Earning money while you sleep, travel, or focus on your primary career is no longer a distant dream. Thanks to a new wave of financial technology, generating passive income is more accessible than ever before. The challenge isn't a lack of options, but rather navigating the crowded marketplace to find the right tools for your specific financial goals, risk tolerance, and starting capital. Many platforms promise effortless returns, but their true value lies in the details-fees, investment minimums, diversification options, and user experience can vary dramatically.

This comprehensive guide is designed to cut through the noise. We've meticulously analyzed the best passive income apps available today, moving beyond marketing claims to provide an in-depth, practical review of each one. Whether you're a complete beginner looking to start with micro-investing, an experienced investor seeking alternative assets like real estate or art, or simply someone who wants to earn cash back on everyday purchases with minimal effort, this resource will help you make an informed decision.

Inside, you will find a detailed breakdown of each application, covering:

- Key Features & Investment Focus: What makes the app unique and what kind of assets you can invest in.

- Potential Returns & Associated Fees: A realistic look at earning potential alongside a transparent breakdown of costs.

- Pros & Cons: An honest assessment of strengths and weaknesses based on real-world usage.

- Who It's Best For: Clear guidance on which type of user will benefit most from each platform.

Each review includes screenshots to guide you and direct links to get started immediately. Our goal is to equip you with the detailed information needed to select the ideal app to begin building your passive income streams today.

In This Guide

- 1 1. Apple App Store (iOS)

- 2 2. Google Play Store (Android/ChromeOS)

- 3 3. Acorns

- 4 4. Betterment

- 5 5. Wealthfront

- 6 6. M1 Finance

- 7 7. Fundrise

- 8 8. RealtyMogul

- 9 9. GROUND FLOOR

- 10 10. Yieldstreet

- 11 11. Rakuten (Cash Back + Browser/Mobile Extensions)

- 12 12. Ibotta (Cash Back + Browser/Safari Extension)

- 13 Passive Income Apps: Feature & Platform Comparison

- 14 Final Thoughts

- 15 Frequently Asked Questions (FAQ)

- 15.1 1. What exactly is a passive income app?

- 15.2 2. Can I really make significant money with these apps?

- 15.3 3. Are these passive income apps safe?

- 15.4 4. How much money do I need to start?

- 15.5 5. What's the difference between a robo-advisor and a micro-investing app?

- 15.6 6. Do I have to pay taxes on income from these apps?

- 15.7 7. Can I lose money with these apps?

- 15.8 8. Which app is best for a complete beginner?

- 15.9 9. What is the most "passive" option?

- 15.10 10. Can I use multiple passive income apps at once?

1. Apple App Store (iOS)

While not a passive income app itself, the Apple App Store is the essential starting point and primary gateway for any iPhone or iPad user seeking to build a passive income portfolio. It functions as a highly curated and secure marketplace, hosting a vast ecosystem of the best passive income apps ranging from robo-advisors and micro-investing platforms to real estate crowdfunding and high-yield savings account managers. Its stringent review process provides a crucial layer of security and trust, filtering out malicious or fraudulent applications before they reach your device.

The platform excels in user experience, offering a clean interface with editorial collections, user ratings, and detailed app pages that help you vet potential tools. This curation is a key differentiator; features like "App of the Day" often highlight innovative finance apps, helping users discover quality options they might otherwise miss. The centralized management of subscriptions and updates simplifies portfolio maintenance, ensuring all your financial tools are secure and up-to-date from a single dashboard.

Key Features & User Experience

- Curated Discovery: Find vetted finance apps through editorial collections, robust search, and chart rankings.

- App Transparency: Product pages provide user reviews, ratings, update history, and clear privacy labels, helping you make informed decisions.

- Integrated Security: Leverages Apple's security infrastructure, including Face ID/Touch ID for purchases and strict developer guidelines.

- Centralized Management: Easily track and cancel subscriptions directly from your Apple ID settings, preventing unwanted recurring charges.

Platform Comparison

| Feature | Apple App Store | Google Play Store |

|---|---|---|

| Vetting Process | Highly stringent; manual review | More automated; less strict |

| Security | Walled-garden ecosystem, low malware risk | Open platform, higher malware risk |

| Exclusivity | Some high-quality finance apps launch on iOS first | Broader app availability, including beta versions |

| Privacy | Mandatory App Tracking Transparency (ATT) | More developer-controlled data access |

Pros & Cons

Pros:

- High Trust & Security: Rigorous app screening process significantly reduces the risk of malware.

- Emphasis on Privacy: App Tracking Transparency gives users control over their data.

- Seamless Ecosystem: Centralized management for subscriptions and app updates simplifies use.

Cons:

- Platform Lock-in: Exclusively available for Apple devices (iPhone, iPad).

- Variable App Quality: While vetted for security, the quality and utility of finance apps can still vary widely.

Link: Apple App Store

2. Google Play Store (Android/ChromeOS)

As the official app marketplace for the world's most popular mobile operating system, the Google Play Store is the primary hub for Android users to discover the best passive income apps. Its open platform boasts an enormous catalog of financial tools, including everything from high-yield savings managers and robo-advisors to cash-back extensions and dividend trackers. This broad selection ensures that users have access to a wide array of options, including niche and early-stage apps that may not be available elsewhere.

The platform’s strength lies in its accessibility and massive user base, which fosters a competitive environment for app developers. While its vetting process is less stringent than Apple's, Google Play Protect provides a baseline of security by actively scanning for malicious behavior. The user experience is straightforward, with curated collections, user reviews, and download counts helping you gauge an app's popularity and trustworthiness before installing. Its integration with your Google Account simplifies payments and subscription management across all your Android devices.

Key Features & User Experience

- Massive App Catalog: Unrivaled selection of apps across investing, savings, and other passive income categories.

- Curated Discovery: Features "Editor's Picks" and algorithm-driven recommendations to help surface quality applications.

- Integrated Security: Google Play Protect automatically scans apps for malware and security threats before and after installation.

- Flexible Payments: Supports various payment methods, including credit/debit cards, PayPal, carrier billing, and Google Play gift cards.

Platform Comparison

| Feature | Google Play Store | Apple App Store |

|---|---|---|

| Vetting Process | More automated; less strict | Highly stringent; manual review |

| Security | Open platform, higher malware risk | Walled-garden ecosystem, low malware risk |

| App Availability | Wider variety, including beta and early access | Some high-quality finance apps launch on iOS first |

| Device Support | Vast range of Android phones, tablets, and ChromeOS | Exclusively Apple devices |

Pros & Cons

Pros:

- Broad Device Availability: Accessible on a massive ecosystem of Android and ChromeOS devices.

- Vast App Selection: Offers a greater number of finance and passive income apps, including experimental ones.

- User-Driven Curation: Rely on download counts and millions of user reviews to vet apps.

Cons:

- Variable App Quality: The less stringent review process means users must carefully research app developers.

- Fragmented Experience: App updates and feature availability can differ based on your device and region.

Link: Google Play Store

3. Acorns

Acorns transforms the concept of passive income by integrating micro-investing directly into your daily spending habits. It is one of the best passive income apps for beginners because it automates the entire process through its "Round-Ups" feature, which invests the spare change from your everyday purchases. This "set-and-forget" model allows users to build a diversified portfolio of ETFs (exchange-traded funds) with minimal effort or financial knowledge, making it an ideal entry point into the world of investing.

Real-Life Example: Sarah, a recent college graduate, wanted to start investing but felt overwhelmed. She installed Acorns and linked her debit card. Her morning coffee purchase of $4.25 automatically rounded up to $5.00, investing the extra $0.75. Over a month, these small, unnoticeable investments added up to over $40 in her portfolio, kickstarting her investment journey without changing her spending habits.

The platform's strength lies in its frictionless user experience, bundling investment, retirement, and even checking accounts into a single, cohesive app. Acorns automatically rebalances your portfolio and reinvests dividends, ensuring your money is always working for you. Beyond spare change, users can set up recurring daily, weekly, or monthly deposits and earn bonus investments through the Acorns Earn program by shopping with partner brands.

Key Features & User Experience

- Automated Round-Ups: Links to your debit/credit cards and automatically invests the spare change from each transaction.

- Diversified ETF Portfolios: Offers pre-built portfolios ranging from conservative to aggressive, designed by financial experts.

- Integrated Financial Suite: Combines an investment account (Acorns Invest), a retirement account (Acorns Later), and a checking account (Acorns Checking) into one subscription.

- Acorns Earn: A built-in rewards program and browser extension that provides cash-back from partner merchants, which is then automatically invested.

Platform Comparison

| Feature | Acorns | Stash |

|---|---|---|

| Investing Philosophy | Fully automated, passive investing | Guided DIY stock & ETF investing |

| Primary Mechanism | Spare change "Round-Ups" & recurring deposits | Subscription-based stock & ETF purchases |

| Portfolio Control | Limited; based on risk tolerance profile | High; users pick individual stocks/ETFs |

| Target Audience | Beginners seeking a hands-off approach | Novice investors who want some control |

Pros & Cons

Pros:

- Extremely Beginner-Friendly: Automates investing, removing the intimidation factor of starting.

- Promotes Consistent Saving Habits: The Round-Ups feature builds an investment habit effortlessly.

- All-in-One Financial Hub: Consolidates investing, retirement, and banking for simplified management.

Cons:

- Fees Can Be High for Small Balances: The flat monthly subscription fee ($3-$9/month) can represent a high percentage of small account balances.

- Limited Investment Customization: Portfolios are pre-determined, offering little control for experienced investors.

Link: Acorns

4. Betterment

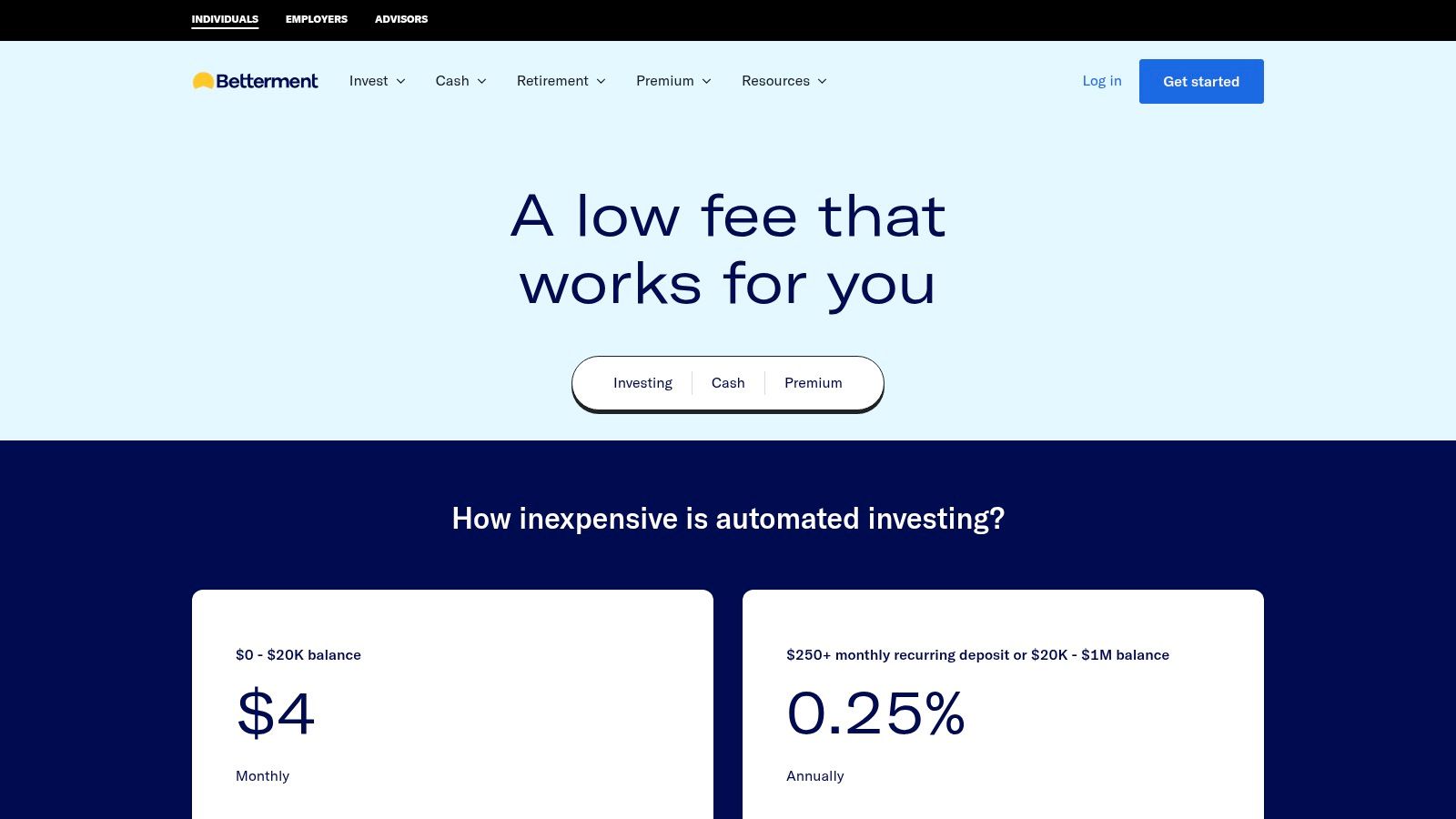

Betterment stands as a pioneer in the robo-advisor space, making it one of the best passive income apps for those who want a truly hands-off investment experience. It automates the complex aspects of building and managing a diversified portfolio, using sophisticated algorithms to select low-cost exchange-traded funds (ETFs) based on your risk tolerance and financial goals. The platform is designed for long-term, set-it-and-forget-it wealth building, taking the guesswork and emotional decision-making out of investing.

Real-Life Example: David and Maria are saving for a down payment on a house in five years. They opened a joint account with Betterment, set their goal, and established a recurring monthly deposit of $500. Betterment automatically invests their money into a moderately conservative portfolio. It also uses tax-loss harvesting to optimize their returns, helping them reach their goal faster without having to manually manage a single trade.

What sets Betterment apart is its combination of powerful automation and user-centric financial planning tools. Features like automatic rebalancing ensure your asset allocation stays on track, while tax-loss harvesting strategically sells losing investments to offset gains, potentially lowering your tax bill. This level of optimization, once reserved for high-net-worth individuals, is now accessible through its intuitive mobile app and desktop interface, making passive income generation both simple and efficient.

Key Features & User Experience

- Automated Portfolio Management: Automatically rebalances your portfolio and performs tax-loss harvesting to optimize returns.

- Goal-Based Planning: Set specific financial goals (e.g., retirement, major purchase) and receive a tailored investment plan.

- Cash Reserve Account: Offers a high-yield cash account with a variable APY and no fees on the cash balance itself, providing a low-risk place for savings.

- Fractional Shares: Invest with any amount of money, as the platform allows for the purchase of partial ETF shares.

Platform Comparison

| Feature | Betterment (Robo-Advisor) | Self-Directed Brokerage |

|---|---|---|

| Management Style | Automated, hands-off investing | Manual, self-directed trading |

| Key Service | Portfolio management & rebalancing | Trade execution & market access |

| Best For | Passive investors seeking simplicity | Active traders wanting full control |

| Fee Structure | Annual advisory fee (0.25%+) | Commission-free stock/ETF trades |

Pros & Cons

Pros:

- Hands-off Investment Management: Ideal for beginners or those who prefer not to manage their own investments.

- Strong Financial Planning Tools: Helps users create and track progress toward long-term financial goals.

- Transparent and Straightforward Pricing: A clear, percentage-based advisory fee with no hidden charges.

Cons:

- Advisory Fees: The annual management fee is charged in addition to the underlying ETF expense ratios.

- Less Direct Control: Investors cannot choose individual stocks or ETFs within their automated portfolio.

Link: Betterment

5. Wealthfront

Wealthfront stands out as a premier automated investing service, or robo-advisor, that makes generating passive income accessible through sophisticated, algorithm-driven portfolio management. It constructs a globally diversified portfolio of low-cost index funds tailored to your risk tolerance and financial goals, automating complex tasks like rebalancing and tax-loss harvesting. This hands-off approach makes it one of the best passive income apps for investors who want their money to grow without active day-to-day management.

Real-Life Example: After receiving a year-end bonus, tech professional Lena wanted her money to work for her without adding another task to her busy schedule. She deposited $25,000 into a Wealthfront automated investing account. The platform's algorithm built a diversified portfolio suited to her long-term growth goals. Six months later, during a market dip, Wealthfront's tax-loss harvesting feature automatically sold some positions at a loss to offset gains elsewhere, maximizing her after-tax returns without her needing to lift a finger.

The platform’s dual-threat capability is a key differentiator. Beyond its core automated investing, the high-yield Wealthfront Cash Account offers a competitive APY, allowing your idle cash to earn significant interest while remaining liquid. This synergy lets you optimize every dollar, whether it is invested for long-term growth or held for short-term needs. For those ready to build an automated financial engine, you can learn more about how to invest wisely with platforms like Wealthfront.

Key Features & User Experience

- Automated Investing: Utilizes Modern Portfolio Theory to build and manage a diversified portfolio, complete with automatic rebalancing.

- Advanced Tax Optimization: Offers industry-leading tax-loss harvesting, which can potentially add significant value to your returns over time.

- High-Yield Cash Account: A fee-free, FDIC-insured cash account that provides a high annual percentage yield (APY) on uninvested funds.

- Goal-Based Planning: Free financial planning tools help you visualize and work toward goals like retirement, homeownership, or college savings.

Platform Comparison

| Feature | Wealthfront | Betterment |

|---|---|---|

| Advisory Fee | 0.25% annually | 0.25% – 0.40% annually |

| Account Minimum | $500 to invest | $0 to start |

| Tax Strategy | Advanced tax-loss harvesting on all accounts | Tax-loss harvesting available; strategy varies |

| Cash Account | High-yield account, FDIC insured up to $8M | High-yield account, FDIC insured up to $2M |

Pros & Cons

Pros:

- Superior Tax Optimization: Its daily tax-loss harvesting is a powerful feature for maximizing after-tax returns.

- Competitive Cash APY: The high-yield cash account is an excellent, low-risk way to earn passive income.

- Low Management Fee: The flat 0.25% advisory fee is competitive and transparent.

Cons:

- $500 Minimum to Invest: Requires a small initial investment to access the robo-advisor features.

- Limited Customization: Investors cannot choose individual stocks or ETFs within the automated portfolio.

Link: Wealthfront

6. M1 Finance

M1 Finance offers a unique hybrid approach, blending the control of self-directed investing with the convenience of automated management. This platform is ideal for building a truly passive income portfolio by allowing users to create custom "Pies" composed of stocks and ETFs. Once your Pie is designed, you can set up recurring deposits, and M1 automatically invests the new funds across your holdings to maintain your target allocation, making it one of the best passive income apps for set-it-and-forget-it compounding.

Real-Life Example: Mark is an experienced investor who wants to build a dividend-focused portfolio. He creates an "Income Pie" on M1 Finance, allocating 25% to a high-dividend ETF, 15% to a REIT ETF, and the remaining 60% across six individual dividend-paying blue-chip stocks. He sets up a $200 weekly auto-deposit. Each week, M1 automatically buys the most underweight "slices" of his Pie, ensuring his portfolio stays balanced without manual calculations. All dividends are automatically reinvested, accelerating his passive income stream.

The platform’s strength lies in this Pie-based system, which visually simplifies portfolio construction and automates complex tasks like rebalancing and dividend reinvestment. For instance, you could create a "Dividend Income Pie" with 10 different high-yield stocks. Whenever dividends are paid or you deposit new cash, M1 intelligently reinvests it to bring underweight "slices" of your Pie back to your desired percentage. This disciplined, automated process is core to its passive income appeal and makes it a compelling option. Learn more in this guide covering the best investment apps for beginners.

Key Features & User Experience

- Customizable Pies: Build and automate portfolios with up to 100 individual stocks or ETFs per Pie.

- Dynamic Rebalancing: Automatically rebalances your portfolio with every new deposit, directing funds to underweight assets.

- Automated Investing: Set recurring deposit schedules for consistent, hands-off portfolio growth.

- Integrated Financial Hub: Combines investing, a high-yield savings account, and personal loans within a single, streamlined application.

Platform Comparison

| Feature | M1 Finance | Acorns |

|---|---|---|

| Automation Style | Pie-based, target allocation | Round-ups, recurring deposits |

| Investment Choice | Custom stocks and ETFs | Pre-built ETF portfolios |

| Control Level | High user control over assets | Low user control (hands-off) |

| Primary Goal | Long-term wealth building | Micro-investing, saving |

Pros & Cons

Pros:

- Powerful Automation: Sophisticated rebalancing and dividend reinvestment features.

- High Customization: Total freedom to choose the stocks and ETFs in your portfolio.

- Commission-Free Trading: No trading fees on standard investment accounts.

Cons:

- Platform Fee: A $3 monthly fee applies for accounts under $10,000 without an active M1 loan.

- Limited Trading Windows: Trades are executed during specific daily windows, not in real-time.

Link: M1 Finance

7. Fundrise

Fundrise democratizes real estate investing, making it one of the best passive income apps for those seeking property-backed returns without the complexities of direct ownership. It allows non-accredited investors to buy into a diversified portfolio of commercial and residential real estate through proprietary eREITs (electronic Real Estate Investment Trusts) and eFunds. The platform is engineered for a hands-off experience, managing property acquisition, development, and tenant relations on behalf of its investors.

Real-Life Example: Emily has always wanted to invest in real estate but doesn't have the six-figure down payment for a rental property. She opens a Fundrise account with their $10 Starter plan. Her small investment is automatically diversified across dozens of properties, including apartment buildings in growing sunbelt cities and industrial logistics centers. She enables the dividend reinvestment plan (DRIP), so her quarterly earnings are automatically used to buy more shares, creating a compounding effect over time.

The platform stands out by offering a low entry barrier, with a minimum investment of just $10 for its Starter plan, making it accessible to nearly everyone. Fundrise’s technology automatically diversifies your investment across dozens of real estate projects, mitigating single-property risk. The user-friendly dashboard provides transparent updates on project developments and quarterly dividend distributions, making it simple to track your portfolio's performance and watch your passive income grow.

Key Features & User Experience

- Low Minimum Investment: Start investing in a diversified real estate portfolio with as little as $10.

- Automated Diversification: Your investment is automatically spread across a mix of eREITs and eFunds, covering various property types and locations.

- Dividend Reinvestment Plan (DRIP): Automatically reinvest your quarterly dividends to accelerate compounding and long-term growth.

- Transparent Reporting: Receive regular project updates and clear performance reports directly through the app and investor dashboard.

Platform Comparison

| Feature | Fundrise | Publicly Traded REITs |

|---|---|---|

| Minimum Investment | As low as $10 | Price of one share (varies) |

| Liquidity | Limited; quarterly redemption windows | High; can be sold daily on stock market |

| Volatility | Lower; not tied to stock market swings | Higher; subject to market volatility |

| Diversification | Automatic across private real estate | Requires buying multiple REIT ETFs |

Pros & Cons

Pros:

- High Accessibility: Opens up private real estate investing to non-accredited investors.

- Set-it-and-Forget-it: A truly passive investment model managed by professionals.

- Potential for High Returns: Offers exposure to both appreciation and quarterly dividend income.

Cons:

- Limited Liquidity: Funds are intended for long-term holds and can be difficult to withdraw quickly.

- Layered Fees: Incurs both an annual advisory fee and fund-level management fees.

Link: Fundrise

8. RealtyMogul

RealtyMogul opens the door to institutional-quality real estate investing for a broader audience, making it one of the best passive income apps for those seeking tangible, income-generating assets. The platform specializes in curated commercial real estate deals, offering both non-traded Real Estate Investment Trusts (REITs) and, for accredited investors, direct private placements. This model allows users to invest in a portfolio of properties like apartment buildings and office complexes without the hands-on responsibilities of being a landlord.

Real-Life Example: Richard, a retired professional, wants a portion of his portfolio to generate consistent monthly income. He invests $25,000 into the RealtyMogul Income REIT. This single investment gives him fractional ownership in a diverse portfolio of commercial properties that are already leased and generating revenue. Each month, he receives a direct deposit distribution from the net rental income, creating a reliable passive income stream to supplement his retirement funds.

The platform distinguishes itself by providing two distinct REITs: the Income REIT, which targets consistent cash flow through monthly distributions, and the Apartment Growth REIT, focused on capital appreciation. This dual approach allows investors to align their strategy with either income or growth objectives. With extensive educational resources and a thorough vetting process for its properties, RealtyMogul provides a structured and supportive environment for building a passive real estate portfolio.

Key Features & User Experience

- Dual REIT Options: Choose between the Income REIT for monthly cash flow or the Apartment Growth REIT for long-term appreciation.

- Accredited Investor Access: Offers exclusive 1031-exchange eligible and private placement deals for those who qualify.

- Thorough Vetting: RealtyMogul conducts extensive due diligence on all properties and sponsors before listing them on the platform.

- Investor Education: A comprehensive Knowledge Center and regular webinars help users understand the nuances of real estate investing.

Platform Comparison

| Feature | RealtyMogul | Fundrise |

|---|---|---|

| Minimum Investment | $5,000 for REITs | Starts at $10 |

| Investor Type | Accredited & Non-Accredited | Primarily Non-Accredited |

| Asset Focus | Commercial & multi-family | Primarily residential & commercial |

| Liquidity | Limited; share repurchase program | Quarterly redemption program |

Pros & Cons

Pros:

- Access to Vetted Deals: Invest in institutional-grade commercial real estate that is typically hard to access.

- Potential for Regular Income: The Income REIT is structured to provide monthly cash distributions.

- Strong Educational Resources: Helps investors make more informed decisions about their portfolio.

Cons:

- High Minimum Investment: The $5,000 minimum for REITs is higher than many competitors.

- Highly Illiquid: Investments are long-term with limited options for early withdrawal.

Link: RealtyMogul

9. GROUND FLOOR

GROUND FLOOR carves out a unique niche in the real estate investing landscape by focusing on short-term, high-yield debt. Instead of buying equity in properties, users fund loans for real estate developers and "flippers," earning interest as the loans are repaid. This model offers a more direct and often quicker path to returns compared to traditional equity crowdfunding, making it one of the best passive income apps for those seeking fixed-income-style returns backed by tangible assets.

Real-Life Example: Seeking higher returns than a traditional savings account, Chloe decides to try real estate debt. She deposits $1,000 into GROUND FLOOR and uses the Auto-Investor tool. She sets her risk profile to 'balanced'. The platform automatically diversifies her $1,000 across 100 different short-term loans, investing just $10 in each. As loans are repaid with interest over the next 6-12 months, her account balance grows. She has the principal and interest automatically reinvested, creating a "flywheel" of compounding returns.

The platform stands out with its exceptionally low barrier to entry and powerful automation tools. While you can manually select individual loans to fund, GROUND FLOOR's Auto-Investor and Flywheel portfolios allow you to set your risk tolerance and automatically diversify your capital across dozens of projects. This "set it and forget it" approach, combined with the ability to automatically reinvest principal and interest payments, creates a powerful compounding effect with minimal active management.

Key Features & User Experience

- Automated Investing: Customize your portfolio with the Auto-Investor tool or use the fully managed Flywheel and Notes products.

- Low Minimums: Start building a diversified real estate debt portfolio with as little as $100 for Flywheel.

- Short-Term Durations: Most loans have terms of 6 to 18 months, providing faster capital turnover than traditional real estate investments.

- Reinvestment Options: Automatically reinvest principal and interest payments to compound your earnings passively over time.

Platform Comparison

| Feature | GROUND FLOOR | Fundrise |

|---|---|---|

| Asset Type | Real Estate Debt (Loans) | Real Estate Equity (eREITs) |

| Minimum Investment | $100 (Flywheel) / $1,000 (Notes) | $10 (Starter Portfolio) |

| Typical Term | 6-18 months | 5+ years |

| Income Source | Borrower Interest Payments | Rent Payments & Property Appreciation |

Pros & Cons

Pros:

- Low Entry Barrier: Extremely low minimums make real estate debt accessible to all investors.

- Passive Automation: Auto-invest and reinvestment features enable a true hands-off experience.

- Shorter Durations: Provides more liquidity and faster return of capital compared to equity investments.

Cons:

- Borrower Default Risk: Returns are not guaranteed, and there is a risk of losing principal if a borrower defaults.

- Limited Liquidity: Funds are tied up until the loan matures; there is no robust secondary market.

Link: GROUND FLOOR

10. Yieldstreet

Yieldstreet offers accredited investors a unique gateway to generate passive income from alternative asset classes typically reserved for institutional players. This platform moves beyond traditional stocks and bonds, providing access to curated investment opportunities in areas like private credit, real estate, art, and industrial assets. It is designed for investors seeking to diversify their portfolios and tap into income streams that are often uncorrelated with the public markets, making it one of the more sophisticated best passive income apps for high-net-worth individuals.

Real-Life Example: As an accredited investor, Dr. Evans wants to diversify away from the stock market. He invests $15,000 into a Yieldstreet private credit fund. This fund holds a portfolio of loans made to various businesses, secured by assets. Instead of being subject to daily market fluctuations, his investment is designed to generate a target annual yield paid out in quarterly distributions, providing a stable, non-correlated income stream.

The platform’s strength lies in its curation and structuring of complex deals into more accessible formats, such as individual offerings or diversified funds like the Alternative Income Fund. This approach allows users to build a portfolio of income-producing private market assets with the goal of receiving regular distributions. However, its high minimums and accreditation requirements position it as a tool for experienced investors comfortable with the higher risks and illiquidity associated with alternative investments.

Key Features & User Experience

- Alternative Asset Access: Invest directly in private credit, art finance, real estate, and other unique income-generating opportunities.

- Diversified Fund Options: Provides managed, multi-asset funds designed for broad exposure and passive income generation.

- Income-Focused Structure: Most offerings are structured to provide regular cash flow distributions to investors.

- Detailed Offering Memorandums: Each investment comes with comprehensive documentation outlining the strategy, risks, and fee structure.

Platform Comparison

| Feature | Yieldstreet | Fundrise |

|---|---|---|

| Investor Requirement | Mostly accredited investors | Open to all investors |

| Asset Classes | Private credit, art, real estate, etc. | Primarily commercial/residential real estate |

| Minimum Investment | Typically $10,000+ | As low as $10 |

| Liquidity | Highly illiquid; tied to deal term | Limited quarterly redemptions (with penalties) |

Pros & Cons

Pros:

- Access to Exclusive Assets: Unlocks private market investment opportunities not available to the general public.

- High Yield Potential: Designed to generate passive cash flow with target yields often higher than traditional fixed-income.

- Portfolio Diversification: Offers assets with low correlation to the public stock and bond markets.

Cons:

- High Minimums & Accreditation: Most deals require a $10,000+ investment and are restricted to accredited investors.

- Illiquidity & Risk: Investments are illiquid and carry significant risks, including the potential loss of principal.

- Complex Fee Structures: Fees can be high and vary significantly between different offerings.

Link: Yieldstreet

11. Rakuten (Cash Back + Browser/Mobile Extensions)

Rakuten transforms your everyday online shopping into a source of passive income by giving you cash back on purchases you were already going to make. Instead of functioning as an investment, it operates as a sophisticated affiliate portal that shares its commission with you. By installing its browser extension or using the mobile app, you can effortlessly earn a percentage back from thousands of participating retailers, making it one of the simplest and best passive income apps for casual earners. The "set it and forget it" nature of its browser extension is its strongest feature, as it automatically alerts you to available cash-back deals and applies coupons at checkout.

Real-Life Example: During the holiday season, the Miller family does most of their gift shopping online. Before starting, they install the Rakuten browser extension. When buying a new laptop from Dell.com, a pop-up reminds them to activate 8% cash back. At checkout, Rakuten automatically tests coupon codes and finds one for an extra $50 off. In one purchase, they save $50 instantly and earn over $100 in cash back, which they receive in their next quarterly "Big Fat Check."

The platform’s real power lies in its seamless integration into your shopping habits. Once activated for a shopping session, it works in the background, tracking your purchases and crediting your account. This process allows you to stack rewards on top of your credit card points, maximizing savings without any extra effort. While you won’t get rich using Rakuten, it provides a consistent and reliable return for minimal effort, turning regular spending into a rewarding habit. The ability to automatically find and test coupon codes further enhances its value, often saving you more than the cash-back percentage itself.

Key Features & User Experience

- Effortless Integration: The browser extension and mobile app automatically detect cash-back opportunities while you shop.

- Automatic Coupon Application: Scans and applies the best available coupon codes at checkout to maximize savings.

- Broad Retailer Network: Partners with thousands of stores, from major department stores to niche online shops.

- Flexible Payouts: Receive your accumulated cash back quarterly via PayPal or a physical check.

Platform Comparison

| Feature | Rakuten | Honey |

|---|---|---|

| Primary Function | Cash back first, coupons second | Coupons first, rewards second |

| Payout Method | Direct cash (PayPal/check) | Gift cards or points system (Honey Gold) |

| Activation | Requires manual activation per session | Often more automated |

| Stacking | Easily stackable with credit card rewards | Rewards may vary |

Pros & Cons

Pros:

- Extremely Low Effort: After initial setup, it requires just one click to activate rewards.

- Stacks with Other Rewards: You can combine Rakuten cash back with credit card points for double benefits.

- Wide Retailer Coverage: Works with a vast network of popular online stores.

Cons:

- Requires Manual Activation: You must remember to click the activation button for each shopping trip.

- Quarterly Payouts: Cash back is paid out periodically, not instantly after each purchase.

Link: Rakuten

12. Ibotta (Cash Back + Browser/Safari Extension)

Ibotta transforms everyday shopping into a passive income stream by offering cash back on groceries, online retail, and more. It stands out by integrating a mobile app for in-store receipt scanning with a powerful browser extension for desktop and Safari. This dual approach ensures you capture rewards whether you're shopping online or at a physical store, making it one of the more versatile best passive income apps for earning from your existing spending habits. The platform automates much of the process, particularly with its browser extension, which actively prompts you to activate offers before you check out.

Real-Life Example: Before his weekly grocery trip to Kroger, Tom opens the Ibotta app and adds offers for items on his list, like milk, bread, and a specific brand of cereal. After checking out, he scans his receipt into the app. Within 24 hours, he gets $3.50 cash back credited to his account. Later that week, he buys a new pair of shoes from Adidas.com, and the Ibotta browser extension reminds him to activate 5% cash back, adding another $4 to his earnings.

The user experience is designed for convenience, bridging the gap between digital and in-person shopping rewards. While many platforms focus exclusively on one or the other, Ibotta’s system lets you link store loyalty cards for automatic rebates or simply snap a photo of your receipt. The browser extension for Chrome and Safari further simplifies online purchases by automatically applying deals, removing the need to manually search for coupon codes or activate offers on a separate site.

Key Features & User Experience

- Browser Extension Prompts: The desktop and Safari extension automatically detects eligible retail sites and reminds you to activate cash-back offers.

- Mobile App Functionality: Supports in-store cash back through receipt scanning and linking retailer loyalty accounts.

- Multi-Platform Sync: Earnings and offer status are synced across your mobile app and browser extension for seamless tracking.

- Broad Retailer Network: Partners with hundreds of retailers, from major grocery chains like Walmart and Kroger to online stores like Amazon and Target.

Platform Comparison

| Feature | Ibotta | Rakuten |

|---|---|---|

| Primary Focus | Groceries and retail | Primarily online retail |

| Automation | Browser extension prompts; loyalty card linking | Browser extension prompts; in-store card-linked offers |

| In-Store Rewards | Receipt scanning and loyalty accounts | Card-linked offers only |

| Payout Method | PayPal, bank transfer, gift cards | PayPal or "Big Fat Check" (quarterly) |

Pros & Cons

Pros:

- Comprehensive Coverage: Earn cash back both in-store and online across a wide range of categories.

- Helpful Automation: The browser extension helps prevent you from missing out on potential rewards.

- Flexible Payouts: Choose between direct deposit, PayPal, or various gift card options.

Cons:

- Requires Activation: Users must remember to activate offers before shopping, both online and in-app.

- Payout Threshold: A minimum balance is required to cash out, which can take time to accumulate.

- Offer Specificity: Some deals require purchasing specific product sizes or quantities to qualify.

Link: Ibotta

Passive Income Apps: Feature & Platform Comparison

| Platform/App | Best For | Minimum Investment | Potential Passive Income Source | Fees | Key Feature |

|---|---|---|---|---|---|

| Acorns | Absolute Beginners | $0 to start; $5 for Round-Ups | Market returns, dividends, cash back | $3-$9/month | Automated spare change investing |

| Betterment | Hands-Off Investors | $0 to start; $10 to invest | Market returns, dividends | 0.25%-0.40% AUM annually | Goal-based robo-advising & tax optimization |

| Wealthfront | Tax-Savvy Automators | $500 for investing | Market returns, dividends, high-yield interest | 0.25% AUM annually | Advanced tax-loss harvesting & high-yield cash account |

| M1 Finance | DIY Automators | $100 | Dividends, market appreciation | $3/mo for accounts <$10k | Customizable "Pies" with auto-investing |

| Fundrise | Aspiring Real Estate Investors | $10 | Real estate rental income & appreciation | ~1% annually | Low-cost entry into private real estate |

| RealtyMogul | Income-Focused RE Investors | $5,000 | Monthly real estate dividends, appreciation | Varies by deal | Access to institutional-grade commercial real estate |

| GROUND FLOOR | Short-Term Debt Investors | $100 | Interest from real estate loans | 0% for investors | Short-term (6-18 mo.) real estate debt investing |

| Yieldstreet | Accredited Investors | $10,000+ | Interest/distributions from alternative assets | Varies by deal | Access to private credit, art, legal finance, etc. |

| Rakuten | Online Shoppers | Free to use | Cash back from online purchases | None | Automatic coupon finding & broad retailer network |

| Ibotta | Grocery & Retail Shoppers | Free to use | Cash back from in-store & online purchases | None | Grocery-focused offers & receipt scanning |

Final Thoughts

The journey into passive income generation is both exciting and deeply personal, and as we've explored, the digital landscape offers a diverse toolkit to get you started. The concept of making your money work for you has evolved from a distant financial goal into an accessible reality, thanks largely to the proliferation of the best passive income apps. These platforms have effectively democratized investing, saving, and earning, breaking down barriers that once kept many on the sidelines.

Throughout this guide, we've navigated a spectrum of powerful tools, from the effortless micro-investing of Acorns to the sophisticated, tax-optimized portfolios managed by Wealthfront and Betterment. We delved into the hybrid, customizable approach of M1 Finance, which empowers you to be both a passive and an active participant in your wealth-building journey. We also ventured into the tangible world of real estate investing through platforms like Fundrise, RealtyMogul, and GROUNDFLOOR, which have made fractional ownership in property-backed assets a straightforward process.

The key takeaway is that there is no single "best" app for everyone. Your ideal platform is a direct reflection of your financial situation, your tolerance for risk, and your long-term goals.

Matching the App to Your Ambition

Choosing the right tool requires an honest assessment of your personal financial philosophy. To distill our findings into actionable advice, consider these archetypes:

- For the Absolute Beginner: If you're just starting and the thought of investing feels intimidating, Acorns is an unparalleled entry point. Its "Round-Ups" feature automates the process, letting you invest spare change without feeling the pinch. It’s the perfect way to build the habit of investing.

- For the Hands-Off Goal-Setter: If you have specific financial goals like saving for a down payment or retirement but prefer a set-it-and-forget-it approach, Betterment and Wealthfront are your best allies. Their robo-advisory services, backed by proven investment theories and tax-loss harvesting, provide a sophisticated, automated path to your objectives.

- For the Hands-On Strategist: If you enjoy having control and want to build a custom portfolio of stocks and ETFs while still benefiting from automation, M1 Finance offers a brilliant hybrid model. You curate your "Pies," and the platform handles the rest.

- For the Aspiring Real Estate Mogul: If the stability and long-term appreciation of real estate appeal to you, but you lack the capital for a direct purchase, Fundrise and RealtyMogul are exceptional choices. They provide access to diversified portfolios of private real estate investments, an asset class previously reserved for the wealthy.

- For the Calculated Risk-Taker: If you have a higher risk tolerance and are intrigued by alternative or short-term, debt-based investments, GROUNDFLOOR (with its real estate debt focus) and Yieldstreet (offering a wide array of alternatives) provide opportunities for potentially higher returns.

- For the Everyday Maximizer: Don't underestimate the power of optimizing your existing spending. Apps like Rakuten and Ibotta turn everyday purchases into a consistent stream of cash back, a simple yet effective form of passive income that requires minimal effort.

Final Actionable Steps

Before you download your first app, take a moment to solidify your strategy. Define a clear, measurable goal. Is it to generate an extra $100 per month? To build a $10,000 portfolio in three years? Having a target will keep you motivated and help you measure your success. Start small to understand the platform's mechanics, and remember that consistency is far more powerful than timing the market. Automate your contributions, no matter how modest, and let the magic of compounding do the heavy lifting over time. Your future self will thank you for the small, consistent steps you take today.

Frequently Asked Questions (FAQ)

1. What exactly is a passive income app?

A passive income app is a mobile or web application that helps you generate money with minimal ongoing effort after an initial setup. These apps fall into several categories, including automated investing (e.g., Betterment), real estate crowdfunding (e.g., Fundrise), micro-investing (e.g., Acorns), and cash-back rewards (e.g., Rakuten). The goal is to make your money work for you.

2. Can I really make significant money with these apps?

Yes, but it depends on the app, your initial investment, and your timeline. Investment apps like Wealthfront or M1 Finance have the potential to generate significant wealth over the long term through market growth and compounding. Cash-back apps like Ibotta will provide a smaller, supplemental income stream. Real estate apps like Fundrise offer a middle ground with potential for both income and appreciation. Consistency is key.

3. Are these passive income apps safe?

Reputable financial apps use high levels of encryption and security protocols. Investment apps are typically SIPC insured (protecting up to $500,000 in securities) and high-yield cash accounts are FDIC insured (protecting up to $250,000 in cash). However, all investments carry risk, and the value of your investments can go down as well as up. Always do your research on an app's security features and regulatory compliance.

4. How much money do I need to start?

This is one of the biggest advantages of modern apps. You can start with very little. Apps like Acorns let you begin by investing spare change, while Fundrise has a minimum of just $10. Robo-advisors like Betterment have no minimum to open an account. This low barrier to entry makes passive income accessible to almost everyone.

5. What's the difference between a robo-advisor and a micro-investing app?

A robo-advisor (like Betterment or Wealthfront) is a fully automated investment manager. You answer questions about your goals and risk tolerance, and it builds and manages a diversified portfolio for you, often including advanced features like tax-loss harvesting. A micro-investing app (like Acorns) focuses on helping you invest small, regular amounts of money, often by rounding up purchases, to build an investing habit.

6. Do I have to pay taxes on income from these apps?

Yes. Income generated from these apps is generally taxable. Dividends and interest are taxed as ordinary income or at a lower capital gains rate. When you sell an investment for a profit, you'll owe capital gains tax. Cash-back rewards are typically considered rebates and are not taxable. Consult a tax professional for advice specific to your situation.

7. Can I lose money with these apps?

For any app involving investments in stocks, ETFs, or real estate, yes, there is a risk of loss. The value of assets can fluctuate. Apps that offer high-yield savings accounts (like Wealthfront's Cash Account) or cash-back services (like Rakuten) are very low-risk, as your principal is generally protected by FDIC insurance or is simply a rebate on spending.

8. Which app is best for a complete beginner?

For someone with zero investing experience, Acorns is an excellent starting point. Its automated "Round-Ups" feature makes investing effortless and helps build good financial habits. For a beginner who wants a more goal-oriented, hands-off approach, Betterment is also a top choice due to its user-friendly interface and simple setup.

9. What is the most "passive" option?

Robo-advisors like Wealthfront and Betterment are arguably the most passive options for investing. After the initial setup and establishing recurring deposits, they handle everything: diversification, rebalancing, and tax optimization. For non-investment options, cash-back browser extensions like Rakuten are extremely passive once installed.

10. Can I use multiple passive income apps at once?

Absolutely. Using multiple apps is a great way to diversify your passive income streams. You could use Betterment for your long-term retirement savings, Fundrise for real estate exposure, and Rakuten for earning cash back on your online spending. This multi-app strategy can help you build wealth across different asset classes and methods.

Ready to take your financial education to the next level? Our in-depth guides and expert analyses at Top Wealth Guide are designed to help you navigate the complexities of wealth creation with confidence. Visit Top Wealth Guide to discover more strategies and tools to accelerate your journey toward financial independence.