America rides the credit card carousel with the average Joe (or Jane) lugging around $6,194 in debt. And that’s just the credit card slice — the collective household debt mountain hit a whopping $17.06 trillion in 2023. The escape hatch? It’s not enough to just chip at those minimums. You need a master plan to break the debt shackles.

Here at Top Wealth Guide, we’ve played detective on the most effective ways to give you a fast pass to financial freedom. The right brew of proven strategies — that’s your ticket. Slice your debt timeline in half, and as a bonus, you’ll build lifelong habits that keep wealth rolling in.

In This Guide

Understanding Your Debt Landscape

Most Americans think they’re on top of their debt game, but cue the reality check – household debt ballooned to $18.59 trillion in the third quarter. It’s time to get real with a debt audit. Grab those three musketeers of credit reports – Experian, Equifax, and TransUnion. Jot down every penny you owe: credit cards, student loans, auto loans, mortgages, personal loans, and yes, those sneaky medical bills. Include the scoop: creditor names, balances, minimum payments, interest rates, and due dates. Sum up your monthly debt diet and multiply by 12 – ta-da, that’s your annual debt service reality.

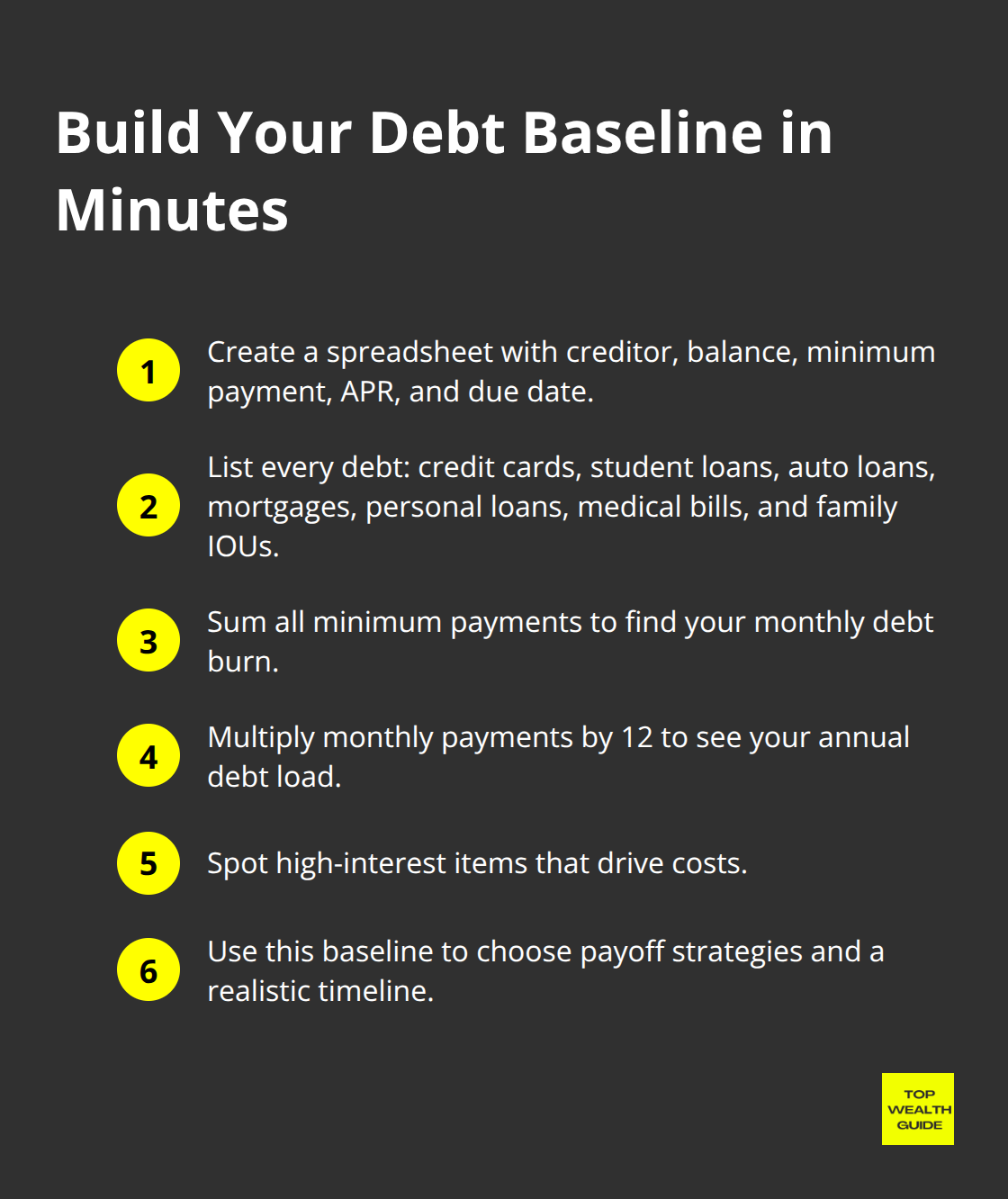

Calculate Total Debt and Monthly Obligations

Your debt dossier needs an airtight strategy. Whip out a spreadsheet with space for creditor, balance, minimum payment, interest rate, and when the bill’s due. Don’t forget anything: credit cards, student loans, auto loans, mortgages, personal loans, medical bills, even those family IOUs.

Total your monthly dues – this is your baseline debt burn. Multiply it by 12 to eye your annual debt load. You might find you’re shelling out $8,000-$15,000 yearly just to keep blinkers on (outside the mortgage).

Identify High-Interest vs Low-Interest Debt

Credit cards sporting an average 21.39% interest should set off the sirens. These high-interest culprits cost you $2,139 annually for every $10K balance. Mortgages running at 3-7% and federal student loans pegged at 5.50% wear the ‘friendlier debt’ badge. Personal loans and auto rides sit in the middle lane at 8-15%. Do the math for your weighted average interest rate: multiply each debt by its rate, add ’em up, and divide by the total debt. Cross the 12% line and it’s time for more than just padding payments.

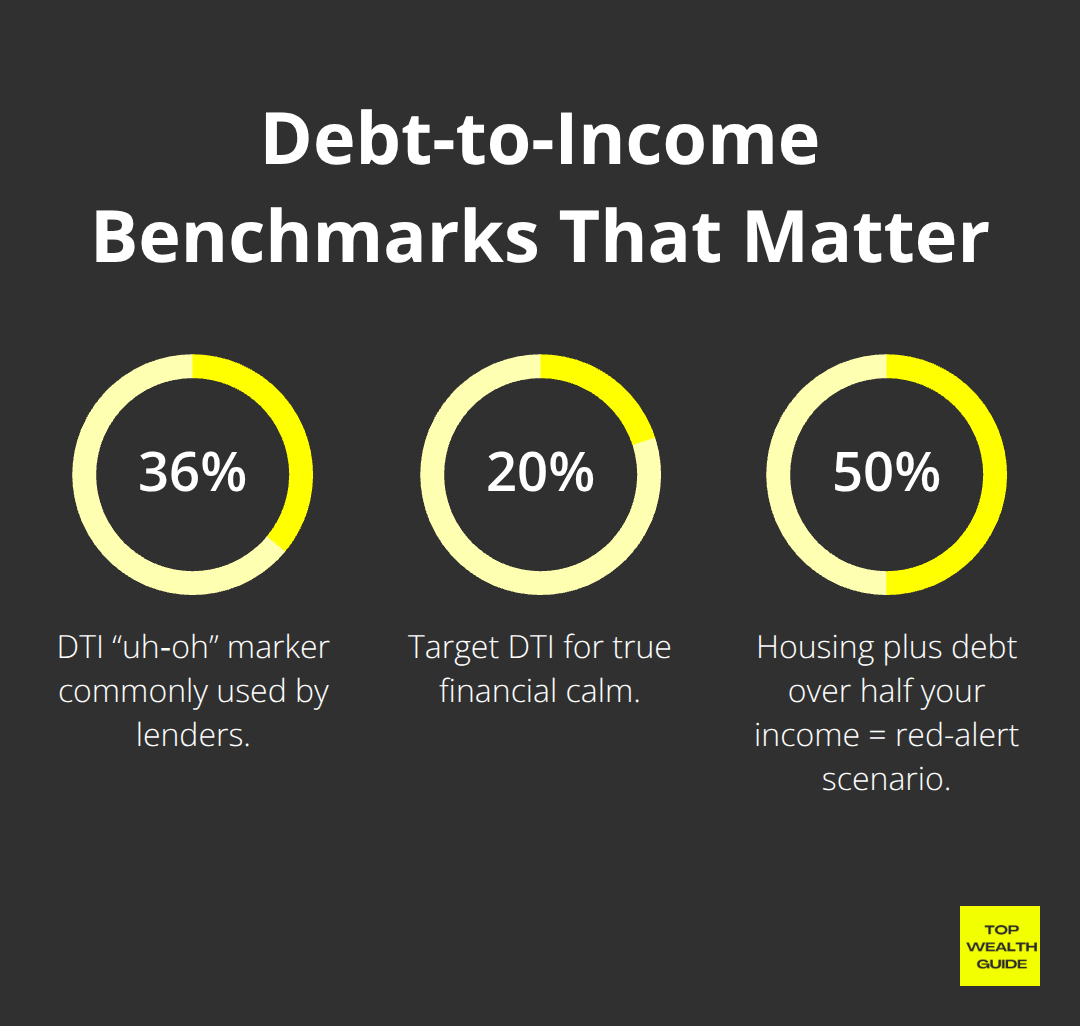

Assess Your Debt-to-Income Ratio

Lenders toss out 36% total debt-to-income as the “uh-oh” marker, but true financial zen means sticking under 20%. Crunch your monthly debt payments by your gross monthly bacon. Keep utilities and groceries out of the mix. At 30-36%, you’re flirting with a danger zone where surprises stir chaos. Push past 36% and it’s debt pulling the strings on your financial life. Housing plus debt eating over half your income? That’s a red-alert scenario – a crisis in the making, with laser precision, as 89% accurate according to the Consumer Financial Protection Bureau.

With your debt landscape fully charted, you can now craft that killer plan to whittle away what you owe. Grasping your personal financial landscape paves the way for sharper choices, while smart cash flow management secures your stride toward financial goals.

Proven Debt Elimination Strategies

Let’s start with what I call the “debt snowball” method – a quirky little strategy where you target (drumroll…) your smallest debts first, while just keeping the lights on with minimum payments on everything else. Dave Ramsey loves to preach this one because, hey, knocking out that pesky $800 medical bill feels downright glorious and gives you that motivational mojo to keep going. It’s not about the numbers, folks. Nope. It’s about those sweet psychological victories that matter way more to most debt-saddled Americans. Oh, and Northwestern’s Kellogg School backs this up-proving people who “snowball” their way out of small debts are more likely to escape the debt dungeon altogether.

Debt Avalanche Saves More Money

And then there’s the one for folks who crave the long game – enter the “avalanche” method, which goes straight for the jugular on those high-interest debts first. Why? Because those 24.99% store cards are just financial vampires sucking you dry. Tackling those first might take you a bit longer to see the first payoff, but trust me, the savings. Are. Real. Just bring your iron will-you’ll need it. The flipside? Progress can feel like watching paint dry. But if you can stomach the slow start and live for calculated financial wins, the avalanche is your ticket to big savings down the line.

Balance Transfers and Consolidation Cut Interest

Time to play the balance transfer card game – literally. Grab a card waving a shiny 0% introductory rate for 12-21 months and watch those interest payments vanish (or, well, dwindle). But there’s a catch, naturally-a 3-5% transfer fee, plus the joy of qualifying for a decent credit limit. Consolidation loans? Sure, but only if you’ve got the eye of a hawk for rates. Oh, and steer clear of home equity loans for unsecured debt unless you’re itching to gamble your house – that’s a financial “don’t” you’ll regret. Be a rate-shopping ninja and read the fine print like it’s your favorite novel.

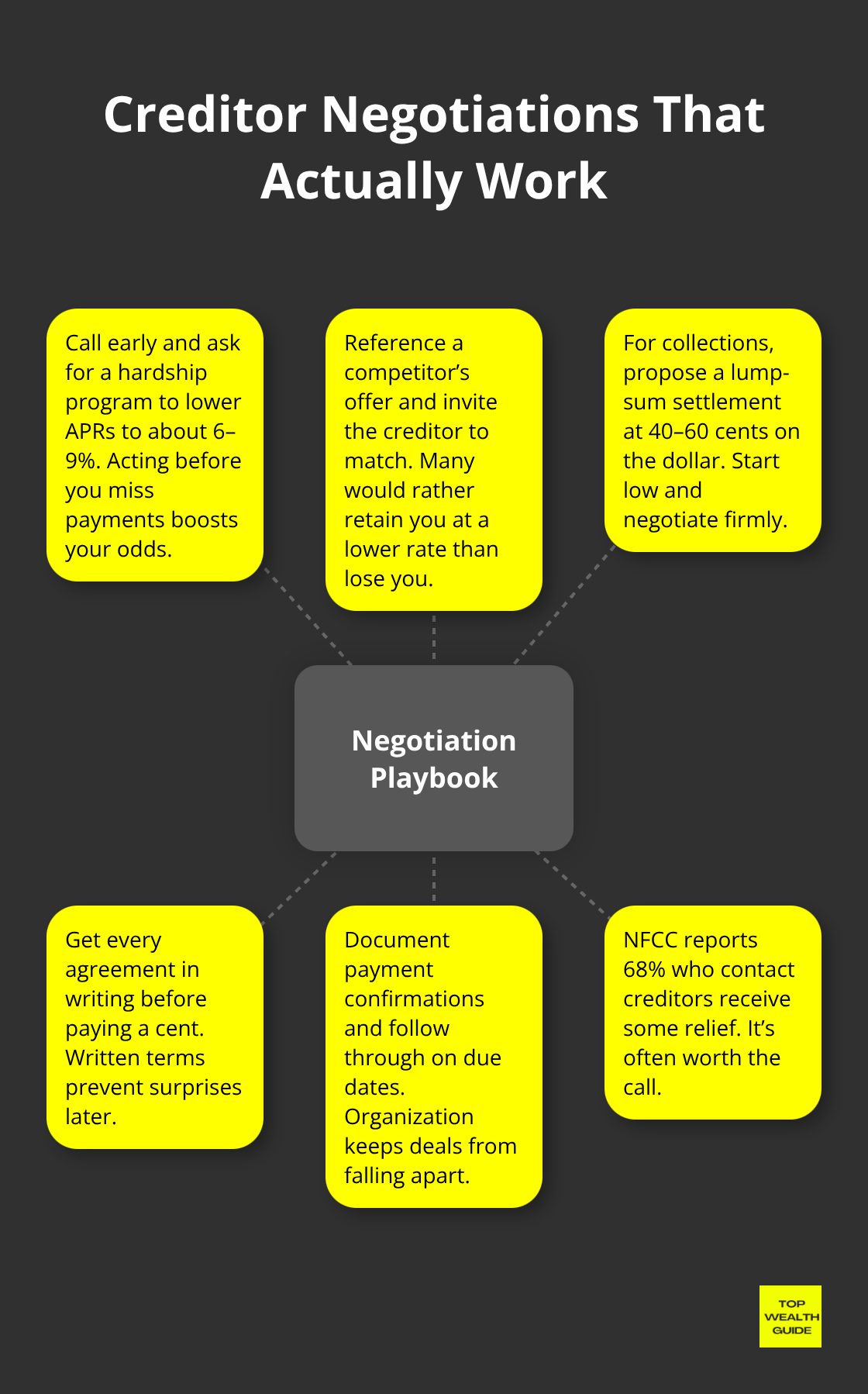

Creditor Negotiations That Actually Work

Had enough jargon yet? Good. Now let’s talk creditor negotiations. You want to pick up the phone and ring those creditors before it’s too late – mention the hardship program and start talking down those interest rates to a friendlier 6-9%.

Mention a competitor’s offer and see if they’re willing to play ball. Believe me, they’d rather make pennies than lose a customer. For those accounts already in the collections dungeon, throw out a lump sum settlement-40 to 60 cents on the dollar and see who bites. Everything you agree on, get it signed, sealed, and delivered in writing before you send a dime. And the cherry on top? The National Foundation for Credit Counseling says 68% of people who chat directly with creditors catch some sort of relief – not bad odds.

These tried and true strategies are your bedrock. But hey, why stop there? Give that income a booster jab, savage those expenses, and you’ll see results pronto. Consider automating payments – there’s magic in setting them above minimums by 20% so you can slice that repayment time in half. Yes, half. For most credit cards, at least.

Accelerate Your Debt Payoff Through Income Optimization

The gig economy-our trusty new lifeline. 36% of workers are now wrangling extra coin from side hustles. Think about it-food delivery drivers pocket a cool $15-25 an hour during peak times, and those with a knack for words? Freelance writers rake in $25-75 per hour (expertise matters). Virtual assistants kick off at $15 and can soar from there. The trick? Align the gig with skills you already have and your calendar gaps.

A nurse hustling weekend shifts at $40 an hour-tramples over someone ridesharing for $12 after expenses. Eye on the prize: target side income that nukes your minimum debt payments. Voila, your main paycheck morphs into a debt-wrangling juggernaut.

Side Hustle Ideas That Actually Pay

Freelance work-it’s the heavyweight champ in the high-pay arena. Web developers are scoring $50-150 an hour, graphic designers scoop $30-80 hourly, and social media managers snag $20-50 per hour. Don’t knock physical services-house cleaners score $25-40 per hour, dog walkers earn $15-25, and handymen bring home $30-60 an hour.

Scalability-your golden ticket. Tutoring? That gets you $20-80 an hour and fosters repeat business. Whip up an online course, and boom, you’ve got passive income post-setup. Event photography kicks off at $100 per session and grows via word of mouth.

Slash Expenses Like Your Financial Life Depends on It

Housing costs-yeah, they’re a wallet vampire, but those willing to move can slice $200-500 off monthly costs-easy peasy. Axe those subscriptions-families blow $273 monthly on unused ones, no thanks to Chase’s findings. Meal plans? They cut grocery bills by 23%, plus going generic trims another 15-30% without losing quality.

Insurance-you can shave $400 annually just by shopping around for auto coverage. Americans drop $3,526 each year on eating out-and slicing that down the middle redirects $1,763 directly into your debt payoff arsenal. Every dollar saved-more ammo against those bills.

Turn Tax Refunds Into Debt Demolition Tools

Got a tax refund? It’s a hefty windfall-but hold up before splurging on vacations or shiny trinkets. Instead, target your highest-interest debt, and you’ll watch those years melt away. Plunking down $3,000 on a $15,000 credit card-raging at 21% interest-saves $4,200 down the line and chops off 18 months.

Bonuses, inheritance, stimulus checks-treat these as debt-neutralizers, not spree fuel. Adjust your tax withholding for smaller refunds and heftier monthly checks-automate those to shred debt before temptation strikes.

Final Thoughts

Debt elimination-it’s where strategy meets hustle. So what’s the plan? Well, for motivation junkies, the debt snowball method is your jam. It scratches that psychological itch. But if you live and breathe spreadsheets, the avalanche method maximizes your savings like a boss. Don’t sleep on balance transfers and creditor negotiations… they’ve got the power to chop your interest rates by 50-70%, speeding up your payoff game.

Keep it real with expectations, folks. On average, Americans using a structured approach kiss $50,000-75,000 in debt goodbye in 3-5 years. The high earners with a side hustle or two? Yeah, they’re fast-tracking that timeline-think payments beating the minimums by 20-50% while throwing every bonus and tax refund straight at the principal.

And once you’re debt-free, it’s game time. Those old payments? Redirect them into investments and watch your wealth stack grow. Automate your emergency fund contributions… because another debt cycle? Hard pass. Remember, financial freedom isn’t a fairy tale. It’s all about the grind and proven tactics. Nail your debt elimination and you’re cruising towards long-term wealth building and financial planning success.