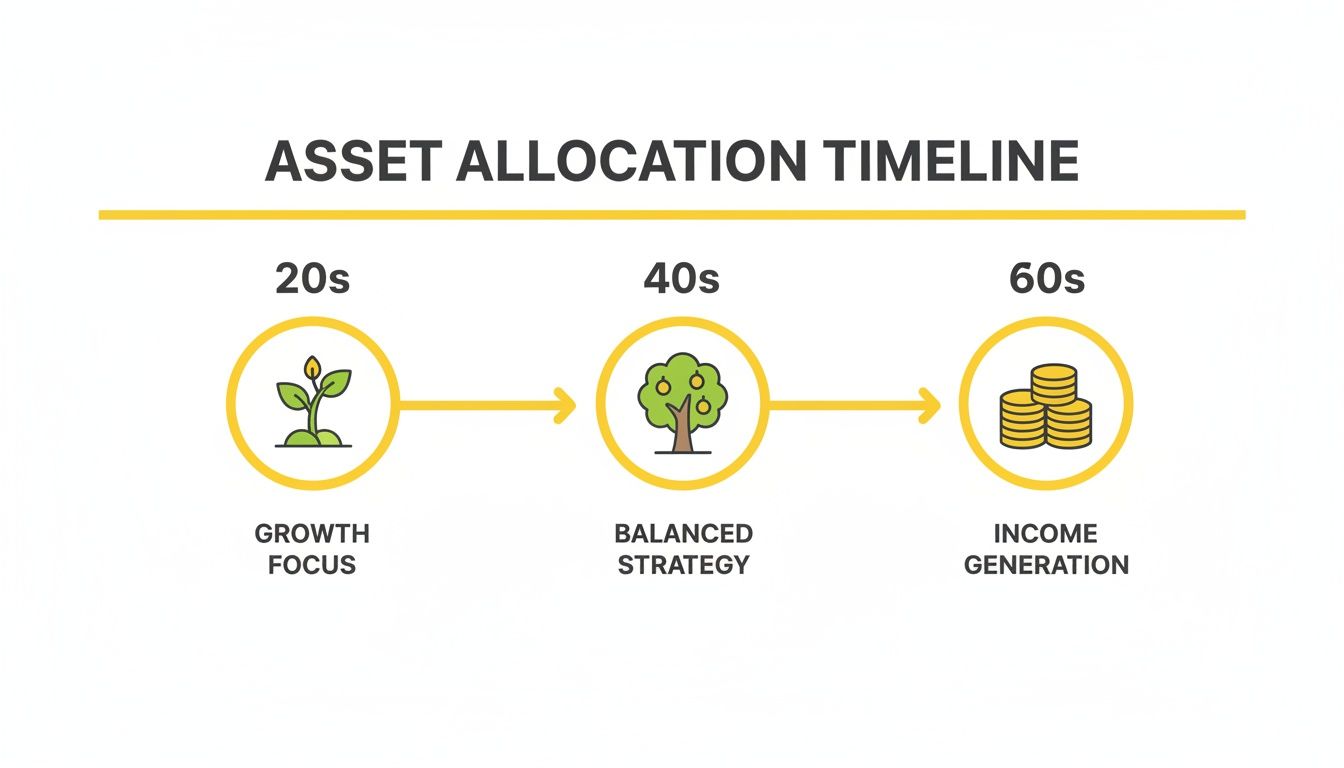

The best asset allocation by age is a strategy of gradually shifting your investment mix from an aggressive, growth-focused portfolio in your 20s and 30s to a more conservative, wealth-preservation approach in your 60s and beyond.

Imagine your financial life as a cross-country road trip. When you first set out, with a long, open highway ahead, you can push the speed a bit for faster progress (more stocks). But as you get closer to your destination, you ease off the gas and drive more cautiously to ensure a safe arrival (more bonds).

In This Guide

- 1 Why Your Age Is the North Star of Investing

- 2 The Building Blocks of Age-Based Investing

- 3 Investing in Your 20s and 30s: Building Your Growth Engine

- 4 Investing In Your 40s and 50s: Balancing Growth with Preservation

- 5 Investing in Your 60s and Beyond: Time to Protect Your Nest Egg

- 6 Putting Your Asset Allocation Plan into Action

- 7 Frequently Asked Questions

- 7.1 1. How often should I rebalance my portfolio?

- 7.2 2. What if my risk tolerance doesn't match my age?

- 7.3 3. Should I include cryptocurrency in my asset allocation?

- 7.4 4. Do target-date funds handle this for me automatically?

- 7.5 5. How should a major life event affect my allocation?

- 7.6 6. Are international stocks really necessary for diversification?

- 7.7 7. Is it okay to be 100% in stocks when I'm young?

- 7.8 8. How does inflation impact my asset allocation strategy?

- 7.9 9. What's the difference between strategic and tactical asset allocation?

- 7.10 10. Should my spouse and I have the same asset allocation?

Why Your Age Is the North Star of Investing

Deciding on your asset allocation is arguably the single most important investment decision you'll ever make. It's far more crucial than trying to pick the next hot stock or perfectly timing the market.

Why? Because your age is the best proxy for your time horizon—the number of years you have until you need to start spending that money. A longer time horizon means you can afford to take on more risk for a shot at higher returns, knowing you have plenty of time to ride out any inevitable market slumps. This simple concept—dialing down risk as your timeline gets shorter—is the bedrock of building real, lasting wealth.

This timeline gives you a great visual of how your investment focus naturally shifts from aggressive growth to capital preservation as you get older.

As you can see, the journey starts with planting seeds for maximum growth and ends with harvesting the income from a portfolio you've carefully cultivated over decades.

The Simple Logic Behind Shifting Your Portfolio

The relationship between your age and your portfolio really boils down to one thing: balancing your growth engines (stocks) with your safety nets (bonds).

- Stocks (Equities): These are the powerhouse of your portfolio. They represent a piece of ownership in a company and have historically delivered the highest long-term returns. The trade-off? They can be volatile.

- Bonds (Fixed Income): Think of these as the shock absorbers. When you buy a bond, you're lending money to a government or a corporation in exchange for interest payments. They offer lower returns but provide stability and income, which is incredibly valuable when the stock market gets rocky.

To kick things off, the table below offers a simple, at-a-glance framework for how this balance typically shifts throughout your life. For a more comprehensive look, you can also learn how to optimize your portfolio with smart asset allocation in our detailed guide.

Quick Guide to Asset Allocation by Age

| Age Range | Recommended Stock Allocation (%) | Recommended Bond Allocation (%) | Risk Profile | Primary Goal |

|---|---|---|---|---|

| 20s–30s | 80–90% | 10–20% | Aggressive | Maximize Growth |

| 40s | 70–80% | 20–30% | Growth | Balance Growth & Preservation |

| 50s | 60–70% | 30–40% | Balanced/Moderate | Increase Preservation |

| 60s+ | 40–50% | 50–60% | Conservative | Generate Income & Protect Principal |

This table provides a solid starting point, but remember that your personal risk tolerance and financial goals are just as important. Think of these numbers as a well-tested guideline, not a rigid rule.

The Building Blocks of Age-Based Investing

Before we start picking stocks or funds, we need to get the "why" right. A smart investment plan isn't about chasing hot tips; it’s about understanding a few core ideas that help you balance growing your money with keeping it safe.

Think of it like building a house. You wouldn't just start throwing up walls without a solid foundation and a clear blueprint. The same goes for your portfolio—every single piece needs to have a job.

Your Most Powerful Asset: Time Horizon

Your time horizon is just a fancy way of saying how long you have until you need the money you’re investing, which for most of us means retirement. If you're 25, that could be 40 years or more. If you're 55, you might only have a decade to go.

This one factor is easily the most powerful tool you have. A long runway gives your investments more time to compound (the real magic of growing wealth) and, just as importantly, more time to recover from the market’s inevitable roller-coaster dips. This is the simple reason why younger investors can, and should, take on more risk.

Risk Tolerance: Your Financial Comfort Zone

While your time horizon is about your ability to take risks, risk tolerance is all about your willingness to stomach them. This is the human side of investing. Can you sleep at night when the market is tanking?

If your portfolio dropped 20%, would you panic and sell everything? Or would you see it as a chance to buy more at a discount? Knowing yourself is crucial. If you need help figuring this out, our guide on how to determine your investment risk tolerance is a great place to start.

A successful investment strategy requires aligning your portfolio not just with your financial goals, but with your emotional temperament. A plan you can't stick with during tough times is a plan destined to fail.

Stocks vs. Bonds: The Engine and the Brakes

At the heart of almost every portfolio are two main ingredients: stocks and bonds. They do very different things, and you need both.

- Stocks (The Engine): These represent a slice of ownership in a company. Stocks are your growth engine, the part of your portfolio designed to deliver the highest long-term returns. The trade-off? They come with a lot more short-term volatility.

- Bonds (The Brakes): Think of these as loans you make to a government or a company. Bonds provide stability and a steady stream of income. They act as the brakes, steadying your portfolio when the stock market gets rocky.

A solid asset allocation strategy is all about finding the right mix of engine and brakes for where you are on your financial journey.

Rules of Thumb: A Simple Starting Point

To make things easier, investors have long relied on simple guidelines. One of the oldest is the ‘100 Minus Age’ rule. You simply subtract your age from 100, and the result is the percentage of your portfolio that should be in stocks.

As we've started living longer, that rule has been updated. Many now use 110 or even 120 minus their age for a more aggressive, growth-focused approach. These rules aren't perfect, but they give you a logical starting point for shifting from growth to safety as you get closer to retirement.

With these foundational concepts in place, we can now start looking at what this means for your portfolio decade by decade.

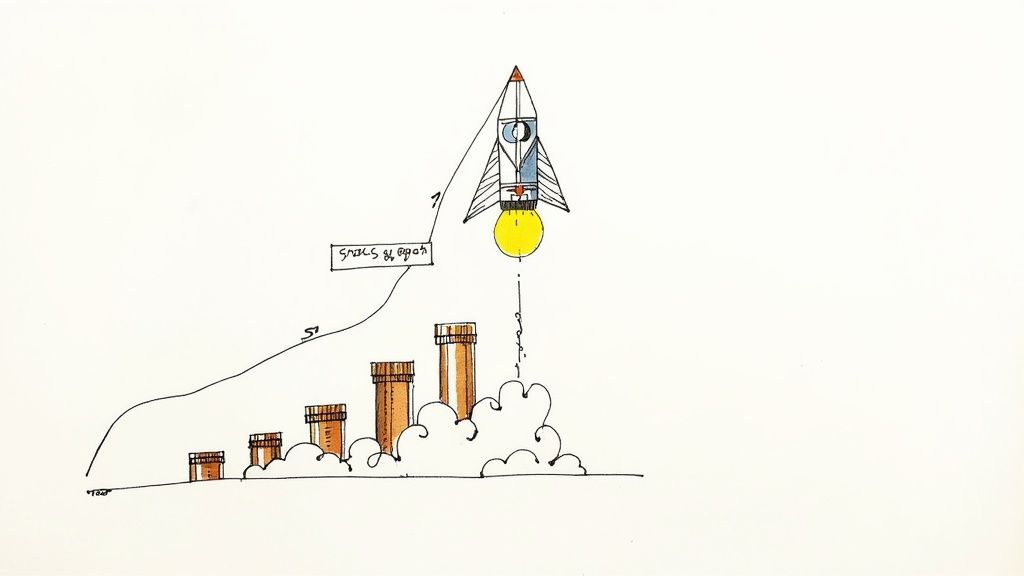

Investing in Your 20s and 30s: Building Your Growth Engine

If you're in your 20s or 30s, you hold the single most powerful tool in any investor's kit: time. With decades stretching out before you hit retirement, your mission isn't just about saving money—it's about aggressively growing it. This is your prime window to build a powerful growth engine, one designed to fully capture the magic of compounding.

The strategy here is straightforward: lean heavily into stocks. A smart and common allocation is putting 80% to 90% of your portfolio into stocks, with the remaining 10% to 20% in bonds. This setup puts your money to work as hard as you do, maximizing its potential to grow over the long haul.

Sure, a portfolio tilted this heavily toward stocks will be more volatile. You'll see bigger swings. But your long time horizon is your safety net. When the inevitable market downturns happen, you can see them not as a threat, but as a buying opportunity—a chance to scoop up more assets on sale.

Why an Aggressive Stance Makes Sense

Going heavy on stocks in your early career is all about playing the long game. It's a proven approach, and we've seen this trend for decades. For instance, back in June 2000, over 70% of retirement savers under 35 had more than half their money in stocks, a sharp contrast to their older, more risk-averse counterparts. You can dig into the numbers yourself and read the full research on investor behavior by age.

This aggressive approach is so critical for two main reasons:

- You Supercharge Compounding: The longer your money sits in high-growth assets, the more time it has to compound. Your early gains start generating their own gains, creating a snowball effect that can build incredible wealth over 30 or 40 years.

- You Have Time to Recover: When—not if—the market takes a big hit, you have decades to ride it out and recover. Unlike someone close to retirement, you won’t be forced to sell your investments at a loss just to pay the bills.

Your 20s and 30s aren't about avoiding risk. They're about taking smart, calculated risks. And a high allocation to diversified stock funds is the most time-tested way to do exactly that.

A Real-Life Example and Sample Portfolio

Let’s make this concrete with a quick case study.

Meet Sarah, a 28-year-old software engineer. She’s diligent about contributing to her company's 401(k) and also funds a personal Roth IRA. With a stable income and a long career ahead, she has a high tolerance for risk and is focused squarely on growth.

Here’s a look at how Sarah might structure her investments to match that aggressive growth strategy.

Sarah's Growth-Focused Asset Allocation (90% Stocks / 10% Bonds)

| Asset Class | Allocation | Example Investment (ETFs) | Purpose |

|---|---|---|---|

| U.S. Stocks | 60% | Vanguard Total Stock Market ETF (VTI) | Broad exposure to the entire U.S. market. |

| International Stocks | 30% | Vanguard Total International Stock ETF (VXUS) | Diversification outside the U.S. |

| Bonds | 10% | Vanguard Total Bond Market ETF (BND) | A small cushion for stability during downturns. |

| Total Portfolio | 100% | An aggressive yet diversified growth engine. |

This portfolio is beautifully simple, incredibly low-cost, and highly effective. By using broad-market index funds and ETFs, Sarah gets instant diversification without the headache of trying to pick individual winning stocks. If you’re new to this idea, our guide explains in detail what index funds are and how they work.

Sarah’s approach is a perfect blueprint for building a powerful financial foundation. It’s a strategy that prioritizes long-term growth, keeps fees to a minimum, and is built to withstand the market's ups and downs for decades to come.

Investing In Your 40s and 50s: Balancing Growth with Preservation

When you hit your 40s and 50s, a major shift happens in your financial life. These are usually your peak earning years, but they often come with heavier responsibilities—mortgages, saving for your kids' college, and the growing realization that retirement isn't just a far-off dream anymore.

The game is no longer just about chasing aggressive growth. Now, it's a balancing act: keeping your money growing while protecting the wealth you’ve worked so hard to build.

This is the perfect time to start making a gradual, deliberate transition in your portfolio. You'll want to slowly dial back the high-octane, stock-heavy mix you might have had in your 20s and 30s for something more moderate. A smart target for this stage of life is an allocation of 60% to 75% in stocks, with the rest moving into the steadying influence of bonds.

The Glide Path To A Secure Retirement

Think of your investment journey like a pilot landing a plane. In your younger years, you were cruising at high altitude, focused on aggressive growth. Now, in your 40s and 50s, it's time to begin the "glide path"—a slow, controlled descent toward your retirement destination. You can't just cut the engines and hope for a soft landing; you need to reduce speed and altitude methodically.

In portfolio terms, this means trimming your exposure to stock market volatility a little bit each year. It’s not a sudden, drastic move. It's a series of small, intentional adjustments that shield your growing nest egg from a sudden market crash, which would be far more painful now than it was two decades ago.

The goal in your 40s and 50s isn't to eliminate risk, but to manage it intelligently. You still need your portfolio to outpace inflation, which means maintaining a healthy allocation to stocks for growth.

A Real-Life Example and Sample Portfolio

Let's look at a practical example to see this in action.

Meet Mark and Jessica, both 45. They have two kids, a mortgage, and are saving for both college and their own retirement. Their income is solid, but their expenses are, too. They need their investments to keep growing, but they absolutely cannot afford a catastrophic loss that would throw their financial plans off course.

After taking stock of their goals, they decide to shift from their previous 85/15 stock-to-bond split to a more balanced 70/30 allocation. This strategy still gives them plenty of room for growth but adds a much-needed layer of stability.

To put this shift in perspective, the table below shows how a sample portfolio might evolve as an investor moves through different life stages.

Comparison of Sample Portfolios by Age Decade

| Asset Class | Allocation in 20s (Aggressive) | Allocation in 40s (Balanced Growth) | Allocation in 60s (Conservative) |

|---|---|---|---|

| U.S. Stocks | 55% | 45% | 25% |

| International Stocks | 30% | 20% | 15% |

| Bonds | 10% | 25% | 50% |

| Alternatives (e.g., REITs) | 5% | 10% | 10% |

| Total Stock Allocation | 85% | 65% | 40% |

| Total Bond/Alternatives | 15% | 35% | 60% |

You'll notice the inclusion of alternatives like REITs (Real Estate Investment Trusts). Adding assets that don't always move in lockstep with the stock market is a great way to add another layer of diversification and smooth out your portfolio's ride.

Making this transition isn't a one-and-done deal; it requires periodic adjustments to stay on track. To really get this right, it's worth understanding the different portfolio rebalancing strategies you can use to make sure your allocation always aligns with your goals.

By taking this balanced approach, Mark and Jessica are putting themselves in a strong position to fund their kids' education and build a secure retirement, all without taking on unnecessary risks during their most critical saving years.

Investing in Your 60s and Beyond: Time to Protect Your Nest Egg

Once you hit your 60s, the entire game changes. Retirement is no longer a distant concept on the horizon; it's right in front of you. For decades, your sole focus was accumulation—growing your wealth as much as possible. Now, the mission shifts completely to wealth preservation and creating a reliable income stream.

It’s less about hitting home runs and more about making sure your nest egg can comfortably support you for the next 20, 30, or even 40 years. This demands a major strategic pivot.

A more conservative stance is now your best friend. Think something in the neighborhood of 40-50% in stocks and 50-60% in bonds and other income-producing assets. This defensive posture is all about protecting your hard-earned capital from a major market nosedive right when you need to start drawing from it.

Sidestepping the Sequence of Returns Trap

For a new retiree, the single biggest threat isn't just a bear market—it's when that bear market hits. This is what we call sequence of return risk. Experiencing a big drop in the market right at the beginning of your retirement can be devastating.

Why? Because you're forced to sell more of your investments at rock-bottom prices to cover your living expenses. Doing that just a few times can permanently cripple your portfolio's ability to last for the long haul.

To fight this, your portfolio needs to be a steady, predictable income machine. The goal is to minimize the need to sell stocks when they're down. This is where high-quality bonds, dividend-paying stocks, and other income-focused assets really shine. They provide the cash flow you need to live on, giving your stock allocation the breathing room it needs to recover and keep growing ahead of inflation.

In retirement, protecting your principal is everything. Remember, a 50% loss requires a 100% gain just to get back to where you started—a nearly impossible task when you're also taking money out.

This shift isn't just personal advice; it's a massive institutional trend. Pension funds, which manage money for millions of retirees, have been dialing back risk. Their equity allocations have recently averaged around 29-33%, down from years past. Meanwhile, they've boosted investments in alternatives like real estate to nearly 28%. It's a clear signal that managing risk and longevity is about more than just stocks and bonds. You can discover more insights about global pension asset trends to see how the pros are adapting.

Real-Life Example: A Retiree’s Income Plan

Let's look at a practical example. Meet David, age 65, who just retired. He's built up a $1.2 million portfolio and needs it to kick off about $4,000 per month ($48,000 a year) to supplement his Social Security. A major market crash in his first few years of retirement would be catastrophic.

So, David and his advisor map out a conservative portfolio built for stability and income.

David’s Retirement Income Portfolio (40% Stocks / 60% Bonds & Cash)

| Asset Class | Allocation | Example Investment (ETFs/Funds) | Purpose |

|---|---|---|---|

| Bonds | 50% | Vanguard Interm-Term Corp Bond (VCIT) | The engine for core income and stability. |

| Dividend Stocks | 20% | Schwab U.S. Dividend Equity ETF (SCHD) | A source of reliable, growing income with growth potential. |

| U.S./Int'l Stocks | 20% | Vanguard Total Stock Market ETF (VTI) | Long-term growth to make sure inflation doesn't eat away at his money. |

| Cash/Short-Term | 10% | Money Market Fund | A "safety bucket" to cover 2-3 years of expenses, so he never has to sell in a down market. |

This setup gives David a reliable paycheck from his bond and dividend holdings. More importantly, that 10% cash bucket acts as a crucial buffer. If the market tanks, he can live off that cash for a couple of years and leave his stocks alone to recover. This thoughtful approach to the best asset allocation by age is what allows him to step into retirement with confidence, knowing his nest egg is built to last.

Putting Your Asset Allocation Plan into Action

It’s one thing to have a solid asset allocation plan on paper. It’s another thing entirely to bring it to life. A plan that just sits there is nothing more than a good intention. This is where we bridge the gap between financial theory and real-world results—turning your strategy into a portfolio that works for you.

Bringing your plan to life doesn't mean you need to become a stock-picking genius. Far from it. For most of us, the simplest and most effective tools are low-cost, broad-market index funds and ETFs. These are brilliant because they give you instant diversification, often holding hundreds or thousands of different stocks or bonds in a single, easy-to-buy package.

The Discipline of Rebalancing

Let’s be honest: left to its own devices, your carefully crafted portfolio will wander off course. It’s natural. If stocks have a killer year, your 70/30 portfolio might creep up to a 78/22 mix without you even noticing. Suddenly, you're taking on more risk than you originally signed up for.

This is where rebalancing comes in. Think of it as a periodic tune-up for your portfolio.

Rebalancing is simply the act of selling a bit of what has done well and buying more of what has lagged to get back to your target percentages. It’s a beautifully simple, disciplined approach that forces you to live by one of the oldest rules in investing: buy low and sell high.

Real-Life Rebalancing Example

So what does this actually look like? Let’s walk through a quick scenario.

- Your Starting Point: You have a $100,000 portfolio and a 60% stock / 40% bond target. That means you start with $60,000 in stocks and $40,000 in bonds.

- One Year Later: The stock market went on a tear, and your stock holdings are now worth $75,000. Your bonds held steady, growing to $41,000. Your total portfolio is now valued at $116,000.

- The Drift: Your new allocation is 64.7% stocks ($75,000 / $116,000) and 35.3% bonds. Your portfolio has become more aggressive than you intended.

- Taking Action: To get back to your 60/40 target, you’d sell $5,400 worth of your high-flying stocks and reinvest that money into bonds. You're locking in gains and pulling your portfolio's risk level back in line.

This simple act is one of the most powerful ways to manage risk and is central to finding the best asset allocation by age. To stay on top of this, it helps to use some of the top portfolio tracking tools every smart investor uses to see when you're drifting off target.

Maximizing Returns with Smart Tax Strategies

Here’s a pro tip that many investors overlook: where you hold your assets can be almost as important as what you hold. This concept, known as asset location, is all about tax efficiency.

The goal is to put your least tax-friendly investments into tax-advantaged accounts (like a 401(k) or IRA) and keep your more tax-efficient assets in your regular taxable brokerage account.

By strategically placing assets in the right accounts, you can significantly reduce your tax drag over the long term, leaving more money in your pocket to compound and grow.

As a general rule of thumb:

- Tax-Advantaged Accounts (401k, IRA): This is the ideal home for investments that generate a lot of annual taxes, like corporate bonds, actively managed funds that trade frequently, or REITs.

- Taxable Brokerage Accounts: Fill these accounts with your most tax-efficient holdings. This includes broad-market stock index funds (which qualify for lower long-term capital gains tax rates) and municipal bonds (which are often tax-free).

When you combine smart investment choices, disciplined rebalancing, and tax-savvy asset location, you’re not just following a plan. You're executing a robust strategy that can serve you well for decades to come.

Frequently Asked Questions

Diving into asset allocation can bring up a lot of questions. Let's tackle some of the most common ones that investors ask, so you can move forward with confidence.

1. How often should I rebalance my portfolio?

Most financial pros suggest rebalancing annually or whenever your allocation drifts more than 5% from your target. For example, if your goal is 70% stocks and a market rally pushes it to 76%, that's your cue to adjust. This simple discipline forces you to systematically sell high and buy low, keeping your risk level in check.

2. What if my risk tolerance doesn't match my age?

The age-based guidelines are starting points, not strict rules. Your personal comfort with risk is the most important factor. If you're 30 but lose sleep during market dips, a more conservative 70% stock allocation might be better for you than the recommended 90%. Conversely, a 60-year-old with a strong pension and high risk tolerance might choose to hold more stocks. Your portfolio must let you sleep at night.

3. Should I include cryptocurrency in my asset allocation?

Cryptocurrency is a highly speculative, volatile asset. If you choose to invest, it should be a very small portion of your portfolio—typically 1-2% at most—and only with money you are fully prepared to lose. For most long-term investors, especially those nearing or in retirement, the extreme risk is not appropriate for a core portfolio.

4. Do target-date funds handle this for me automatically?

Yes, this is their primary function. Target-date funds offer a "set it and forget it" solution. You pick a fund with a year close to your expected retirement (e.g., "Target 2050 Fund"), and it automatically adjusts its asset allocation over time, becoming more conservative as the target date approaches. They manage the "glide path" for you, making them an excellent choice for hands-off investors.

5. How should a major life event affect my allocation?

Major life events—like getting married, having a child, changing careers, or receiving an inheritance—are perfect times to review your financial plan. These events can alter your financial goals, time horizon, and risk tolerance. For instance, having a child might prompt you to open a separate, more conservative 529 college savings plan, while your personal retirement portfolio remains on its original track.

6. Are international stocks really necessary for diversification?

Absolutely. The U.S. stock market accounts for a large portion of the world's market cap, but not all of it. International markets don't always move in the same direction as the U.S. market, which can help smooth out your portfolio's returns. Investing globally provides broader diversification and access to growth opportunities in different economies, preventing you from putting all your eggs in one country's basket.

7. Is it okay to be 100% in stocks when I'm young?

While tempting for maximum growth, holding 100% stocks is generally not recommended, even for young investors. A small allocation to bonds (even just 10%) acts as a crucial "shock absorber" during a market crash. This stability can provide the psychological fortitude needed to stay invested and avoid the costly mistake of panic selling at the bottom.

8. How does inflation impact my asset allocation strategy?

Inflation is the silent erosion of purchasing power. This is precisely why stocks are a critical component of every long-term portfolio—their historical returns have outpaced inflation significantly. For those nearing retirement, adding inflation-protected assets like Treasury Inflation-Protected Securities (TIPS), I-Bonds, or real estate can provide an extra layer of defense against the rising cost of living.

9. What's the difference between strategic and tactical asset allocation?

- Strategic Asset Allocation is your long-term, core plan based on your goals and risk tolerance (e.g., maintaining a 60/40 stock/bond mix). You stick to it through market ups and downs.

- Tactical Asset Allocation is a short-term, active strategy where you temporarily deviate from your strategic mix to try to capitalize on a perceived market opportunity.

For the vast majority of individual investors, a disciplined strategic approach is simpler and often more effective.

10. Should my spouse and I have the same asset allocation?

It's best to view your and your spouse's investments as one unified household portfolio. Your combined asset allocation should reflect your shared goals, joint retirement timeline, and a risk level you are both comfortable with. You can then use all available accounts (401(k)s, IRAs, taxable accounts) to build this target allocation in the most tax-efficient way possible (a concept known as asset location).

At Top Wealth Guide, we're committed to giving you the clarity and tools needed to build your financial future. For more expert insights and proven strategies, explore our resources today.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.