You’ve downloaded another budgeting app, promised yourself this time would be different, and deleted it two weeks later. You’re not alone-most people abandon budgeting apps within the first month.

At Top Wealth Guide, we’ve found that the problem isn’t your willpower. It’s that budgeting apps are built on a flawed assumption: that technology solves behavioral problems. The truth is simpler and more powerful.

In This Guide

Why Most Budgeting Apps Lose Users Fast

The 30-Day Abandonment Pattern

The average budgeting app user quits within 30 days. The reason has nothing to do with willpower. Apps create friction at every interaction, and that friction compounds until users delete the app entirely.

Many people won’t be honest about expenses, even when logging them. This undermines accuracy from the start. Beyond honesty issues, apps demand constant manual data entry. Users feel overwhelmed by endless transaction logging and multiple payment methods, which derails budgeting efforts before momentum builds. The setup promises automation, but reality delivers tedious categorization work that feels less like progress and more like a chore.

Rigid Systems That Don’t Match Real Life

Most apps force a one-size-fits-all structure that ignores how real people earn and spend money. Someone with irregular freelance income hits a wall when the app assumes a steady paycheck. Someone paid weekly faces friction with monthly budget templates. The rigid calendar doesn’t match your pay cycle, and the predefined expense categories don’t reflect your life. Apps also bury actionable insights under flashy dashboards filled with pie charts and progress bars. You see that groceries consumed 22% of your spending, but that tells you nothing about whether you should cut back or how to actually change behavior. The visual appeal masks the absence of real guidance.

Feature Overload and Notification Fatigue

Budgeting apps pack in features to justify subscription fees: investment trackers, bill reminders, credit monitoring, loan offers, and savings goals all compete for attention on the same screen. This creates decision fatigue before you even start budgeting. Budgeting tools require active participation and consistent habit formation; they are not a universal solution for everyone. When an app tries to be everything, it becomes overwhelming for most users. The notification overload worsens the problem. Apps send constant alerts about upcoming bills, savings milestones, and spending thresholds, turning your phone into a source of financial anxiety rather than clarity. Budgeting apps can trigger budget micromanagement, increasing anxiety about money and straining your relationship with finances. The psychological toll compounds the friction. Tracking every penny shifts your mindset from building wealth to obsessing over minor expenses, creating guilt and self-criticism that makes people abandon the app entirely.

What Actually Works Instead

Macro-level budgeting with broad categories reduces stress and keeps long-term plans intact. The simplest systems survive because they respect your time and psychology, not because they lack features. This shift from app-driven tracking to behavior-driven strategy opens a different path forward-one where your budgeting method actually aligns with how you live.

What Works When Apps Don’t

Reverse Budgeting: Save First, Spend Later

The shift from app-dependent tracking to manual systems reveals a counterintuitive truth: hands-on engagement produces better financial outcomes than passive automation. Julian B. Morris, CFP at Concierge Wealth Management, advocates for reverse budgeting as the antidote to app failure. Instead of tracking every expense and then saving what remains, you automate savings first for emergencies and retirement, then spend what’s left without guilt. This approach eliminates the need to log transactions obsessively. Automating savings prevents funds from sitting idle in checking accounts and ensures consistent progress toward financial goals. Once your savings targets are funded automatically, you’re free to spend the remainder, which removes the psychological burden that makes budgeting apps feel punitive.

Macro-Level Budgeting Over Granular Tracking

John Browning at Guardian Rock Wealth reinforces this by emphasizing macro-level budgeting with broad categories rather than granular expense tracking. When you collapse dozens of micro-categories into three to five major buckets-essentials, savings, discretionary-decision fatigue drops dramatically, and you actually stick with the system. The reason manual tracking outperforms automated systems isn’t complexity; it’s ownership. When you move money intentionally or write down a purchase, you engage your decision-making brain. That engagement builds awareness without triggering the anxiety that constant app notifications create.

Ownership Drives Real Behavior Change

Real behavior change happens when budgeting aligns with how you actually live, not how software engineers think you should live. James Taska at Forest Hills Financial Group points out that automatically contributing to retirement accounts, brokerage accounts, and high-yield savings removes daily decision fatigue entirely. The remaining spending happens with mental freedom because you’ve already secured your future. This pay-yourself-first discipline works because it’s automated at the savings level, not the expense level.

Consistency Matters More Than Tools

Michael Ryan at Michael Ryan Money stresses that consistency and mindful spending matter far more than which specific app or system you use. The underlying principle is simple: simplify by cutting back on data entry, using simple categories, and letting automatic transfers handle the heavy lifting. For freelancers and self-employed earners with irregular income, John Browning recommends allocating a percentage of any income to savings before budgeting the rest, rather than forcing a monthly template onto an unpredictable earning pattern. The systems that last are those that respect your income structure, your psychology, and your time. They require discipline, but they don’t demand constant maintenance. That functional difference between budgeting methods that work and apps that get deleted points toward a clearer path: the strategies that succeed are those that remove friction from your financial life rather than add it. Understanding which specific methods actually stick requires looking at the proven approaches that people use successfully.

Three Systems That Actually Work

The budgeting methods that survive aren’t flashy or complicated. They work because they align with how people actually spend money and they require minimal daily maintenance.

The 50/30/20 Rule for Stable Income

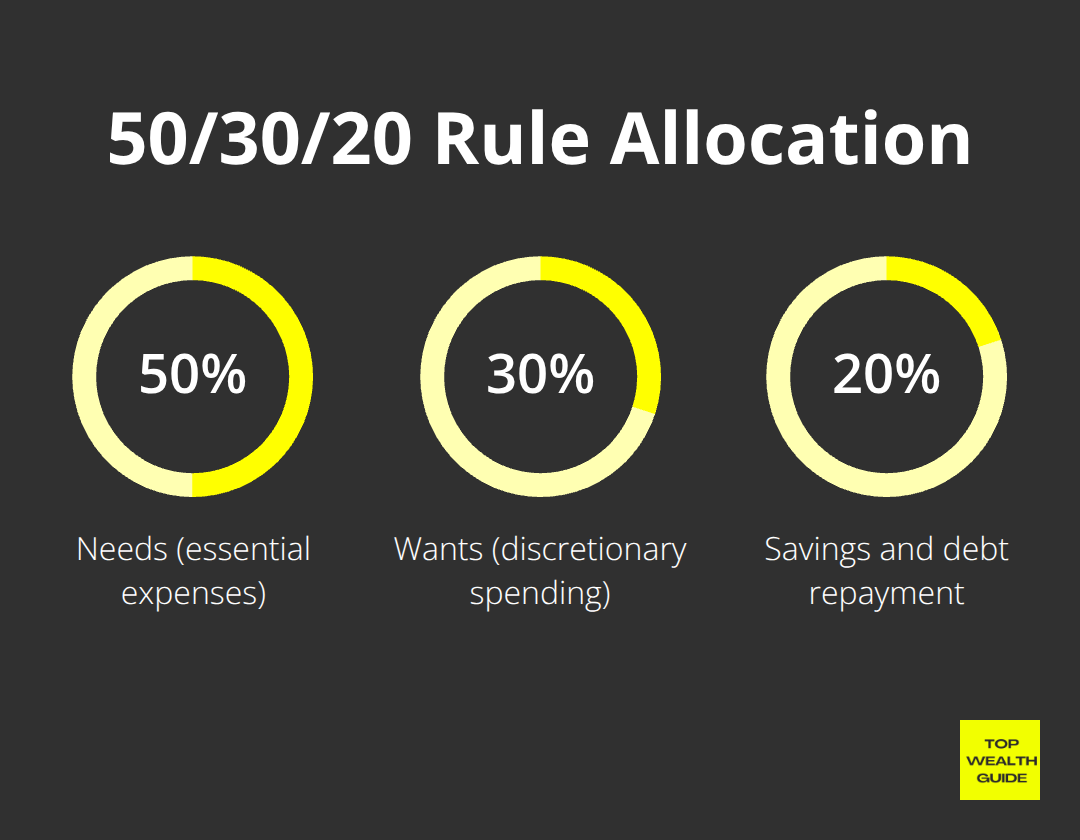

The 50/30/20 rule allocates 50 percent of after-tax income to needs, 30 percent to wants, and 20 percent to savings and debt repayment. This framework works best for people with stable monthly income because it creates clear guardrails without forcing granular tracking. If your take-home is $3,000 monthly, you immediately know your ceiling: $1,500 for essentials like rent and groceries, $900 for discretionary spending, and $600 for savings. The simplicity is the strength.

You don’t categorize every coffee purchase or debate whether a restaurant meal belongs in needs or wants. Instead, you monitor spending at the bucket level each month and adjust the following month if you overshoot. The approach fails for freelancers and gig workers because irregular income makes percentage-based allocation difficult.

Zero-Based Budgeting for Complete Control

Zero-based budgeting assigns every dollar a purpose before you spend it. You list your income, subtract fixed expenses like rent and insurance, then allocate what remains to variable categories and savings goals until the number reaches zero. This method forces intentionality because you can’t ignore money sitting in your account. You must decide whether it goes to a restaurant, a vacation fund, or an emergency account. The friction of that decision is actually the feature, not a bug. Users who practice zero-based budgeting reduce their average monthly spending because the allocation process creates awareness. For self-employed earners, zero-based budgeting works especially well because it forces income clarity and works for anyone willing to spend 15 minutes monthly reviewing allocations.

The Envelope Method for Visible Constraints

The envelope method, historically used with physical cash divided into envelopes, serves the same psychological function in digital form. You transfer money into separate accounts or allocate it within a spreadsheet to specific categories: groceries, transportation, entertainment, gifts. Once an envelope is empty, you stop spending in that category until the next month. This creates a hard boundary that apps with soft limits fail to enforce. The envelope method works particularly well for categories where you struggle with overspending because the visual depletion of funds triggers restraint faster than a notification ever could. People who respond to visible constraints and those who want to eliminate the mental burden of deciding whether a purchase fits their budget find this method most effective.

Matching Systems to Your Life

The three systems succeed for different income and personality types. The 50/30/20 rule suits salaried employees with predictable income and moderate spending discipline. Zero-based budgeting works for anyone willing to invest time in monthly reviews and works especially well for self-employed earners. The envelope method appeals to people who respond to visible constraints and those seeking to eliminate constant spending decisions. None of these systems require an app subscription, constant notifications, or complex automations. What they require is a single monthly review and the discipline to stop spending when a limit is reached. That simplicity is why people actually maintain them for years instead of abandoning them within weeks.

Final Thoughts

The budgeting apps you’ve tried failed because they prioritize features over behavior change. They demand constant data entry, send endless notifications, and force rigid structures that don’t match how you actually earn and spend money. What works instead is radically simpler: systems that remove friction from your financial life rather than add it.

Reverse budgeting automates your savings first, then lets you spend the remainder without guilt. Macro-level budgeting collapses dozens of categories into three to five major buckets, eliminating decision fatigue. The envelope method creates visible constraints that trigger restraint faster than any notification. These approaches work because they respect your time, your psychology, and your actual income pattern-whether you earn a steady salary, work as a self-employed professional, or struggle with overspending in specific categories.

Your financial foundation builds through automated savings, intentional spending decisions, and systems simple enough to maintain for years. Start with one method that matches your income structure and personality type, implement it for one month, and track progress at the monthly level rather than daily. At Top Wealth Guide, we focus on practical strategies that actually work in real life, and budgeting is one piece of building wealth.