Most investors panic when bear markets arrive. At Top Wealth Guide, we believe downturns create genuine wealth-building opportunities for those prepared to act.

This guide shows you concrete strategies to profit while others freeze. You’ll learn which assets to buy, how to generate income, and which sectors offer the best long-term potential.

In This Guide

What Happens to Your Money in a Bear Market

Defining Bear Markets and Their Historical Pattern

A bear market means a 20% or more decline in broad market indices over at least two months. Between 1929 and 2022, the S&P 500 experienced 27 bear-market declines of this magnitude, lasting an average of about 289 days according to Ned Davis Research. The typical decline reaches around 38.4%, but understanding what that means for your specific holdings matters far more than memorizing statistics. Different asset classes behave wildly differently during downturns, and knowing which ones hold value while others collapse separates disciplined investors from panic sellers.

The COVID-19 crash illustrates this perfectly: the S&P 500 dropped nearly 34% in five weeks starting in early 2020, yet by August 18 of that year, it had rebounded to prior highs. This wasn’t luck-it was the natural outcome of market cycles combined with smart positioning.

How Different Assets Respond to Downturns

Defensive sectors like consumer staples, utilities, and healthcare typically outperform during bear markets because people still buy groceries and pay for electricity regardless of economic conditions. Meanwhile, growth stocks and speculative names get hammered. Bonds often move in the opposite direction of stocks, which is why a diversified portfolio that includes both stocks and fixed income can produce positive real returns even when equity markets crater.

Research from Ned Davis shows that a 30% stock, 50% bond, and 20% cash portfolio generated about 7.3% real annual returns from September 1929 to February 1937, matching long-run equity returns while enduring one of history’s worst bear markets. This data proves that proper asset allocation protects wealth during severe downturns.

The Psychology of Bear Market Decisions

Your behavior during a bear market matters more than the market’s behavior. Investors who panic sell near the bottom lock in losses and miss the recovery. Morgan Stanley Wealth Management research shows that investors who were on track at the market peak largely stayed on track at the bottom if they had a formal financial plan. The psychological pressure during downturns is intense-watching your portfolio drop 30% or 40% triggers fear responses that evolved to keep us alive in physical danger, not to manage capital.

Most investors make their worst decisions during bear markets: they sell when prices are lowest and buy when they’re highest. Dollar-cost averaging removes this emotional trap by having you invest fixed amounts regularly regardless of price, letting you accumulate more shares when prices are depressed and fewer when they’re high.

Identifying Quality Companies Worth Buying

Large-cap, well-capitalized companies with strong balance sheets and positive cash flow weather downturns far better than overleveraged firms. During bear markets, quality matters intensely. A company with minimal debt, strong margins, and consistent cash generation can maintain dividends and operations while competitors fail.

This is why selective buying during downturns-focusing on fundamentally sound businesses trading at discounts-can build substantial wealth. The worst bear markets create the best opportunities for those prepared to act. When you understand which sectors hold up and which companies possess the financial strength to survive, you position yourself to profit while others remain frozen by fear.

Strategies That Actually Work in Bear Markets

Identifying Quality Companies Worth Buying

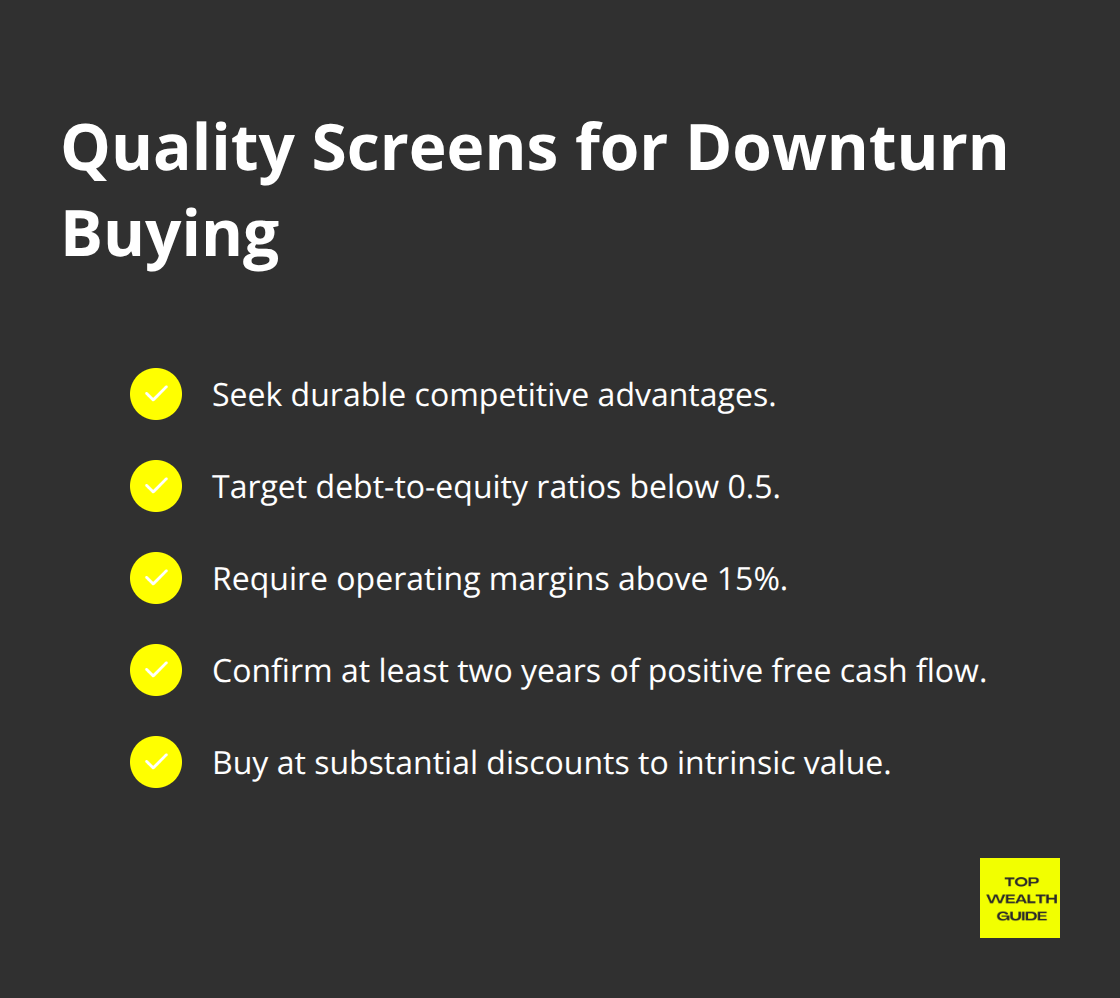

The most profitable bear market investors ignore timing the bottom and focus instead on what to buy and when to accumulate. Warren Buffett’s approach during downturns centers on identifying companies with durable competitive advantages, minimal debt, and strong management that trade at substantial discounts to intrinsic value. During the COVID crash, quality companies with fortress balance sheets recovered faster than overleveraged competitors. Start with screening for firms that maintain debt-to-equity ratios below 0.5, operating margins above 15%, and at least two years of positive free cash flow.

These metrics filter out struggling businesses and reveal companies positioned to weather the downturn and capture market share afterward.

Benjamin Graham taught in Security Analysis that you should buy at a margin of safety buying stocks 30% to 40% below intrinsic value absorbs your analytical errors and gives you a cushion if conditions worsen further. This approach protects your capital while positioning you for outsized gains when the market recovers.

Dollar-Cost Averaging Into Quality Names

Dollar-cost averaging removes the pressure to time the exact bottom. Investing $2,000 monthly into a diversified basket of defensive and quality growth stocks lets you accumulate more shares when prices crater and fewer when they recover. This systematic approach eliminates emotional decision-making and ensures you participate in the recovery without the stress of predicting market bottoms.

Defensive Sectors Provide Immediate Protection

Healthcare, consumer staples, and utilities typically decline less than the broader market during bear phases because demand for medications, groceries, and electricity remains constant regardless of economic conditions. Defensive stocks typically have a beta of less than 1.0, meaning they tend to perform better during sell-offs. Large-cap utility stocks yielding 3% to 4% with dividend histories spanning decades offer both income and capital preservation. These holdings generate steady cash flow while you wait for broader market recovery.

Fixed Income as Portfolio Ballast

Bonds move inversely to stocks; research from Ned Davis shows that adding fixed income to an equity portfolio substantially reduces volatility without sacrificing long-term returns. A portfolio weighted toward bonds during downturns provides stability and capital preservation while you position for the next bull market phase.

Advanced Tactics: Short Selling and Put Options

Short selling and put options appeal to traders with specific market views and risk tolerance for potentially significant losses. Short selling requires you to borrow shares and sell them, betting the price falls so you repurchase cheaper; put options give you the right to sell at a fixed price, capping losses to the premium paid. Both strategies carry substantial risk-short selling theoretically has unlimited loss potential, and most retail investors underestimate volatility and moves against their positions. If you pursue these tactics, limit position sizes to 5% of your portfolio maximum, use stop losses religiously, and focus on broad index shorts or sector ETF puts rather than individual stocks where company-specific news can trigger explosive moves against you.

The safest bear market approach combines quality stock accumulation through dollar-cost averaging with defensive sector rotation and modest fixed-income allocation. This strategy generates steady returns while volatility creates buying opportunities others ignore. Once you’ve positioned your core holdings for stability and recovery, the next step involves identifying which oversold sectors offer the strongest long-term potential for wealth accumulation.

How to Build Wealth When Markets Crash

The Power of Systematic Investment During Downturns

The systematic approach to profiting during bear markets separates successful investors from those who merely survive downturns. Rather than trying to predict market bottoms or chase momentum in falling sectors, a deliberate strategy combining regular investment, sector selection, and income generation works reliably. Dollar-cost averaging reduces initial timing risk and appeals to investors who understand the long-term importance of putting money to work. When you invest $1,500 to $2,500 monthly into a diversified basket regardless of price, you accumulate significantly more shares during the crash than during recovery periods. Someone who invested $2,000 monthly from March 2020 through August 2020 bought far more shares at $200 than at $300, yet stayed fully invested for the rebound. This mechanical discipline outperforms 95% of investors who attempt market timing. The mathematics work relentlessly in your favor: lower prices mean more shares purchased, and when the market recovers, those accumulated shares generate outsized gains.

Selecting Quality Companies Worth Your Capital

Focus your purchases on companies with debt-to-equity ratios below 0.5 and free cash flow that remains positive and growing. These metrics filter out struggling businesses and reveal companies positioned to weather the downturn and capture market share afterward. Oversold sectors reveal themselves through valuation metrics rather than sentiment. Healthcare trades at discounts during panics despite maintaining steady patient demand. Utilities and consumer staples typically decline 15% to 25% during bear markets versus 30% to 40% for the broader market, yet their dividend yields spike from 2.5% to 4.5% as prices fall. These aren’t speculative bets; they represent cash-generative businesses offering immediate income while you wait for broader recovery.

Large-cap healthcare stocks yielding 2% to 3% with 20-year dividend growth histories provide genuine downside protection because investors desperately seek stability during crashes, supporting prices even as growth stocks collapse. The key distinction separates amateur investors from professionals: professionals focus on fundamentals rather than sentiment, and they never chase falling knives hoping to catch the exact bottom.

Defensive Sectors Deliver Stability and Income

Defensive sectors provide immediate protection and steady cash flow during market turmoil. Utilities, healthcare, and consumer staples typically decline less than the broader market during bear phases because demand for medications, groceries, and electricity remains constant regardless of economic conditions. These holdings generate steady cash flow while you wait for broader market recovery. A utility stock yielding 3% to 4% with a dividend history spanning decades offers both income and capital preservation. When the broader market recovers, these positions appreciate alongside growth stocks, yet they’ve protected your capital and generated income throughout the downturn.

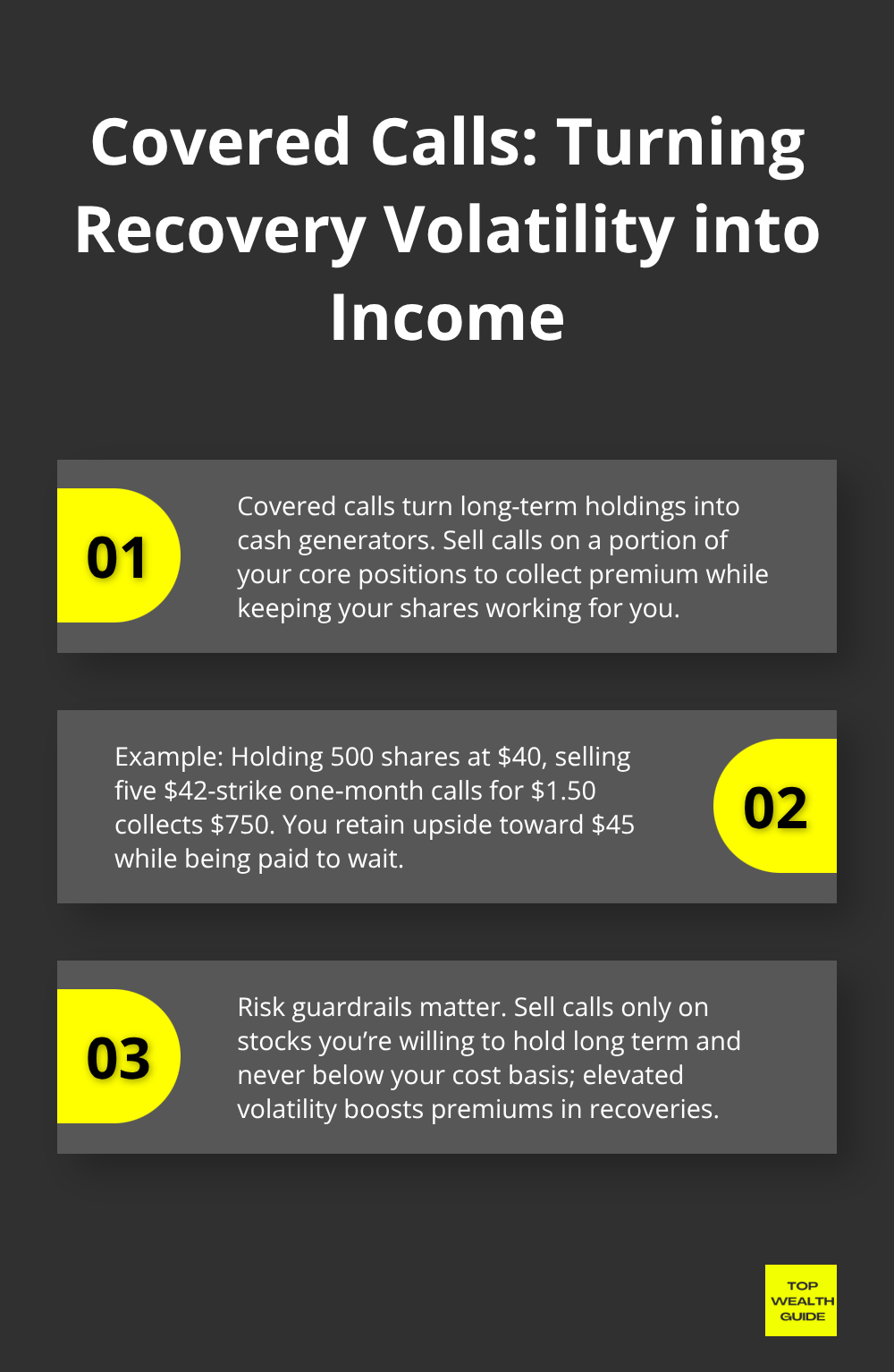

Income Strategies Amplify Returns During Recovery

Income strategies amplify returns during recovery phases when volatility finally decreases. Once you’ve accumulated quality dividend stocks through your systematic buying program, covered calls transform those holdings into income generators. Selling one-month covered calls against 25% of your core positions generates 2% to 3% monthly income on depressed valuations. If someone owns 500 shares of a utility stock trading at $40 after a 35% crash, selling five covered calls at the $42 strike for $1.50 per contract generates $750 monthly income while maintaining upside participation if the stock recovers to $45 or higher.

This strategy works because volatility during bear market recoveries is elevated, pushing option premiums substantially higher than normal periods. You sell expensive options against stocks you plan to hold long-term anyway, creating a win-win scenario. The key distinction separates amateur option sellers from professionals: professionals sell calls only against positions they’re comfortable holding indefinitely if assigned, and they never sell calls at strikes below their cost basis. A stock purchased at $35 after the crash should never have covered calls sold below that price. This mechanical income approach during the recovery phase compounds your wealth faster than passive holding alone, yet carries far less risk than aggressive short selling or purchasing out-of-the-money calls on speculative names.

Final Thoughts

Bear market profitability comes down to three core principles: systematic investment, quality selection, and disciplined income generation. Investors who build wealth during downturns ignore market noise and follow mechanical processes that remove emotion from decision-making. Dollar-cost averaging into quality companies with strong balance sheets and positive cash flow works because it forces you to accumulate more shares when prices are lowest, creating a mathematical advantage that compounds over time.

Balancing risk and opportunity requires honest assessment of your time horizon and financial situation. If you need cash within two years, defensive stocks and bonds protect capital while generating modest returns. If your investment horizon spans a decade or longer, aggressive accumulation of quality dividend stocks through systematic monthly purchases positions you for outsized gains when the bear market recovers and the market rebounds to new highs.

Your conviction during downturns separates you from the 95% of investors who panic sell near lows. When you understand that bear markets are temporary, that quality companies survive and thrive afterward, and that lower prices mean better future returns, you act with confidence while others freeze. We at Top Wealth Guide believe bear markets reveal character and separate disciplined wealth builders from reactive traders, and your plan becomes your north star during volatility.