Feeling buried under credit card debt is an incredibly heavy weight to carry. The good news is that the best credit card debt payoff strategies aren't complicated; they just require a clear, disciplined plan. The two most effective methods I've seen work time and again are the Debt Avalanche, which is designed to save you the most money on interest, and the Debt Snowball, which leverages powerful psychological wins to keep you in the fight.

In This Guide

- 1 Your Starting Point For Taking Control Of Credit Card Debt

- 2 How The Debt Avalanche Method Saves You The Most Money

- 3 Why the Debt Snowball Method Keeps You Motivated

- 4 How To Build A Sustainable Payoff Plan

- 5 Got Questions About Paying Off Credit Cards? We've Got Answers.

- 5.1 1. Which debt payoff strategy is mathematically the best?

- 5.2 2. Is it better to pay off one credit card at a time or spread extra payments across all of them?

- 5.3 3. Will paying off my credit cards hurt my credit score?

- 5.4 4. Should I close my credit cards after I pay them off?

- 5.5 5. What if I can't afford to make more than the minimum payments?

- 5.6 6. Are balance transfer cards a good idea?

- 5.7 7. What's the difference between debt consolidation and a debt management plan (DMP)?

- 5.8 8. Should I use my savings or retirement funds to pay off credit card debt?

- 5.9 9. How can I stay motivated during a long debt payoff journey?

- 5.10 10. Can I negotiate my credit card interest rate or debt amount?

Your Starting Point For Taking Control Of Credit Card Debt

Let's be honest: staring at a pile of credit card bills can feel completely paralyzing. You're not alone in this. Many people are juggling balances on several cards, each with its own frustratingly high interest rate. The key to breaking free isn't some magic trick; it's about picking a structured approach that fits you and your money mindset, then sticking with it.

This guide will help you cut through the noise and focus on proven strategies that real people use to get back on their feet financially. It’s not just about the math—it's also about understanding the "why" behind your spending and saving habits. For some, the pure mathematical efficiency of the Debt Avalanche is all the motivation they need. For others, the quick, tangible wins from the Debt Snowball provide the fuel to keep going. Figuring out which camp you're in is the first real step toward building your own freedom financial road.

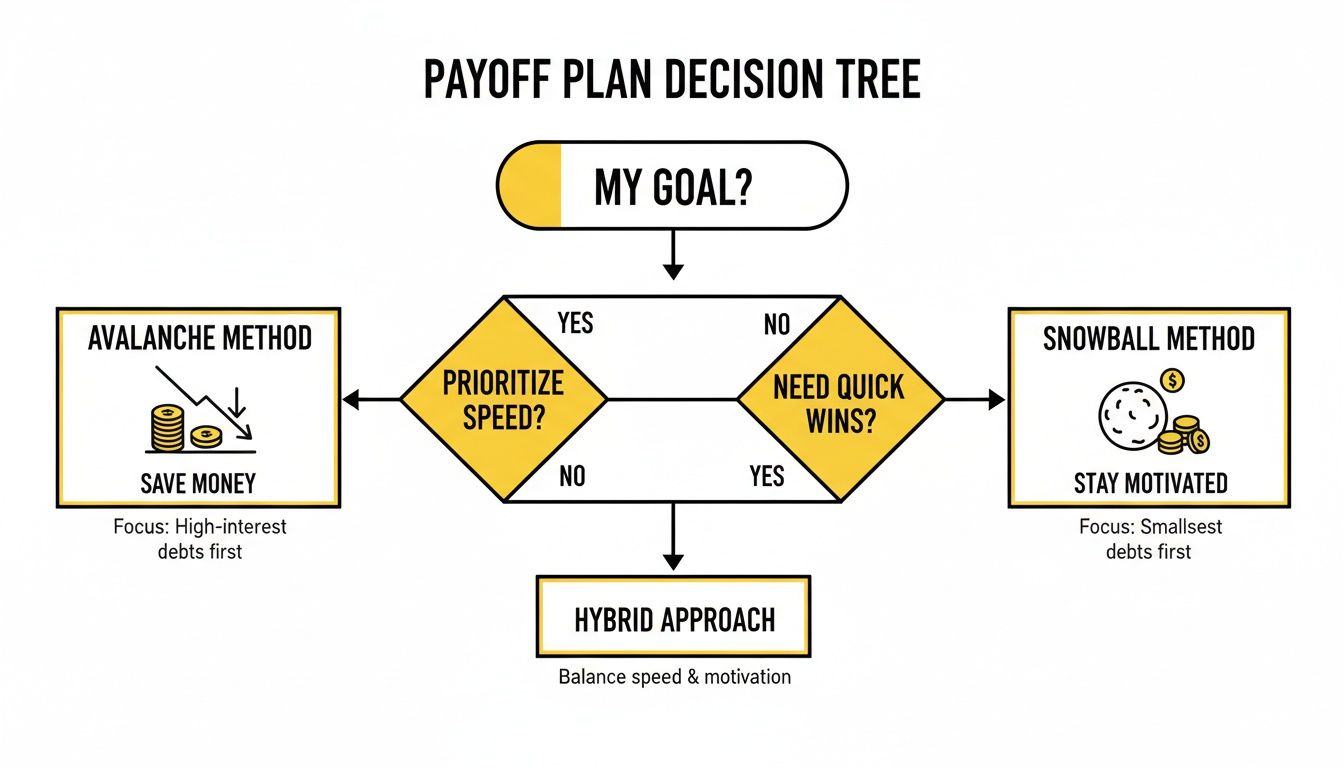

Choosing Your Payoff Path

At the end of the day, the best strategy is the one you’ll actually follow. One approach is a pure numbers game, focused on saving money. The other is all about building momentum through small victories. This decision tree lays out the core difference to help you see which path aligns with your main goal.

As the graphic shows, it really boils down to what drives you. If your absolute priority is to pay the least amount of interest possible, the Avalanche method is your clear winner. But if you know you need those early wins to stay motivated, the Snowball method was practically designed for you.

To help you get a clearer picture, I've put together a quick side-by-side comparison. It breaks down the key differences between these two popular credit card debt payoff strategies.

Quick Look Debt Snowball vs Debt Avalanche

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Primary Focus | Behavioral and Motivational | Mathematical and Cost-Saving |

| Attack Order | Pay off smallest balances first | Pay off highest interest rates first |

| Key Advantage | Quick psychological wins create momentum | Saves the most money on interest over time |

| Best For | Individuals who need to see fast progress to stay motivated | Disciplined individuals focused on efficiency and long-term savings |

| Potential Drawback | May cost more in total interest paid | Can feel slow at the start, potentially leading to discouragement |

Seeing them laid out like this really highlights that there's no single "right" answer. The best choice depends entirely on your personality and what will keep you committed for the long haul on your journey to becoming debt-free.

How The Debt Avalanche Method Saves You The Most Money

If your main goal is to pay as little interest as possible, the debt avalanche is your best bet. Forget the quick psychological wins for a moment—this strategy is all about the math. It’s designed to be the most efficient and cost-effective way to get out of debt, period.

The idea is simple but powerful. You line up all your debts not by balance, but by their interest rate (APR), from highest to lowest. You'll keep making the minimum payments on everything to stay current, but every extra cent you can squeeze from your budget gets thrown at the debt with the highest APR.

Once that expensive debt is gone, you don't just stop. You take its entire payment—the minimum plus all the extra you were paying—and roll it into the payment for the card with the next-highest rate. This is the "avalanche" effect, and it's what makes this method so incredibly effective.

The Math Behind The Savings

To really get why this works so well, think of a credit card with a 25% APR as a bucket with a giant hole in it. A huge chunk of your monthly payment is just covering the interest that dripped out that month, not actually lowering the principal inside the bucket. By targeting that high-interest "leak" first, you plug the biggest hole and make sure every dollar you pay goes toward emptying the bucket for good.

This isn't just theory; it’s a critical strategy in today's economy. With total revolving debt in the U.S. hitting over $1.18 trillion in late 2024 and average credit card rates climbing, interest charges are spiraling out of control for millions.

Studies have shown that using the avalanche method can slash the total interest you pay by double-digit percentages compared to just spreading extra cash around. That can mean getting out of debt months, or even years, sooner. You can dig deeper into the numbers with these full credit card statistics on sellerscommerce.com.

A Real-Life Avalanche Scenario

Let's see how this plays out with a real-world example. Say you have two cards and you've found an extra $200 a month to put towards debt.

| Card | Balance | APR | Minimum Payment |

|---|---|---|---|

| Store Card | $6,000 | 25% | $150 |

| Bank Visa | $3,000 | 15% | $75 |

Following the avalanche method, your first move is clear. You’d make the regular $75 minimum payment on the Bank Visa. But for the Store Card, you’d combine its $150 minimum with your extra $200, hitting it with a powerful $350 payment each month.

Once that $6,000 Store Card is paid off, the magic happens. You take that entire $350 and avalanche it over to the Bank Visa. Your new payment on the Visa is now a massive $425 a month ($350 from the old payment + its original $75 minimum). That remaining $3,000 will disappear in no time.

Key Takeaway: By focusing your firepower on the 25% APR card first, you save hundreds, potentially thousands, of dollars in interest that would have otherwise accumulated. This approach ensures your money is always fighting the most expensive debt first.

Is The Avalanche Right For You?

This method is built for people who are driven by logic and long-term results. If seeing the total interest savings on a spreadsheet gets you fired up, the avalanche is your perfect match. It does take discipline, though. That first big, high-interest debt might take a while to knock out, and you won't get the morale boost of quick, small wins.

But the financial payoff is huge. Mastering this plan is one of the most powerful debt elimination tactics for faster financial freedom. If you can stick with it, the debt avalanche will get you to the finish line with more money in your pocket than any other strategy.

Why the Debt Snowball Method Keeps You Motivated

On paper, the debt avalanche method looks like the clear winner. But in the real world? The debt snowball method often takes the crown. This strategy isn't about fancy math or optimizing interest rates; it’s built on something much more fundamental: human psychology.

If you've ever stared at a mountain of bills and felt so overwhelmed you just wanted to give up, the snowball method was made for you.

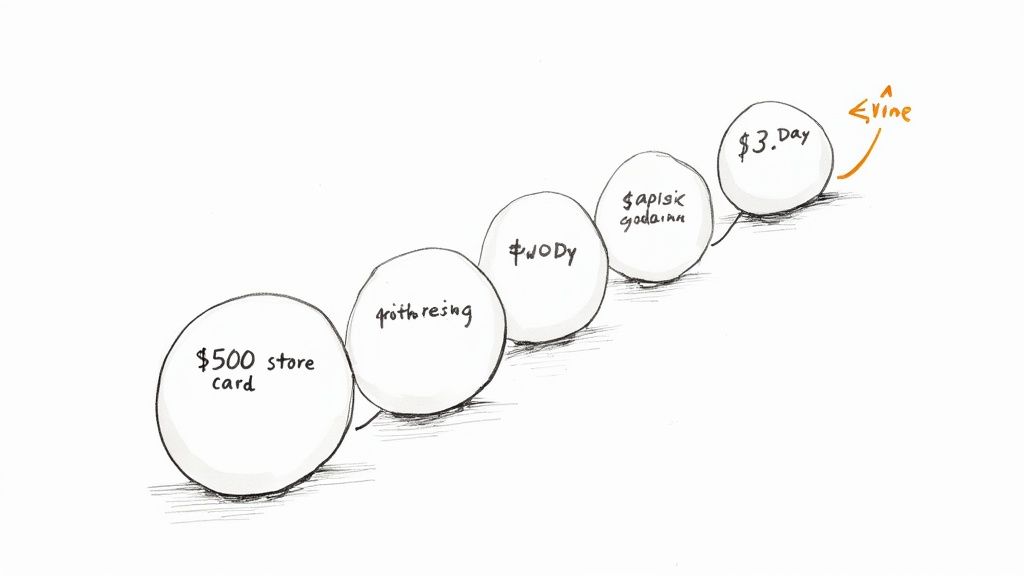

The whole idea is to build momentum. You start by listing all your debts from the smallest balance to the largest, completely ignoring the interest rates for now. You'll make the minimum payments on everything, but then you throw every extra penny you have at that one, smallest debt.

Once it's gone—poof!—you get a huge psychological win. That feeling of progress, plus the cash you just freed up, rolls right into attacking the next-smallest debt. This creates a "snowball" of payment power that gets bigger and bigger as you go.

The Power of a Quick Win

Think about it. Imagine you’re feeling completely buried by debt. You have a few big credit card balances looming over you, plus a small, nagging $500 store card. With the snowball approach, that $500 card is your only focus. You might be able to wipe it out in just a couple of months.

That victory is real. You actually get to see one less bill in the mail. You can close an account and physically cross a debt off your list. For so many people, that one small win is the fuel they need to stay in the fight for the long haul.

Snowball Method in Action: A Real-Life Example

Let's use the same numbers from our avalanche example, but this time, we'll apply the snowball strategy. Remember, you've found an extra $200 a month to throw at your debt.

| Card | Balance | APR | Minimum Payment |

|---|---|---|---|

| Bank Visa | $3,000 | 15% | $75 |

| Store Card | $6,000 | 25% | $150 |

Using the snowball method, the order gets flipped. The Bank Visa has the smallest balance, so it becomes your first target, even though it has a lower interest rate.

- Target the Smallest Debt: First, you make the required $150 minimum payment on the Store Card. Then, you take the Bank Visa's $75 minimum, add your extra $200, and send a powerful $275 payment to that card every month.

- Roll It Over: Once the $3,000 Visa is paid off, you've suddenly freed up that $275. Now you "snowball" that entire amount over to the next target: the Store Card.

- Build the Snowball: Your payment on the Store Card becomes a massive $425 a month (the $275 from the paid-off Visa plus the original $150 minimum). That kind of accelerated payment will make the remaining $6,000 balance disappear far faster than you ever thought possible.

Key Insight: Sure, you might pay a little more in total interest compared to the avalanche method. But the motivation you get from wiping out that first debt quickly can be the difference between sticking with your plan and giving up after a few months.

Comparing the Two Payoff Journeys

So, which way is better? Honestly, it comes down to what makes you tick. What's going to keep you going when things get tough? This table breaks down the experience of each method.

| Aspect | Debt Snowball Experience | Debt Avalanche Experience |

|---|---|---|

| Initial Feeling | Hopeful and empowered with a quick, achievable goal. | A bit daunting, as you face the biggest, highest-interest balance first. |

| How You Measure Progress | Celebrating the number of accounts you've paid off. | Tracking the total interest you've saved over time. |

| Source of Motivation | Frequent, small victories that build your confidence. | The long-term financial win of saving money. |

| Behavioral Impact | Fantastic for building and maintaining positive habits. | Requires strong discipline, especially during the slow start. |

At the end of the day, choosing a credit card debt payoff strategy is a personal decision. If you're a numbers person who gets fired up by pure efficiency, the avalanche is your best bet. But if you need to see real, tangible progress to stay in the game, the debt snowball is an incredibly powerful tool.

Want to learn more? You can dive deeper into how to crush your debt fast with the Debt Snowball method.

Once you’ve picked a payoff strategy like the Avalanche or Snowball method, it’s time to look for ways to put it on the fast track. Think of the next two tools as your secret weapons for getting ahead of high-interest debt. They work by fundamentally changing the math in your favor.

The most powerful options here are balance transfer credit cards and debt consolidation loans. Both are designed to do one thing exceptionally well: slash your interest rate. When you're not forking over a huge chunk of your payment to interest every month, you can start making real progress on the actual debt.

Hitting Pause on Interest with a 0% APR Balance Transfer

A balance transfer card is probably the closest you’ll get to hitting a pause button on interest. These cards offer a special introductory window—usually somewhere between 12 to 21 months—where you pay 0% APR on any balances you move over from other high-interest cards.

This gives you a golden opportunity to throw every spare dollar at the principal without interest piling up behind you. It’s a powerful move, but it comes with a couple of critical catches you have to watch out for.

- The Transfer Fee: Almost every card charges a one-time fee, typically 3% to 5% of the amount you transfer. So, if you move $8,000, a 3% fee adds $240 to your new balance right away.

- The Promotional Cliff: That 0% rate isn't forever. When the promotional period ends, the APR on any leftover balance will jump to the card's standard rate, which can be brutally high.

Streamlining Your Debt with a Consolidation Loan

Another excellent route is using a personal loan to consolidate your debt. Here, you take out a single new loan with a fixed interest rate and a defined repayment schedule, like three or five years. You use that money to wipe out all your credit card balances in one go.

Suddenly, you've gone from juggling multiple credit card payments to managing just one predictable monthly bill. The real win, though, is the interest rate. If you have decent credit, personal loan rates are almost always much lower than what credit cards charge.

With average credit card APRs often north of 20%, the savings can be massive. According to an Equifax report on global credit trends, high-interest consumer debt remains a significant burden. Swapping a 24% APR for a 10% personal loan can easily save you 10–20 percentage points in interest.

Let’s run the numbers: consolidating $8,000 of 24% APR card debt into a 10% loan could cut your annual interest cost from roughly $1,920 down to $800. That’s over $1,100 back in your pocket in the first year alone.

Real-World Scenario: Balance Transfer vs. Personal Loan

So, which one is right for you? Let's say you're sitting on $8,000 in credit card debt at a painful 24% APR. Your credit is solid, so you qualify for good offers.

You could get a 0% APR balance transfer card for 18 months (with a 3% fee) or a 3-year personal loan at 10% APR. Let's break it down.

| Feature | 0% APR Balance Transfer Card | 10% APR Personal Loan |

|---|---|---|

| Upfront Cost | $240 (3% transfer fee) | $0 |

| Initial Interest Rate | 0% for 18 months | 10% fixed |

| Monthly Payment to Pay Off | $458/month (to clear $8,240 in 18 months) | $258/month (over 36 months) |

| Total Paid (if successful) | $8,240 | $9,295 |

| Best For | Someone with enough cash flow to be aggressive and pay it all off before the 0% period ends. | Someone who needs a lower, more predictable monthly payment and a clear end date. |

The Verdict: If you have the discipline and the budget to handle the higher payments, the balance transfer card is the cheaper option. But if your cash flow is tight, the personal loan provides breathing room and a guaranteed finish line, even if it costs a bit more over the long haul. Your choice really hinges on your personal financial reality.

Ultimately, these tools are just accelerators; they aren’t a complete solution. You still need a solid budget and a firm commitment to stop adding new debt. When you combine the right strategy with the right tool, you create a powerful engine for becoming debt-free.

To figure out the best combination for your specific numbers, check out our wealth plan builder.

How To Build A Sustainable Payoff Plan

Picking a method like the Debt Avalanche or Snowball is a great start, but it's just one piece of the puzzle. The real secret to getting out of credit card debt for good is building a plan you can actually live with month after month. This is where you move from just having a strategy to taking consistent action that gets results.

It all begins with an honest look at your money. A budget isn't a financial straitjacket; it’s a tool for clarity and control. When you track what's coming in and where it's going, you'll almost always find extra cash you can throw at your debt.

Start With A Starter Emergency Fund

Before you go all-out on extra debt payments, your first mission is to build a small financial cushion. Your goal is to get $500 to $1,000 tucked away in a separate savings account. Think of this as your "life happens" fund.

So, why is this step so critical? Without it, a single unexpected expense—a flat tire, a vet bill, a dead water heater—will send you right back to your credit cards. That not only undoes your progress but can completely crush your motivation.

A small emergency fund is the firewall between you and new debt. It protects your payoff plan from the inevitable bumps in the road, ensuring one setback doesn’t derail your entire journey.

This little fund buys you priceless peace of mind and keeps your momentum rolling forward. Once it’s in place, you can attack your debt with confidence.

Find More Money To Accelerate Progress

With your budget mapped out and a starter emergency fund in the bank, it’s time to find more money to send to your creditors each month. Even small bumps in your payment can shave months, or even years, off your debt-free date. The two proven ways to do this are cutting your spending and boosting your income.

Ways to Increase Your Payoff Power:

- Negotiate a Raise: Have you been killing it at work? Build a solid case based on your achievements and what the market is paying for your skills. A permanent bump in your salary is the single most effective way to supercharge your debt payoff.

- Find a Flexible Side Hustle: The gig economy is full of options. You could drive for a rideshare service, deliver meals, or offer freelance services online. Even something as simple as dog walking in your neighborhood can bring in a few hundred extra dollars a month.

- Sell Unused Items: Take a tour of your own home. That old tablet, the clothes you never wear, or the extra furniture in the garage can be turned into quick cash. Use that money to make a satisfying lump-sum payment on your highest-priority card.

While some people consider more drastic moves, it's crucial to weigh your options carefully. If you're wondering about using other assets, our guide on whether you should sell stocks to pay off debt breaks down the pros and cons.

Track Your Progress And Stay Motivated

Nothing fuels motivation like seeing tangible progress. A simple spreadsheet or a budgeting app can turn your debt-free journey into a game you’re winning, keeping you engaged and focused.

A Simple Tracking System:

- List Your Debts: Make a simple chart with columns for the creditor name, current balance, interest rate (APR), and minimum payment.

- Update Monthly: Once a month, log in to your accounts and update the current balance for each debt. Watching those numbers go down is a huge boost.

- Celebrate Milestones: Set small, achievable goals. Maybe it's paying off that first small card or knocking 10% off your total debt. When you hit a goal, reward yourself with something that doesn’t involve spending much, like a movie night at home or cooking your favorite meal.

This isn't just about tracking numbers. It's about building the discipline and financial habits that will keep you out of debt for life. By creating a plan that is both practical and inspiring, you’re setting yourself up not just to clear your balances, but to build a much healthier financial future.

Got Questions About Paying Off Credit Cards? We've Got Answers.

Starting your debt-free journey can feel overwhelming, and it's natural to have a ton of questions pop up. Let's tackle some of the most common ones I hear from people who are ready to get serious about their credit card balances.

1. Which debt payoff strategy is mathematically the best?

The Debt Avalanche method is mathematically superior. By prioritizing debts with the highest interest rates (APRs), you minimize the total amount of interest you pay over the life of the loans. This approach ensures you become debt-free at the lowest possible cost, though it may not provide the same early motivational wins as the Debt Snowball.

2. Is it better to pay off one credit card at a time or spread extra payments across all of them?

It is almost always better to focus your extra payments on one card at a time. Spreading small extra amounts across multiple cards dilutes your impact. By targeting a single card (either the one with the highest interest rate or the smallest balance), you eliminate it much faster, which then frees up its minimum payment to "snowball" or "avalanche" onto the next debt, accelerating your overall progress.

3. Will paying off my credit cards hurt my credit score?

In the long run, paying off credit card debt significantly helps your credit score. Initially, you might see a small, temporary dip if you close an old account. However, the most significant factor here is your credit utilization ratio (the amount of debt you have compared to your total credit limit). Lowering this ratio by paying down balances demonstrates responsible credit management and is highly favorable for your score.

4. Should I close my credit cards after I pay them off?

Generally, it's better to keep the accounts open, especially older ones. Closing an account reduces your total available credit, which can increase your credit utilization ratio if you have balances on other cards. It also shortens the average age of your credit history. The best practice is to keep the card open with a zero balance and perhaps use it for a small, planned purchase every few months (and pay it off immediately) to keep it active.

5. What if I can't afford to make more than the minimum payments?

If you can only afford minimum payments, the first priority is to stop adding new debt. From there, meticulously review your budget to find any extra cash, even $20 or $30, to put toward your target debt. If you are truly unable to pay more and are falling behind, consider contacting a non-profit credit counseling agency. They can help you negotiate with creditors and create a manageable debt management plan.

6. Are balance transfer cards a good idea?

They can be an excellent tool, but only if used strategically. A 0% APR balance transfer card allows you to make progress on the principal without interest working against you. However, you must be disciplined enough to pay off the entire balance (or as much as possible) before the promotional period ends. Be mindful of the transfer fee (typically 3-5%) and the high interest rate that will apply to any remaining balance once the intro period is over.

7. What's the difference between debt consolidation and a debt management plan (DMP)?

A debt consolidation loan is a new loan you take out to pay off multiple existing debts, leaving you with one single monthly payment, hopefully at a lower interest rate. A Debt Management Plan (DMP) is typically arranged through a credit counseling agency. They negotiate with your creditors on your behalf to lower interest rates and create a structured payment plan. With a DMP, you pay the agency, and they distribute the funds to your creditors. DMPs often require you to close the enrolled credit card accounts.

8. Should I use my savings or retirement funds to pay off credit card debt?

This is rarely advisable. Your emergency savings fund is your buffer against unexpected expenses that could otherwise force you back into debt. Tapping into retirement funds like a 401(k) should be a last resort. You not only face taxes and penalties but also lose out on the powerful long-term growth from compound interest. The exception might be for extremely high-interest debt, but even then, it should be weighed carefully against the long-term financial consequences.

9. How can I stay motivated during a long debt payoff journey?

Motivation is key. Track your progress visually with a chart or spreadsheet to see how far you've come. Celebrate small milestones, like paying off one card or reaching a certain percentage of your goal. Remind yourself of your "why"—the reason you want to be debt-free, whether it's for financial security, less stress, or the ability to pursue other goals.

10. Can I negotiate my credit card interest rate or debt amount?

Yes, it's often possible. You can call your credit card issuer and ask for a lower interest rate, especially if you have a good payment history. If you are significantly behind on payments, you may be able to negotiate a settlement for less than the full amount owed, either on your own or with the help of a debt settlement company. However, be aware that debt settlement can have a significant negative impact on your credit score.

Ready to take the next step in your financial journey? The Top Wealth Guide provides exclusive insights and proven tactics to help you build and manage your wealth effectively. Explore our resources today!

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.