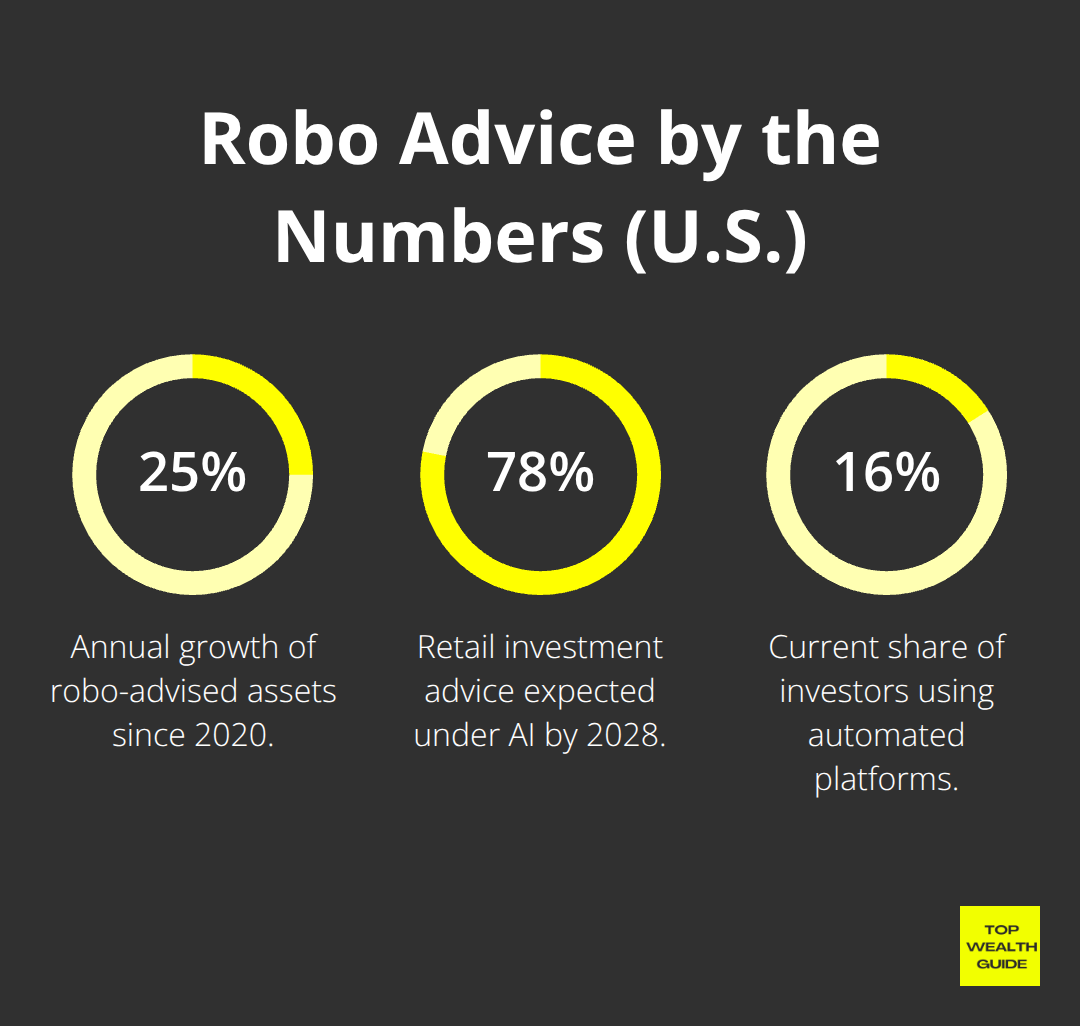

Robo advisors… they’ve completely reshaped the investment landscape for millions of Americans. These digital dynamos handle over $1.4 trillion in assets—yeah, that’s trillion with a “T”—and they’ve been riding a growth wave of 25% annually since 2020.

Over at Top Wealth Guide, we’re witnessing a seismic shift in traditional wealth management. The real question isn’t if robo advisors will change the game—it’s how fast they’ll seize the reins and run the show.

In This Guide

How Do Robo Advisors Actually Work

Robo advisors strip down the tangled mess of traditional wealth management and replace it with sleek algorithmic precision. These platforms latch onto Modern Portfolio Theory to whip up diversified portfolios from ETFs, fine-tuning your investments based on your risk tolerance, age, and investment horizon. Betterment charges a measly 0.25% annually, while the old-school advisors gouge you for 1% or more-that’s an annual difference of $750 on a $100,000 portfolio. This tech-savvy system keeps an eagle eye on your account, rebalancing whenever allocations veer more than 5% from their targets.

The Algorithm Behind Your Portfolio

It all kicks off with those tedious risk assessment questionnaires that pour data into super-smart algorithms. Wealthfront’s setup digs into more than 11 asset classes-from domestic stocks to emerging market bonds-crafting portfolios that fit your unique risk vibe. These platforms cleverly reinvest dividends, harvest tax losses, and sustain optimal asset allocation without a human pressing any buttons. With AI-driven robo-advisors handling over $1.26 trillion in assets as of 2025, it’s proof-machines are running the show at an unimaginable scale.

Why Fees Destroy Your Returns

Your friendly neighborhood financial advisors slap on 1% to 1.5% annually, plus fund fees adding another 0.5% to 1%. Meanwhile, robo advisors like Schwab ask for zero advisory fees, and Betterment and Wealthfront stick around 0.25%. Over the span of 30 years, that gap in fees seriously compounds-a $50,000 investment swells to $432,000 with 1.5% fees but balloons to $506,000 at a mere 0.25%. The numbers are clear-automation wins hands down.

Daily Operations That Never Sleep

Robo advisors have their finger on the market pulse 24/7, making trades when there’s a drift from your target allocations. They snatch up tax loss harvesting automatically (raking in up to $1,500 in annual deductions), reinvest dividends within mere hours, and calibrate risk levels as you age. This ongoing optimization happens with zero phone calls, zero meetings, zero paperwork-just pure, unadulterated efficiency boosting your returns while you catch some Zs.

But hey, with all that automation, there are trade-offs you need to mull over against these tempting benefits.

What Makes Robo Advisors So Appealing

Low Barriers Break Down Investment Walls

Robo advisors are the battering rams smashing down the gates of exclusive portfolio management – making it accessible for the everyday investor. Charles Schwab Intelligent Portfolios? You need absolutely nada to get started, while Fidelity Go lets you hop on board for a mere $10. Contrast that with traditional advisors who often want you to cough up $100,000 just to sit at the table. Betterment’s got your back with a tiny $4 monthly fee for accounts under $20,000, blowing that 1% cut on small portfolios out of the water – that’s $200 a year saved on a $20,000 stash. And hey, these platforms are the ultimate night owls, executing trades at 3 AM if the market’s mood swings call for some rebalancing action, all while you’re catching Zs.

Round-the-Clock Portfolio Management

Automation is the rock star here, with a 24/7 show that human advisors can only dream about. Robo platforms? They’ve got their finger on the market’s pulse every single second. They’ll rebalance the minute your allocations wander off the path and reinvest dividends faster than you can say “windfall.” Tax-loss harvesting – it’s a sophisticated parlor trick to keep Uncle Sam’s hand out of your pocket, leaving you with more dough to play with. All this magic happens without the dreaded phone tag, sit-downs, or paperwork piles – just pure, unadulterated efficiency that elevates your returns through clockwork-like precision.

Where Human Complexity Beats Algorithms

But hang on – with all this convenience, there’s a trade-off. Robo advisors are out of their league when it comes to life’s messier financial conundrums. Buying a house, selling a business, or managing those assets you’ve inherited from dear old dad … yeah, the algorithms won’t be much help. Tax-loss harvesting is great for taxable accounts, but it’s not holding your hand through 401k rollovers or figuring out college fund strategies. Life throws curveballs – divorce, pink slips, unexpected millions – and that’s where the robots hit a major roadblock.

The Reality Gap in Adoption

There’s this mighty chasm between interest and action. Folks are intrigued by robo advisory services if they don’t have a financial wizard on speed dial. Yet, when it comes to actually diving in, not so much. Why? Because when money decisions get tangled up in emotions and complexity, people crave a human touch. The stats look shiny, but real-world uptake tells a sobering tale of what investors truly need once financial tangles become reality shows.

So, here we are at the crux: can traditional financial advisors hold their own against these slick automated systems, or are they offering some next-level, priceless insight that makes their steeper costs worth every penny? For the wealth-builders out there gearing up, understanding these trade-offs ain’t just a good idea – it’s essential.

Which Advisor Type Wins on Cost and Results

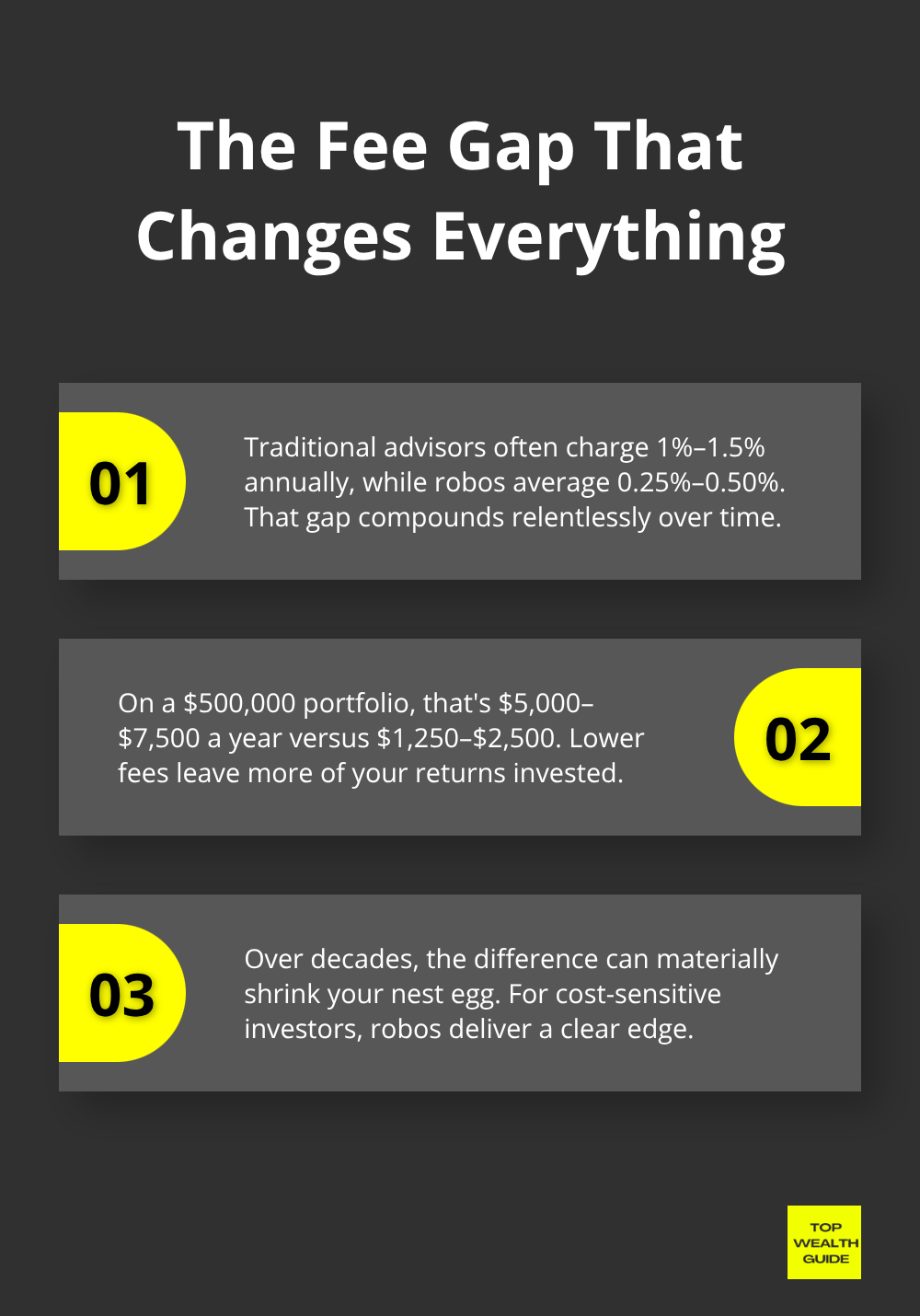

The Fee Gap That Changes Everything

Let’s talk fees-those sneaky little gremlins that nibble at your returns. Traditional financial advisors? They’re taking 1% to 1.5% annually. Not pocket change. Meanwhile, robo advisors are down here chilling at 0.25% to 0.50%. Do the math on a $500,000 portfolio: we’re talking $5,000 to $7,500 lining advisors’ pockets vs. a much lighter $1,250 to $2,500 with robos. Fast forward 25 years, and – boom – that difference just blew up your long-term growth potential.

Robo advisors bring serious cost advantages – low costs that aren’t kidding around.

Now, why pay more for the human touch? Traditional advisors pitch their 1% for the whole enchilada: financial planning, tax taming, estate strategy, and being your emotional rock when the market’s having a nervous breakdown. You get those in-person powwows and tailored advice that a robo just can’t deliver.

Investment Strategies That Define Performance

So, what’s the investment play here? Robos go passive with low-cost ETFs, throwing your dollars across 6 to 12 asset classes and hitting the ‘rebalance’ button when things drift beyond 5%. Wealthfront and Betterment throw in tax-loss harvesting like it’s candy, sidestepping wash sales.

Our human friends might dabble in active strategies, or fancy alternatives – maybe even direct indexing for the big fish. Reality check: 89% of actively managed funds can’t keep up with their benchmarks over 15 years. Ouch. Robo’s passive angle looks better for most.

Service Levels That Matter Most

Robo platforms? Great at your basic portfolio housekeeping. But they trip over anything complex – divvying up business sales, divorce settlements, multi-generational wealth puzzles. They handle the rebalancing, reinvest dividends, optimize taxes – all sans human touch.

People advisors? They swoop in when life hits you with complications. They’ll manage 401k rollovers, buddy up with tax pros, and tweak plans as life throws its curveballs. Plus, during market freefalls, when you’re close to panic mode, having someone to talk you off the ledge is priceless.

Who Should Choose Which Path

If your portfolio isn’t breaking $250,000 and life isn’t too complicated, the robo route is a no-brainer. Why? Because 1% fees on smaller accounts? They eat up your future like termites through wood.

But when you hit the $1 million mark, have a complex tax puzzle, run a business, or need estate planning? Cue the human advisors. You need brains for retirement, sorting inherited messes, and nailing tax-smart withdrawal strategies. Robo just can’t compete in that arena.

Final Thoughts

Ah, the robo advisor-hurtling forward like a bullet train with a mission. They’re reshaping finance, folks, and the numbers? Jaw-dropping! We’re talking about $4.53 trillion in assets under management by 2027. Yep, you heard right. The bots are on the rise, with a whopping 78% of retail investment advice expected to fall under the AI umbrella by 2028. Yet, even with this rocket-fueled growth, adoption is… kinda lagging. A mere 16% of people are hopping onto these automated platforms.

See, the stats paint a picture: For portfolios under $500k, robo advisors are killing it in the cost department. Above a million bucks though, the human touch takes the crown in navigating the tricky waters of complex financial strategies. The smart money? It’s on hybrid models-think algorithmic brain with a human heart. It’s working for the savvy folks; they let the bots handle the grunt work while humans steer the big-picture strategy.

So, what’s your move? Depends on your stash and the level of financial wizardry you require. If you’re just starting out with clear, simple goals, dive into those robo platforms (your wallet will thank you with all those fee savings). But if you’re rolling with the big dogs-business assets, estate plans, legacies-human advisors, folks. They got the goods. Head over to Top Wealth Guide for the lowdown on how to grow your fortune in every market frenzy.