As Father Time turns the pages, your investment strategy should… change. You go from swinging for the fences to playing it safe with your nest egg. Get the balance right — stocks, bonds, the whole shebang — and you’re cruising into retirement with ease. Mess it up? Hello, stress.

Our team at Top Wealth Guide does the heavy lifting — breaking down the best portfolio moves for each chapter of life. This roadmap? It’s got the numbers, the steps, all the goodies to boost those returns while keeping the risk gremlins in check for where you’re at in your journey.

In This Guide

What Portfolio Mix Works Best at Each Life Stage

Aggressive Growth in Your Twenties and Thirties

Ah, the roaring twenties and thirties-a time for aggressive growth. You’re young, wild, and free, which translates in investing to: load up on stocks. Bonds? Keep those on the backburner. Why? Because the magic of compounding is your best friend when you’ve got 30-40 years ahead. Ever heard of target-date funds? They’re the ones to cozy up with if you’re 25.

Market crashes? Barely a blip on your radar due to the decades you have to bounce back. Keep it simple-low-cost index funds tracking the S&P 500 and other global markets are your jam. Stock picking? Yeah, skip it.

Turns out, despite what your friend Steve says, studies prove he’s likely to trail behind those humble index funds.

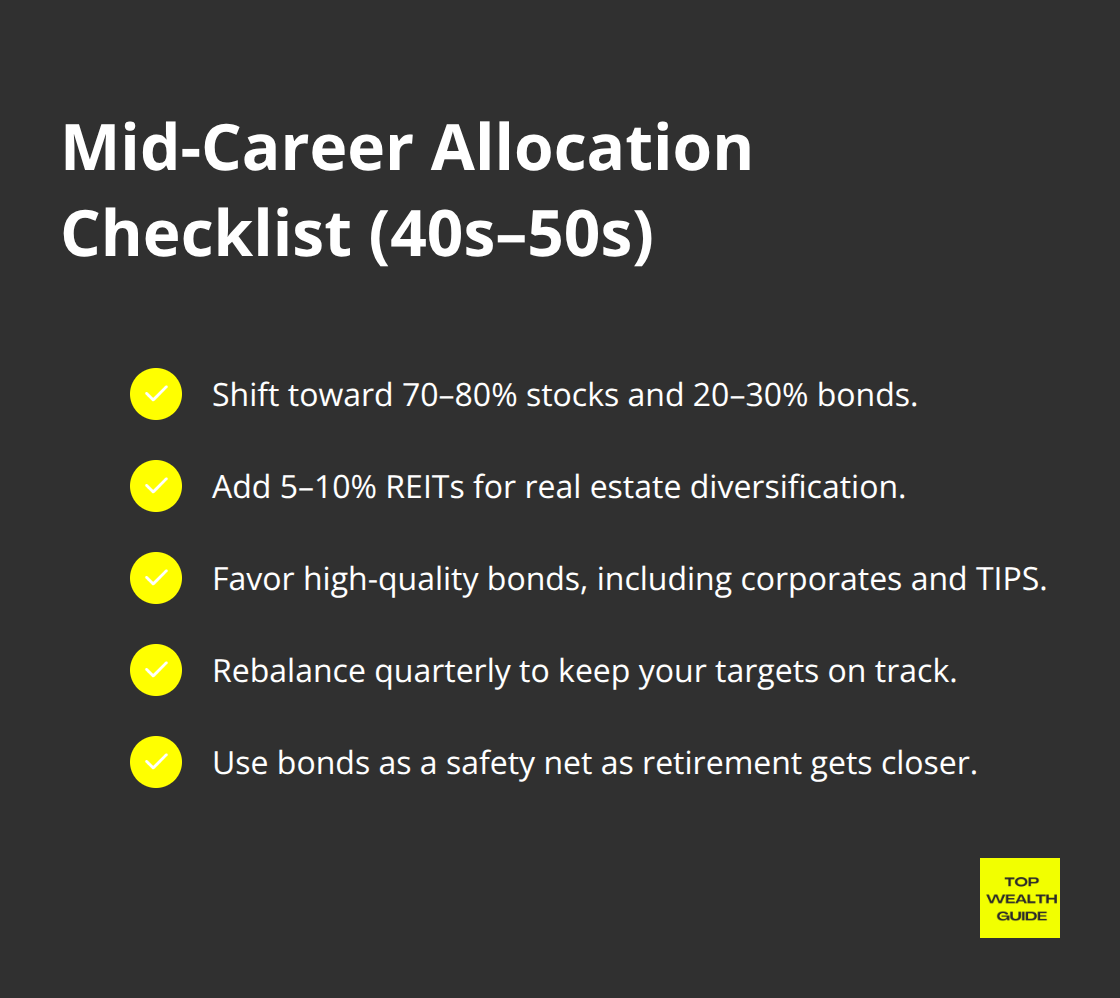

Mid-Career Portfolio Shifts

Entering your forties and fifties? Time to get a bit strategic-it’s rebalance o’clock. Research says moving to a 70-80% stock and 20-30% bond mix is the sweet spot. Why? You still want growth, but also a little more peace of mind when you sleep.

And listen-real estate investment trusts? Slide 5-10% of those into your basket during this stage. Remember 2008? The lesson was clear: when retirement is around the corner, bonds become your safety net.

Corporate bonds, Treasury Inflation-Protected Securities-they’re your new besties. And yep, rebalance every quarter-it’s not just a good habit; it’s proven to buff your returns over those who cling to buy-and-hold strategies for dear life.

Pre-Retirement Risk Management

Welcome to the 60-plus club! Capital preservation is the name of the game. The old-school rule says let your bond percentage mirror your age. But with folks living longer these days, tweaking to a 60-40 bond-to-stock ratio might be the smarter move.

Think of high-yield savings accounts and CDs as your trusty sidekicks-keep enough to cover 1-2 years of expenses in here. Municipal bonds? Perfect for the tax-savvy nearing retirement. And please, steer clear of those roller-coaster growth stocks post-65. Taking a big hit here? Not something you have the luxury of recovering from.

Sure, these strategies lay the groundwork, but your unique risk appetite and time horizon will paint the rest of the picture.

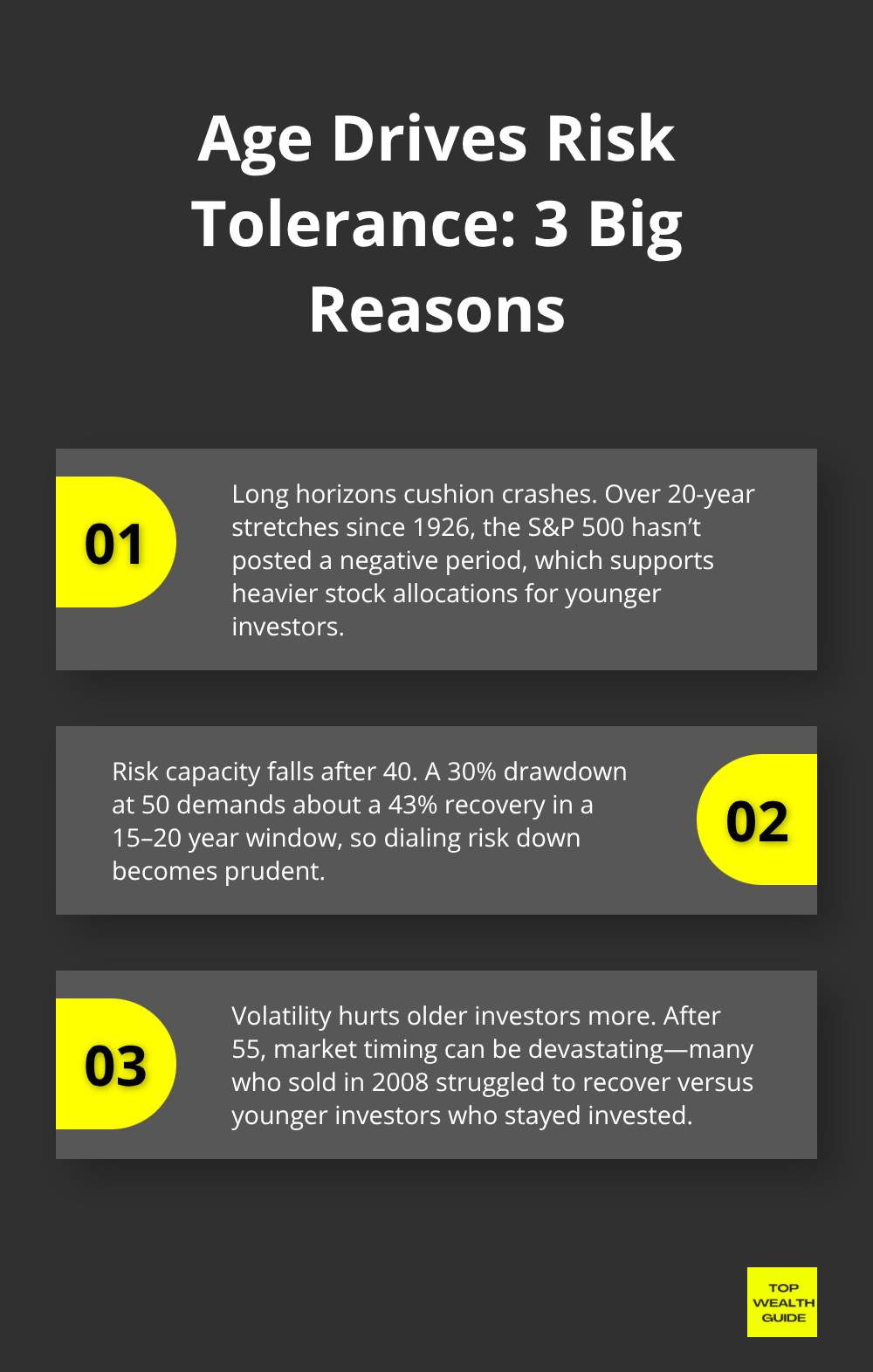

Why Your Age Determines Your Investment Risk Tolerance

Your appetite for risk? It’s not just a personality quirk-it’s all about the numbers. A 25-year-old? They can laugh off a 50% market nosedive because they’ve got decades-like four, to rebound. But if you’re 65 and that crash hits? Game over, man. The data’s on point: check the S&P 500, not one negative return period over 20 years since 1926. Not once.

Risk Capacity Shifts Everything After 40

Hit your forties, and everything changes-it’s less about risk appetite, more about managing what you’ve got. The smart folks? They go for that 70-30 or 60-40 stock-bond mix. Simple math: drop 30% on your portfolio at 50, and you need to claw back 43% just to get back where you started, all in a quick 15-20 years.

Market Volatility Destroys Older Investors

Trying to time the market after 55? Yeah, that’s playing with fire. Younger investors recover; older ones, not so much. Remember 2008? Brutal lesson there-investors over 55 who bailed on stocks had a way harder time bouncing back than the under-40 crowd. That’s the kind of difference that makes or breaks retirement.

Time Horizon Math Changes the Game

Check out the time horizon math-doesn’t lie. A 30-year-old has like 35 years until retirement, can ride out those market roller coasters. History tells us, big market corrections-20% dives, they pop up every 3-4 years. Young folks? They can chill through 8-10 of these before heading off into the sunset. But someone at 60? Just 1-2 corrections could spell disaster for their nest egg.

These age-based risk truths lay the groundwork for smart portfolio building-but here’s where it gets fun: seeing how these ideas shape your asset mix. That’s the real magic show.

What Do Winning Portfolios Look Like at Every Age

Alright, let’s dive into the numbers – where the action’s at. If you’re 25, here’s the play: 90% stocks, 10% bonds… end of story. Think Vanguard Total Stock Market Index and Total Bond Market Index funds – they’re cheap as chips with expense ratios under 0.05%. No need for the flashy extras.

Fidelity or Vanguard’s target-date funds are your autopilot buddies (your investment mix tweaks itself as you age, shedding about 1% in stocks each year after you hit 40). So, picture this: you’re pulling down $50K a year, maxing out a Roth IRA at $7K annually with this bold strategy – the math adds up to $1.2 million by the time you hang up your boots (assuming you’re pulling in a 7% annual return).

The 40-Something Sweet Spot

You’re in your forties now, so play it smart: 70% stocks, 25% bonds, and sprinkle in 5% REITs. Swap out some of those growth stocks for the big dividend guys – think Johnson & Johnson and Coca-Cola, the ones dishing out more dividends for 25 years or more. Add some international spice with developed market funds covering Europe and Asia.

Morningstar’s got the goods on this mix – it’s given 8.3% annual returns over three decades and cut volatility by 15% compared to going all-in on stocks. Rebalance every quarter, not once a year – MIT says it gives you an extra 0.4% bump annually. Extra cash never hurts.

The 60-Plus Safety Net

Once you hit 60, time to dial it back – 40% stocks tops, and the rest goes to high-grade bonds and ready cash. Treasury Inflation-Protected Securities (or TIPS if you’re cool) are a must-have – they’ve outshone standard bonds by 2.1% per year during inflation since 2000.

For the big earners in states with killer taxes like California or New York, municipal bonds are your best friends. Keep a stash – two years of living costs in high-yield savings accounts raking in 4-5% these days. Steer clear of growth stocks – Amazon tanked 50% in 2022, and when you’re pulling income, recovery time is the name of the game.

Final Thoughts

So here’s the deal: How you slice up your investments as you age-that’s what decides if you retire sipping piña coladas or clocking in till you drop. The math? Simple enough-go big on aggressive growth when you’re in your twenties and thirties. Then, shift to balanced portfolios as you cruise through your forties and fifties. Hit sixty, and it’s all about keeping what you’ve got. The big oops? Going all out conservative too early or channeling your inner Wall Street wolf when you’re coming in for a landing.

And here’s where folks really stumble-letting emotions grab the wheel. Market crashes? Yeah, they roll around every so often, but it’s panic selling that’s the real wealth killer. Young guns who bailed out in ’08? They missed the big bounce back. And those older folks stuck with growth stocks? Took a beating they couldn’t bounce back from.

So, jump in now with low-cost index funds, give them a little tweak every quarter, and hang tight to that age-wise blend. Max out those retirement accounts first. Once that’s locked, dive into the taxable investments (tax savings-trust me, those add up). At Top Wealth Guide, we break it all down-solid strategies, hard numbers, and no-nonsense steps to grow your wealth at every age leap.