Venturing into the world of cryptocurrency investing can feel like navigating a complex maze, with high potential rewards often accompanied by significant volatility. The key to success isn't just picking the "right" coin; it's about deploying the right strategy. A well-defined approach separates informed investors from speculators, providing a framework for managing risk and capitalizing on opportunities in this dynamic market. Without a plan, emotional decision-making can quickly lead to costly mistakes.

This guide is designed to cut through the noise and provide a clear, actionable roadmap. We will break down nine distinct cryptocurrency investment strategies, each suited for different financial goals, risk tolerances, and levels of active involvement. From the set-and-forget simplicity of Dollar-Cost Averaging (DCA) to the more active approach of swing trading, we will explore the mechanics, pros, and cons of each method.

You will learn not just what these strategies are, but how to implement them effectively. We’ll provide practical examples, specific tips, and detailed comparisons to help you determine which approach, or combination of approaches, aligns best with your personal investment philosophy. This article will equip you with the knowledge to move beyond guesswork and build a crypto portfolio with confidence and purpose.

In This Guide

- 1 1. Dollar-Cost Averaging (DCA)

- 2 2. HODLing (Hold On for Dear Life)

- 3 3. Staking and Yield Farming

- 4 4. Swing Trading

- 5 5. Portfolio Diversification

- 6 6. Grid Trading

- 7 7. Arbitrage Trading

- 8 8. Value Investing (Fundamental Analysis)

- 9 9. Momentum Trading

- 10 Cryptocurrency Investment Strategies: A Comparative Overview

- 11 Crafting Your Personal Crypto Blueprint

- 12 Frequently Asked Questions (FAQ)

- 12.1 1. What is the best cryptocurrency investment strategy for a beginner?

- 12.2 2. How much of my portfolio should I allocate to cryptocurrency?

- 12.3 3. Can I combine different investment strategies?

- 12.4 4. What is the difference between swing trading and HODLing?

- 12.5 5. Is staking crypto safe?

- 12.6 6. How do I manage risk when investing in cryptocurrency?

- 12.7 7. What are "tokenomics" and why are they important for value investing?

- 12.8 8. Do I have to pay taxes on my cryptocurrency profits?

- 12.9 9. Which is better: active trading or passive investing in crypto?

- 12.10 10. How do I research a cryptocurrency before investing?

1. Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is one of the most accessible and effective cryptocurrency investment strategies, especially for beginners. It involves investing a fixed amount of money into a specific cryptocurrency at regular intervals, such as weekly or monthly, regardless of its price. This systematic approach helps mitigate the risks associated with market volatility by averaging out your purchase price over time.

The core principle is simple: when the price is low, your fixed investment buys more of the asset. When the price is high, it buys less. This method removes the emotional stress of trying to "time the market," a notoriously difficult feat. By automating your purchases, you stick to a disciplined plan, which can lead to better long-term results compared to making reactive, lump-sum investments based on market sentiment.

Real-Life Example: Imagine an investor decides to buy $100 worth of Bitcoin every month. In January, Bitcoin is $40,000, so they get 0.0025 BTC. In February, the price drops to $30,000, and their $100 now buys 0.0033 BTC. In March, it rises to $50,000, and they get 0.002 BTC. After three months, they've invested $300 and acquired 0.0078 BTC at an average cost of approximately $38,461 per Bitcoin, lower than the average market price over that period. This demonstrates how DCA can lower the average cost basis during volatile periods. To explore this foundational strategy further, check out this guide on how to invest in cryptocurrency.

How to Implement Dollar-Cost Averaging

Implementing DCA is straightforward with modern crypto platforms.

- Choose Your Platform: Select a reliable exchange that offers recurring buy features. Popular options include Coinbase's "Recurring buys," Swan Bitcoin's automated purchase plans, or Binance’s "Auto-Invest" function.

- Set Your Parameters: Decide on the cryptocurrency you want to accumulate, the fixed dollar amount you'll invest (e.g., $50), and the frequency (e.g., every Friday).

- Automate and Monitor: Link your bank account and set up the automatic transfers. Once set, your primary job is to let the strategy run its course without emotional intervention, especially during market downturns. The key is consistency.

2. HODLing (Hold On for Dear Life)

HODLing, an acronym for "Hold On for Dear Life," is a foundational cryptocurrency investment strategy rooted in a long-term belief in an asset's potential. This buy-and-hold approach involves purchasing a cryptocurrency and holding it for an extended period, often several years, regardless of short-term market volatility or price swings. The strategy's core philosophy is that the long-term value appreciation driven by technological adoption and network effects will far outweigh any temporary downturns.

This strategy removes the stress of timing the market and is exemplified by major institutional players like MicroStrategy, which has consistently accumulated Bitcoin as a primary treasury reserve asset. The HODL approach is less about technical analysis and more about fundamental conviction in a project's long-term vision and utility. This mindset aligns with building generational wealth, as you can invest for generations by focusing on assets with enduring value. HODLing is one of the most passive yet powerful cryptocurrency investment strategies for those with a strong, long-range perspective.

How to Implement HODLing

Effectively implementing a HODL strategy requires conviction, patience, and a focus on security.

- Choose Projects with Strong Fundamentals: Your success depends on the long-term viability of your chosen assets. Thoroughly research the technology, the development team, the use case, and the community behind a cryptocurrency before committing.

- Secure Your Assets: For long-term holding, never leave significant amounts of crypto on an exchange. Transfer your assets to a secure hardware wallet (cold storage) like a Ledger or Trezor to maintain full control and protect them from exchange hacks.

- Develop a Strong Mindset: The key to HODLing is ignoring short-term price movements and market noise. Avoid panic-selling during market crashes or FOMO-buying during rallies. Stick to your long-term thesis without emotional interference.

3. Staking and Yield Farming

Staking and Yield Farming are advanced cryptocurrency investment strategies designed for generating passive income by actively participating in a blockchain's ecosystem. Staking involves holding and locking up your cryptocurrency in a wallet to support the operations of a Proof-of-Stake (PoS) network, such as validating transactions. In return, you earn rewards, similar to earning interest in a savings account.

Yield farming is a more complex practice within Decentralized Finance (DeFi) where you provide liquidity to a protocol. This usually means lending or depositing your crypto assets into a liquidity pool, which others use for trading or borrowing. For providing this service, you are rewarded with a portion of the protocol's fees or with new tokens. These methods allow your assets to work for you, creating a consistent stream of potential returns beyond simple price appreciation.

Real-Life Example: An investor holding Ethereum (ETH) can stake it directly on the network or through a platform like Lido. By doing so, they help secure the network and, in return, earn an annual percentage rate (APR) in the form of more ETH. This allows their holdings to grow over time, regardless of price fluctuations. A yield farmer might deposit both ETH and a stablecoin like USDC into a Uniswap liquidity pool, earning trading fees from every transaction that uses that pool.

How to Implement Staking and Yield Farming

While powerful, these strategies require more active management and understanding of the underlying technology.

- Choose Your Strategy and Platform: For staking, you can choose networks like Ethereum or Cardano. You can stake directly, join a staking pool, or use a "liquid staking" service like Lido. For yield farming, platforms like Uniswap, Aave, or PancakeSwap are popular starting points for providing liquidity or lending.

- Understand the Risks: Staking often involves a "lock-up" period where you cannot access your funds. Yield farming carries the risk of impermanent loss, where the value of your deposited assets can decrease compared to simply holding them. Smart contract bugs are also a significant risk.

- Start Small and Diversify: Begin with a small amount of capital you are willing to risk. Diversify your assets across multiple established and audited platforms to mitigate the impact of any single protocol failing. Regularly monitor your positions and the reward rates, as they can change quickly.

4. Swing Trading

Swing Trading is a medium-term strategy focused on capturing price "swings" in the cryptocurrency market over several days to weeks. Unlike day trading, which involves multiple trades per day, swing traders aim to profit from larger market movements. This approach relies heavily on technical analysis to identify potential entry and exit points, capitalizing on cyclical price patterns and market momentum.

The core principle is to identify an asset's likely short-term direction, enter a position, and hold it until the momentum shows signs of reversing. For example, many traders successfully executed swing trades during Bitcoin's 2020-2021 bull run by entering positions during periods of consolidation and exiting after significant upward moves. This method requires a deeper understanding of market dynamics than passive strategies like DCA, making it one of the more involved cryptocurrency investment strategies.

How to Implement Swing Trading

Successful swing trading requires a blend of technical skill, risk management, and discipline.

- Master Technical Analysis: Learn to read price charts and use indicators like Moving Averages (MA), Relative Strength Index (RSI), and MACD. These tools help identify trends, momentum, and potential reversal points to form a clear trading thesis.

- Set Strict Risk Parameters: Never enter a trade without a predefined stop-loss order to cap potential losses. A common rule is to not risk more than 1-2% of your total trading capital on a single trade. This protects you from catastrophic losses in a volatile market.

- Identify and Wait for Setups: Be patient and wait for high-probability trade setups that align with your strategy. This means not forcing trades when market conditions are unclear. Keep a detailed trading journal to track your performance, review mistakes, and refine your approach over time.

5. Portfolio Diversification

Portfolio diversification is a foundational risk management strategy adapted for the high-stakes crypto market. It involves spreading investments across various cryptocurrencies to minimize the impact of poor performance from any single asset. Instead of betting on one winner, you build a balanced portfolio including different market caps (large, mid, small), sectors (DeFi, NFTs, Layer-1s), and blockchain ecosystems. This approach helps reduce overall portfolio volatility while preserving potential for significant growth.

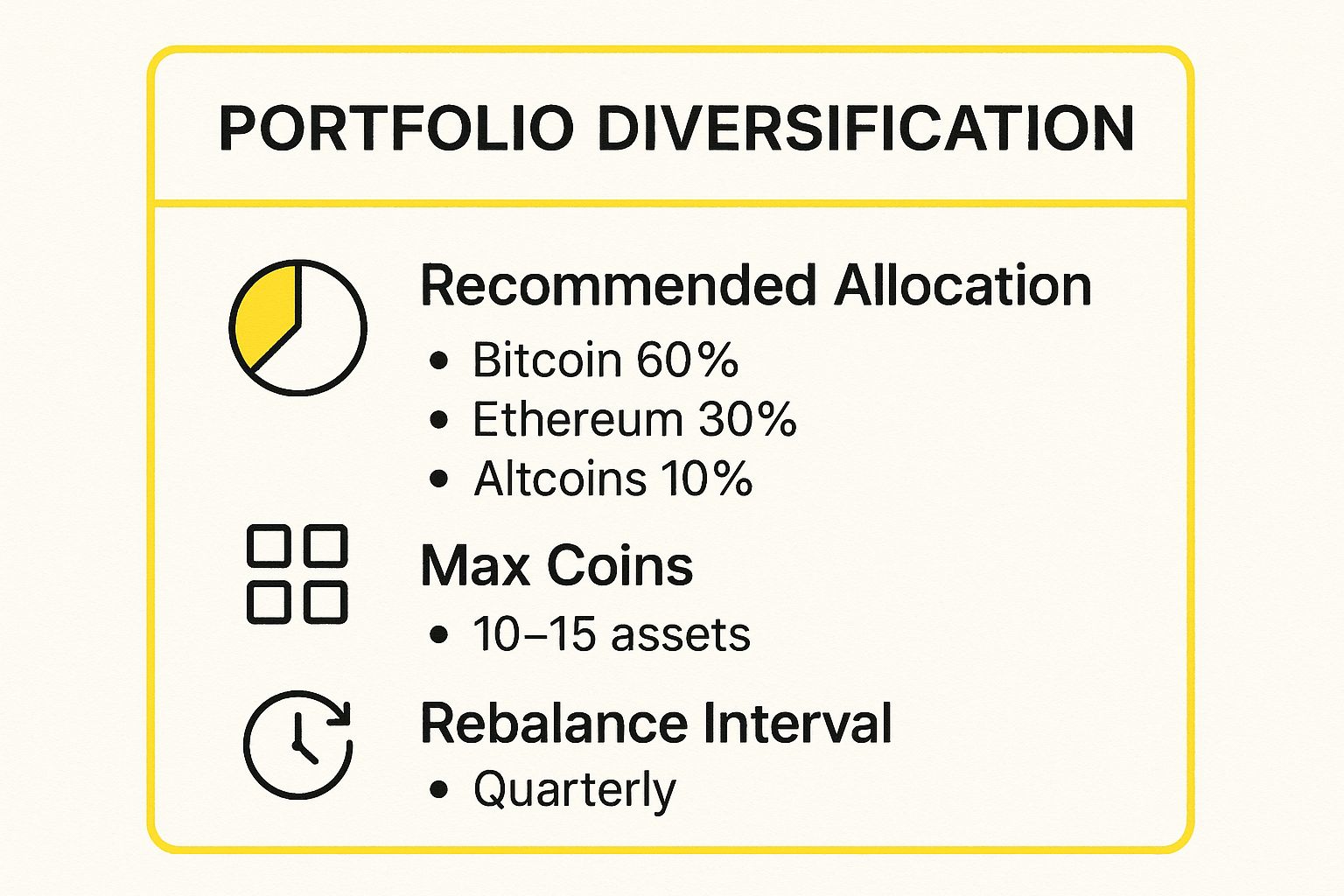

This strategy, rooted in Modern Portfolio Theory, is one of the most vital cryptocurrency investment strategies for long-term investors aiming to weather market storms. For instance, a portfolio might consist of 60% in established giants like Bitcoin, 30% in a major platform like Ethereum, and 10% in promising but riskier altcoins. This balance captures the stability of market leaders while allowing for the high-growth potential of emerging projects.

The infographic below outlines a common framework for implementing a diversified crypto portfolio.

This visual guide provides a clear starting point: a heavy allocation to Bitcoin for stability, a significant portion for Ethereum’s ecosystem growth, and a smaller, controlled allocation to higher-risk altcoins, all while maintaining a manageable number of assets and a regular rebalancing schedule.

How to Implement Portfolio Diversification

Building a diversified crypto portfolio requires careful planning and ongoing management.

- Define Your Allocation: Start by setting allocation targets. A common approach is a core-satellite model: a large "core" in Bitcoin and Ethereum (e.g., 80-90%) with smaller "satellite" positions in carefully researched altcoins that align with your risk tolerance.

- Research and Select Assets: Go beyond market cap. Investigate each project’s use case, technology, team, and tokenomics. Ensure your portfolio includes assets from different sectors like decentralized finance (DeFi), smart contract platforms, and gaming (GameFi) to avoid overexposure to a single narrative.

- Rebalance Periodically: Market movements will shift your portfolio's balance over time. Set a regular schedule (e.g., quarterly) to rebalance your holdings back to their target allocations. This enforces a disciplined "buy low, sell high" approach. For more on building a resilient investment plan, you can learn more about how to effectively manage your wealth for long-term growth.

6. Grid Trading

Grid Trading is an automated, algorithmic cryptocurrency investment strategy designed to profit from market volatility. It works by placing a series of buy and sell orders at predetermined price intervals above and below a set price, creating a "grid" of orders. The core principle is to automatically buy when the price drops to a certain level and sell when it rises to another, capturing small profits from normal price fluctuations within a specific trading range.

This systematic approach takes the emotion out of trading and is most effective in sideways or "range-bound" markets where the price oscillates between two levels. By setting up a grid, traders can capitalize on these movements without needing to constantly monitor charts. The strategy essentially automates the "buy low, sell high" mantra on a micro-level, making it a popular choice among quantitative and algorithmic traders looking to leverage market volatility.

How to Implement Grid Trading

Many crypto exchanges and third-party platforms now offer built-in grid trading bots, making this strategy accessible to all.

- Select a Platform and Pair: Choose an exchange with a reliable grid trading bot, such as Binance, KuCoin, or a service like 3Commas. Select a highly liquid trading pair (e.g., BTC/USDT or ETH/USDT) to ensure your orders are filled quickly.

- Define Your Grid Parameters: Set the upper and lower price boundaries for your grid, which defines your trading range. Then, decide on the number of "grids" or levels, which determines the spacing between your buy and sell orders.

- Allocate Capital and Launch: Allocate the amount of capital you want the bot to use. Start with a small amount to test your strategy. Once configured, launch the bot, which will automatically place the orders and begin trading based on your rules. Regularly monitor the bot's performance and be prepared to stop it if the price breaks out of your defined range.

7. Arbitrage Trading

Arbitrage trading is a sophisticated cryptocurrency investment strategy that capitalizes on price discrepancies of the same asset across different markets. Traders exploit these temporary inefficiencies by simultaneously buying a cryptocurrency on an exchange where its price is lower and selling it on another where the price is higher. This method aims to generate profits from the price difference, often with minimal market risk since the trades are executed almost instantly.

The core principle of arbitrage is rooted in the law of one price, which states that identical assets should trade at the same price everywhere. However, due to market fragmentation, varying levels of liquidity, and different trading volumes across exchanges, price differences frequently occur. A well-known example is the "Kimchi Premium," where Bitcoin has historically traded at a significantly higher price on South Korean exchanges compared to global platforms. This strategy is popular among institutional firms and automated trading bots designed to execute high-frequency trades.

How to Implement Arbitrage Trading

Successfully implementing arbitrage requires speed, precision, and access to multiple platforms.

- Monitor Multiple Exchanges: Use specialized software or API tools to track real-time prices for your chosen cryptocurrency across several exchanges simultaneously. Platforms like Binance, Coinbase Pro, and Kraken often show slight price variations.

- Maintain Ready Capital: To act instantly, you must hold balances (both fiat currency and crypto) on multiple exchanges. Transferring funds between platforms is too slow to capture fleeting arbitrage opportunities.

- Calculate Profitability: Always account for all associated costs before executing a trade. These include withdrawal fees, trading fees, and network transaction (gas) fees, as they can quickly erode or eliminate your potential profit.

- Utilize Automation: Due to the speed required, most successful arbitrage trading is done via automated bots. These bots can identify and execute trades in milliseconds, a task nearly impossible for a human trader to perform efficiently.

8. Value Investing (Fundamental Analysis)

Value investing, a strategy popularized in traditional finance by figures like Warren Buffett, has been adapted for the digital asset space as one of the most research-intensive cryptocurrency investment strategies. It involves identifying cryptocurrencies that are trading below their perceived intrinsic value. This approach requires a deep dive into a project's fundamentals, including its technology, use case, development team, tokenomics, and community engagement, to assess its long-term potential.

The goal is to find promising projects that the market has not yet fully appreciated. For instance, early investors in Ethereum may have used fundamental analysis to recognize the immense potential of smart contracts long before they became mainstream. Similarly, recognizing Chainlink's crucial role in providing decentralized oracle services to blockchains was a value-based thesis. This strategy rewards patience and thorough research over chasing short-term market hype. To start your research, you can explore top cryptocurrencies to invest in now and apply these principles.

How to Implement Value Investing

Successfully applying fundamental analysis requires a structured and analytical approach.

- Study the Whitepaper: This is your primary source document. Analyze the project's mission, the problem it solves, its technical architecture, and its roadmap. A clear, well-written whitepaper is a strong positive signal.

- Analyze the Team and Community: Investigate the backgrounds and track records of the core developers and leadership. A strong, experienced team is critical. Also, gauge the size, activity, and sentiment of the project's community on platforms like Discord, Telegram, and X (formerly Twitter).

- Evaluate Tokenomics: Understand the token's utility, total supply, distribution schedule, and inflation/deflation mechanics. Strong tokenomics create a sustainable economic model that aligns incentives for all stakeholders.

- Assess Real-World Adoption: Look for evidence of partnerships, user growth, and transaction volume. A project with tangible utility and growing adoption is more likely to have long-term value.

9. Momentum Trading

Momentum trading is a dynamic cryptocurrency investment strategy centered on the idea that assets exhibiting strong upward price trends will continue to do so. Traders using this approach buy cryptocurrencies that are already showing significant positive price movement and sell those displaying downward momentum. The goal is to ride the "wave" of a trend for as long as it lasts, capitalizing on market sentiment and volatility rather than fundamental value.

This strategy is based on market psychology, where strong performance attracts more buyers, pushing the price even higher. Successful momentum traders identify these trends early and exit their positions as soon as indicators suggest the momentum is fading or reversing. Notable examples include Bitcoin's breakout past $20,000 in late 2020, which triggered a massive bull run, and the "DeFi Summer" of 2020, where certain tokens saw exponential growth driven by hype and adoption.

How to Implement Momentum Trading

Implementing momentum trading requires active market monitoring and a firm grasp of technical analysis.

- Identify Strong Trends: Use technical indicators like the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and trading volume to spot assets with strong upward momentum. A sustained move above a key moving average, coupled with high volume, often signals a strong trend.

- Establish Entry and Exit Points: Define clear rules for when to enter and exit a trade. An entry might be triggered when a coin breaks a significant resistance level. Your exit strategy should include a take-profit target and, crucially, a strict stop-loss order to protect against sudden reversals.

- Practice Risk Management: This strategy is inherently risky. Never invest more than you can afford to lose on a single trade. Focus on highly liquid markets to ensure you can enter and exit positions easily without significant price slippage. Avoid chasing assets that have already experienced a parabolic move, as these are often prone to sharp corrections.

Cryptocurrency Investment Strategies: A Comparative Overview

Choosing the right strategy depends on your goals, risk tolerance, and available time. This table provides a side-by-side comparison to help you decide which approach, or combination of approaches, fits best.

| Strategy | Time Commitment | Risk Level | Best For | Core Principle | Example |

|---|---|---|---|---|---|

| Dollar-Cost Averaging (DCA) | Low (Automated) | Low-Medium | Beginners, long-term investors | Mitigate volatility by averaging purchase price | Buying $50 of BTC every Friday |

| HODLing | Very Low | High (Volatility) | Long-term believers | Buy and hold through market cycles | Buying ETH and storing it in a hardware wallet for 5+ years |

| Staking & Yield Farming | Medium (Monitoring) | Medium-High | Income-focused investors | Earn passive rewards on crypto holdings | Staking SOL to earn ~7% APY or providing liquidity on Uniswap |

| Swing Trading | High (Active) | High | Experienced traders | Capture price "swings" over days/weeks | Buying a coin at a support level and selling at resistance |

| Portfolio Diversification | Medium (Research) | Medium | Risk-averse investors | Reduce risk by spreading investments | Holding BTC, ETH, and a few selected altcoins |

| Grid Trading | Medium (Setup/Monitoring) | Medium | Algorithmic traders | Profit from volatility in a set range | Setting up a bot to trade ETH/USDT between $3,000 and $3,500 |

| Arbitrage Trading | High (Automated) | Low | Advanced traders | Exploit price differences across exchanges | Buying BTC on Exchange A for $60k and selling on B for $60.1k |

| Value Investing | High (Research) | Medium-High | Analytical investors | Identify undervalued projects | Researching a project's team, tech, and tokenomics before investing |

| Momentum Trading | High (Active) | Very High | Short-term speculators | Ride the trend of rising assets | Buying into a coin that has just broken a new all-time high |

Crafting Your Personal Crypto Blueprint

The journey through the world of cryptocurrency investment strategies can feel like learning a new language. From the steady, patient rhythm of Dollar-Cost Averaging (DCA) and HODLing to the dynamic, fast-paced world of Swing and Momentum Trading, the options are as varied as the assets themselves. We've explored nine distinct approaches, each with its own methodology, risk profile, and potential for reward. You’ve seen how strategies like Staking and Yield Farming can generate passive income, while methods like Arbitrage and Grid Trading aim to capitalize on market inefficiencies and volatility.

The most critical takeaway is that there is no universal "best" strategy. The ideal approach is not found in a trading guru's newsletter or a trending social media post; it is built by you, for you. Your personal crypto blueprint must be a direct reflection of your individual circumstances. Are you investing for long-term retirement, requiring a lower-risk, hands-off approach like HODLing a diversified portfolio? Or are you a more active participant, with the time and technical skill to engage in swing trading based on market patterns?

From Theory to Action: Building Your Framework

The true power of understanding these diverse cryptocurrency investment strategies lies in their application. Your next step isn't to blindly pick one but to thoughtfully combine elements that resonate with your personal financial identity.

Consider this practical synthesis:

- The Foundation: Use DCA as the bedrock of your portfolio, consistently investing in established assets like Bitcoin and Ethereum, regardless of market noise. This builds a strong, long-term core.

- The Growth Engine: Allocate a smaller portion of your capital to Value Investing principles. Research promising altcoin projects with strong fundamentals, treating them as you would a growth stock.

- The Income Stream: Stake a percentage of your holdings in proof-of-stake networks to generate a steady yield, compounding your returns over time.

This blended approach balances stability, growth potential, and passive income generation. It transforms abstract concepts into a concrete, actionable plan tailored to your goals. Success in this space is not about predicting every market move; it's about building a resilient and strategic framework that can weather volatility and capitalize on opportunities over the long haul. Remember, the crypto market is relentlessly dynamic. The strategy that serves you today may need refinement tomorrow. Continuous learning, periodic re-evaluation of your portfolio, and a disciplined mindset are the ultimate tools for navigating this exciting financial frontier.

Frequently Asked Questions (FAQ)

1. What is the best cryptocurrency investment strategy for a beginner?

For most beginners, Dollar-Cost Averaging (DCA) is the recommended starting point. It's simple to implement, removes the emotional burden of trying to time the market, and helps mitigate volatility by averaging your purchase price over time. Combining DCA with a HODL (long-term hold) mindset for established assets like Bitcoin and Ethereum is a solid foundation.

2. How much of my portfolio should I allocate to cryptocurrency?

This depends entirely on your personal risk tolerance, financial situation, and investment horizon. A common rule of thumb for traditional investors is to allocate a small percentage, typically 1-5%, of their total investment portfolio to high-risk assets like crypto. More aggressive investors might go higher, but it's crucial to only invest what you can afford to lose.

3. Can I combine different investment strategies?

Absolutely. In fact, a blended approach is often the most effective. For example, you can use DCA to build a core position in Bitcoin (HODLing), while also allocating a small portion of your capital to stake an altcoin for passive income and another small portion for exploring value investments in emerging projects.

4. What is the difference between swing trading and HODLing?

The primary difference is the time horizon and goal. HODLing is a long-term strategy (years) based on fundamental belief in an asset's future value. Swing trading is a medium-term strategy (days to weeks) focused on profiting from price fluctuations using technical analysis, with no long-term commitment to the asset.

5. Is staking crypto safe?

Staking is generally considered safer than active trading, but it's not without risks. The main risks include potential smart contract bugs, validator slashing (penalties for misbehavior), and price volatility of the staked asset. Using reputable platforms and staking well-established cryptocurrencies can help mitigate these risks.

6. How do I manage risk when investing in cryptocurrency?

Key risk management techniques include: 1) Diversifying your portfolio across different assets and sectors, 2) Only investing what you can afford to lose, 3) Using stop-loss orders for active trading, 4) Securing your assets in a hardware wallet (cold storage), and 5) Sticking to a predefined investment plan to avoid emotional decisions.

7. What are "tokenomics" and why are they important for value investing?

Tokenomics refers to the economics of a cryptocurrency. It includes factors like total supply, distribution schedule, inflation/deflation mechanics, and the token's utility within its ecosystem. Understanding tokenomics is crucial for value investing because it helps determine a token's potential for long-term value accrual and scarcity.

8. Do I have to pay taxes on my cryptocurrency profits?

Yes. In most countries, including the United States, cryptocurrencies are treated as property for tax purposes. This means you will owe capital gains tax on any profits you realize from selling, trading, or spending your crypto. The specific rules vary by jurisdiction, so it's essential to consult with a tax professional.

9. Which is better: active trading or passive investing in crypto?

Neither is inherently "better"; it depends on your personality, skills, and available time. Passive investing (like DCA and HODLing) is less stressful, requires less time, and is generally more suitable for beginners. Active trading (like swing or momentum trading) offers the potential for faster profits but requires significant skill, time, and emotional discipline, and carries much higher risk.

10. How do I research a cryptocurrency before investing?

Start with the project's official whitepaper to understand its purpose and technology. Investigate the development team's background and experience. Analyze its tokenomics to see if the economic model is sustainable. Check for real-world adoption, partnerships, and community engagement on platforms like X (formerly Twitter), Discord, and GitHub. Finally, compare it to competitors to understand its unique value proposition.

Ready to take your financial literacy to the next level? The world of investing extends far beyond crypto, and a holistic understanding is key to building lasting wealth. Visit Top Wealth Guide at Top Wealth Guide for expert insights and comprehensive guides on everything from stocks and real estate to personal finance, helping you build a truly diversified and robust investment portfolio.