Many investors dismiss blue chip stocks as boring relics of the past. But the data tells a different story.

At Top Wealth Guide, we’ve seen how these established companies deliver steady returns, meaningful dividends, and genuine protection when markets turn volatile. This guide shows you exactly why blue chip stocks belong in your portfolio today.

In This Guide

What Are Blue Chip Stocks

Blue chip stocks are shares of large, financially stable companies with market capitalizations typically around $10 billion or more. These businesses have built strong reputations, operate across multiple markets, and produce consistent earnings year after year. Think of companies like Microsoft, Coca-Cola, Johnson & Johnson, and Berkshire Hathaway-names that appear in everyday products and services. What separates them from smaller companies isn’t just size; it’s their ability to maintain profitability through economic cycles. These firms have weathered recessions, adapted to market shifts, and continued paying dividends even during downturns. The term itself comes from poker, where blue chips held the highest value, reflecting how investors view these stocks as premium holdings in any portfolio.

How Blue Chips Performed When Markets Crashed

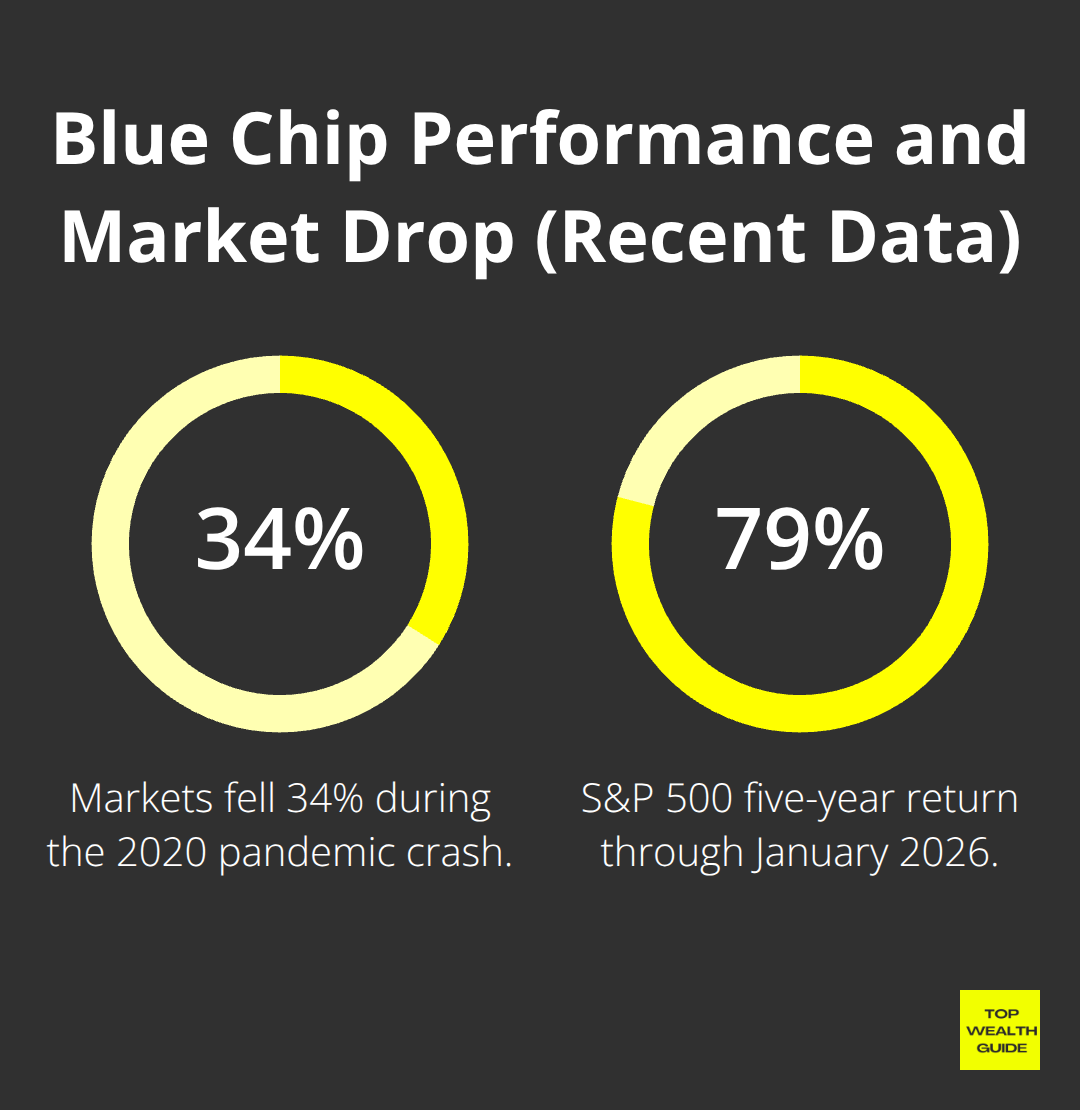

The 2008 financial crisis tested blue chips severely, yet they recovered faster than smaller stocks. Companies like Microsoft and Coca-Cola maintained dividend payments throughout the crisis, providing income when investors needed it most. Fast forward to the 2020 pandemic crash-markets fell 34% in weeks, but blue chips like Apple and Microsoft not only recovered but reached new highs within months. Over the past five years through January 2026, the S&P 500 index, dominated by blue chips, returned approximately 79%, while the Nasdaq Composite gained about 107%.

This demonstrates that blue chips don’t just survive volatility; they often emerge stronger. Dividend-paying blue chips cushioned losses during downturns because investors continued receiving payments, reducing the psychological pressure to sell during panic.

Why Blue Chips Beat Growth and Emerging Stocks Long Term

Growth stocks promise explosive returns but deliver inconsistency. A startup-focused fund might soar 50% one year then drop 40% the next. Blue chips like Procter & Gamble and Exxon Mobil offer something different-steady 8-12% annual returns with far less stomach-churning swings. Emerging market stocks carry currency risk and political uncertainty that blue chips largely avoid. When you own Microsoft or Visa, you own exposure to global economic growth without betting on any single country’s stability. Blue chips also solve the timing problem that destroys most investors. Rather than trying to pick the next Tesla, you own companies already producing massive cash flows. Coca-Cola has paid dividends for over 120 years, increasing payouts consistently. That track record beats any growth story because it’s proven, not promised.

What Makes These Companies Stand Out

Blue chip companies possess characteristics that smaller firms struggle to match. They control significant market share in their industries, which protects them from sudden competitive threats. Strong balance sheets mean they can invest in innovation, acquire smaller competitors, or return cash to shareholders through dividends and buybacks. These firms also attract top talent and maintain pricing power-customers pay premium prices for Coca-Cola or Microsoft products because they trust the brand.

Financial strength allows blue chips to weather supply chain disruptions, regulatory changes, and economic slowdowns that would cripple weaker companies. This resilience translates into lower volatility for your portfolio and more predictable returns over time.

The Dividend Advantage That Compounds Over Decades

Dividend payments separate blue chips from most other stocks. Companies like Johnson & Johnson and Procter & Gamble have increased dividends for 60+ consecutive years, rewarding long-term shareholders with rising income. When you reinvest dividends back into the stock, you harness the power of compounding-earning returns on your returns. A $10,000 investment in a blue chip paying 2-3% dividends that you reinvest can double in value over 20-25 years without you adding another dollar. This passive income stream also provides psychological comfort during market downturns because you still receive payments regardless of stock price fluctuations. The combination of capital appreciation and dividend growth makes blue chips particularly effective for building wealth over decades.

These characteristics explain why blue chips have remained central to successful portfolios across generations. Understanding their strengths sets the stage for examining the specific financial benefits they deliver to your overall investment strategy.

How Blue Chips Generate Real Wealth Through Income and Stability

Dividends That Actually Arrive in Your Account

Blue chip dividends aren’t theoretical promises-they’re actual cash flowing into your account every quarter. When you own 100 shares of a blue chip yielding 2.5% annually, that’s real money arriving whether the stock price rises, falls, or stays flat. This income stream matters because it separates your returns from market sentiment. During the 2020 pandemic crash, investors who owned dividend-paying blue chips continued receiving payments while panicked traders watched their growth stocks crater 50% or more. The practical advantage surfaces immediately: dividends fund living expenses, reinvest for compounding, or simply reduce portfolio anxiety during downturns.

How Reinvested Dividends Build Wealth Over Time

Johnson & Johnson, another dividend aristocrat with 60+ years of consecutive increases, demonstrates that reinvested dividends compound dramatically over time. A $50,000 investment in a blue chip paying 2.5% dividends that you reinvest can generate an additional $15,000 to $20,000 in capital over 20 years without touching your principal. This happens because reinvested dividends purchase more shares at various prices, amplifying your ownership stake automatically. Each quarter, your dividend payment buys fractional shares, which then produce their own dividends-a self-reinforcing cycle that accelerates wealth creation.

The Volatility Advantage That Protects Your Portfolio

The volatility gap between blue chips and other stocks directly impacts your portfolio’s ability to weather downturns without forcing you into bad decisions. Apple and Microsoft experienced single-day swings exceeding 5% during recent market corrections, yet their 52-week volatility ranges typically fall below 30%, compared to 60%+ for emerging growth stocks. This stability allows you to sleep at night instead of obsessing over daily price movements. Sector-specific downturns rarely crater your entire position when you own blue chips across multiple industries.

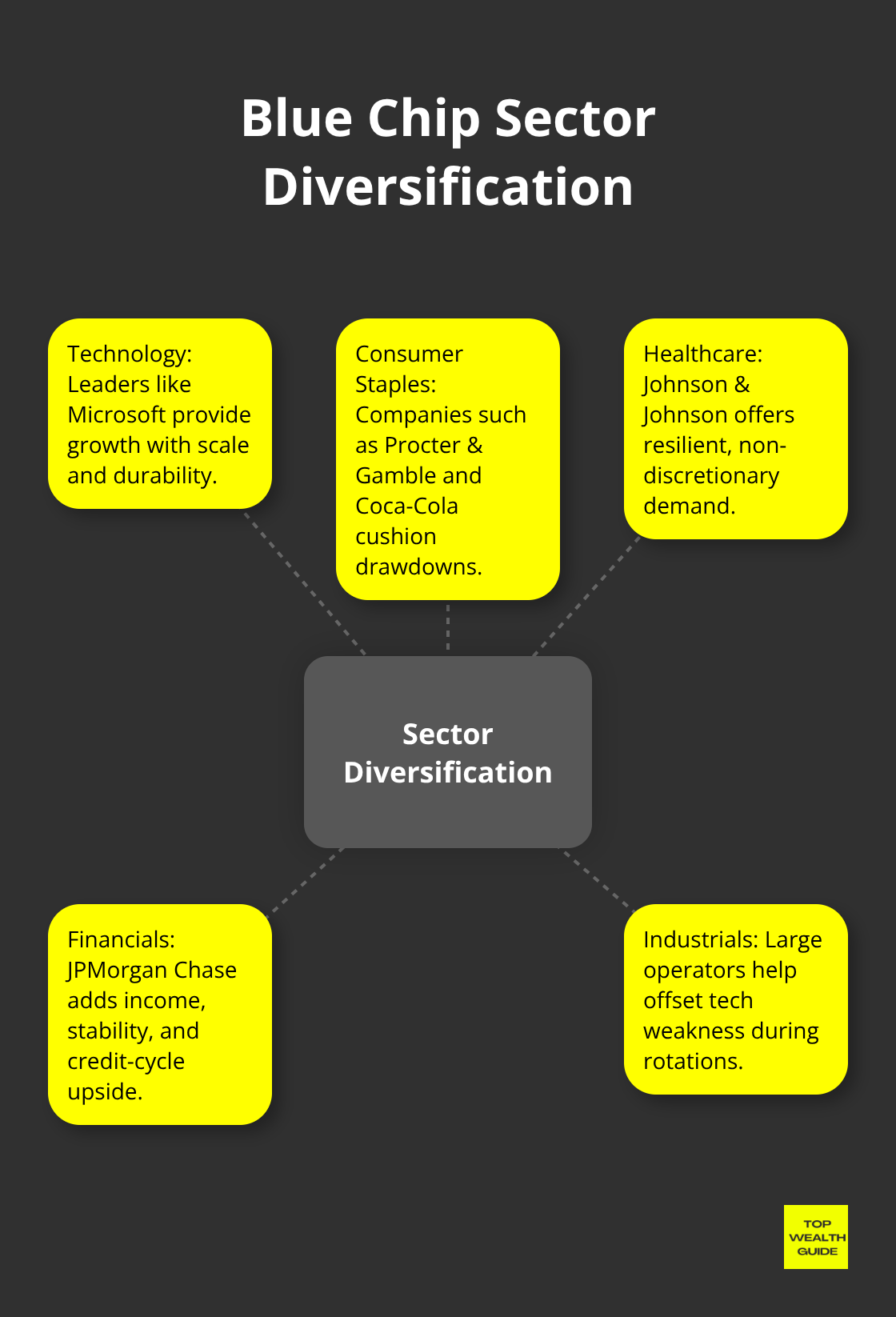

Sector Diversification Creates a Balanced System

The S&P 500, dominated by blue chips, includes companies across technology, consumer staples, healthcare, financials, and industrials-meaning weakness in one area gets offset by strength elsewhere. When tech stocks fell 25% in early 2022, blue chip consumer staples like Procter & Gamble and Unilever held their ground, cushioning overall portfolio damage.

Building a blue chip foundation across sectors means owning Microsoft for tech exposure, Johnson & Johnson for healthcare, Coca-Cola for consumer staples, and JPMorgan Chase for financials. This approach creates a balanced system where these companies operate in different economic cycles and serve different consumer needs, making simultaneous collapses nearly impossible. Sector diversification works because strength rotates throughout market cycles-what struggles one year often leads the next.

Understanding how blue chips generate income and stability through dividends and sector balance reveals why they deserve consideration in your portfolio. The next section examines how these stocks perform in today’s market environment and identifies which companies continue delivering results.

How Blue Chips Perform When Markets Shift

Blue chip stocks have delivered measurable outperformance across recent market cycles, and the data vindicates investors who held positions through volatility. From January 2021 through January 2026, the S&P 500 returned approximately 79% while the Nasdaq Composite gained about 107%, yet this headline masks a critical truth: blue chips within those indices provided stability that growth stocks couldn’t match. During the 2022 market correction when tech stocks fell 25%, blue chip consumer staples and industrials cushioned losses for balanced portfolios. Apple climbed roughly 200% over the five-year period despite multiple 10-15% pullbacks, while Microsoft gained about 166%, proving that large-cap leaders can compound wealth substantially without requiring you to time market entry perfectly. Coca-Cola and Johnson & Johnson delivered steady 8-12% annual returns through dividend payments plus modest capital appreciation, rewarding patient shareholders who ignored short-term noise.

Which Blue Chips Actually Delivered Results Recently

The companies that matter most today are those that demonstrate earnings growth alongside dividend reliability. Microsoft stands out because it expanded earnings per share by over 20% annually while maintaining a growing dividend, combining growth and income in a way most stocks cannot achieve. Visa processed over 190 billion transactions in 2024, generating recurring revenue that powers consistent dividend increases. Procter & Gamble maintained pricing power throughout inflation, raising prices on consumer staples without losing market share, which translates directly into higher dividend payments for shareholders. These aren’t theoretical advantages; they represent concrete business outcomes that translate into actual returns in your account. When you own these companies, you benefit from their ability to raise prices on essential products that consumers repurchase monthly, creating predictable cash flows regardless of economic conditions. JPMorgan Chase and Bank of America both increased dividends substantially in 2024 despite banking sector headwinds, signaling management confidence in future earnings power. The practical lesson here is straightforward: blue chips that grow earnings and raise dividends consistently outperform those relying on stock price appreciation alone.

Why Economic Slowdowns Reveal Blue Chip Strength

Economic slowdowns separate blue chips from weaker companies because established firms possess pricing power and market share that smaller competitors lack. During the 2023-2024 period when inflation pressures forced many companies to absorb rising costs, blue chips like Coca-Cola and Microsoft actually expanded profit margins through price increases that customers accepted without complaint. This happens because switching costs matter; replacing your Microsoft software or Coca-Cola supply chain carries friction that protects margins. When consumer spending weakens, blue chip staples companies like Procter & Gamble and Unilever continue generating revenue because people still purchase toothpaste, soap, and personal care items regardless of economic cycles. Healthcare blue chips including Johnson & Johnson prove even more resilient because medical treatments and pharmaceutical products represent non-discretionary spending. The real advantage surfaces when you compare this to growth stocks, which typically see earnings collapse during slowdowns because customers defer purchases or switch to cheaper alternatives. Holding blue chips means your portfolio continues generating dividends and modest capital appreciation even when broader economic growth slows, protecting your wealth during the inevitable downturns that occur every 5-7 years.

Final Thoughts

Blue chip stocks solve real problems that other investments cannot address simultaneously. They generate actual dividend income that arrives quarterly, provide stability when markets panic, and compound wealth over decades without requiring you to predict market timing or identify the next breakout company. The evidence proves clear: companies like Microsoft, Coca-Cola, and Johnson & Johnson have delivered consistent returns through multiple market cycles while protecting shareholders during downturns.

Building a balanced approach means treating blue chip stocks as your portfolio foundation rather than your entire strategy. Start by allocating 40-60% of your investment capital to blue chips across different sectors, then add bonds or fixed deposits for additional stability, and include smaller allocations to growth stocks or international equities for upside potential. This structure lets you capture the wealth-building power of blue chips while maintaining exposure to faster-growing opportunities.

Your next step involves evaluating which blue chips align with your specific situation. Research companies in sectors relevant to your goals, examine their dividend history and growth rates, and confirm they maintain strong balance sheets. Top Wealth Guide provides practical frameworks and analysis tools to help you identify opportunities that match your risk tolerance and timeline.