To build serious wealth, just parking your money in a standard savings account — not gonna cut it. The savvy investors out there? They’re mixing high-return playbooks with passive income channels to really… turbocharge their money stack.

Our team at Top Wealth Guide has done the homework for you — yeah, you’re welcome. We’ve pinpointed tried-and-true methods that can seriously speed up your trek to affluence. We’re talking everything from dabbling in the stock market, to diving into real estate deals, and tapping into today’s digital income streams.

In This Guide

Which Investments Actually Multiply Your Money Fast

Stock Market Growth and Index Fund Power

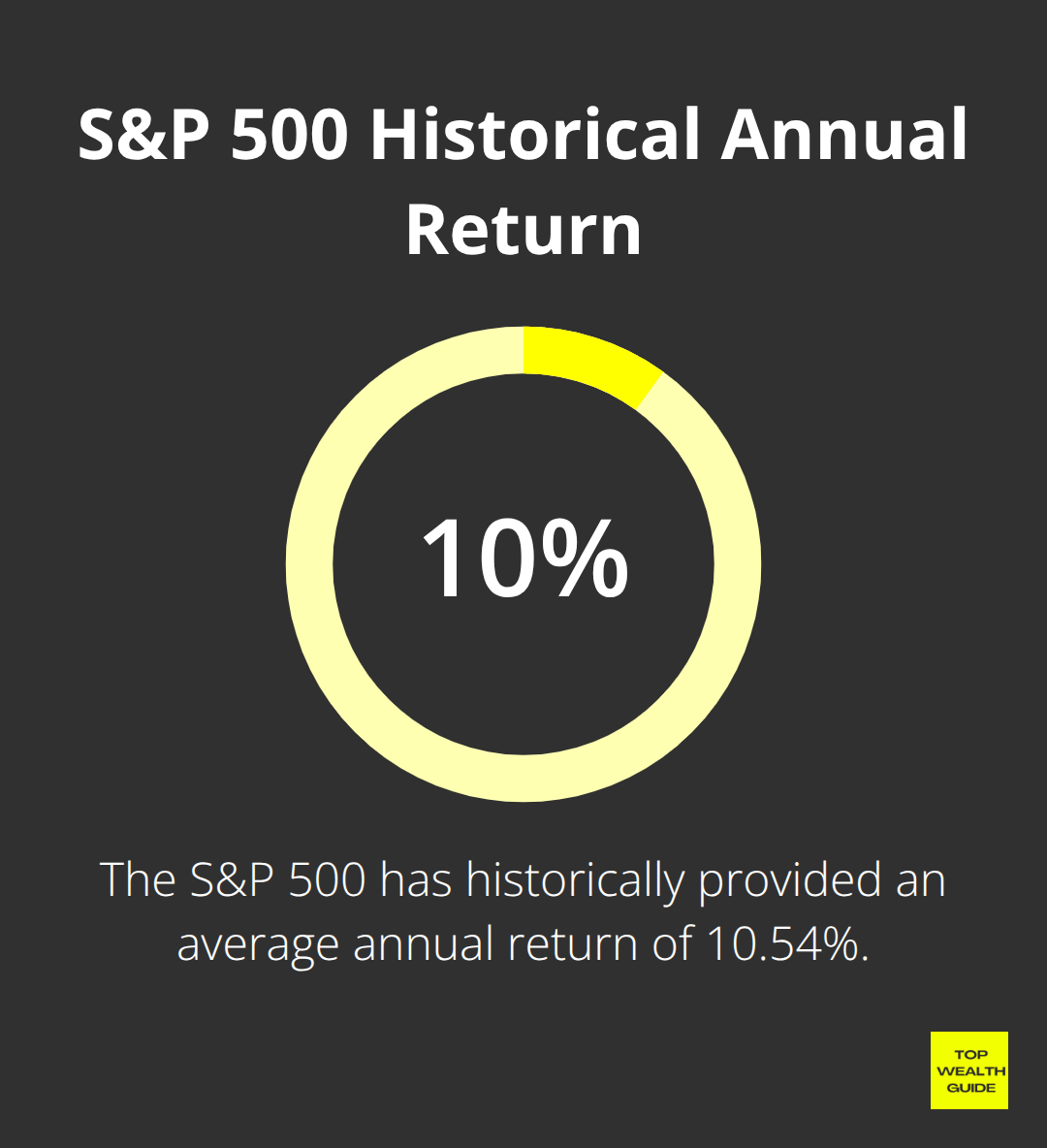

Alright folks, let’s talk about where you can actually make your money do a little dance. The stock market, still the go-to choice if you’re looking to turbocharge your wealth – and I mean with the right moves, of course. Growth stocks (yeah, the ones everyone’s drooling over) are all about companies that crank up earnings every single year… you know, your Apples and Microsofts. They leave the average market returns in their dust, especially in bull markets. The S&P 500? Solid at 10.54% annual returns, historically speaking, but growth stocks crush that. Now, if the mere thought of picking stocks gives you hives, index funds like VTSAX or VTI offer a buffet of 500+ companies with expense ratios below 0.05% – a no-brainer for those new to the game.

Real Estate That Actually Pays You Back

Then there’s real estate. It’s like owning a piece of the world without the drama of hefty down payments or dealing with tenants that don’t pay rent. Enter REITs, like that reliable friend Realty Income Corporation, serving up monthly dividends in the 4-6% zone while property values also catch a lift. Want more? Dive into direct rental properties – those little gems in booming areas often nudge 8-12% in returns through rent plus appreciation. And for the budget-conscious, real estate crowdfunding platforms like Fundrise? They roll out the red carpet with just $500 to join deals that once needed $100K+ just to get a foot in the door.

Alternative Assets Beyond Traditional Markets

And for those playing the long game, there’re the alternative assets – think of them as the avocado toast of investments. A little cryptocurrency, say 5-10% of your portfolio, could seriously rev up wealth acceleration. Bitcoin’s done its thing over the past decade (sure, it’s a rollercoaster, but what isn’t these days?). Commodities like gold and silver? Classic hedge against inflation when markets falter. And don’t sleep on volatile stocks, especially in emerging market equities, pulling in 6-8% returns through personal loans. Oh, and art, collectibles, intellectual property – those bad boys often shine, especially when the economy gets wobbly.

These high-octane strategies? They’re just part of your wealth-building playbook. The next big move? Creating those income streams that keep rolling in while you catch some shut-eye.

How Do You Build Income While You Sleep

Let’s talk about what the smart money does. Yep, passive income – the magic sauce separating the haves from the have-nots. The wealthy? They own assets that churn out cash like a mint, while everyone else is stuck swapping hours for dollars. Here at Top Wealth Guide, we cut through the noise and focus on strategies that, well, basically run on autopilot without you.

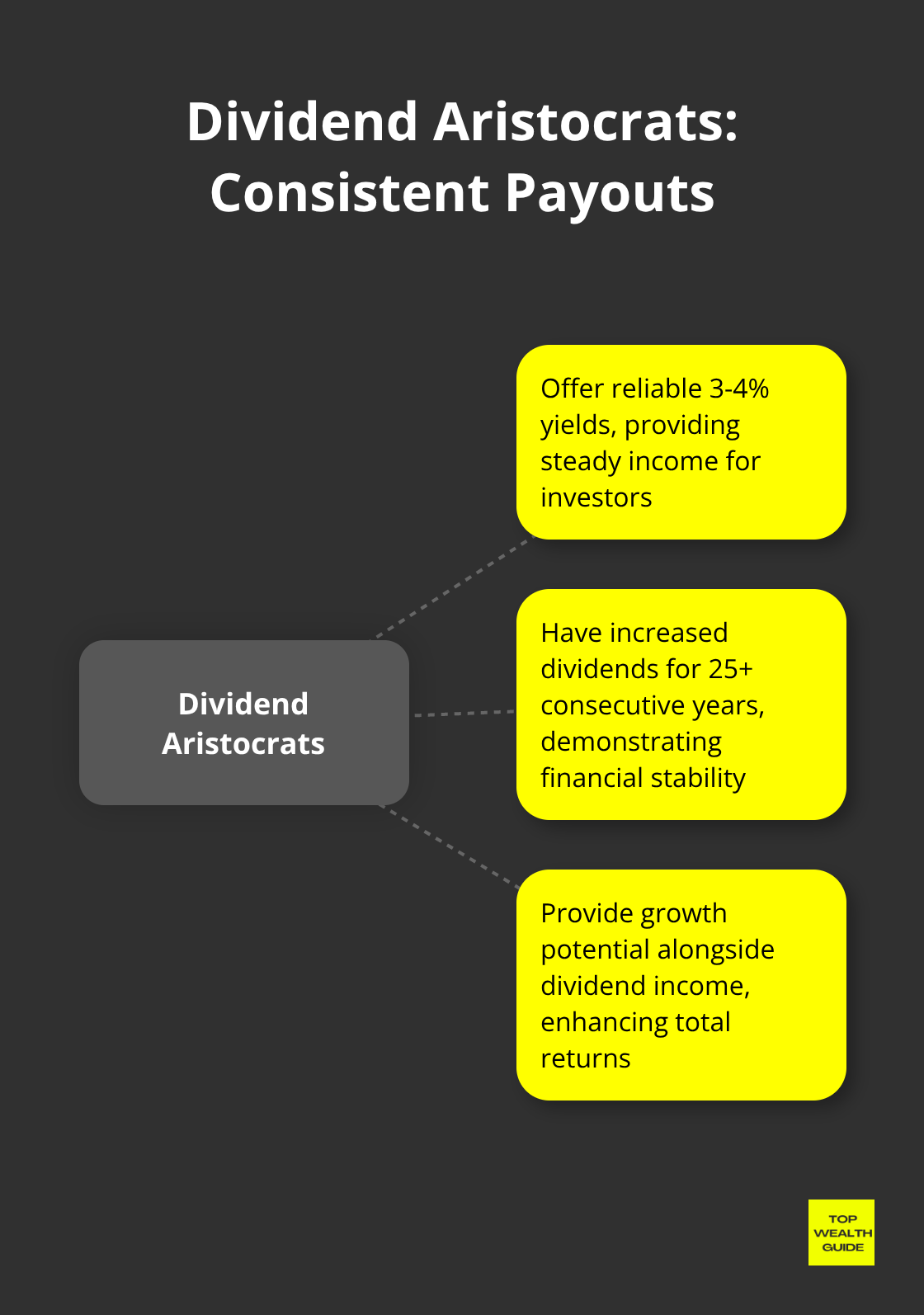

Dividend Stocks That Pay You Consistently

Enter the world of Dividend aristocrats. Ever heard of Johnson & Johnson or Coca-Cola? These guys have been shelling out increase after increase for 25+ years in a row. It’s like a financial metronome – reliable 3-4% yields with growth potential to boot. And if tracking this royalty is your jam, the Vanguard Dividend Appreciation ETF has you covered and at a measly 0.06% expense ratio. A bargain in Wall Street terms.

Now, bond strategies – not exactly the sexiest topic, but they get the job done. Treasury Direct? That’s your no-hassle way to lock in those 4-5% yields on 10-year notes, without giving a cut to brokers. LQD, a corporate bond ETF, throws a little more risk your way for a 4.8% payoff. Here’s where it gets spicy: reinvest those dividends and watch compound growth work its magic. A $100k portfolio earning 4%? Give it 20 years, and voilà, it’s $219k, just like that.

Digital Products That Generate Revenue

Cue the digital age: where online business models make your traditional job look like a horse and buggy. Over at Teachable, course creators rake in $1,000 to $50,000 monthly – that’s right, they get paid for knowing stuff. Then you’ve got your affiliate marketers – a little Amazon Associates action nets them 1-10% on stuff they hawk.

SaaS, or Software as a Service, is where it gets juicy, with those tasty 80-90% profit margins once you’ve built it. Kindle Direct Publishing flips book royalties into $500-$10,000 monthly for the savvy. Not to mention YouTubers cashing in through ads and sponsorships while the rest of us binge-watch. Here’s the kicker: master one model, knock it out of the park, then scale like there’s no tomorrow. The failure playbook? Jumping from one shiny object to another instead of nailing the execution.

Real Estate Without the Headaches

Sure, rental properties can dish out 8-12% returns – in the right market. But direct ownership? That’s like adding a second job to your plate. Enter real estate crowdfunding, where platforms like Fundrise require just $1,000 to join the party, promising returns of 8-12%. Meanwhile, YieldStreet opens doors to commercial deals once the domain of the big institutional players.

And how about those REITs? Realty Income Corporation does the heavy lifting, dealing out monthly dividends without the landlord headaches. Fundrise reported juicy returns depending on how long you stay in, but remember – yesterday’s news doesn’t promise tomorrow’s results. Mix diversified REIT portfolios with crowdfunding, spread the risk, and you still get that sweet yield.

Stringing together these passive income streams is like playing financial Tetris. What’s next? Ramp up your savings rate while eliminating debt that’s basically a giant vacuum sucking your potential wealth into a black hole.

Where Should You Stash Cash for Maximum Growth

High-Yield Savings That Actually Work

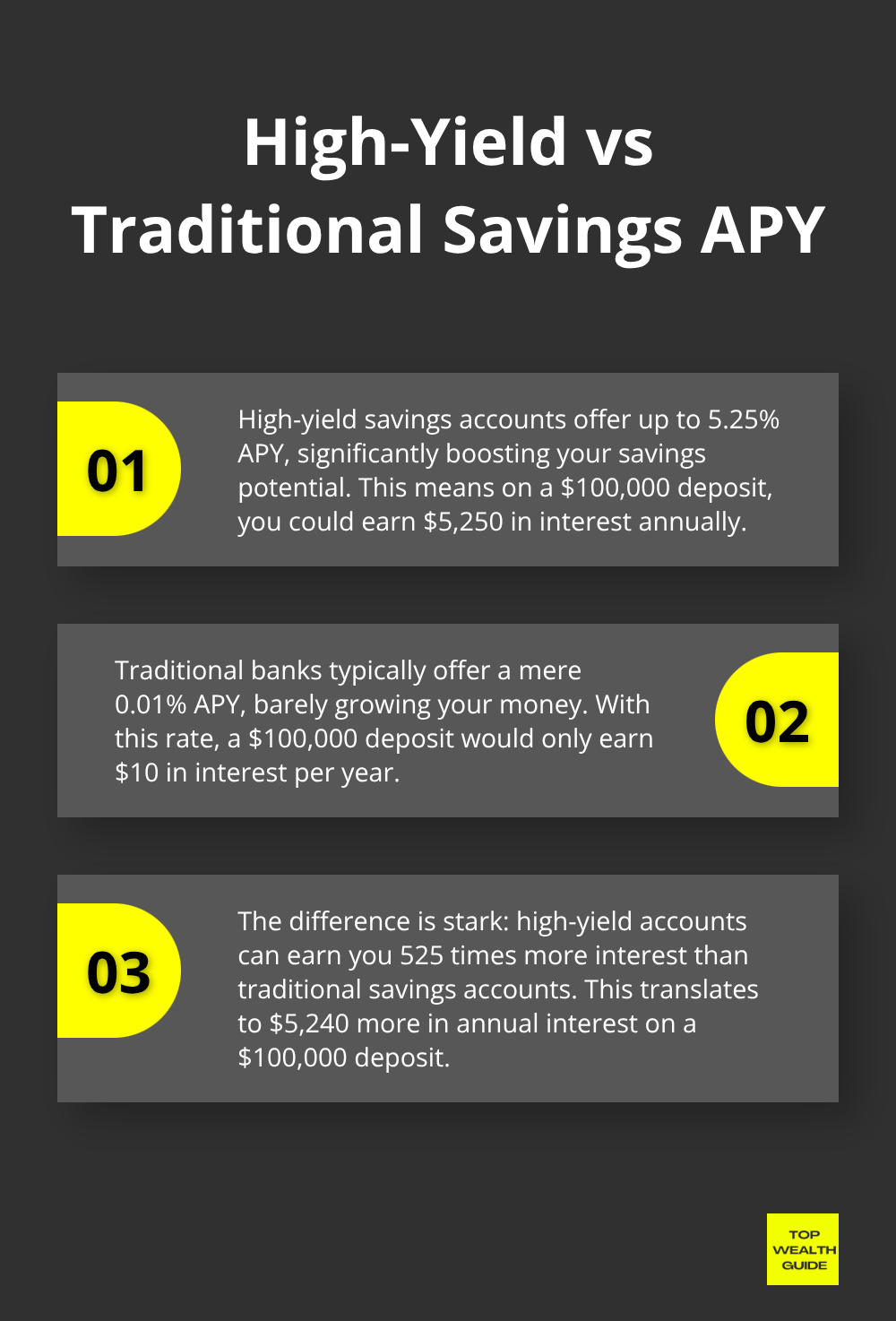

Let’s talk high-yield savings-miles ahead of those dinosaur banks. Look at Marcus by Goldman Sachs or Ally Bank, tossing out 4.5-5.25% APY. Compare that to the snooze-fest 0.01% from Chase or Bank of America. Do the math, folks-that’s $4,500 more each year on just $100k. Money market funds at places like Vanguard or Fidelity? They sweeten the pot even more, hitting 5.0-5.3%. The star of the show? Federal Money Market Fund VMFXX. Turn that rainy day fund into a roaring wealth engine, instead of letting inflation happily eat away at it.

Debt Destruction Before Wealth Creation

Credit card debt is the silent killer of dreams-high-interest rates that laugh at your investment returns. Go ninja on it with the avalanche method: pay minimums everywhere, then channel every extra cent to the highest interest rate debt. Debt consolidation through SoFi or LightStream could drop those rates to 7-15% for those who qualify. One rule though-stop racking up more debt. It’s simple math, really: rid yourself of any cash vampires first.

Tax-Advantaged Accounts That Multiply Money

Max out those tax-advantaged accounts. We’re talking 401k-stuff it up to $23,000 a year and grab that employer match. That’s free cash, my friends. Roth IRA backdoor strategies are the secret weapon for high earners who want to dodge those pesky limits. Traditional IRAs cut your taxes now, but Roth growth is your untaxed ride to the future. For anyone serious about leveling up their finances, these accounts are the hidden turbo boost-if you stick to the playbook.

Final Thoughts

Let’s be real – amassing wealth isn’t about finding a golden ticket. Nope. It’s about weaving together strategies like a finely knit sweater – different yet complementary threads. You’ve got your stock market play with those tempting 10%+ returns from growth stocks and index funds (…not too shabby). Then there’s the steady cash flow from REITs and rental properties – think slow and steady like a diesel engine. Looking for some sizzle? Cryptos and alternative assets add spice to those aggressive growth portfolios.

Start stacking that passive income by hitching your wagon to dividend aristocrats dishing out 3-4% yields, and keep it rolling with digital products that ring up $1,000 to $50,000 monthly (jackpot!). Real estate crowdfunding platforms like Fundrise swoop in, taking the hassle off your hands – no more landlord nightmares. They toss you 8-12% returns while you’re feet-up (midnight repair calls not included). And hey, high-yield savings accounts? They’re the savior to those measly 0.01% banks – we’re talking a solid 5%+.

Slice through that towering high-interest debt like a hot knife in butter. Next stop: tax-advantaged accounts – $23,000 in your 401k with employer matching? That’s a no-brainer. Knock these off one at a time, master each, then layer on the next. We at Top Wealth Guide are here to chart the course on your adventure to financial freedom.