The question isn’t whether you need a financial advisor-it’s whether one makes sense for your specific situation. Some people thrive managing their own investments, while others benefit from professional guidance.

At Top Wealth Guide, we believe the answer depends on your finances, your time, and your comfort level with markets. This post breaks down when self-management works and when financial advisors genuinely add value.

In This Guide

When You Can Successfully Manage Your Own Finances

Low Complexity Financial Situations

Self-management works best when your situation stays straightforward. Over a third of Americans manage their own investments according to eMoney research, and many succeed because their financial lives remain uncomplicated. If you earn W-2 income, have a modest investment portfolio, no dependents with special needs, and no significant tax complications, self-management becomes feasible. The math works: you avoid advisor fees typically range from 0.5% to 2% annually on assets under management, which translates to real savings over decades. A person with a $500,000 portfolio paying 1% in fees loses $5,000 every year that could compound into your retirement account instead.

You Have Genuine Interest and Available Time

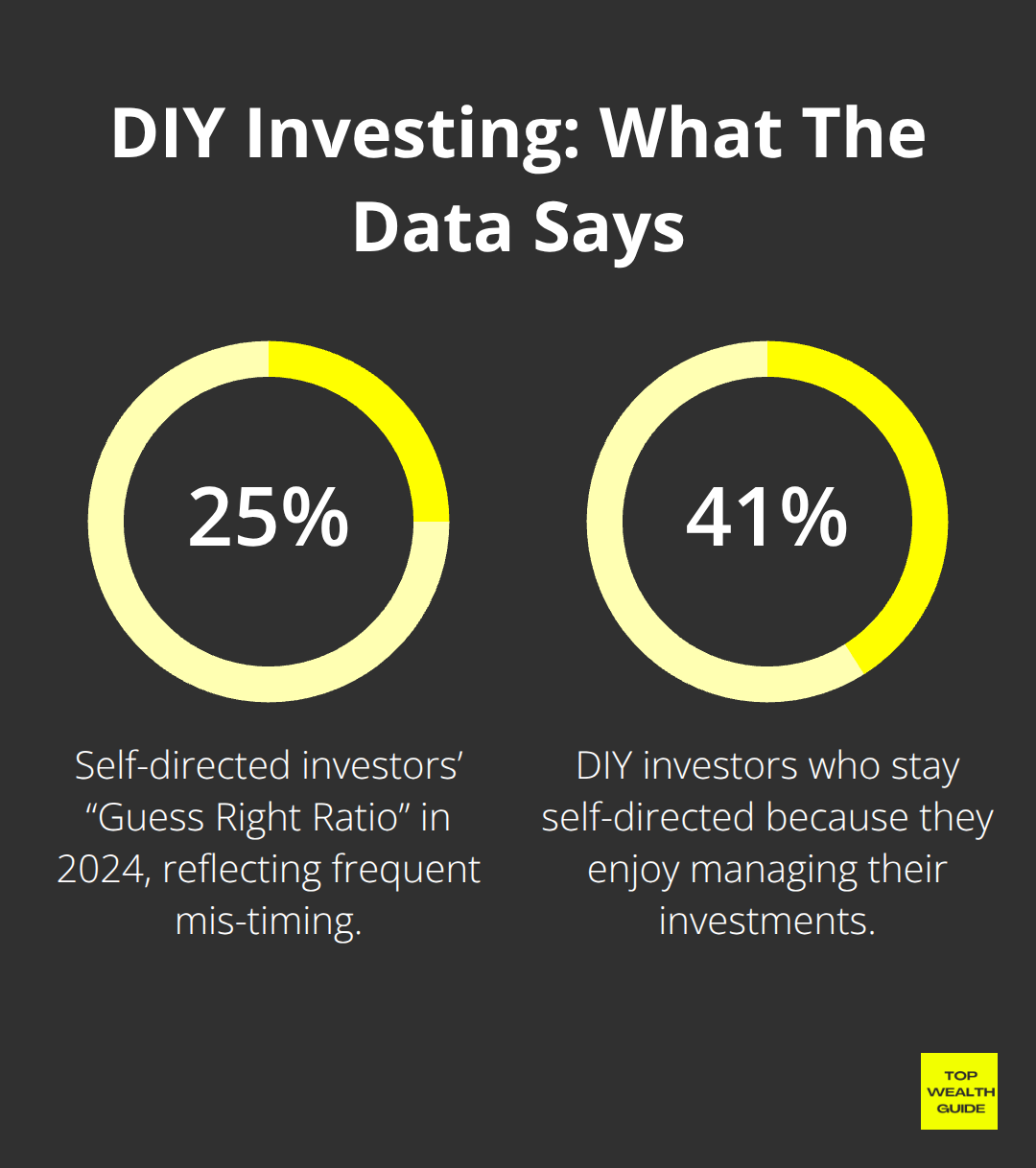

Self-directed investors who succeed commit real time to the work. Most spend several hours weekly researching, monitoring positions, and rebalancing their portfolios. This matters because DALBAR research shows that self-directed investors often underperformed the S&P 500 by significant margins, with the “Guess Right Ratio” falling to just 25% in 2024. That gap came from emotional decisions and poor timing, not from the strategy itself. If you actively study market trends, understand your own behavioral biases, and stay disciplined during downturns, you possess advantages most DIY investors lack. The eMoney survey found that 41% of DIY investors stay self-directed because they genuinely enjoy managing their investments.

These aren’t people forcing themselves through tedious tasks. They find the work engaging and take pride in their decisions. If managing money feels like a chore rather than an interest, self-management probably isn’t your path.

Your Resources Match Your Needs

Quality online tools have democratized investing in ways that matter. Platforms like Vanguard and Fidelity offer commission-free trading, low-cost index funds, and educational content that rivals paid advisory services in usefulness. Vanguard earned the top ranking for do-it-yourself investor satisfaction in the J.D. Power 2025 U.S. Investor Satisfaction Study. You can access research, build diversified portfolios, and execute your strategy without paying advisory fees. However, free tools have limits. A robo-advisor might handle basic portfolio rebalancing, but it cannot help you navigate a job loss, inheritance, or major life transition. When your situation stays within the parameters those tools address well, self-management through quality platforms works effectively. Yet as your finances grow more complex-whether through business ownership, significant assets, or major life changes-the limitations of self-directed platforms become apparent, and professional guidance starts to make financial sense.

When a Financial Advisor Genuinely Helps

Professional advisors deliver measurable value in three specific areas where self-directed investors consistently stumble.

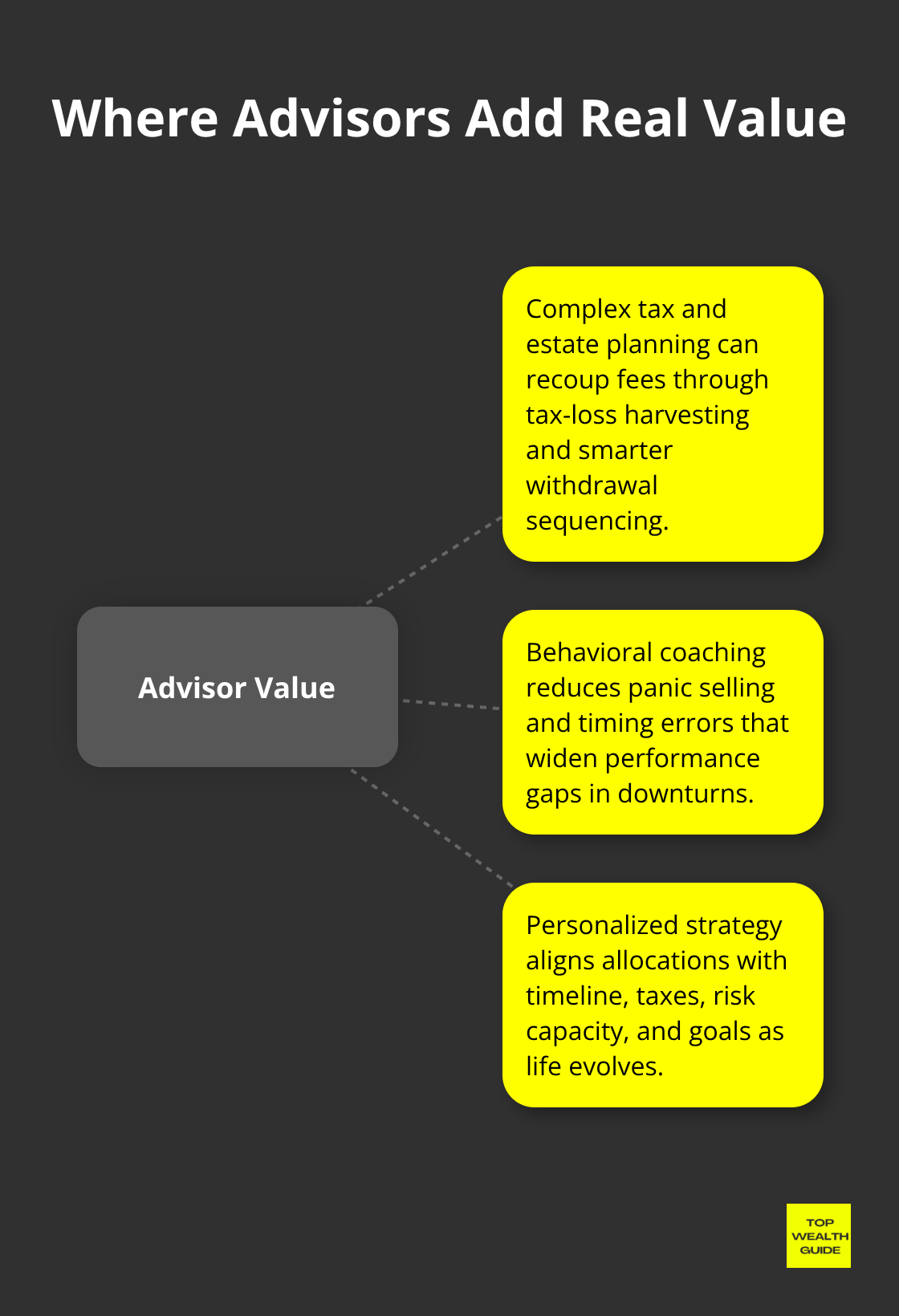

Complex Tax and Estate Situations

Complex tax and estate situations demand expertise that online tools simply cannot provide. If you own a business, manage significant real estate holdings, have multiple income streams, or face inheritance planning, an advisor who specializes in tax-efficient strategies can save you far more than their fees cost. A business owner paying 1% in advisory fees might recover that cost in a single year through better tax-loss harvesting or strategic withdrawal sequencing. These specialized strategies require someone who understands your complete financial picture, not a generic platform designed for average investors.

Behavioral Coaching During Market Downturns

Behavioral coaching during market downturns separates advisors who genuinely help from those who simply manage money. 2024 DALBAR research revealed that self-directed investors underperformed the S&P 500 by 5.5 percentage points that year alone, driven almost entirely by panic selling and poor market timing. When markets dropped in 2022, self-directed investors lost 21.17 percent versus the S&P 500’s 18.11 percent decline. Vanguard research found that behavioral coaching from advisors contributes roughly 0 to 2 percentage points annually in returns simply by preventing emotional mistakes. An advisor who kept you from selling at the bottom prevented losses that would have taken years to recover.

Personalized Investment Strategy Development

Personalized investment strategy development goes beyond picking funds. A true advisor aligns your portfolio with your specific timeline, tax situation, risk capacity, and life goals rather than pursuing generic market-beating returns. Someone retiring in five years needs a completely different portfolio than someone with thirty years until retirement, yet most DIY investors build static allocations that ignore these critical differences. This tailored approach compounds over time, especially when your financial life grows more complex.

The Retirement Success Gap

Vanguard’s research on Personal Advisor Services found that advised investors have an 80 percent or greater chance of meeting their retirement goals, compared to significantly lower success rates for self-directed investors managing comparable portfolios. That gap exists because advisors prevent costly emotional decisions, implement tax-aware strategies tailored to your situation, and rebalance systematically rather than sporadically. An advisor provides a structured financial plan that addresses retirement income sequencing, Social Security timing, estate documents, insurance gaps, and wealth transfer strategies as one integrated system. Self-directed investors typically address these elements piecemeal, missing optimization opportunities that could amount to hundreds of thousands of dollars over a lifetime.

When Complexity Demands Professional Guidance

This matters most when your financial life grows complex enough that a single mistake cascades into consequences. As your assets increase, your income sources multiply, or your life circumstances shift, the limitations of self-directed management become apparent. The question then shifts from whether you can manage your finances to whether you should spend your time doing so when a professional could optimize outcomes significantly. Understanding your own financial complexity helps clarify whether professional guidance makes sense for your situation, which brings us to the practical framework for making this decision.

Making the Right Choice for Your Situation

Map Your Financial Complexity First

Start by mapping your actual financial complexity rather than guessing. Create a simple inventory: write down your income sources, investment accounts, real estate holdings, business interests, dependents with special needs, and any major life changes coming in the next five years. This exercise takes thirty minutes but clarifies whether your situation genuinely stays simple. If you have W-2 income only, one home, a standard brokerage account, and no inheritance planning needs, self-management through quality platforms like Vanguard or Fidelity makes financial sense.

However, if you own a business, manage rental properties, have multiple income streams, face significant tax complications, or anticipate major changes like retirement or inheritance within two years, professional guidance becomes practical rather than optional. The distinction matters because complexity doesn’t announce itself-it creeps in gradually. Many people think their finances are simple until they face a major life event and suddenly realize they lack a coordinated strategy across taxes, investments, and estate planning.

Calculate What Advisor Fees Actually Cost

Stop thinking about advisor fees as a percentage and start calculating them in real dollars against your actual investment returns. A 1% annual fee on a $500,000 portfolio costs $5,000 per year. Over thirty years, assuming 7% average returns, a 1% difference in annual fees can reduce your final portfolio value by 20-30%.

That calculation only works if you actually achieve those returns through self-management. Self-directed investors often fail to match market returns due to poor timing and emotional decisions. If an advisor’s behavioral coaching and tax strategies add even 2% annually to your after-tax returns through better decision-making and tax efficiency, that advisor pays for themselves while you sleep. The real question isn’t whether 1% feels expensive-it’s whether you consistently beat the market after accounting for your own mistakes. Most people don’t.

Calculate your actual performance over the past three years by comparing your portfolio returns to the S&P 500 index. If you’ve underperformed, particularly during the 2022 downturn or the 2023 recovery, an advisor likely adds value. If you’ve matched or beaten the index consistently, self-management works for you.

Assess Your Emotional Discipline

The critical factor isn’t hours per week spent researching investments-it’s whether you can execute a strategy without abandoning it during market panic. One of the biggest reasons investors lag behind the market is emotion-driven decision-making. Fear and greed dominate investor behavior, leading to costly mistakes at critical moments.

During the 2022 market decline, self-directed investors lost 21.17% while the S&P 500 fell 18.11%. That 3% gap represents thousands or millions in losses caused entirely by emotional decisions and poor market timing. An honest self-assessment requires asking whether you can watch your portfolio drop 20% without second-guessing your strategy or making panic trades. If you’ve sold positions at market bottoms in the past, experienced analysis paralysis during volatility, or frequently changed your investment approach based on market news, you lack the emotional discipline that makes self-management work.

Conversely, if you’ve held through downturns, maintained your allocation strategy despite market fear, and made investment decisions based on your goals rather than headlines, you possess the temperament for self-direction. This temperament matters more than investment knowledge because discipline prevents the costly mistakes that destroy self-directed returns.

Final Thoughts

The decision between self-management and financial advisors comes down to three concrete factors: your financial complexity, your actual investment performance, and your emotional discipline during market stress. If your situation stays simple, you consistently match market returns, and you’ve held your strategy through downturns without panic selling, self-management works. If your finances involve multiple income streams, significant assets, or complex tax situations, or if you’ve underperformed the market during volatility, professional guidance pays for itself through better decisions and tax efficiency.

Many people find that a hybrid approach fits their reality better than choosing one path exclusively. You might manage your core portfolio through low-cost platforms like Vanguard while working with an advisor on tax planning, estate documents, or retirement income strategy. This arrangement lets you maintain control over daily decisions while leveraging professional expertise where it matters most.

Start this week by mapping your financial complexity, calculating what your recent returns actually were, and assessing whether you’ve maintained discipline during market downturns. That honest assessment clarifies your path forward, and Top Wealth Guide helps you think through these decisions with practical frameworks and honest analysis.