When you stack up real estate vs. stock market returns, you're really looking at two completely different beasts. Real estate gives you a tangible, physical asset—something you can stand on—that you can control and finance heavily. On the other hand, the stock market offers liquid, fractional ownership in businesses, big and small.

Historically, stocks might have the edge on average annual returns, but a smart real estate deal, juiced with the right financing and tax breaks, can easily blow past those numbers. Ultimately, the right choice for you boils down to a simple question: Do you value liquidity and a hands-off approach, or are you after control and the power of leverage?

In This Guide

- 1 The Definitive Investor Showdown: Real Estate Vs. Stocks

- 2 A Century of Wealth Creation: Historical Performance

- 3 The Game Changer: How Leverage Impacts Real Returns

- 4 Want Real Estate Returns Without Being a Landlord?

- 5 Comparing Risk, Liquidity, and The True Cost of Investing

- 6 Choosing What's Right for Your Financial Goals

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. Which investment has historically had higher average returns?

- 7.2 2. What does "leverage" mean in real estate and why is it important?

- 7.3 3. I want to invest in real estate but don't want to be a landlord. What are my options?

- 7.4 4. What are the main tax advantages of owning rental properties?

- 7.5 5. Which investment is more liquid?

- 7.6 6. How much money do I need to start investing in each?

- 7.7 7. How does inflation affect real estate vs. stocks?

- 7.8 8. What are the biggest "hidden" costs of owning rental property?

- 7.9 9. Is rental income truly "passive income"?

- 7.10 10. Should I invest in real estate or the stock market first?

The Definitive Investor Showdown: Real Estate Vs. Stocks

Figuring out where to put your money is one of the biggest financial decisions you'll ever make. For as long as anyone can remember, the conversation has always come down to two wealth-building titans: real estate and the stock market. Both have made people incredibly wealthy, but they couldn't be more different in how they work and what they ask of you.

The stock market is your ticket to owning a piece of the global economy. By buying stocks, you get to share in the profits and growth of the world's most innovative companies without ever having to clock in. This world is famous for its liquidity—you can turn your shares into cash in seconds—and its incredible accessibility. Anyone can get started with just a few dollars.

Real estate, however, is about owning a tangible slice of the planet. It’s an asset you can see, touch, and even live in. This path usually demands a more hands-on effort, whether you're screening tenants or fixing a leaky faucet. But the trade-off is huge. You get to use leverage (a bank's money) to control a massive asset with a relatively small down payment, and you unlock tax advantages that stock investors can only dream of. This guide will cut through the hype and give you a straight, data-backed look at how these two powerhouses truly compare.

At a Glance: Comparing Real Estate and Stock Market Investing

Before we get into the nitty-gritty, this table offers a quick, high-level snapshot of the core differences between investing in real estate and the stock market. It's a great way to get a feel for their unique personalities.

| Attribute | Real Estate | Stock Market |

|---|---|---|

| Asset Type | Tangible, physical property (land and buildings). | Intangible, financial security (ownership shares). |

| Liquidity | Low; selling can take weeks or months. | High; can be bought or sold within seconds. |

| Leverage | High; mortgages commonly allow 80-95% financing. | Low to moderate; margin is available but riskier. |

| Entry Capital | High; requires a significant down payment and fees. | Low; can start with minimal funds via fractional shares. |

| Management | Active; requires hands-on management or a paid manager. | Passive; requires minimal ongoing effort, especially with funds. |

| Tax Benefits | Excellent; includes depreciation, interest deductions, and more. | Limited; primarily focused on capital gains rates. |

| Volatility | Lower day-to-day volatility but illiquid. | Higher day-to-day volatility but highly liquid. |

As you can see, they are worlds apart in nearly every way. Now, let’s unpack what these differences mean for your money and your long-term goals.

A Century of Wealth Creation: Historical Performance

To really get to the heart of the real estate vs. stock market returns debate, you have to look back. Looking at how these two wealth-building giants have performed over the long haul gives us a powerful lens into their fundamental nature. It shows us how each has weathered decades of economic booms, busts, and everything in between.

While no one has a crystal ball, this historical data reveals some essential truths about their potential.

On paper, the stock market has consistently delivered higher returns. This makes sense when you think about it. Stocks represent ownership in businesses that can innovate, scale, and generate profits far faster than a physical property can appreciate. They are the engines of economic growth, and their value reflects that dynamic power.

The Stock Market's Long-Term Edge

When you dig into the raw numbers over many decades, the evidence is pretty compelling. The stock market, usually tracked by broad indexes like the S&P 500, has historically outpaced the appreciation of residential real estate. This isn't just a recent trend; it's a pattern that has held up through all kinds of market cycles.

Over nearly a century of data, the S&P 500 has delivered an impressive 12.25% average annual return between 1978 and 2024. Compare that to residential real estate, which saw a 10.6% return over a similar period from 1965 to 2024.

Looking at a more recent window, from 1992 to 2024, the S&P 500 generated a 10.39% average annual return (including dividends). Over that same time, the U.S. housing market provided a more modest 5.5% rate of return.

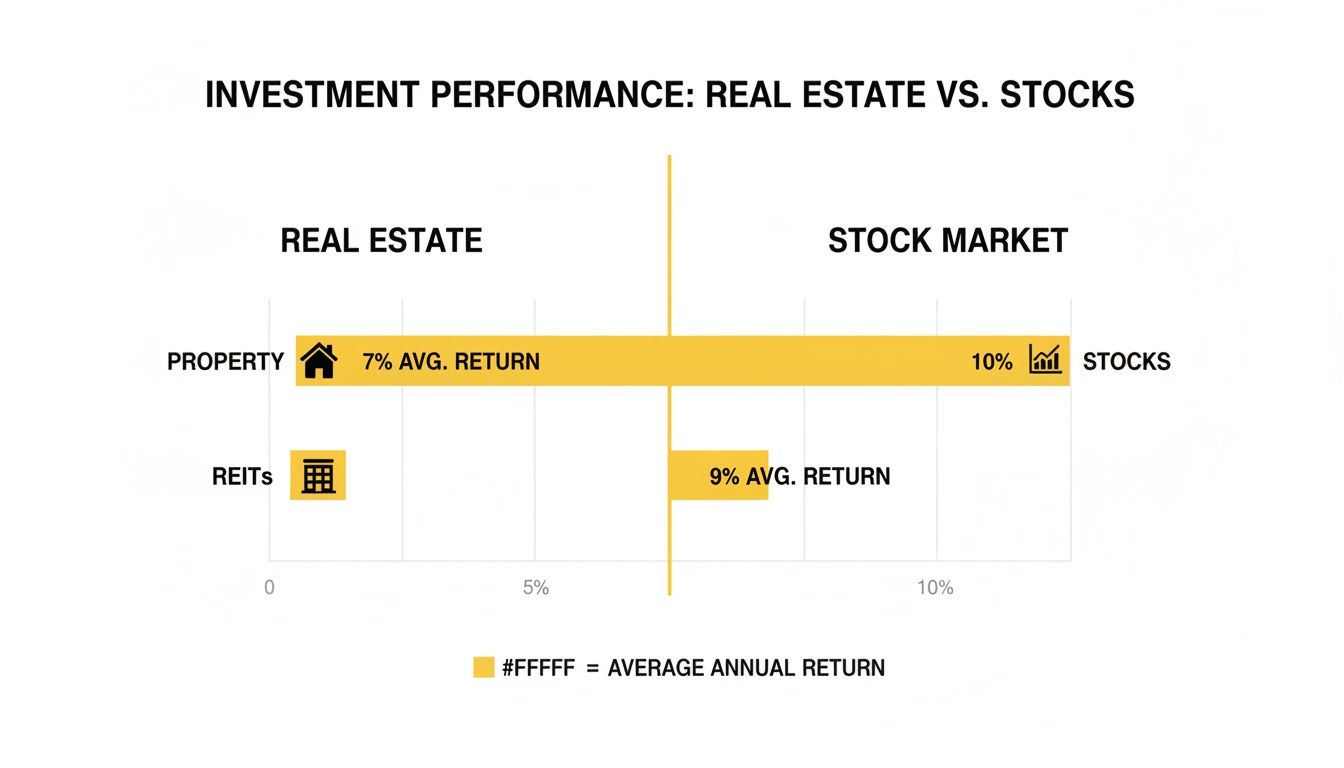

This chart gives you a simple visual breakdown of what that looks like.

As you can see, the stock market has historically offered the highest average returns. REITs (which we'll cover later) are a close second, with direct property ownership showing slower growth.

Real Estate's Path to Steady Growth

While stocks might win the sprint on paper, real estate's performance tells a different, equally important story. Its growth is all about slower, more stable appreciation. For investors who get queasy watching the stock market's wild swings, this steadiness is a huge draw.

Real estate values are tied to fundamental, real-world factors like population growth, the health of the local economy, and interest rates. Unlike stock prices, which can crater overnight based on a bad earnings report or a tweet, housing prices tend to move more predictably over time.

The real magic of real estate isn't just in appreciation. It's in its ability to generate consistent cash flow from rent and act as a powerful hedge against inflation. As the cost of living goes up, so do property values and rental income.

This stability provides a psychological and financial anchor that a stock portfolio often lacks. For anyone looking to build wealth methodically, that consistency is a major plus. You can also explore our guide to better understand the average rate of return for different asset classes.

Ultimately, the historical data shows two very different paths to building wealth. Stocks offer a faster, more dynamic route with higher potential returns, but you have to stomach more volatility. Real estate offers a slower, steadier journey, grounded in a tangible asset and predictable income.

The numbers give stocks the edge in pure growth, but as we'll explore next, raw returns don't tell the whole story. Especially when you introduce the game-changing power of leverage.

The Game Changer: How Leverage Impacts Real Returns

If you only look at nominal returns, the stock market often seems to come out ahead. But that's not the whole story. This view completely misses the single most powerful tool in a real estate investor's arsenal: leverage.

Using borrowed money to control a much larger asset fundamentally rewrites the return equation. It’s the secret sauce that explains how real estate can generate such incredible wealth.

Think about it this way. When you buy stocks, you're almost always using 100% of your own money. A $10,000 investment gives you control over exactly $10,000 worth of stock. Simple enough. But in real estate, that same $10,000 could be a down payment to control a $100,000, $200,000, or even larger property.

This ability to use "other people's money"—in this case, the bank's—magnifies every dollar of your return. You're not just earning appreciation on your initial cash; you're earning it on the total value of the asset.

A Real-Life Example: The Power of Leverage in Action

Let's walk through a real-world scenario to see how this plays out. Imagine two investors, Alex and Ben, each starting with $50,000.

- Alex (The Stock Investor): He puts his entire $50,000 into an S&P 500 index fund. If the market goes up 5% in a year, his investment grows to $52,500, giving him a $2,500 profit. His return on investment is 5%.

- Ben (The Real Estate Investor): He uses his $50,000 as a 20% down payment on a $250,000 rental property. If the property's value also increases by 5% that year, it's now worth $262,500. His gain is $12,500 on the same $50,000 investment. His cash-on-cash return from appreciation alone is 25%.

This simple comparison shows how leverage can supercharge gains, allowing a slower-appreciating asset to potentially deliver a much higher return on the money you actually invested.

The Mechanics of Amplified Returns

Let's break down that example in a clear table.

| Investor | Initial Investment | Asset Value | Asset Appreciation (5%) | Return on Investment (ROI) |

|---|---|---|---|---|

| Alex (Stocks) | $50,000 | $50,000 | $2,500 | 5% ($2,500 / $50,000) |

| Ben (Real Estate) | $50,000 | $250,000 | $12,500 | 25% ($12,500 / $50,000) |

As you can see, Ben’s return on his actual cash invested is five times higher than Alex’s. Both underlying assets grew at the exact same rate, but leverage supercharged Ben's gains. This is precisely why the real estate vs. stock market debate gets so much more interesting in the real world.

Beyond Appreciation: The Four Pillars of Leveraged Returns

Leverage does more than just boost appreciation. It enhances your returns from multiple sources at the same time, creating a powerful wealth-building engine.

- Appreciation: As we just saw, you profit from the entire property's value going up, not just your small slice of equity.

- Loan Paydown (Equity Buildup): Every month, your tenant's rent payment covers the mortgage. A portion of that payment pays down your loan, increasing your equity. It’s like a forced savings account paid for by someone else.

- Cash Flow: This is the gravy. Any rental income left over after covering the mortgage, taxes, insurance, and other expenses is pure profit in your pocket.

- Tax Benefits: Real estate offers fantastic tax advantages. Deductions for mortgage interest, property taxes, and depreciation can significantly lower your taxable income, boosting your true net return.

The magic happens when you combine these four return streams, all amplified by leverage. It's what allows a well-chosen property to potentially outperform the stock market, even if its base appreciation rate is lower.

This isn’t just a theory. A fascinating 25-year inflation-adjusted return analysis from 2000 to 2025 found something remarkable. Both the S&P 500 and a leveraged residential property in Phoenix delivered similar inflation-adjusted returns of about 5% annually. The property kept pace thanks to the immense power of a mortgage, which let the investor capitalize on a housing boom.

Of course, leverage is a double-edged sword. Just as it magnifies gains, it absolutely magnifies losses if the property's value falls. This is not a risk to take lightly. Understanding how to use financing responsibly is critical, which is why we put together a guide on smart leverage strategies for accelerated wealth building. Smart financing and careful property selection are your best defenses against the downside.

Want Real Estate Returns Without Being a Landlord?

Not everyone is cut out for the hands-on work of owning property. Let's be honest, getting a call about a broken toilet at 2 a.m. isn't exactly the dream. But what if you could tap into real estate's financial upside without ever having to unclog a drain?

This is where the stock market offers a brilliant workaround, blurring the lines in the real estate vs stock market returns debate. You can get property-like returns with the click-and-buy ease of a stock.

The go-to vehicle for this is a Real Estate Investment Trust (REIT). Think of a REIT as a company that owns and operates a massive portfolio of income-producing properties—office towers, apartment buildings, shopping centers, you name it. When you buy a share, you're buying a tiny slice of that entire portfolio.

It’s a powerful hybrid. You get exposure to the property market, with its potential for rental income and appreciation, but with the liquidity of a stock. You can buy and sell shares on any given Tuesday from your brokerage account, no questions asked.

REITs vs. Index Funds: A Head-to-Head Look

So, you’ve decided to invest in real estate through the market. Your main choice often boils down to a dedicated REIT ETF versus a broad-market index fund, like one that tracks the S&P 500. While they both trade on an exchange, what's under the hood is completely different.

REITs give you a focused bet on the real estate sector. Their performance is tethered to the health of property markets—think rental income, occupancy rates, and property values. A standout feature is that REITs are legally required to pay out at least 90% of their taxable income to shareholders. This usually translates into much juicier dividend yields than you’d find in the broader market.

An S&P 500 index fund, on the other hand, is your ticket to broad diversification. It spreads your money across every major sector of the U.S. economy, from tech and healthcare to finance and consumer goods. While some of these companies own real estate, it’s not the fund’s core business. The returns here are driven by corporate profits, economic cycles, and overall market mood.

REITs are the ultimate middle ground in the real estate versus stocks dilemma. They let you invest directly in property markets while keeping the simplicity and liquidity of stock trading.

How They Perform and Where They Fit

So, can REITs actually keep up with the stock market? History says yes, and then some. They’ve proven to be a compelling alternative for investors seeking property exposure through equities.

Between 1972 and 2019, REITs delivered an average annual total return of 11.8%. That performance actually edged out the S&P 500's 10.6% return over that same 47-year stretch. You can dig deeper into these numbers and see how REITs stack up against direct property ownership on NerdWallet.

This strong, independent performance makes REITs a fantastic diversifier. Since their returns don't always move in lockstep with the rest of the market, adding them to a portfolio can help smooth out the ride by reducing overall volatility.

Here’s a simple breakdown of what you're choosing between:

| Feature | REITs (Real Estate Investment Trusts) | S&P 500 Index Funds |

|---|---|---|

| Primary Exposure | Concentrated in the real estate sector (commercial, residential, etc.). | Diversified across all major sectors of the U.S. economy. |

| Income Potential | Typically high dividend yields due to the 90% payout rule. | Lower average dividend yields. |

| Return Drivers | Property values, rental income, occupancy rates, interest rates. | Corporate profits, economic growth, overall market sentiment. |

| Diversification | Diversifies a stock-heavy portfolio with real estate assets. | Provides instant, broad-market diversification across industries. |

| Best For | Investors seeking high income and specific real estate exposure. | Investors seeking broad, passive exposure to the entire U.S. market. |

In the end, it really comes down to your goals. If you want targeted real estate exposure and a robust income stream from dividends, REITs are a fantastic tool. To get a better handle on the mechanics, check out our guide on real estate investment trusts. But if you'd rather have a simple, ultra-diversified, "set-it-and-forget-it" investment, an S&P 500 index fund is tough to beat.

Comparing Risk, Liquidity, and The True Cost of Investing

Headline returns are exciting, but they don't tell the whole story. The real-world experience of an investment is often defined by the risks you face, how quickly you can get your cash back, and the often-overlooked costs that slowly eat away at your profits. It's here that the differences between owning property and owning stocks become crystal clear, shaping your day-to-day life as an investor.

To truly settle the real estate vs stock market returns debate for yourself, you have to look beyond a simple spreadsheet. You need to understand the practical trade-offs you're making with your hard-earned capital.

Unpacking the Risk Profiles

Every investment has risk, but the kind of risk couldn't be more different between these two assets. Stock market risk is broad and systematic; it often feels like you're a passenger on a ride you can't control. Real estate risk, on the other hand, is intensely personal and concentrated.

With stocks, your biggest enemy is market volatility. Your portfolio's value can swing dramatically based on economic reports, global events, or just a change in investor mood. One bad day on Wall Street can wipe out months of gains, even if the actual companies you own are doing just fine.

Real estate risk is hyperlocal. Your entire investment is tied to one building in one neighborhood. This creates a very different, and very concentrated, set of potential problems:

- Tenant Risk: A nightmare tenant who damages the property or stops paying rent can instantly flip a profitable asset into a costly liability.

- Vacancy Risk: Every month that property sits empty is a month where you're covering the mortgage, taxes, and insurance out of your own pocket.

- Location Risk: What happens if a major local employer shuts down? Your property values and the pool of quality tenants could shrink overnight.

- Liquidity Risk: As we’ll get to next, the inability to sell quickly can become a massive financial risk if you face a personal emergency or the market suddenly turns sour.

While stocks expose you to the whims of the global economy, a single rental property exposes you to the whims of a single tenant and a single neighborhood.

The Liquidity Gap: A Mile Wide

Liquidity is just a fancy word for how fast you can turn an asset into cash without taking a big hit on the price. On this front, it’s not even a fair fight. The stock market offers almost instant liquidity, whereas real estate is one of the most illiquid investments you can possibly own.

You can sell $100,000 worth of an S&P 500 ETF in a matter of seconds with a few taps on your phone. The cash will be in your bank account in about two business days.

Now, try selling a $100,000 property. It's a long, expensive, and uncertain journey. You have to hire an agent, prep the home, market it, schedule showings, negotiate offers, and then wait for inspections and the buyer’s financing to clear. This process can easily take 60 to 90 days or more, and that’s assuming you’re in a decent market.

This isn't just about convenience; it's a fundamental part of risk management. When you urgently need cash, the stock market delivers. Real estate makes you wait.

The True Cost of Ownership

Finally, you have to get real about the ongoing costs that affect your net returns. Both investments have them, but their structures are worlds apart. With stocks, the primary costs are generally minimal and transparent. With real estate, the costs are numerous, constant, and often sneak up on you.

Let's break down exactly what you're up against.

Investment Factor Showdown: Real Estate Vs. The Stock Market

To really see the difference, it helps to put the key factors side-by-side. This table shows where your money actually goes and the effort required for each investment type.

| Factor | Direct Real Estate | Stock Market (Index Funds/ETFs) |

|---|---|---|

| Transaction Costs | High: Agent commissions (5-6%), closing costs (2-5%), legal fees. | Low: Minimal or zero brokerage commissions, low expense ratios on funds. |

| Ongoing Costs | High & Variable: Property taxes, insurance, maintenance, repairs, property management fees (8-12% of rent). | Very Low: Primarily the fund's expense ratio (often below 0.10%). |

| Capital Expenditures | Significant: Large, infrequent costs like a new roof ($10k+) or an HVAC system ($5k+). | None: These costs are handled by the companies you're invested in. |

As you can see, the carrying costs of real estate are no joke. They can easily eat up 30-40% of your gross rental income, which is why a property that looks great on paper can sometimes end up losing you money each month.

Understanding how these hidden drags impact your portfolio is critical. Seeing how investment fees are secretly destroying your wealth reveals just how much these seemingly small costs can compound over time, dramatically shrinking your final nest egg.

Choosing What's Right for Your Financial Goals

The whole real estate vs. stock market returns debate isn't about crowning a single champion. The truth is, the best investment is the one that actually fits you—your personality, your financial situation, and what you’re trying to achieve down the road. It really boils down to your goals, how much risk you can stomach, the cash you have on hand, and how much work you want to put in.

Figuring out what kind of investor you are is the most important first step. Once you know which camp you fall into, you can build a strategy that feels right and that you can stick with for the long haul. That’s how you build real, lasting wealth.

The Hands-Off Wealth Builder

If you want to grow your money without making it a part-time job, the stock market is almost certainly your best bet. You’re someone who values simplicity, the ability to get your money out when you need it, and spreading your risk far and wide. Your time is precious, and you have zero interest in screening tenants or fixing leaky faucets.

For this type of investor, a portfolio of low-cost index funds or ETFs is perfect. It’s a straightforward way to own a small piece of the entire market, letting you ride the wave of broad economic growth without having to be a stock-picking genius. This is the classic "set-it-and-forget-it" approach where you let compounding do the heavy lifting over many years.

- Primary Vehicle: S&P 500 Index Funds, Total Stock Market ETFs.

- Why it Works: You get maximum diversification with minimal effort and can sell anytime.

The Active Entrepreneur

For those who see investing more like running a business, owning property directly is an incredible opportunity. You're happy to trade your time and energy for more control, great tax breaks, and the powerful wealth-building effect of leverage. You actually enjoy hunting for deals, managing properties, and building a physical portfolio you can see and touch.

This path requires a hands-on approach and a totally different set of skills—think negotiation, project management, and people skills. The payoff? The potential for much higher returns and the satisfaction of building a tangible, income-generating business from the ground up.

This investor thrives on control. The ability to directly influence an asset’s value through renovations, better management, or strategic financing is a key advantage that the stock market simply cannot offer.

The Retiree Seeking Income

Once your focus shifts from growing wealth to living off it, the conversation changes. Both real estate and stocks can generate cash flow, but they do it in very different ways. For retirees, what matters most is reliability and consistency.

- Real Estate: A rental property that’s fully paid off can be a fantastic source of steady income, and rents tend to rise with inflation. But don't mistake it for truly passive income—you still have to manage the property and save for inevitable costs like vacancies and repairs.

- Stocks (and REITs): A portfolio of solid, dividend-paying stocks or REITs offers a truly hands-off income stream. The dividends just show up in your account, no work required. This gives you a level of simplicity and liquidity that direct property ownership can't match.

For many retirees, the sweet spot is often a mix of both, creating a well-rounded and diversified income stream.

The Young Investor with a Long Time Horizon

When you're just starting out, your biggest advantage is time. Having decades ahead of you means you can afford to take on more risk for a shot at higher growth, since you'll have plenty of time to recover from any market slumps.

Because of this, the stock market is an amazing place to start. The barrier to entry is incredibly low; you can get started with just a few dollars and build a diversified portfolio. Historically, stocks have delivered superior growth, giving your money the best possible chance to compound over 30, 40, or even 50 years. Before jumping in, it's a good idea to get a handle on your own comfort with market swings; our guide on how to determine your investment risk tolerance can walk you through it.

Frequently Asked Questions (FAQ)

1. Which investment has historically had higher average returns?

Historically, the stock market, often represented by the S&P 500, has delivered higher average annual returns compared to the appreciation of residential real estate. However, this doesn't account for rental income or the powerful effects of leverage in real estate.

2. What does "leverage" mean in real estate and why is it important?

Leverage is the use of borrowed capital (like a mortgage) to purchase an asset. It's crucial because it allows you to control a large, expensive asset with a relatively small amount of your own money. This magnifies your potential returns, as you profit from the appreciation of the entire property value, not just your down payment.

3. I want to invest in real estate but don't want to be a landlord. What are my options?

Real Estate Investment Trusts (REITs) are an excellent option. They are companies that own and operate income-producing real estate. You can buy shares of REITs on the stock market, giving you exposure to real estate returns with the liquidity and ease of buying a stock.

4. What are the main tax advantages of owning rental properties?

Direct real estate ownership offers significant tax benefits, including deductions for mortgage interest, property taxes, insurance, and operating expenses. The most powerful is depreciation, which allows you to deduct a portion of the property's value from your taxable income each year, even if the property is appreciating.

5. Which investment is more liquid?

The stock market is far more liquid. You can sell stocks or ETFs and have cash in your bank account within a few days. Selling a physical property is an illiquid process that can take months and involves significant transaction costs.

6. How much money do I need to start investing in each?

The barrier to entry for the stock market is extremely low; you can start with just a few dollars using fractional shares or low-cost index funds. Direct real estate requires a much larger initial investment for the down payment and closing costs, typically tens of thousands of dollars at minimum.

7. How does inflation affect real estate vs. stocks?

Real estate is generally considered a strong hedge against inflation. As the cost of living rises, property values and rental income tend to increase as well. The effect on stocks is more varied; some companies can pass on rising costs to consumers, while others may see their profits shrink.

Beyond the mortgage (PITI – principal, interest, taxes, insurance), you must budget for maintenance, repairs, capital expenditures (like a new roof or HVAC system), property management fees (if you hire one), and potential vacancies. These can significantly impact your net cash flow.

9. Is rental income truly "passive income"?

Not usually. While it can be a source of income that doesn't require a 9-to-5 job, managing a property requires active involvement: finding tenants, handling maintenance requests, and managing finances. It's more passive if you hire a property manager, but that comes at a cost (typically 8-12% of gross rents). Dividend income from stocks is a truer form of passive income.

10. Should I invest in real estate or the stock market first?

For most beginners, especially those with limited capital, the stock market is the more accessible starting point. It allows you to start small, learn the principles of investing, and benefit from diversification and compounding immediately. As your capital and experience grow, you can then explore direct real estate investing.

At Top Wealth Guide, our mission is to provide you with the insights and strategies needed to build lasting wealth. Whether you're exploring stocks, real estate, or other investment avenues, we have the resources to help you succeed. Learn more about how to secure your financial future at Top Wealth Guide.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.