Dollar-cost averaging (DCA) is a simple but powerful investment strategy. It involves investing a fixed amount of money at regular intervals, no matter what the market is doing. This disciplined method means you end up buying more shares when prices are low and fewer when they are high, which can smooth out your purchase price over the long haul.

In This Guide

- 1 Understanding the Core of Dollar Cost Averaging

- 2 How Dollar-Cost Averaging Works: A Real-Life Example

- 3 The Pros and Cons of Dollar-Cost Averaging

- 4 When to Use Dollar-Cost Averaging in Your Strategy

- 5 How to Automate Your Dollar-Cost Averaging Plan

- 6 Frequently Asked Questions About Dollar-Cost Averaging

- 6.1 1. Is Dollar-Cost Averaging Better Than Lump-Sum Investing?

- 6.2 2. What Is the Best Frequency for Investing (Weekly, Monthly)?

- 6.3 3. Can I Use DCA for Individual Stocks or Crypto?

- 6.4 4. What Happens if the Market Only Goes Up After I Start?

- 6.5 5. How Long Should I Use the DCA Strategy?

- 6.6 6. Does Dollar-Cost Averaging Guarantee a Profit?

- 6.7 7. What's the Biggest Mistake to Avoid with DCA?

- 6.8 8. What Are the Best Assets to Use With DCA?

- 6.9 9. Should I Ever Change My DCA Investment Amount?

- 6.10 10. Is DCA Only for Beginners or Small Investments?

- 7 Your Path to Consistent and Confident Investing

Understanding the Core of Dollar Cost Averaging

Think of it like buying gas for your car. You probably have a budget, say $50 a week. When gas prices are high, that $50 gets you fewer gallons. When prices drop, that same $50 fills the tank up more. You didn't try to predict the price swings; you just stuck to your budget and naturally bought more when it was cheaper.

That’s the exact logic behind dollar-cost averaging, just applied to assets like stocks, ETFs, or even crypto. It's a method designed to take the emotion and guesswork out of investing. Instead of chasing the impossible dream of "timing the market" perfectly, you commit to a consistent plan, turning market volatility from an enemy into a potential ally.

Key Principles of the Strategy

The whole approach hinges on a few simple ideas that work together to build discipline and manage risk.

- Fixed Investment Amount: You decide how much you'll invest each time—maybe $100 or $500. This keeps you from getting carried away and investing too much when the market feels hot.

- Regular Intervals: The real magic is in the consistency. You invest on a set schedule, whether it’s weekly, bi-weekly, or monthly. This automates the decision-making and stops you from reacting to scary headlines.

- Averaging Your Purchase Price: Because you're investing the same dollar amount, you automatically scoop up more shares when they're on sale and fewer when they're expensive. This is the mechanism that defines the strategy.

By committing to a regular investment schedule, you shift your focus from short-term market timing to long-term accumulation. The goal isn't to buy at the perfect moment, but to build a position over many moments, good and bad.

This strategy really shines because it builds a system around your investing. It forces a disciplined habit that’s hard to stick with on your own, especially when the market swings between fear and greed.

Dollar Cost Averaging At a Glance

To make this crystal clear, let's break down how these core principles work in practice. The table below gives you a quick snapshot of the entire concept.

| Principle | How It Works | Key Benefit |

|---|---|---|

| Fixed Investment Amount | You invest the same amount of money each period, for example, $100 per month. | Establishes a disciplined investing habit and prevents emotional overspending at market highs. |

| Regular Intervals | Investments are made on a consistent schedule, such as weekly, bi-weekly, or monthly. | Automates your investment process and removes the temptation to make impulsive decisions. |

| Ignores Market Fluctuations | You commit to investing whether the market is surging or dipping. | Reduces risk by avoiding emotional reactions like panic selling or fear of missing out. |

| Averages Your Purchase Price | Your fixed dollar amount naturally buys more shares when prices are low and fewer when they are high. | Potentially lowers your average cost per share compared to the average market price over time. |

Ultimately, DCA provides a straightforward and repeatable framework for building wealth over time without needing a crystal ball.

How Dollar-Cost Averaging Works: A Real-Life Example

Alright, let's move past the theory and see how dollar-cost averaging (DCA) actually plays out in the real world. Imagine an investor named Alex who wants to get started but is nervous about trying to "time the market." It’s a common fear.

Alex decides to keep it simple and invest a fixed amount of $100 every single month into an S&P 500 ETF. This is a classic, set-it-and-forget-it approach. The key here is consistency. Alex's $100 goes in like clockwork, regardless of whether the market is having a great month or a terrible one. This takes the emotion right out of the equation.

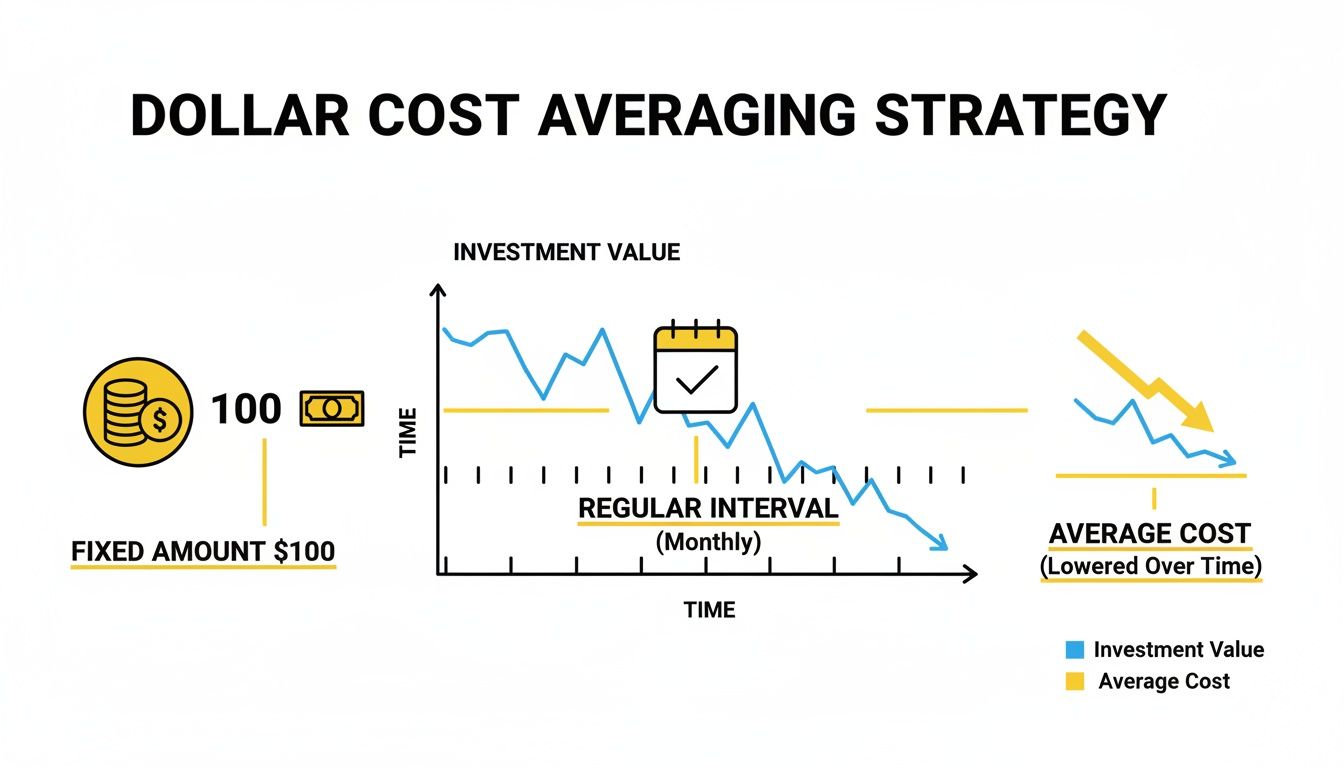

The basic idea is illustrated below: you invest a fixed amount on a regular schedule. Over time, this discipline naturally helps you lower your average purchase price.

As you can see, the process isn’t complicated. It’s designed to turn the market's natural ups and downs into an advantage rather than a source of stress.

A Step-by-Step Example

Some months, the ETF's price is a bit high, so Alex's $100 buys fewer shares. But in other months, when the market dips and prices are lower, that same $100 automatically scoops up more shares. This is the heart of the strategy. Alex isn't trying to guess what will happen next; the consistent investment does the smart work automatically.

Pay attention to how the number of shares Alex buys changes each month. It’s an inverse relationship: when the price goes down, the share count goes up. This is how DCA thrives on the very price swings that make other investors anxious. You can learn more about these market movements in our guide on what is market volatility.

To make it crystal clear, let's break down Alex's first six months in a table.

Alex's $100 Monthly Investment Journey

Here’s a look at how Alex’s steady $100 monthly investment performed as the share price fluctuated.

| Month | Investment Amount | Share Price | Shares Purchased | Total Shares Owned | Total Invested | Average Cost Per Share |

|---|---|---|---|---|---|---|

| January | $100 | $50 | 2.00 | 2.00 | $100 | $50.00 |

| February | $100 | $45 | 2.22 | 4.22 | $200 | $47.39 |

| March | $100 | $40 | 2.50 | 6.72 | $300 | $44.64 |

| April | $100 | $42 | 2.38 | 9.10 | $400 | $43.96 |

| May | $100 | $48 | 2.08 | 11.18 | $500 | $44.72 |

| June | $100 | $52 | 1.92 | 13.10 | $600 | $45.80 |

Analyzing The Results

So, what happened after six months? Alex invested a total of $600 and now owns 13.10 shares. But the most important number to look at is the average cost per share: $45.80.

Why does this matter? Because the average market price of the ETF over that same period was $46.17. Alex effectively paid less per share than the "average" price, all without any special effort.

Think about the alternative. If Alex had tried to time the market and dumped the full $600 in June when the price peaked at $52, they would have only bought 11.54 shares.

By sticking to a simple, unemotional plan, Alex ended up with more shares for their money. They turned market volatility from a threat into an opportunity, all without the stress of trying to predict the future.

The Pros and Cons of Dollar-Cost Averaging

Let's be clear: no investment strategy is a silver bullet. Every approach has its moments to shine and its potential blind spots. To figure out if dollar-cost averaging (DCA) is the right tool for your financial toolkit, you have to look at both sides of the coin. A balanced view is the only way to see if it truly fits your goals and, just as importantly, your temperament as an investor.

The biggest win for DCA is how it helps manage the two things that derail most investors: risk and emotion. By putting your investments on autopilot, you neatly sidestep the temptation to time the market—a game even the pros rarely win. This discipline is a powerful antidote to fear-driven selling during a downturn or greed-fueled buying at a market peak.

The Advantages of a Steady Approach

For long-term investors, especially those just getting their feet wet, the benefits of dollar-cost averaging are hard to ignore.

- Keeps Emotions in Check: Its set-it-and-forget-it nature forces you to stick to the plan. This system keeps you from panic-selling when the market dips or chasing a hot stock out of FOMO. Logic trumps emotion.

- Softens the Blow of Bad Timing: We all have that fear of investing a large sum of money right before a massive market crash. DCA smooths this out by spreading your investments over time, meaning you never go "all in" at a single, potentially terrible, price point.

- Makes Investing Simple: DCA is a wonderfully straightforward way to start building a portfolio. You don't need to be a market wizard overnight. It just gets you into the crucial habit of saving and investing consistently.

The real magic of dollar-cost averaging is the psychological peace of mind it offers. It provides a clear plan that can turn market volatility from a source of stress into a built-in opportunity to lower your average cost over the long haul.

At its core, this strategy is all about consistency. And consistency is the bedrock of building real, lasting wealth. Committing to a regular schedule ensures you’re always participating in the market, methodically accumulating assets through all its ups and downs.

Potential Drawbacks to Consider

While DCA is fantastic for managing risk, it’s not perfect. There are trade-offs, particularly when the market is behaving in certain ways.

The primary downside is something called “cash drag.” This happens when your money is sitting on the sidelines, waiting for its turn to be invested. In a strong, steadily rising market, that uninvested cash is missing out on gains. An investor who put all their money in at the beginning would have come out ahead.

History tends to back this up. A landmark study from Vanguard revealed that from 1976 to 2022, lump-sum investing actually outperformed DCA about 68% of the time across global markets. Why? Because, over the long term, markets have historically gone up more than they've gone down. You can dive deeper into the full analysis of lump-sum vs. DCA strategies to see the numbers for yourself.

DCA vs. Lump-Sum Investing: A Head-to-Head Comparison

To really nail down the differences, here’s a head-to-head look at dollar-cost averaging versus its main alternative, lump-sum investing. This table helps you decide which strategy aligns better with your goals and risk tolerance.

| Feature | Dollar-Cost Averaging (DCA) | Lump-Sum (LS) Investing |

|---|---|---|

| Primary Goal | Minimize risk and the potential for regret by averaging out your purchase price. | Maximize potential returns by getting all of your capital working for you immediately. |

| Best in… | Volatile or declining markets where you can buy shares at a discount. | Consistently rising (bull) markets where every day counts. |

| Psychological Impact | Much lower stress. It promotes discipline and makes it easier to stay the course. | Can be nerve-wracking. A market drop right after you invest can be tough to stomach. |

| Historical Returns | Often lower than lump-sum in markets that trend upward over the long run. | Tends to outperform DCA about two-thirds of the time, according to historical data. |

So, what’s the right call? It really comes down to what you prioritize: squeezing out every last potential penny of return, or sleeping well at night knowing you've minimized the risk of bad timing. While lump-sum might win more often on paper, DCA’s real strength is keeping you calmly invested through the market's inevitable turbulence—and that might be the most valuable feature of all.

When to Use Dollar-Cost Averaging in Your Strategy

Knowing when to use an investment strategy is just as important as knowing how it works. Dollar-cost averaging isn't the perfect tool for every single situation, but it really shines in scenarios where keeping risk and emotions in check is the top priority.

For a lot of people, DCA is the ideal on-ramp to the world of investing. It’s a structured, low-stress way for beginners to start building a portfolio without feeling paralyzed by the need to find the "perfect" time to jump in.

Ideal Scenarios for Implementing DCA

The real magic of this strategy happens when you match it with the right financial goals and market conditions. It’s all about creating a disciplined framework that can turn choppy markets into an advantage.

Here are a few situations where dollar-cost averaging is a particularly smart move:

- For New Investors: Just starting out? DCA provides a simple, almost automatic way to build a consistent investing habit. It helps you get past the "analysis paralysis" that can come from staring at volatile market charts all day.

- For Retirement Contributions: If you contribute to a 401(k) or IRA, you're already a dollar-cost averager! Those regular deductions from your paycheck buy into your funds every couple of weeks, smoothing out your purchase price over your entire career.

- For Volatile Assets: This strategy is a lifesaver for assets known for wild price swings, like certain growth stocks or cryptocurrencies. Making regular, fixed-dollar buys helps you ride out the turbulence and can lower your average cost when prices inevitably dip.

By committing to a regular investment schedule, you sidestep the nearly impossible task of market timing. Instead, you focus on what you can control: your saving discipline and your long-term accumulation of assets.

Investing a Large Sum of Money

One of the most common and powerful uses for DCA is when you suddenly come into a large amount of cash. Think of an inheritance, a big work bonus, or the proceeds from selling a house.

The idea of investing $100,000 or more all at once is terrifying for most people. What if you put it all in the market the day before a major crash? It’s a completely rational fear.

DCA offers a methodical solution to this exact problem. Instead of making one giant lump-sum investment, you can break that cash pile into smaller, equal chunks and invest them over a set timeline, like six or twelve months. For example, you could decide to invest $10,000 on the first of every month for ten months. This approach dramatically reduces the risk of putting all your capital to work right at a market peak. Sure, you might miss out on some gains if the market shoots straight up, but the peace of mind is often worth it.

In the end, whether you're building your first portfolio with small, regular contributions or carefully investing a large windfall, DCA provides a sensible, emotionally grounded path forward. It's a strategy built for anyone who prefers consistency over speculation. For those looking for great assets to pair with a DCA strategy, our guide on what are index funds is a fantastic place to start.

How to Automate Your Dollar-Cost Averaging Plan

The real magic of dollar-cost averaging happens when you put it on autopilot. Sure, you could log in and manually buy your investments every week or month, but that brings emotion right back into the picture—the very thing this strategy helps you avoid. Setting up an automated plan makes DCA a powerful, hands-off system that builds wealth for you in the background.

This "set it and forget it" approach is your best defense against emotional decisions. When the market is dropping and every headline is screaming "sell," your automated plan just keeps buying. It turns those scary market dips into fantastic opportunities without you having to lift a finger.

Step 1: Choose the Right Platform

First things first, you need a brokerage or investment app that offers recurring investments. This feature is the engine of your automation, so it's a must-have. Thankfully, most modern platforms have this built-in, from the big-name brokerages to the slick new apps, and they usually don't charge extra for it.

Here’s what to look for when you're picking a platform:

- Asset Availability: Can you buy the specific stocks, ETFs, or index funds you've got your eye on?

- Fractional Shares: This is a big one. Make sure the platform lets you buy a piece of a share. It's how you can invest a neat, fixed amount like $50 into a stock that might cost $200 a share.

- Fees: Stick to platforms with zero-commission trades and no account fees. Even small fees can really drag down your returns over the long haul.

We've done the legwork for you in our guide to the best investment apps for beginners, which spotlights platforms that make automation a breeze.

Step 2: Link Your Bank and Set Your Schedule

Once your account is open, setting things up is pretty simple. You'll connect your checking or savings account, which gives the platform permission to pull the funds for your investments automatically.

Then, you create the recurring investment plan. It boils down to three simple choices:

- The Asset: Pick the stock, fund, or ETF you want to buy consistently.

- The Amount: Decide how much you want to invest each time (for example, $100).

- The Frequency: Choose how often you'll invest. A great trick is to line this up with your payday—weekly, bi-weekly, or monthly—so the money is always there waiting.

Step 3: Monitor and Adjust Annually

"Set it and forget it" doesn't mean "never look at it again." A quick check-in once or twice a year is just good financial hygiene. This isn't about second-guessing your strategy every time the market wobbles.

The real reason for an annual review is to see if you can contribute more. Got a raise? A new side hustle? Bumping up your automated investment amount, even by a little, can dramatically speed up your journey to building serious wealth.

By following these simple steps, you're not just investing; you're building a disciplined, automated wealth machine. It takes the emotion out of the equation and forces consistency, letting you methodically grow your portfolio without having to watch it every day.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Frequently Asked Questions About Dollar-Cost Averaging

Once you start exploring dollar-cost averaging, you’ll naturally have questions. The concept is simple, but the details matter. To help you get comfortable and confident with this strategy, we’ve tackled ten of the most common questions investors ask.

1. Is Dollar-Cost Averaging Better Than Lump-Sum Investing?

There's no single "better" strategy—it depends on market behavior and your personal risk tolerance. Historically, lump-sum investing has often produced higher returns because markets tend to rise over time. However, DCA significantly reduces the risk of investing a large sum right before a market downturn, offering valuable peace of mind. If your priority is managing risk and avoiding emotional decisions, DCA is an excellent choice.

2. What Is the Best Frequency for Investing (Weekly, Monthly)?

The optimal frequency is less important than consistency. The best schedule is one that aligns with your income and budget, making it easy to automate and stick to. For most people, setting up automatic investments to coincide with their paychecks (bi-weekly or monthly) is a highly effective "pay yourself first" approach that ensures discipline.

3. Can I Use DCA for Individual Stocks or Crypto?

Yes, absolutely. DCA is particularly effective for volatile assets like individual stocks and cryptocurrencies. By investing a fixed amount regularly, you can smooth out the effects of sharp price swings. This disciplined approach helps you avoid emotional mistakes like panic selling during a dip or buying into hype at a peak, turning volatility into a potential advantage.

4. What Happens if the Market Only Goes Up After I Start?

In a continuously rising (bull) market, a lump-sum investment will outperform DCA. This is due to "cash drag"—the portion of your money waiting to be invested isn't participating in the market's growth. However, it's crucial to remember that you are still making money with DCA, just more gradually. You're trading potentially higher returns for significantly lower risk.

5. How Long Should I Use the DCA Strategy?

This depends on your goal. For regular contributions from your income (like in a 401(k)), DCA is a lifelong strategy for wealth accumulation. If you're investing a large windfall (e.g., an inheritance), a common approach is to spread the investment over a period of 6 to 12 months. This timeframe balances getting your money into the market with mitigating short-term volatility risk.

6. Does Dollar-Cost Averaging Guarantee a Profit?

No. No investment strategy can guarantee a profit or protect against loss if the underlying asset declines in value over the long term. DCA is a method for managing the timing of your purchases to reduce the impact of volatility. Your ultimate success still depends on choosing fundamentally sound investments that are likely to grow over time.

7. What's the Biggest Mistake to Avoid with DCA?

The single most damaging mistake is to stop your regular investments during a market downturn. It feels counterintuitive, but downturns are when DCA is most powerful—your fixed investment buys more shares at a lower price, reducing your average cost. Pausing your plan out of fear defeats the entire purpose of the strategy.

8. What Are the Best Assets to Use With DCA?

The best assets align with your long-term financial goals and risk tolerance. For most investors, low-cost, broadly diversified index funds or ETFs (like an S&P 500 fund) are an ideal choice. They provide instant diversification and are simple to manage. DCA can also be used for individual stocks you've thoroughly researched and believe in for the long haul.

9. Should I Ever Change My DCA Investment Amount?

Yes, it's wise to review your DCA plan annually or after a significant life event, such as a salary increase. As your income grows, consider increasing your regular investment amount. This can dramatically accelerate your wealth-building progress. The key is to base adjustments on your financial capacity, not on attempts to time the market.

10. Is DCA Only for Beginners or Small Investments?

Not at all. While DCA is an excellent starting point for new investors, it's also a sophisticated technique used by wealthy individuals and financial institutions to deploy large sums of capital. Investing a large windfall over several months via DCA is a prudent risk-management strategy that protects against the perils of bad market timing.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Your Path to Consistent and Confident Investing

So, what’s the big takeaway on dollar-cost averaging? Think of it less as a complex investment tactic and more as a mindset—a disciplined framework for building wealth over time, without the stress.

By setting up automatic, regular investments, you effectively take your emotions out of the driver's seat. Market volatility stops being a source of fear and starts becoming an advantage, allowing you to buy more when prices are low.

This straightforward approach helps you steadily grow your portfolio, tuning out the day-to-day market chatter and focusing on the long game. It's a powerful reminder that consistent, deliberate action almost always beats trying to perfectly time the market.

Your journey toward becoming a more confident, hands-off investor can begin with a single automated transfer. When you pair this strategy with a solid grasp of fundamental concepts like the magic of compound interest explained, you're building a truly robust toolkit for your financial future.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.