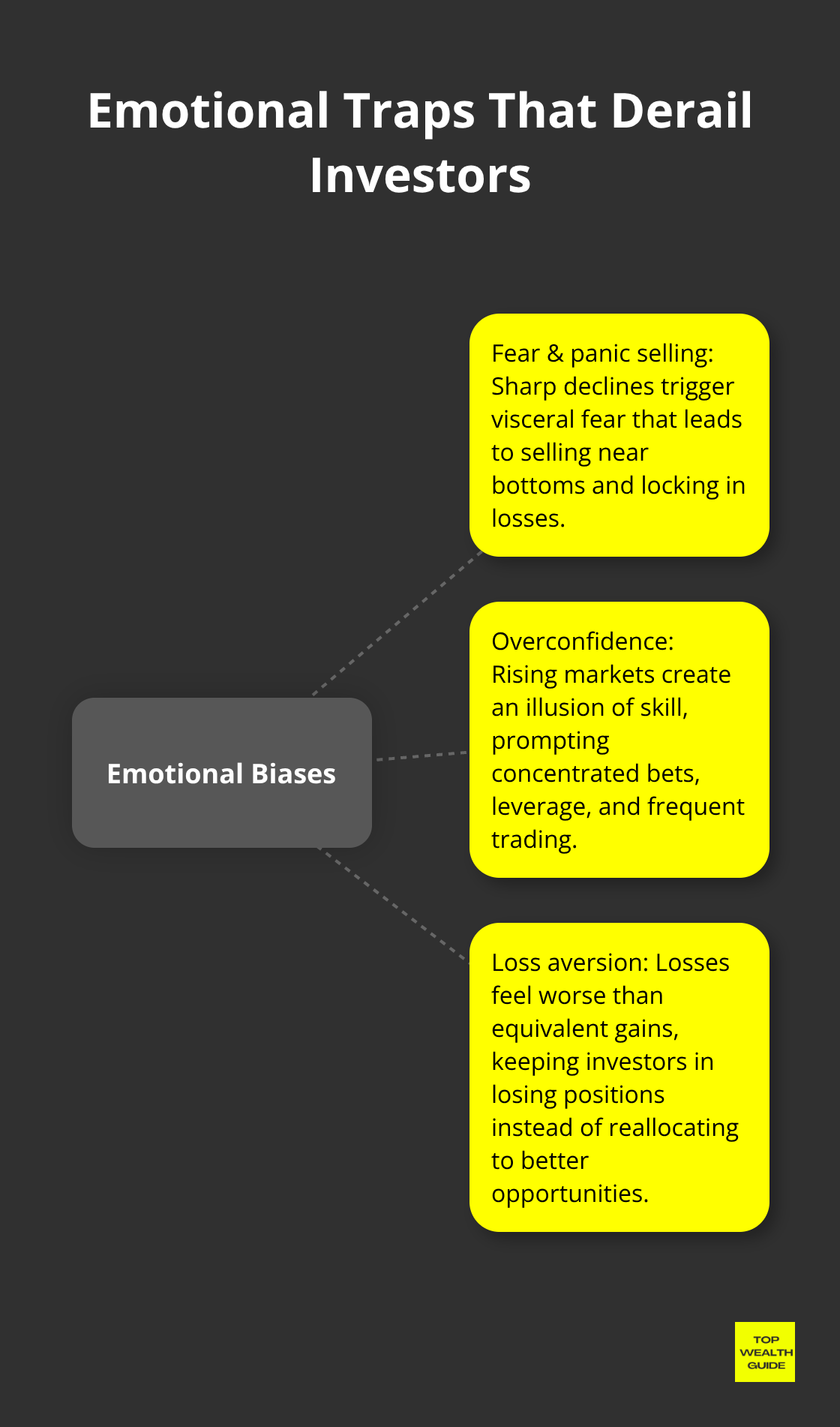

When markets drop 15 percent in a week, most investors face a psychological crisis they didn’t anticipate. The fear is real and visceral-your portfolio on screen shows thousands of dollars evaporating, and news outlets amplify every negative headline. During the 2020 pandemic crash, equity fund outflows hit 30 billion dollars in a single month as panicked investors sold near the bottom. This wasn’t rational analysis; it was pure emotional reaction.

Selling during downturns locks in losses permanently. Investors who stayed invested and continued their regular contributions during that same 2020 crash saw their portfolios recover fully within months and generate significant gains over the following years. Fear and panic selling during market downturns represents one of the costliest mistakes you can make because you’re not just accepting a temporary loss-you’re transforming it into a permanent one by exiting at the worst possible time.

Overconfidence Destroys Portfolios in Bull Markets

Bull markets create a dangerous illusion of invincibility. When stocks rise steadily for months or years, investors convince themselves they’ve finally cracked the code and can predict market moves. This overconfidence bias leads to concentrated bets in hot sectors, excessive leverage, or frequent trading-all behaviors that dramatically increase risk.

During the 2021 tech rally, overconfident retail investors poured money into speculative growth stocks at valuations that made no fundamental sense. Many of these same investors panicked and sold at losses when the inevitable correction arrived in 2022. Investors who trade frequently and believe they can time markets underperform buy-and-hold investors according to behavioral finance research.

Overconfidence also blinds you to risk. You might hold 40 percent of your portfolio in a single sector because recent gains make it feel safe, when that concentration actually exposes you to catastrophic loss if sentiment shifts.

Loss Aversion Keeps You Trapped in Losing Positions

Loss aversion is a behavioral cognitive bias where a loss is perceived as more psychologically impactful than a gain of equivalent value. This asymmetry in emotional response causes investors to hold onto underperforming investments far longer than logic would suggest.

You bought a stock at 50 dollars and it now trades at 30 dollars. Instead of acknowledging the loss and reallocating that capital to something with better prospects, you hold on, hoping it will return to your entry price. That hope-based thinking costs you real money. The stock might continue falling while better opportunities pass you by.

A practical solution is to establish clear exit rules before you invest. Decide in advance that if a holding drops 20 percent from your entry price, you’ll sell and redeploy the capital. This removes emotion from the decision because you’ve already committed to the rule when your thinking was clear. Another tactic is to ask yourself honestly: if you had no position in this investment today, would you buy it at the current price? If the answer is no, you should sell it regardless of your entry price. The past is irrelevant to future returns.

These emotional patterns repeat across all market cycles, but they intensify when you lack a structured framework to guide your decisions. The next section reveals which psychological biases operate beneath the surface of these emotional reactions and how they systematically distort your judgment.

Common Psychological Biases That Affect Investors

Confirmation Bias Blinds You to Risk

Confirmation bias leads you to seek out information that supports what you already believe while ignoring evidence that contradicts it. An investor convinced that tech stocks will outperform might spend hours reading bullish analyst reports and tech industry blogs while dismissing any warning signs about valuations or sector risks. This selective information gathering creates a false sense of certainty that leads to overweighting positions.

The antidote requires deliberate action. Actively seek out the bear case for any investment you’re considering. Read the most critical analyses, not just the optimistic ones. Ask yourself what would prove your thesis wrong, then go find that information. When you own a stock, schedule a monthly review where you specifically hunt for reasons to sell it. This counterintuitive practice prevents you from building conviction based on incomplete data.

Anchoring Bias Locks You Into Bad Decisions

Anchoring bias locks your judgment to the first price you see, distorting every decision that follows. You buy a stock at 100 dollars, and years later when it trades at 60 dollars, you feel like you’re down 40 percent and reluctant to sell. That 100-dollar entry point is irrelevant to what the stock is worth today.

What matters is whether 60 dollars represents fair value for your future returns.

Many investors also anchor to previous market highs, convincing themselves that a stock trading 20 percent below its peak is undervalued when the peak itself might have been irrational. Set a rule: never reference your purchase price when evaluating a position. Instead, research what professional analysts and fundamental metrics suggest the investment should be worth right now. If current price exceeds that estimate, sell it. If it’s below that estimate and fits your portfolio, hold or buy more. Strip away the anchor.

Herd Mentality Inflates Bubbles and Destroys Wealth

Herd mentality operates at scale and ranks among the most destructive biases. When everyone around you buys a particular investment, the social pressure and fear of missing out becomes overwhelming. During 2021, retail investors piled into meme stocks and speculative cryptocurrencies not because fundamentals justified the prices but because the crowd was there. This behavior inflates bubbles and ensures that the average investor buys near peaks and sells near troughs.

Counter this by pausing whenever you notice that everyone is doing the same thing. Check the valuation metrics: if a stock trades at 50 times earnings while the market average is 18 times, you’re likely in a bubble regardless of how many people own it. Compare the current investment opportunity to your written plan and your asset allocation targets. If adding to a position would push you above your target allocation, stop buying even if the crowd is still buying. Discipline means standing apart.

These three biases operate beneath the surface of emotional reactions, systematically distorting your judgment across market cycles. Understanding how they work is the first step toward protecting your portfolio, but recognition alone won’t stop them from influencing your decisions. The next section reveals concrete strategies that remove emotion from your investment process entirely.

Strategies to Overcome Psychological Barriers

Create a Written Investment Plan and Stick to It

Your written investment plan acts as the only defense that works when panic hits. Without one, you make decisions in real time while your amygdala fires and your judgment collapses. A proper plan documents three specific things: your financial goals with target dates, your current risk tolerance measured honestly, and the exact asset allocation you’ll maintain across market cycles. When the S&P 500 drops 20 percent, you don’t debate whether to sell. You open your plan, confirm that your 60/40 stock-bond split still matches your ten-year timeline, and you take no action. Investors with written plans outperform those without them by measurable margins because they’ve eliminated the moment when emotion hijacks the decision.

Write your plan when markets are calm, not during a crisis. Include specific numbers: if you need 500,000 dollars for retirement in 15 years and you’re starting with 200,000 dollars, calculate the exact annual return required. This specificity anchors you to reality rather than to fear or greed. The plan becomes your reference point whenever uncertainty strikes.

Dollar-Cost Averaging Removes Timing Decisions Entirely

Dollar-cost averaging means you invest a fixed amount at regular intervals regardless of market price. By sticking to a fixed investment schedule and amount, you’ll naturally buy more shares when the price is low vs. high. This mechanical approach eliminates the decision-making process where emotions sabotage you. During the 2022 market correction when the S&P 500 fell 18 percent, investors who maintained their monthly contributions actually accumulated shares at lower prices and built larger positions for the recovery. Those who paused their investments because they feared further losses missed the opportunity entirely.

Set up automatic monthly or quarterly contributions through your brokerage so the money moves without your intervention. This removes the temptation to skip months when headlines are negative or to invest lump sums when sentiment is euphoric. The consistency matters more than the amount. Even 200 dollars monthly compounds into substantial wealth over decades because you capture both bull and bear markets at their natural prices.

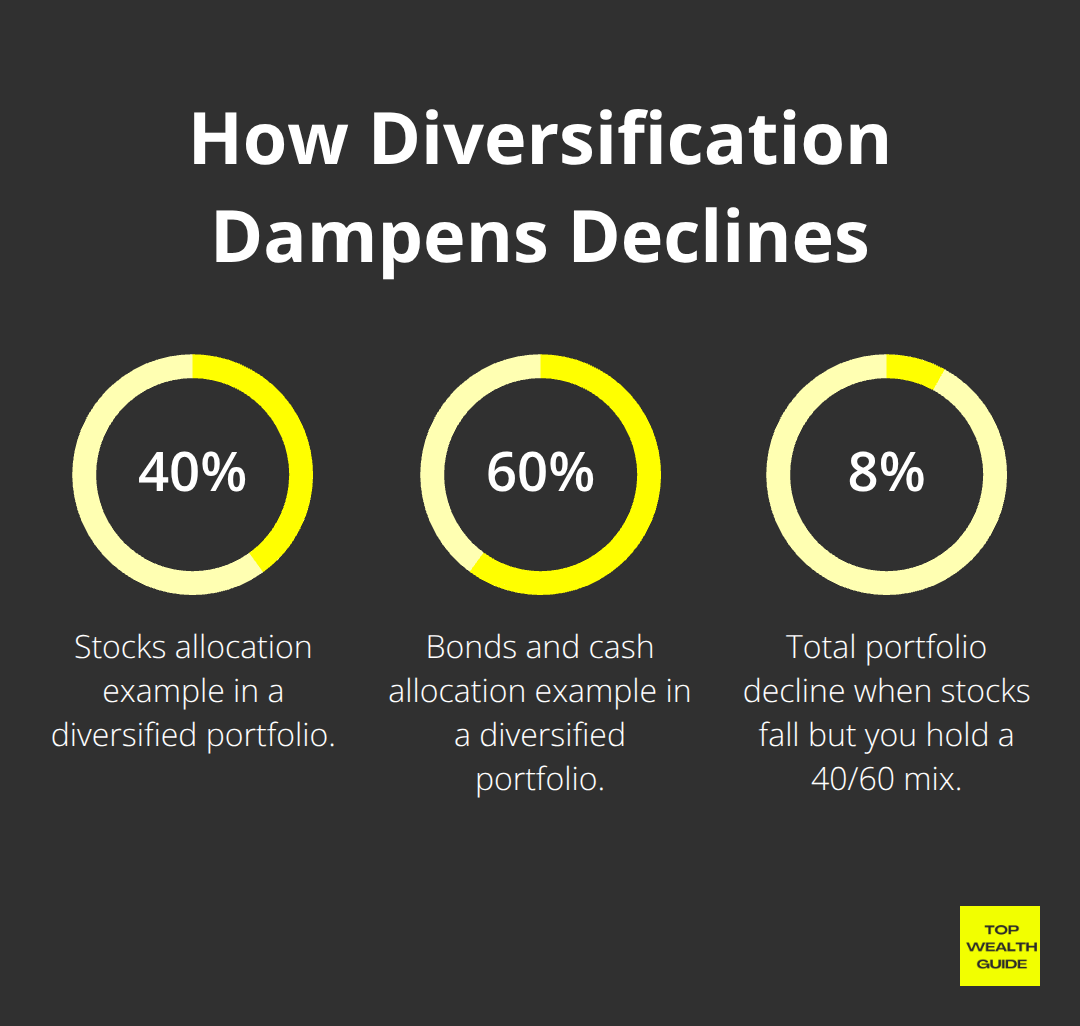

Diversification Stops Panic Before It Starts

Diversification across stocks bonds and alternative assets reduces the magnitude of portfolio swings that trigger panic responses. When 40 percent of your portfolio sits in stocks and 60 percent sits in bonds and cash, a 20 percent stock market decline moves your total portfolio down only 8 percent. That smaller decline feels psychologically tolerable, and you’re far less likely to make a rash decision.

Investors with concentrated portfolios face 30 or 40 percent drops during corrections, which triggers existential fear and poor choices.

Diversification doesn’t prevent losses but it prevents the catastrophic swings that override your rational mind. Rebalance your portfolio quarterly by selling whatever asset class has gained the most and purchasing what has lagged. This forces you to sell high and buy low automatically, the opposite of what your emotions want to do. During the 2020 pandemic crash, investors who rebalanced their portfolios by purchasing depressed stocks with cash from bond gains captured the subsequent recovery while others sat paralyzed. This mechanical process transforms your biases into an advantage rather than a liability.

Final Thoughts

Your investment success hinges on recognizing that market psychology shapes every decision you make. The emotions and biases we’ve covered throughout this post aren’t character flaws-they’re hardwired survival mechanisms that worked for your ancestors but sabotage your wealth today. The investors who build real portfolios understand this fundamental truth and act accordingly.

Discipline transforms market psychology from your enemy into irrelevance. A written investment plan removes the need to decide anything during a crisis because you’ve already decided everything when your thinking was clear. Dollar-cost averaging means you stop trying to time markets and instead let time do the work. Diversification ensures that normal market swings don’t trigger panic responses.

The investors who build generational wealth aren’t smarter than everyone else-they’re simply more disciplined about ignoring the noise. Markets will crash, headlines will terrify you, and your friends will brag about their hot stock picks, but none of that changes your plan. We at Top Wealth Guide help readers build the financial foundations that support this kind of discipline through practical guides on investing, personal finance, and wealth-building strategies.