Your credit utilization ratio directly controls whether lenders approve you for investment capital. Banks use this metric to decide if you’re financially responsible enough to borrow more money.

At Top Wealth Guide, we’ve seen countless investors miss opportunities because their credit utilization was too high. The good news is that fixing this problem takes weeks, not months, and the payoff is substantial.

In This Guide

Why Your Credit Utilization Ratio Matters More Than Your Credit Score

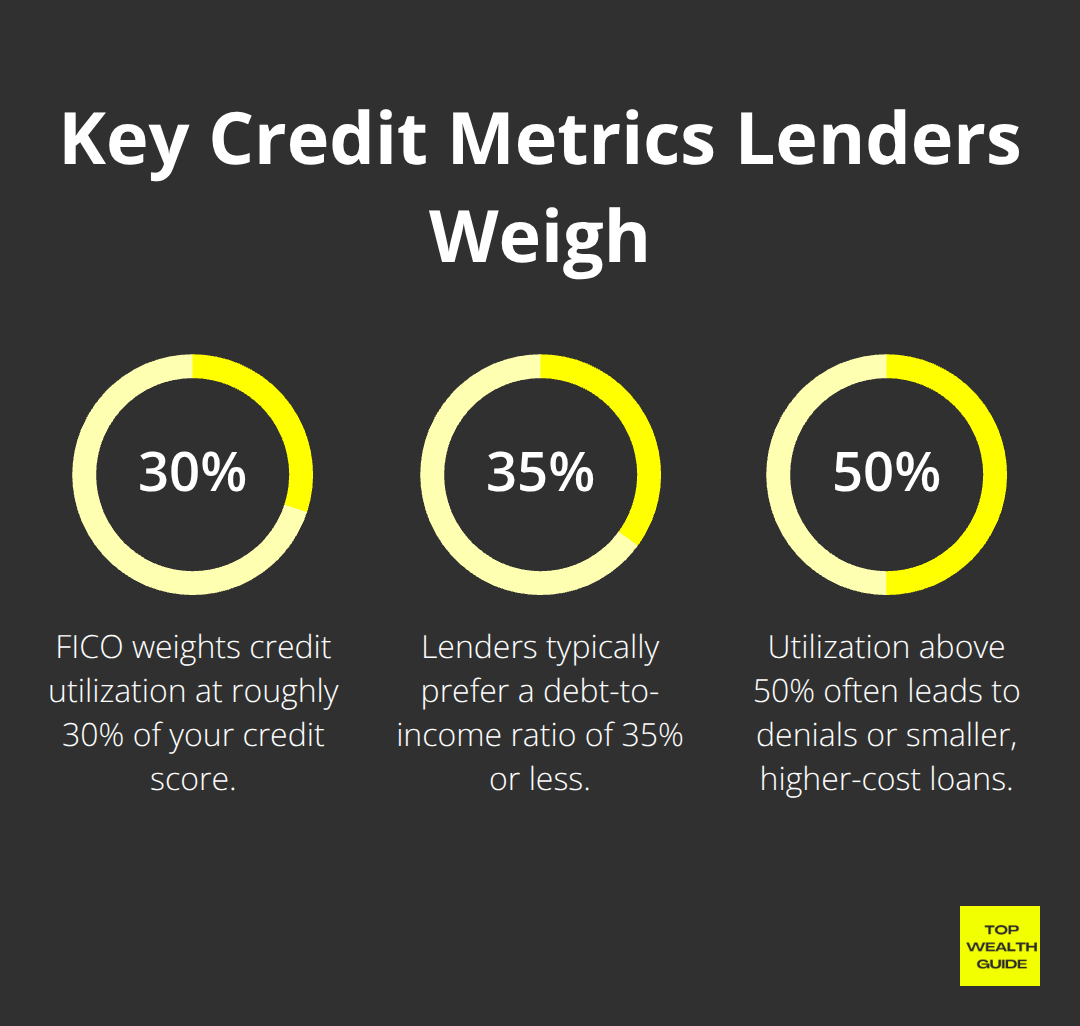

Your credit utilization ratio is the percentage of available credit you actually use, calculated by dividing your total outstanding balances by your total credit limits and multiplying by 100. According to FICO, credit utilization accounts for roughly 30 percent of your credit score, making it one of the most influential factors lenders examine. However, the real power of this metric extends beyond your score.

Lenders view your utilization ratio as a direct signal of financial stress. A person using 80 percent of available credit appears financially stretched, regardless of whether they pay on time. A person using 15 percent appears in control. This perception shapes whether lenders approve your application, how much they’ll lend you, and what interest rate they’ll offer. If you seek investment capital for a down payment, business expansion, or acquisition, lenders will scrutinize this number before anything else. High utilization tells them you’re already maxed out and additional debt is risky. Low utilization tells them you have room to borrow and the discipline to manage it.

Banks Assess More Than Your Score

When banks assess your financial reliability, they calculate your debt-to-income ratio alongside your utilization. Your DTI divides your total fixed monthly payments by your gross monthly income. Lenders typically prefer DTI of 35 percent or less, but here’s the critical part: if your credit utilization is simultaneously high, they’ll question your ability to handle additional debt even if your DTI technically qualifies. A person with a 50 percent utilization ratio and a 30 percent DTI looks far riskier than someone with 15 percent utilization and the same DTI. Banks view high utilization as evidence you use credit as a crutch, not a tool. They worry you’ll spend whatever new credit limit they extend.

Research from the Consumer Financial Protection Board’s Consumer Credit Panel found that roughly half of credit card holders revolve debt at high interest rates, treating higher limits as a buffer against financial shocks. These revolvers spend more as limits rise, accumulating more debt. Banks know this pattern and price it into their lending decisions. Low utilization demonstrates you treat credit strategically, which makes you fundamentally more attractive to lenders.

The Approval Rate Gap Widens Dramatically

The difference in approval rates between someone with 25 percent utilization and someone with 65 percent utilization is substantial. Lenders don’t approve or deny based on a single threshold. They assign risk tiers that directly affect loan size and interest rates. Someone with utilization below 30 percent typically qualifies for larger loan amounts at lower rates. Someone above 50 percent often faces loan denials or approval for only modest amounts at significantly higher rates.

This gap compounds over time. If you need $100,000 for an investment opportunity and your utilization is high, you might qualify for only $40,000 at 8 percent interest. With low utilization, you could qualify for the full $100,000 at 5 percent interest. The difference in total interest paid reaches tens of thousands of dollars. Worse, high utilization can block you from opportunities entirely. If a lender denies you outright, you lose the chance to invest when the market or property is available.

Timing Creates Real Consequences

Timing matters in real estate and market investments, and a high utilization ratio forces you to wait months while you pay down debt before reapplying. The practical takeaway is simple: controlling your utilization ratio directly controls your access to investment capital and the cost of that capital. Understanding this relationship positions you to act when opportunities appear, rather than scramble to qualify after the fact. The next section reveals specific strategies that move your utilization into the optimal range and unlock larger loan amounts at better rates.

How to Lower Your Utilization Ratio Fast

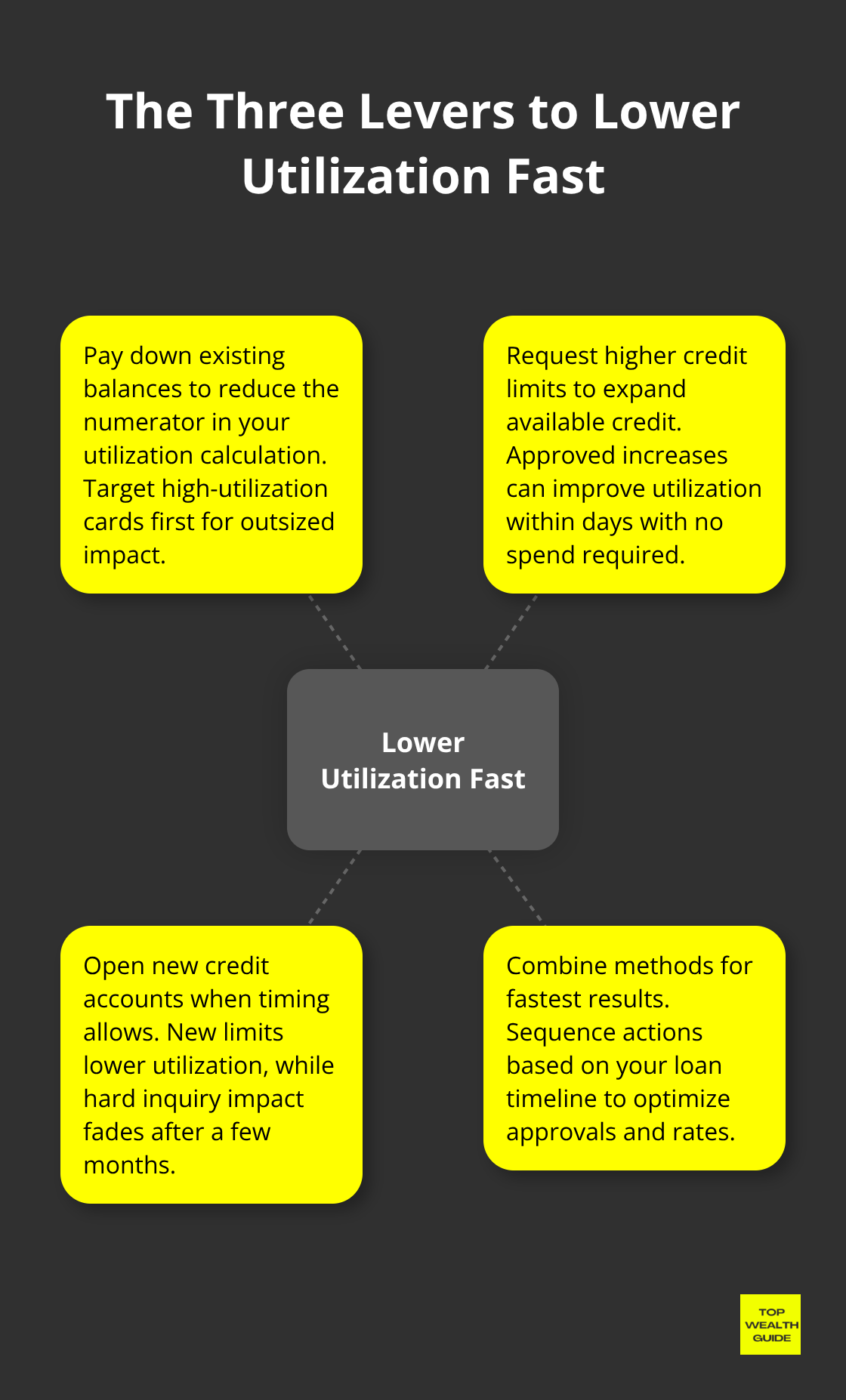

The fastest way to improve your investment capacity is to attack your utilization ratio directly. You control three concrete levers: pay down existing balances, request higher credit limits, or open new credit accounts. The most effective approach combines all three, but the timing and execution matter significantly.

If you carry $15,000 in balances across $50,000 in total credit limits, you sit at 30 percent utilization. To drop to 15 percent, you need either $7,500 in paid-down balances or $50,000 in additional credit limits (or some combination). Most people focus exclusively on paying down debt, which takes months. A dual strategy works faster: pay down your highest-utilization cards immediately while simultaneously requesting limit increases on cards with available balances. A $5,000 payment combined with a $30,000 limit increase moves you from 30 percent to roughly 13 percent utilization within weeks.

Target Your Highest-Utilization Cards First

The card where utilization exceeds 50 percent demands your attention first. Reducing balances on a card at 70 percent utilization has far greater impact on your overall ratio than spreading small payments across multiple cards. Pay down the problem cards aggressively while keeping lower-utilization cards open and untouched. This focused approach produces faster results than scattered payments across your entire portfolio.

Request Limit Increases Before You Need Them

Most investors wait until they need capital to address utilization, which is backwards. Request limit increases now, while your credit is good and before you apply for investment loans. Banks conduct soft inquiries for limit increases on existing accounts, meaning no credit score damage occurs. Call your card issuer and request a $5,000 to $10,000 increase on each card. State that you want to improve your financial flexibility. Many issuers approve increases within 24 hours with no hard pull.

If you’ve held a card for over two years with clean payment history, approval odds are high. Some cards offer automatic limit increases every six to twelve months if you maintain on-time payments, so check your account statements and online portals for these offers. Building a $100,000 total credit limit across five cards takes far less time than paying down $30,000 in existing balances. Once your limits are higher, your utilization drops immediately without spending a dime on debt repayment.

Time Your Credit Applications Strategically

Opening new credit accounts lowers utilization by increasing your total available credit limit, but it triggers a hard inquiry that temporarily dings your score. The key is timing this strategically around investment loan applications. If you plan to apply for a mortgage or business loan in six months, open new cards now. The hard inquiry impact timeline means the inquiry stays on your report for up to two years but only affects your score for a few months, and the increased credit limit benefit compounds immediately. A new card with a $10,000 limit drops your utilization ratio instantly.

However, never open new cards within sixty days of applying for major investment loans, since lenders view recent hard inquiries as a red flag suggesting financial desperation. If your utilization is above 40 percent and you need investment capital within three months, skip new card applications and focus entirely on paying down existing balances and requesting limit increases. The timing calculation is straightforward: if you have six months before you need capital, use cards now and let the hard inquiry recover. If you need capital in six weeks, attack existing balances only.

Execute Your Utilization Strategy in Phases

Phase one focuses on immediate wins. Request limit increases on all existing cards this week. Most approvals arrive within days, and your utilization ratio improves without any additional effort. Phase two targets debt reduction. Allocate available funds to your highest-utilization cards first, paying more than the minimum each month to reduce balances faster. Phase three involves timing new applications. If your timeline allows, open new cards strategically to maximize the credit limit boost while minimizing hard inquiry damage.

The combination of these three actions produces measurable results within four to eight weeks. Your utilization ratio drops and your credit score improves, positioning you as a lower-risk borrower to lenders. With your utilization optimized, you’re positioned to qualify for larger investment loans at better rates. Building wealth requires both debt management and strategic capital deployment-this utilization strategy unlocks the second half of that equation.

What Happens When Credit Utilization Blocks Real Investment Deals

The Investor Who Lost a Deal Due to High Utilization

A real estate investor had saved $40,000 for a down payment on a rental property. The numbers worked perfectly: a $200,000 duplex in an up-and-coming neighborhood, strong rental income projections, and a clear path to positive cash flow. Then the lender pulled his credit report. His utilization ratio sat at 62 percent across five credit cards. The lender approved him for only $120,000 instead of the requested $200,000, forcing him to abandon the deal. Three months later, that same property sold for $225,000 to another investor. He had the cash but not the credit profile to deploy it.

The lesson is brutal: your utilization ratio doesn’t just affect interest rates. It directly determines whether you can access capital when opportunities materialize. This investor spent the next six months paying down $18,000 in card balances and requesting limit increases that added $35,000 in available credit. His utilization dropped to 31 percent. When the next property appeared six months later, he qualified for the full loan amount at 0.5 percent lower interest than his first application. The delay cost him one deal but taught him that credit management precedes opportunity.

The Investor Who Acted Before Needing Capital

Another investor took the opposite approach and saw immediate results. She carried $8,500 in credit card balances across $45,000 in total limits, sitting at 19 percent utilization. Rather than waiting, she called all five card issuers and requested limit increases totaling $55,000 additional credit. Four approved within 48 hours. Her utilization dropped to just 10 percent without paying a single dollar toward debt.

Two weeks later, she applied for a business acquisition loan. The lender flagged her improved utilization as a positive signal and approved her for $250,000 at 6.2 percent interest instead of the 7.1 percent she would have received before the limit increases. The difference amounts to roughly $2,250 annually in interest savings. Her strategic approach to utilization management cost her nothing upfront and positioned her to act immediately when capital needs emerged.

The Timing Mistake Most Investors Make

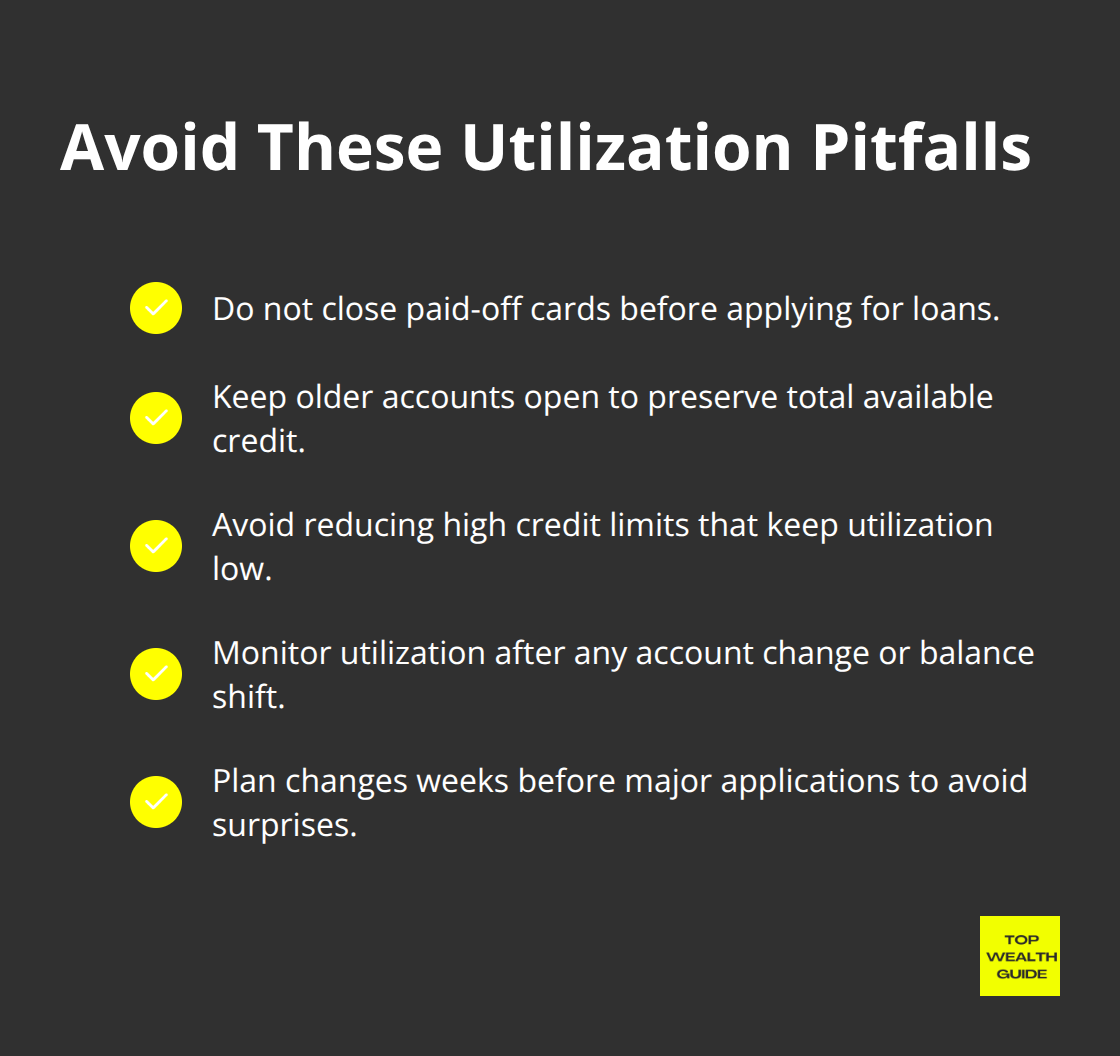

Most investors treat utilization as something to address only after they need money. They apply for investment loans, discover high utilization is blocking approval or forcing higher rates, then scramble to pay down debt while the opportunity window closes. The timing is backwards. Utilization management must happen before you identify an investment target. This proactive stance separates investors who capture deals from those who watch them pass.

The Card-Closing Trap

Another common error involves closing old credit cards after paying them off. Closing a card reduces your total available credit limit, which immediately raises your utilization ratio even though your actual debt hasn’t changed. An investor with $20,000 in balances across $100,000 in limits sits at 20 percent utilization.

Close a $40,000 card and that same $20,000 in balances suddenly represents 33 percent utilization against remaining limits.

The utilization jump can trigger a credit score decline that lenders notice. Investors close paid-off cards thinking they were improving their financial situation, only to watch their approval odds decline on subsequent investment loan applications. Keep every card open, especially older accounts that demonstrate a long credit history. The available credit limit matters more than the account status.

Final Thoughts

Your credit utilization ratio controls whether you access investment capital when opportunities appear. Unlike your credit history, which takes years to build, or your income, which changes slowly, your utilization improves within weeks through deliberate action. The investors who capture deals manage this metric proactively, not reactively.

Call your card issuers this week and request limit increases on every account with clean payment history (most approvals arrive within 48 hours). Calculate your current credit utilization ratio by dividing your total outstanding balances by your total credit limits, then commit to a specific paydown target if the number exceeds 30 percent. A $5,000 monthly payment on high-utilization cards combined with limit increases moves you from 60 percent to 25 percent utilization in eight weeks.

Start optimizing your utilization now if you anticipate needing investment capital within the next six months. Top Wealth Guide helps readers build wealth through practical financial strategies, and credit management is foundational to that mission. Your utilization ratio directly determines your investment capacity, so treating it as a priority positions you to deploy capital strategically rather than scramble for approval.