By Jane Doe, CFP, Senior Financial Analyst at Top Wealth Guide

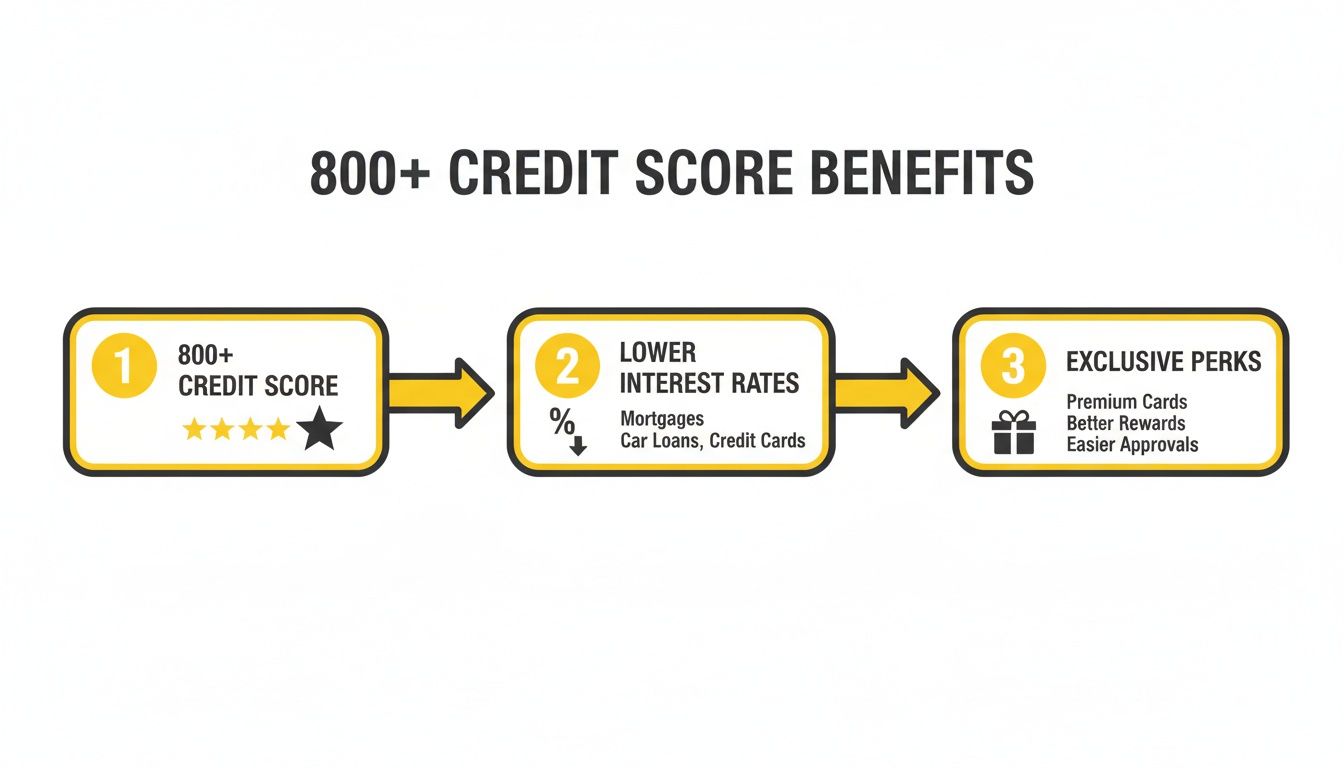

An 800 credit score means you’re part of a small circle of top-tier borrowers. With an 800+ rating, you unlock the lowest loan rates and premium credit card perks. Over time, that level of credit health can translate into thousands of dollars in savings.

In This Guide

Financial Advantages With An 800 Score

Hitting the 800 mark delivers real, measurable benefits. You’ll see:

- Ultra-low interest on mortgages, auto loans, and personal lines of credit

- Superior approval odds for elite cards with higher limits

- Exclusive perks like waived fees, boosted rewards rates, and concierge services

Roughly 22.5% of U.S. consumers reach this “exceptional” tier. Experian’s detailed report shows that these borrowers consistently secure the best loan terms and card offers.

Even shaving a fraction off your APR can save you a small fortune over a lengthy loan.

Scenario Buying A New Car

Imagine financing a $30,000 vehicle. Exceptional scorers often land a 2.5% APR, while the national average is around 5.4%. That difference cuts about $2,500 off total interest and lowers your monthly payment by nearly $40.

Scenario Refinancing A Mortgage

Let’s say you refinance $300,000. An 800+ borrower might snag 3.1%, versus 4.2% for the average applicant. That rate drop trims about $200 from your monthly mortgage and saves more than $72,000 in interest over 30 years.

Below is a quick snapshot of how an exceptional score stacks up against typical consumers:

Benefits of an 800+ Score Versus National Average

| Benefit | Exceptional Score (800+) | National Average |

|---|---|---|

| Auto Loan APR | 2.5% | 5.4% |

| Mortgage Rate (30-year fixed) | 3.1% | 4.2% |

| Credit Card Intro Bonus (points) | 75,000 | 30,000 |

| Approval Odds (Personal Loan) | 95% | 70% |

This side-by-side view highlights why that “800 bump” is more than just bragging rights—it’s real money back in your pocket.

Exclusive Credit Card Offers

Top issuers roll out their best sign-up bonuses and spending thresholds for exceptional credit profiles. For instance, you might see:

- 100,000 points after $5,000 spend in 3 months (versus 50,000 points for average applicants)

- No-fee first year plus fee waivers on travel purchases

- Up to 5x points on dining and flights

Comparing these offers makes it clear why an 800+ score pays off every time you swipe.

Check out our guide on mortgage options to explore refinancing strategies for high scorers: https://topwealthguide.com/tag/mortgage-options/

Impact On Affluent Borrowers

High-net-worth individuals often push their 800+ scores even further. They negotiate:

- Brokerage margin rates below 2.5%

- Exclusive lines of credit for real estate or private investments

Over time, those lower rates on everything from car loans to mortgages can add up to tens of thousands in extra savings.

Build On-Time Payments And Maintain Low Utilization

On-time payments and low credit utilization work together to push your FICO score higher. Since 35% of your FICO profile hinges on payment history, skipping a due date can set you back significantly.

Consistency matters more than perfection. Twelve months of punctuality beats one flawless statement followed by a hiccup.

Sample Monthly Calendar:

- Week 1: Pay the statement balance on Card A (due by the 7th).

- Week 2: Cover the minimum on Card B to keep it active.

- Week 3: Automate the payment on Card C and scan your statements for errors.

Smart Budget Allocation Across Cards

When you have several cards, give each a budget slice so you never miss a payment.

- Assign 50% of your monthly spend to the card with the highest limit—this helps keep overall utilization low.

- Funnel 30% to your second-largest card to balance activity and spread out charges.

- Cap the last 20% on smaller cards—and pay early if you’re overspending.

- Revisit these percentages every quarter when limits change or spending shifts.

Reduce Your Credit Utilization

Top scorers target 4% utilization—far below the national 28% average. Zero delinquencies seals the deal.

- Make small purchases on every card, then pay them off before the statement closes.

- Ask issuers for limit increases to automatically shrink your utilization ratio.

- Set balance alerts in your issuer’s app so you know when you’re nearing thresholds.

Even a single 5% spike in utilization can cost you 10 points overnight.

This flowchart shows how breaking 800+ unlocks 1.5% APR cuts and premium reward tiers.

Real-World Impact Scenarios

| Scenario | Score Shift |

|---|---|

| Late Payment | -100 |

| Utilization Spike (20%+) | -30 |

On the flip side, flawless payment records deliver +10–20 points per quarter. Staying under 7% utilization tacks on another 5–10 points.

For proven methods to keep balances low, see our credit card debt payoff strategies.

Sample Annual Payment Timeline

Over twelve months, punctuality and smart utilization stack up:

- Months 1–3: On-time payments + 3% utilization = +15 points

- Months 4–6: A single 30-day late = -100 points

- Months 7–9: Return to perfect payments = +10 points

- Months 10–12: Consistent sub-7% utilization = +8 points

Tools To Automate Your Progress

Let automation handle the busywork so you can stay on track.

- Schedule autopay for full balances three days before due dates.

- Activate balance threshold alerts (e.g., at 50%, 30%, and 10%).

- Try platforms like Mint or Truebill for spending insights.

Comparison of Budgeting Platforms

| Platform | Key Features | Cost | Best For |

|---|---|---|---|

| Mint | Budgeting, bill reminders, spending categorization | Free | Beginners |

| Truebill | Subscription cancellation, bill negotiation, custom budgets | Free basic, $3/mo premium | Subscription management |

Real-Life Example: After using Truebill’s negotiation feature, Lisa eliminated a $15 recurring subscription and saw her monthly utilization drop by 2%, contributing to a 6-point increase in her FICO score over two months.

Automating your payments yields a 98% on-time success rate.

Handling Unexpected Charges

When emergencies hit, keep utilization spikes in check.

- Have a zero-balance backup card and move payments there immediately.

- Shift new purchases to a high-limit card to dilute utilization.

- Consider a 0% APR balance transfer for short bursts of debt—then pay it down fast.

Key Takeaways

- Automate every payment to never miss a due date.

- Target overall utilization below 7%.

- Review and adjust card allocations each quarter.

Consistency is the secret sauce on your journey to an 800 credit score.

Avoid Common Pitfalls

Small mistakes can undo months of work:

- Closing old cards shortens your credit history and can ding your score.

- Multiple hard inquiries in quick succession raise risk flags.

- Overuse of 0% APR balance transfers without cutting principal invites future debt.

Stay disciplined, avoid these traps, and watch your score climb.

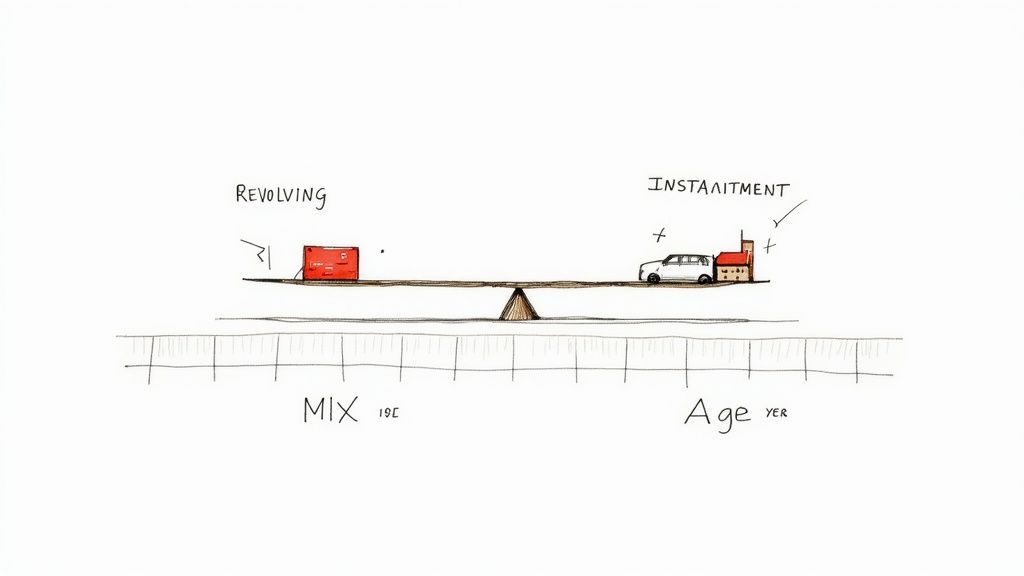

Optimize Credit Mix And Account Age

Getting the right blend of credit types is often what separates a good score from an 800+ achiever. Lenders like to see both revolving accounts and installment loans—proof you can juggle balances and hit set payment dates.

Adding a small personal or auto loan is a low-risk way to introduce an installment line. This simple move can activate the 10% credit mix factor and give your score a gentle nudge.

Benefits Of Diverse Credit Profile

- Installment loans showcase a track record of steady payments over months or years.

- Revolving accounts reveal your skill at managing shifting balances.

- Together, these account types make up 10% of your FICO score—enough to smooth out those ups and downs.

Tactics For Adding New Accounts

- Space out hard inquiries by at least six months to avoid back-to-back score hits.

- Opt for a modest loan amount (say $2,000–$5,000) so you’re not overextending yourself.

- Time your application when your cards are well under 30% utilization.

- Run soft pulls with rate-check tools before committing to any hard inquiry.

If you take out a $3,000 personal loan seven months after a card statement closes, you’ll see a fresh installment line pop up—without a major score slide.

| Feature | Profile A (No Installment) | Profile B (With $3K Loan) |

|---|---|---|

| Credit Mix Impact | 0% Installment | 10% Installment |

| Score Change | 0 points | +8 points |

| Stability | Moderate | High |

Staggering Account Openings

Rushing through multiple credit applications can shorten your average account age and ding your recent-credit factor. Instead:

- Wait 120 days between new applications—your score will thank you.

- Review your credit-age metrics each quarter before adding another line.

- Use soft inquiries first; switch to a hard pull only when the terms fit.

Case Study With Staggered Applications

Emily took out a car loan in January and a small personal loan in May. By keeping those requests four months apart, she limited the impact on her recent-credit score to just 5% of the mix. Six months later, her average account age hovered near 4 years and she’d picked up +10 points.

Maintaining Your Oldest Accounts

Long-standing cards are gold. They boost your average age and underline a history of on-time payments. To keep them active:

- Charge a small amount once a year and pay it off right away.

- Ask issuers for annual-fee waivers on cards you rarely use.

- Verify there are no missed payments or negative marks on these accounts.

How Account Longevity Boosts Scores

Account age counts for 15% of your FICO. A decade-old card can outweigh two new accounts and recent inquiries combined.

- Keep that 10-year-old card open even if you’ve moved on to newer products.

- Make a tiny annual purchase and pay in full to prevent inactivity closures.

- Negotiate fee waivers to maintain legacy cards at no cost.

A 10-year-old account adds more score value than opening two new cards combined.

Example Scenarios

- John’s Profile only had revolving credit. He introduced a $4,500 auto loan and saw his installment share hit 10%, translating to +6 points in a single cycle.

- Maria’s Portfolio featured a 12-year-old card. When she opened two new cards at once, her average age slipped and she lost 5 points, despite higher limits.

Leveraging Mix For 800 Score

Seasoned investors often tap secured lines or business credit to diversify without boosting personal balances.

- Business cards usually start with soft inquiries and broaden your profile.

- Properly structured secured loans can count as installment accounts—even at 0% interest.

- Ask issuers to report your status as an authorized user on veteran accounts.

Keep a simple spreadsheet or credit-tracking app to monitor new accounts, avoid overlap, and prevent utilization spikes.

Manage New Credit And Monitor Your Score Progress

Applying for a new card at the wrong moment can knock points off your score. Hard inquiries alone only shave off a few, but piling them up too quickly magnifies the hit. Keep a log of inquiry dates and aim to space applications at least six months apart.

- Start with soft pulls to compare rates risk-free

- Plan each request when your utilization dips below 30%

- Track projected account openings alongside your payment cycles

Choosing Balance Transfer Offers

A well-timed balance transfer can rescue you from high-interest debt. Look for cards that cover the full amount you owe and give you enough time to clear it.

- Seek offers with 12 months of 0% APR

- Watch out for fees—most hover around 3% of the transferred balance

- Initiate transfers right after statement closing to maximize promo days

- Target paying off the principal before the 0% period ends

Credit Monitoring Tools Comparison

Keeping an eye on your credit report means catching hiccups before they snowball. This table lays out popular monitoring services, so you can decide which fits your routine.

| Tool Name | Features | Monthly Cost |

|---|---|---|

| Credit Karma | Free credit updates, score simulators, alerts | Free |

| Experian CreditWorks | Real-time FICO score, dark web scans, identity lock | $19.99 |

| PrivacyGuard | Credit file monitoring, identity restoration tools | $14.99 |

| LifeLock Advantage | Identity theft insurance, lost wallet protection | $24.99 |

Whether you choose a no-cost plan or a premium subscription, set up both email and SMS alerts. Instant notifications help you act on errors before they escalate.

If you want a deeper dive into credit monitoring perks, check out Experian’s Guide to Credit Monitoring Benefits.

Spotting Errors And Fraud Quickly

Mistyped personal details and unknown accounts are immediate red flags. When you review your report:

- Look for a mistyped digit in your SSN

- Flag any account you never opened showing late payments

- Watch for bursts of inquiries on the same day

Catching one dispute-worthy error can protect you from a 50-point drop. Make it a habit to scan and file disputes within 30 days of your report release.

Maintaining Credit Dashboard

A straightforward dashboard keeps your credit story front and center. Try this monthly routine:

- Pull reports from all three bureaus at the start of the cycle

- Compare summary scores, balances, and inquiries side by side

- Dispute discrepancies immediately

- Record new credit offers and weigh them against your long-term plans

Routine Review Case Studies

Sarah spotted a creeping balance error and gained 3 points after a quick dispute. Mike caught a fraudulent inquiry, froze his profile, and had his score back on track within days.

Integrating credit signals into your portfolio tracking tools every smart investor uses helps you see how credit events align with market trends. That unified view is priceless for high-net-worth readers.

By timing your inquiries smartly, using selective balance transfers, and staying vigilant, you’re on a clear path to an 800 credit score. Stay proactive, rotate your tools, and adjust tactics as you spot new patterns.

Avoid Credit Pitfalls And Use Repair Strategies

A single error—say shuttering a decades-old card or piling up hard pulls—can throw off months of progress on the road to an 800 score. Here, you’ll recognize the most common missteps and get targeted fixes that work. Think of this as your roadmap to sidestep setbacks and stay on track.

Identify Credit Traps

Length of credit history carries weight—about 20% of your FICO model hinges on account age. Closing a long-held card instantly drags down that average. Meanwhile, multiple hard inquiries in a tight window raise red flags with issuers.

- Closing cards open longer than five years

- Applying for multiple cards within 30 days

- Spiking utilization over 30% during emergencies

Take Lisa’s example: she applied for three new cards in a month and watched her score drop by 15 points as soon as those inquiries posted.

“Even a single 5% jump in utilization can knock off 10 points,” warns credit coach Tom Nguyen.

Case Study Of Late Payment Recovery

Mark’s profile featured two 60-day late payments after an unexpected job loss, sliding his score from 780 down to 675. He tackled recovery head-on:

- Pulled complete credit reports to pinpoint every late mark

- Crafted goodwill letters explaining his hardship

- Negotiated removal in exchange for full payment of past-due balances

- Enabled automatic full-balance payments on all future due dates

Within four months, Mark reclaimed 85 points, pushing his score back to 760.

Case Study Of Identity Theft Repair

Sarah woke up to find new lines of credit she never opened—her starting score was 450. She moved fast:

- Placed fraud alerts and froze credit with all three bureaus

- Disputed each unauthorized account through online portals

- Supplied identity documents to creditors and filed an FTC affidavit with a police report

After 90 days, fraudulent items were gone and her score climbed 40 points, landing at 490.

Negotiation And Goodwill Tactics

A well-crafted goodwill request can clear negative marks without litigation. Keep it brief and personal:

- Offer a sincere apology for the oversight

- Attach proof of hardship (medical records, job termination letter)

- Pledge to settle any outstanding balance immediately

Expert Insight: Lenders remove negative marks for about 50% of goodwill requests, especially when the account is otherwise spotless.

When To Use Paid Repair Services

Not every paid service lives up to its promises. Before you sign up, look for:

- Transparency with an online dashboard tracking each dispute

- Custom dispute templates designed for all three credit bureaus

- A solid refund policy spelling out timelines and conditions

| Service Name | Monthly Fee | Refund Policy |

|---|---|---|

| CreditFix Pro | $129 | Full refund within 90 days |

| Score Surge | $149 | Refund minus work completed |

| FairCredit Care | $99 | Pro-rated refund after 30 days |

Aim for month-to-month plans that don’t lock you in. Zero-interest financing can help spread out fees—just watch for auto-renewal clauses and dispute limits.

DIY Repair Tools And Resources

Automating disputes and tracking progress saves time and prevents errors. These tactics keep you organized:

- Pull all three credit reports and highlight every negative item

- Use a standardized dispute letter template and send via certified mail

- Log bureau responses and follow up within 45 days

- Set calendar alerts for deadlines and next steps

Integrate these steps with your routine monitoring to ensure no error slips through. Read also our in-depth guide on debt elimination tactics for faster financial freedom to reinforce your repair journey.

Preventing Future Pitfalls

Even after repair, vigilance pays dividends. Establishing simple habits now stops small issues from becoming score killers:

- Maintain a credit diary to note inquiries, closures, and disputes immediately

- Review statements monthly and dispute unfamiliar charges within 30 days

- Enable two-factor authentication on lender and bureau accounts

These preventive moves protect every hard-earned point and keep your path to an 800 score firmly on course.

Frequently Asked Questions

This guide tackles the toughest questions about reaching and sustaining an 800 credit score. You’ll find straightforward advice, real-world examples, and actionable steps—all laid out so you can keep your progress moving forward.

How Long Does It Take To Reach An 800 Credit Score?

It really depends on where you’re starting. If you’re already around 700 and paying on time each month, keeping your utilization under 10% could push you to 800 within 12–18 months. Track your score every 30 days so you spot trends and tweak your approach as needed.

Can I Achieve An 800 Score With Limited Credit History?

Absolutely. Start with a small installment loan or a secured credit card, then pay in full each statement. Over 2–3 years, consistent on-time payments and low balances will earn you that 800 milestone. Pro tip: automate your payments to eliminate the risk of a late charge.

Pro Tip Even a short credit-builder loan can add +8 points once it reports.

Do Hard Inquiries Block Me From 800?

A single hard pull might shave off a few points temporarily. Space out applications by at least six months and rely on soft pulls for rate-shopping. Keep an eye on your report weekly after any inquiry to catch surprises fast.

Is Credit Mix Essential For An Exceptional Score?

Yes—revolving and installment accounts make up about 10% of your FICO mix. If you only carry cards, consider a small auto or personal loan to diversify. Just watch yourself: no more than two credit inquiries per year is a safe rule.

Can Balance Transfers Speed My Progress?

They can, provided you play your cards right. Look for a 0% APR offer that lasts at least 12 months, then tackle the debt aggressively. Always factor in transfer fees before you commit.

How Often Should I Monitor My Score?

Monthly checks on all three credit bureaus let you catch errors or fraud early. Sign up for alerts so you’re notified of any change—and set calendar reminders to review them.

What If I Encounter Fraud On My Report?

Immediately place a fraud alert and freeze your files at each bureau. File disputes for any unauthorized accounts and send supporting documents to speed removal. After resolution, double-check to confirm everything’s cleared.

Should I Close Old Accounts?

Only if you really have to. Those long-standing cards boost your average account age. A single annual charge—immediately paid—keeps them active. Just verify that your issuer won’t shut them down for inactivity.

| Action | Impact on Score |

|---|---|

| Keep Open | +15–20 points |

| Close Account | -10–15 points |

Can I Use Authorized User Accounts?

Definitely. As an authorized user, you inherit the primary account’s age and payment history. Choose someone with low utilization for maximum benefit. Watch as your overall credit limit rises and your utilization rate falls.

What Advanced Strategies Help High-Net-Worth Investors?

Seasoned investors often tap private bank lines or secured business cards to avoid public hard pulls. Margin loans tied to brokerage accounts can also diversify your profile without major score hits. The golden rule remains: never miss a payment.

Key Takeaways

Automate your payments.

Keep utilization below 10% monthly.

Monitor all three bureaus every month.

By reviewing your progress regularly and adjusting tactics, you’ll not only hit 800 but stay there for the long haul.

Final Notes And Disclaimer

Before you put this plan into action, double-check that it fits your unique financial situation.

Take a moment to read our privacy policy—it explains exactly how we handle your data.

Looking for more insights? Explore Top Wealth Guide for practical strategies and real-world examples.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions