Millennials—yep, those avocado toast lovers—are grappling with estate planning hurdles their parents never dreamed of. We’re talking digital assets (your crypto stash), student debt (yikes!), and that gig economy paycheck… all tangled up in some mind-boggling wealth transfer puzzle.

Here’s the thing: at Top Wealth Guide, we’ve cracked the code on this. Get ahead… plan in your 20s or 30s, not when you’re greying in your 40s or 50s. Why? Because savvy estate strategies now can shield your assets and slash tax hits for the folks you leave things to. It’s not just smart—it’s essential.

In This Guide

What Makes Millennial Estate Planning So Complex?

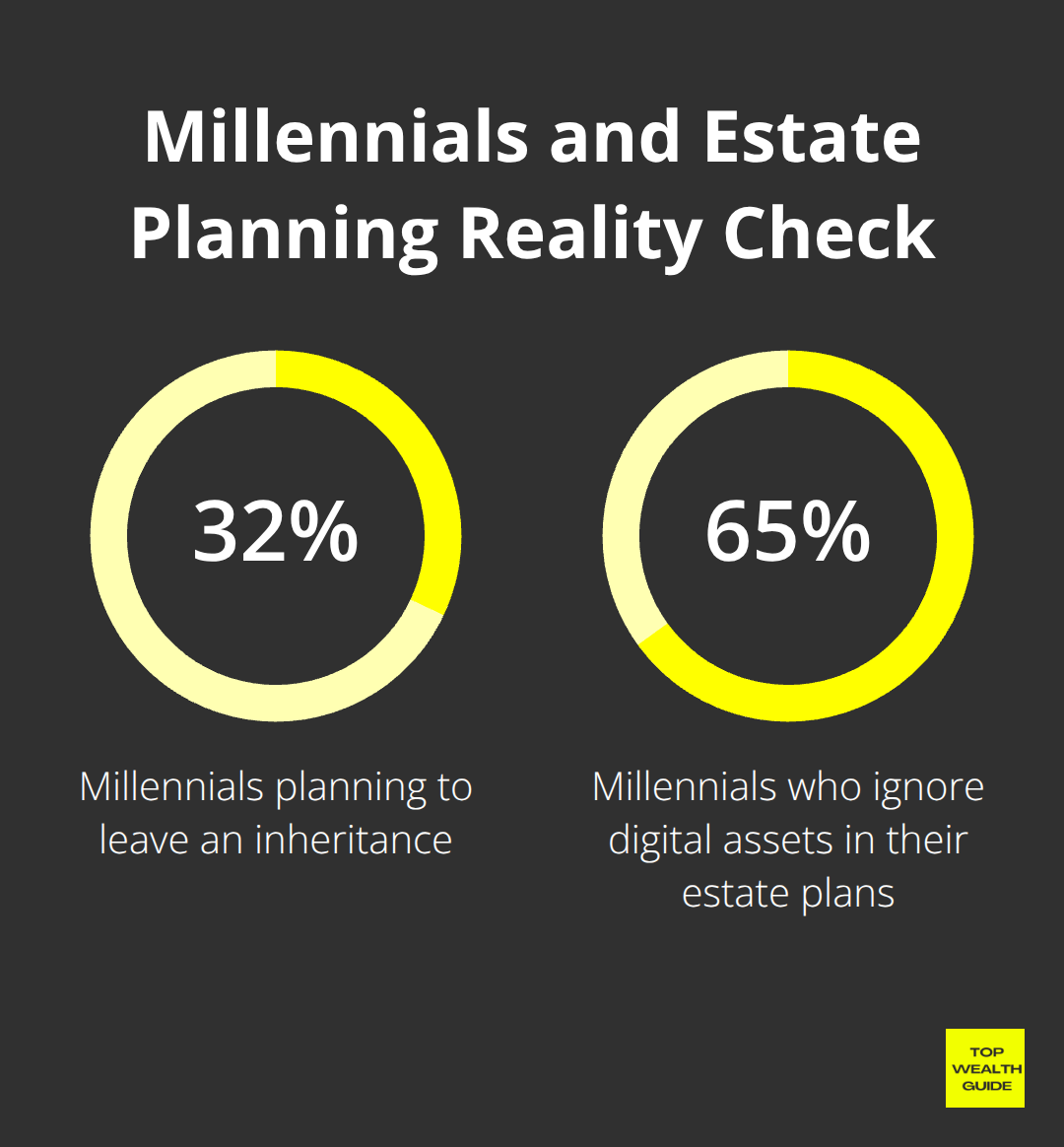

Ah, Millennials… always facing challenges the boomers never dreamed of. Got $50,000 in Bitcoin sitting pretty in your crypto wallet? Great, but guess what-no one in your family knows the private keys to access it. And your Instagram account pulling in $3,000 a month from sponsored content? No succession plan in sight, folks. Northwestern Mutual research highlights a rather telling picture: just 32% of Millennials are thinking about leaving an inheritance, while 65% pretend digital assets don’t even exist when making their plans.

Digital Assets Require Immediate Action

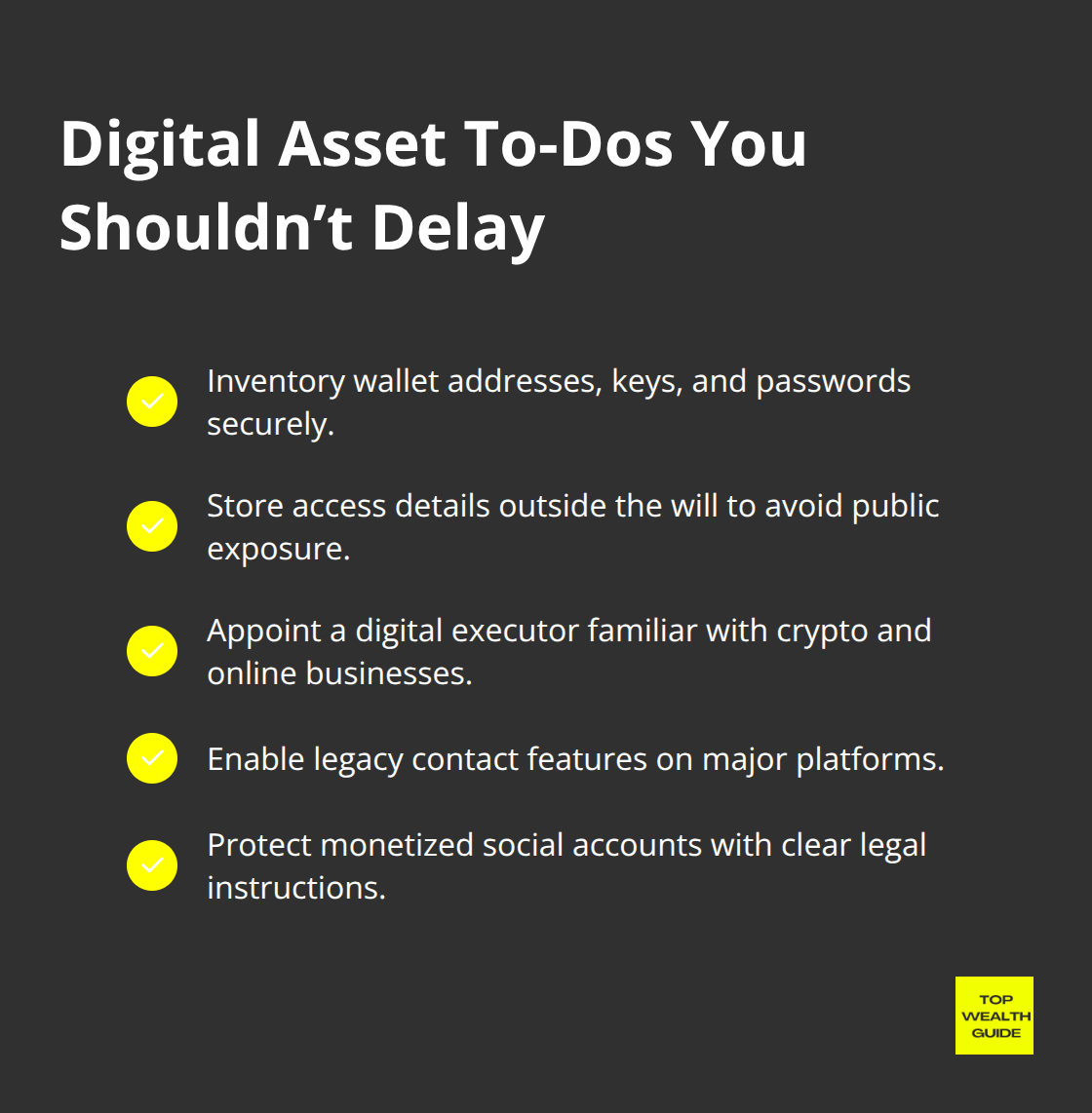

Listen up-your crypto, online ventures, social media clout… these are real assets that could vanish without a trace if you don’t act now. Get a grip on your digital wealth: list those wallet addresses, private keys, account passwords… the whole shebang. Keep this info away from your will, or risk making it public during probate.

Find a digital executor-someone who speaks blockchain and can navigate the online business maze. Facebook and Google have legacy contact features begging for attention, but only if you set them up yesterday. And that TikTok with 100,000 followers? It’s got value that needs airtight legal protection.

Student Debt Creates Complex Challenges

Let’s talk student loans… or nightmares, rather-totaling a staggering $1.814 trillion. Federal loans? They’ll discharge when you kick the bucket. But private ones? They stick like glue to cosigners or spouses. Dig into those loan agreements, pronto, to grasp what your survivors might face. Income-driven repayment plans and Public Service Loan Forgiveness programs? They approach your estate in a completely different way than the standard fare. Your attorney better be on top of these intricacies or your heirs could end up buried under debt.

Gig Economy Income Demands Flexible Approaches

What about all you freelancers and gigsters out there? Without the safety net of employer benefits, estate planning’s a whole different ball game. Your Uber haul, Etsy shop earnings, consulting fees-they’re irregular, unpredictable, and need tailored trust structures. Shield those personal assets with separate business entities to dodge professional liabilities. And don’t count on traditional life insurance (that’s just for employees)-individual coverage is your savior. Your estate strategy needs to be flexible, factoring in those income swings and diverse revenue streams that traditional plans just overlook.

These aren’t your grandma’s estate challenges. Millennials need tools that respect today’s wealth dynamics-digital, gig-fueled, tech-savvy. Are you up for it?

Essential Estate Planning Tools for Young Investors

Let’s ditch the dusty estate planning manuals, shall we? Millennials-you’re in a different ball game. Your will needs to speak your language (not ancient Greek). AARP’s data throws us a curveball: only 4 out of 10 American adults have a will. Your secret weapon? Tackle crypto, gig economy gigs, and those side hustles. Got kids? Name their guardians. Own a digital empire? Who gets that? And hey, debts-spell out how they’re managed. Oh, and those beneficiary designations on retirement accounts and insurance policies? They’re the heavyweight champs, knockout power over your will.

Will Creation Addresses Modern Asset Types

Here’s the deal: your will has to grapple with stuff your parents never dreamed of. Silo those crypto wallets away from the usual suspects in your asset lineup, but pro tip-keep those private keys out of the document. Why? Your will’s a public spectacle once it hits probate. Have online biz? Social media fortune? Digital content stash? Draw up direct orders. Your executor? Needs a degree in tech savviness to weave through digital mazes. Forget cookie-cutter templates-they flatline when it’s time to juggle gig work income or intellectual rights from your YouTube fame.

Power of Attorney Documents Protect Financial Operations

When life throws lemons (or curveballs), you want solid protection. Financial and healthcare POAs-they’re your guardians. Your financial POA? Make it a Swiss Army knife: banking, investments, business ops, taxes-it’s a wild west out there for gig rockstars. Healthcare directives? Those HIPAA boxes must be ticked so your go-to can navigate your medical maze. Pick a tech guru, not just your Aunt Sally.

Trust Structures Shield Wealth From Multiple Risks

Revocable trusts-your invisibility cloak against probate. So no prying eyes on your crypto treasure or biz ledger. Asset protection trusts? They’re the bodyguards for freelancers facing daily skirmishes. Peek at places like Nevada or Delaware for their domestic asset protection trusts-they’re fortresses against creditors. Irrevocable life insurance trusts? Handy-they shrink death benefits from your taxable estate, sprouting ready cash for estate taxes.

These are your legal bricks and mortar-sturdy ground for complex tax choreography that dodges the taxman’s big grasp. Make Uncle Sam play nice.

Tax-Efficient Wealth Transfer Strategies

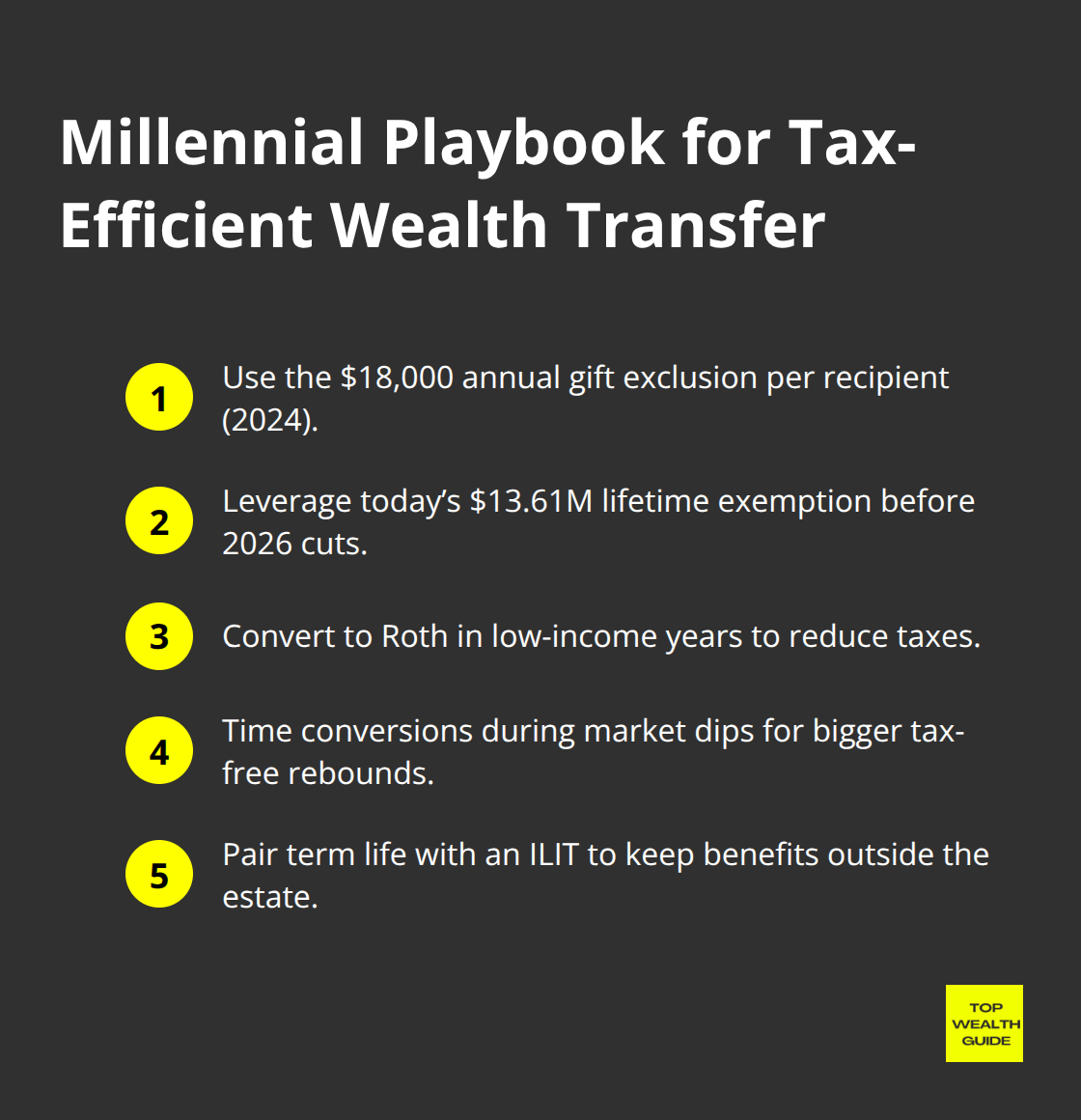

So, let’s talk free money-courtesy of the IRS. Yep, you get to hand out $18,000 per recipient in 2024 without any tax headaches. Savvy millennials are all over this, maxing it out to parents, siblings, future heirs-whoever-while building wealth. But here’s the deal: your lifetime exemption is a chunky $13.61 million through 2025, and then… it nosedives to about $7 million in 2026 unless Congress steps in. Time to initiate your wealth transfer while the going’s good.

Annual Gift Exclusions Create Tax-Free Transfers

Gifting $18,000 to as many people as you like each year? It’s like tax-free Oprah-no paperwork, no tax dramas. For married couples, that’s $36,000 per recipient-double fun. Gift stocks, real estate, stuff that grows, and shrink your taxable estate in the process. Need to help the ‘rents with bills? Just gift them the cash-it counts for the exclusion and shrinks your estate. Just keep the documents straight to keep the IRS off your back.

Roth Conversions Beat Traditional Retirement Plans

Roth conversion time: picture moving $10,000 from your traditional IRA to a Roth when, say, you earn $40,000 during a gap year (instead of your usual $80,000). The tax sting is lighter, and your heirs score a tax-free payday later. The SECURE 2.0 Act says non-spouse beneficiaries must clear out inherited IRAs in 10 years-Roth IRAs play by different rules with zero tax on distributions. Spread conversions over years to dodge those sky-high tax brackets.

Market Downturns Offer Conversion Opportunities

Market hits the rocks-your time to shine. Converting shares when prices are down? Genius.

Turn a $50,000 IRA that slips to $35,000 into prime conversion material. Pay taxes on $35,000, watch it rebound tax-free to $50,000 (or more). Smart timing during career switches or low-income years seals the deal.

Life Insurance Amplifies Estate Value

Enter the dirt-cheap world of term life insurance-millennials can snag a million-dollar policy for about $30 a month. Irrevocable life insurance trusts pull death benefits out of your taxable estate, giving you peace of mind for estate taxes or family liquidity needs. Whole life policies? They build cash you can tap for real estate or business dreams (though term typically gives more bang for your buck). Plus, tax-free death benefits offer a leg up in multiplying wealth where stocks and bonds might not.

Final Thoughts

Estate planning-yeah, it’s a must-do for millennials orbiting the crypto and gig economy. This isn’t something you defer. It’s today’s problem, not tomorrow’s. Let’s talk basics: you gotta draft a will that takes modern assets into account. Power of attorney? You bet. Trust structures? Absolutely essential if you want to keep your assets safe from whatever turbulent economic weather’s ahead.

Look at the numbers. 70% of Americans haven’t even touched wills, and only a measly 32% of millennials are thinking inheritances. It’s like gift-wrapping an advantage when you act proactively. Convert those old-school IRAs to Roth while you’re not rolling in it yet, grab some term life insurance while you’re still doing push-ups without aches, and make sure each digital treasure of yours is boxed with succession plans (future you’ll be the favorite ancestor because of it).

Biting the bullet early pays off in spades. Your heirs? They’ll skip the probate circus, your clever wealth transfer schemes dodge those tax landmines, and your digital footprint stays intact-an online fort, if you will. Over at Top Wealth Guide, we boost millennials who dive into estate planning before the midlife crisis era hits, laying down firm fiscal bedrock compared to the late bloomers. So, go ahead. Book that legal meet-up, freshen up your beneficiary list, and tally your digital goldmine ASAP.