Wealthy investors — they’re shelling out an average effective tax rate of 23%, compared to the middle-class folks who are hovering around 22%. The kicker? It’s all about the strategy. Those with deep pockets are masters at employing legal tax shelters that shave down taxable income quite significantly.

At Top Wealth Guide, we’ve dug deep into these tactics that the high-net-worth crowd swears by. The takeaway? When you play your cards right, these strategies can chop your tax burden by a cool 30-50%.

In This Guide

Tax-Advantaged Retirement Accounts for Wealthy Investors

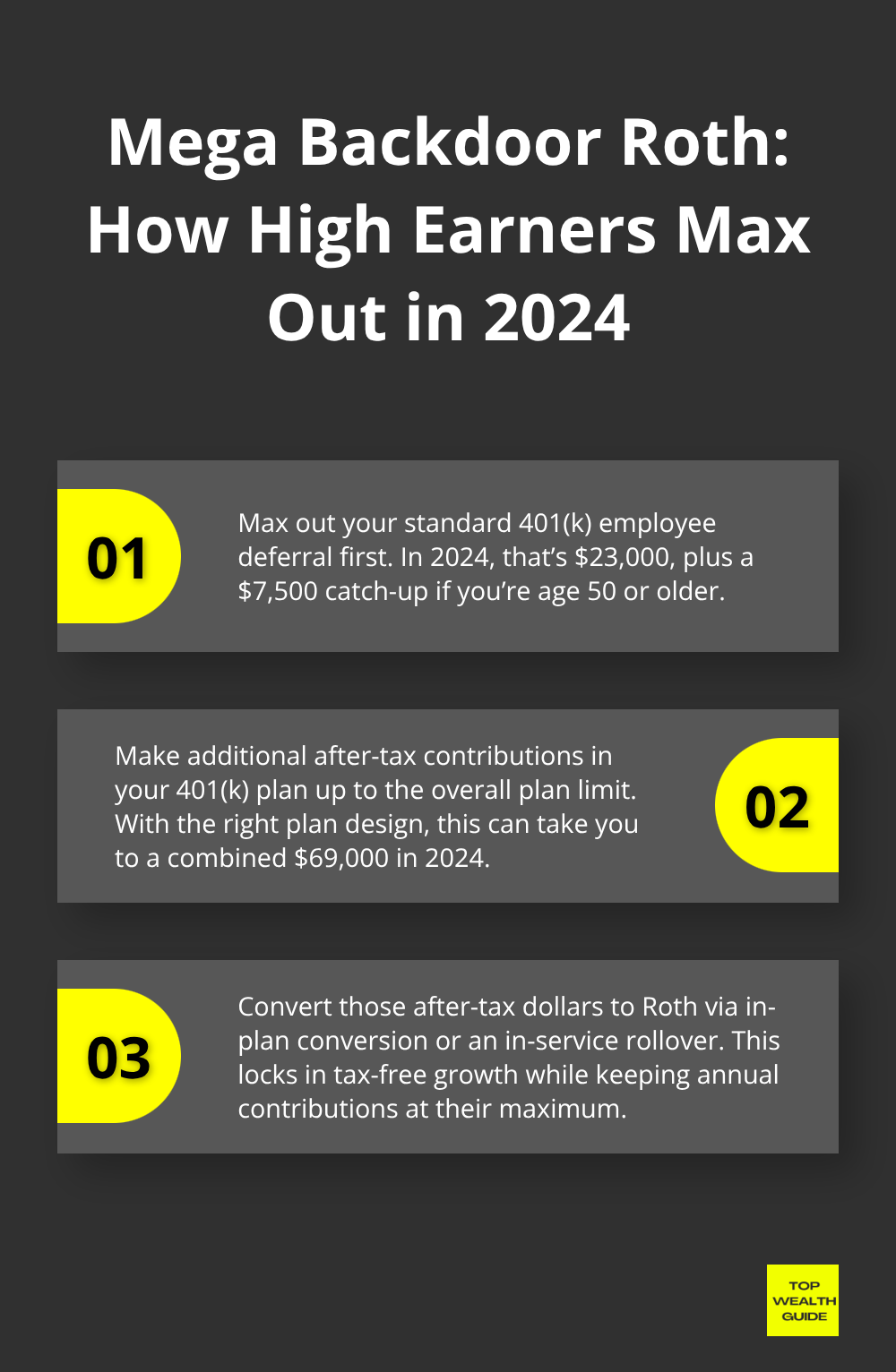

So, if you’re in the big leagues with your cash, you’re all about tax-advantaged retirement accounts – these things are gold. The mega backdoor Roth conversion is like the grandmaster move, letting high rollers sock away up to $69,000 a year into their retirement stash in 2024 (IRS is the source of truth here). It’s all about maxing out that $23,000 in a 401k, tossing in an extra $7,500 if you’re in the 50+ club, and then-boom-another $46,000 in after-tax dough that you can convert to Roth. A real juggernaut, right?

Solo 401k Plans Deliver Maximum Contribution Power

Now, if you’re steering your own ship, Solo 401k plans are where it’s at – double whammy benefits for the entrepreneurial spirit. Contributions? Yeah, we’re talking up to $69,000 when you play both employee and boss. It’s like inviting yourself to a tax shelter buffet. Especially juicy for business owners flying solo – employee plus employer contributions rolled into one tasty morsel.

Defined Benefit Plans Generate Massive Tax Deductions

And then there are the Defined benefit plans – the heavyweight champ of tax shelters for those hauling in serious green. Sure, it’s heavy on the actuarial stuff – you need a pro with a calculator to make it sing – but the tax savings are worth the paperwork. Doctors, consultants, and law wizards? They’re sheltering huge chunks of income here, socking it away like squirrels before winter.

Advanced Investment Options Expand Wealth Protection

Oh, and don’t forget the Solo 401k accounts – not just a one-trick pony. Need cash flow? Take a loan up to $50,000 or half your balance – try doing that with a regular IRA. And investment smarts? They can dive into real estate, private equity, and those alternative ventures, if you route it all through self-directed custodians. Cooking up layers of tax protection while building wealth like a financial fort, diversifying assets faster than you can say “traditional real estate strategy.

Real Estate Investment Tax Strategies

Real estate is the tax haven of choice-it’s the playground where wealthy investors thrive. Numbers don’t lie. These savvy investors are slashing their tax bills with strategies layered like a complex game of Jenga. How? One word: depreciation. According to tax policy bigwigs, it’s the key piece of the puzzle. We’re talking strategies that mesh so well, they purr like a high-performance engine.

1031 Exchanges Eliminate Capital Gains Forever

Enter the 1031 like-kind exchange-the holy grail of tax strategies in real estate. It’s that golden ticket allowing investors to dodge capital gains taxes by rolling one property into another. Clever investors just keep this cycle going, like a hamster on a really lucrative wheel, building colossal portfolios without paying a dime in capital gains. But, there’s a catch (because of course, there is)-you’ve got 45 days to identify your next property and 180 days to wrap it all up. Miss these and-boom-the IRS is at your door. Many pros hire qualified intermediaries to keep this dance on beat.

REITs Deliver Tax-Efficient Income Streams

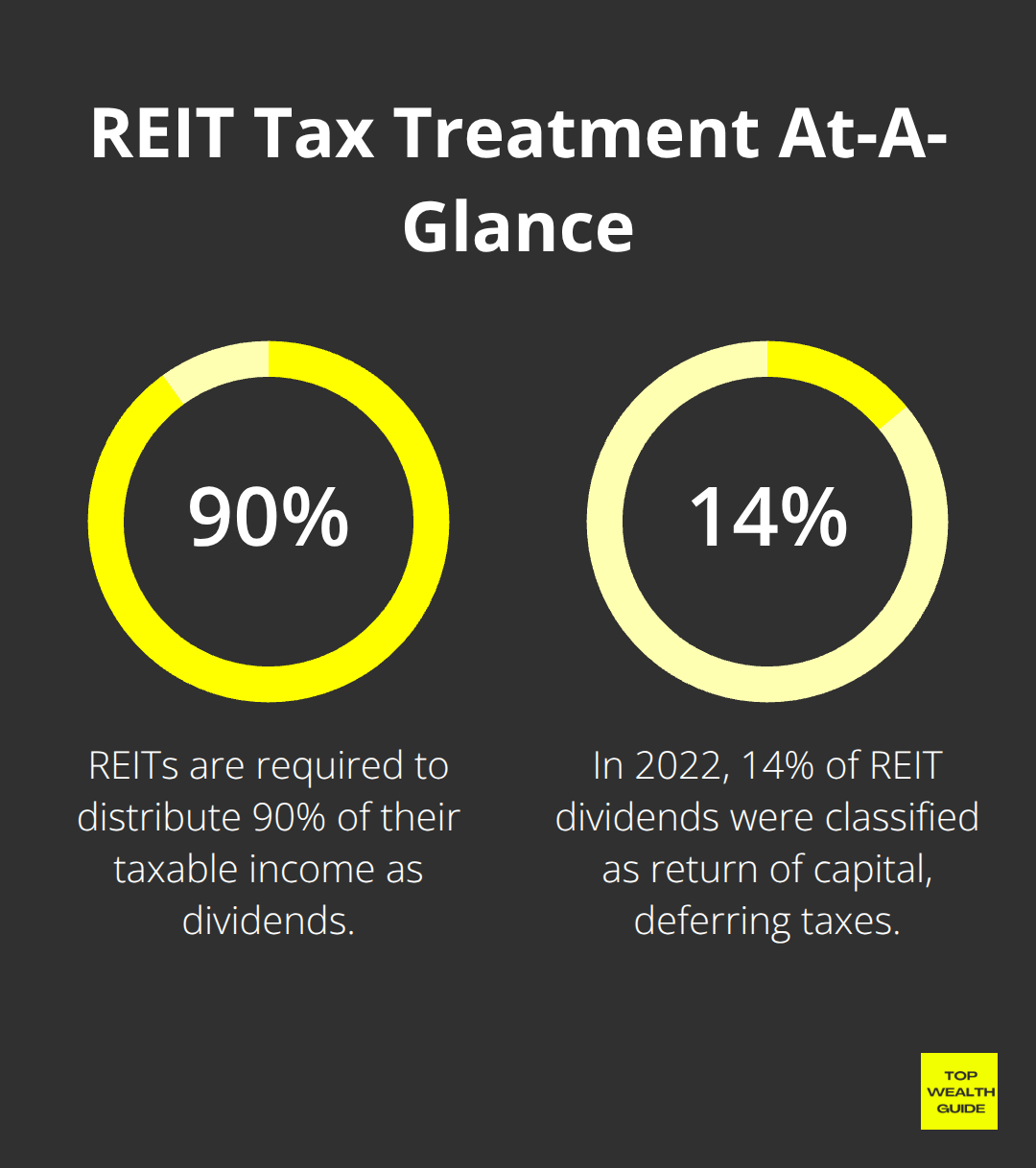

Real Estate Investment Trusts… well, they’re like the stealth bombers of tax efficiency. REITs must distribute a hefty 90% of their income as dividends. And here’s the twist-in 2022, 14% of these dividends were labeled as a return of capital (meaning no taxes now). So, without the drama of property upkeep, you pocket immediate tax savings and grow your wealth through real estate.

Depreciation Creates Massive Paper Losses

Then there’s depreciation-a sweet deal for rental property folks. Write off at 3.636% yearly for residential, 2.564% for commercial. What does that mean? A $500,000 rental throws off $18,180 in deductions every year, often resulting in paper losses that conveniently sponge up other income streams.

Layer on mortgage interest deductions, property tax slashes, maintenance write-offs, and you’re often looking at a negative taxable income while cash keeps flowing in.

These real estate strategies are gold, especially when combined with business entities that supercharge those tax benefits.

Business Entity Tax Optimization

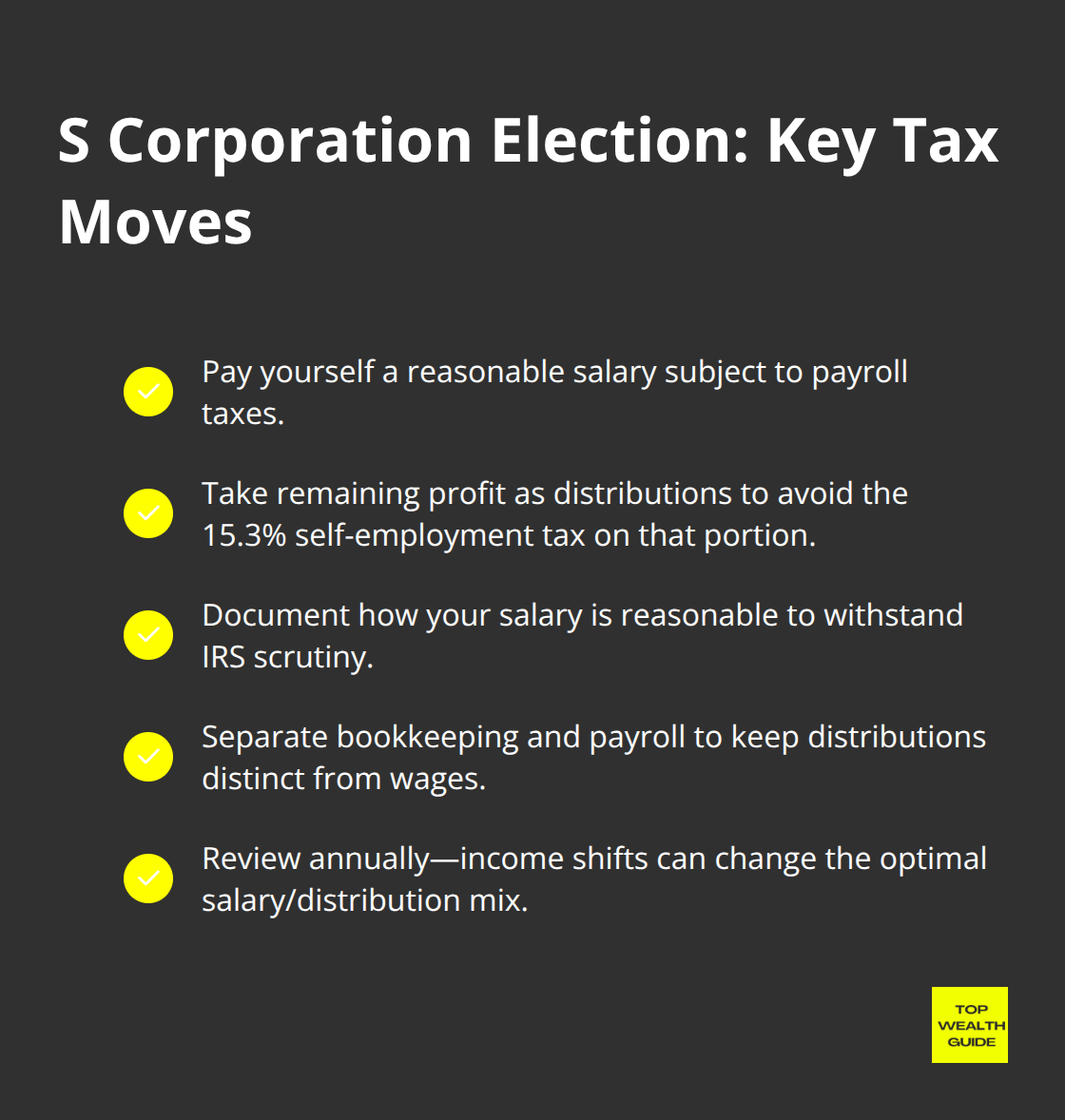

Here’s the thing about S Corporation elections-they’re like the magic wand for self-employed folks looking to slice through that self-employment tax jungle. Essentially, you’re paying yourself a reasonable salary which gets hit with payroll taxes, but then-voila-any extra profit swirls through as distributions, skirting around the classic 15.3% self-employment tax snare. Imagine a consultant raking in $200,000… they might set an $80,000 salary and then let that sweet $120,000 glide in as distributions, zigzagging past about $9,180 in taxes. Sweet, right? But here’s the nudge-pay yourself too little and the IRS will poke around, sniffing out anything fishy.

LLC Tax Elections Maximize Flexibility

Now enter the scene-Limited Liability Companies, the chameleons of the tax world, offering a buffet of choices to trim tax exposure. Default? It’s like a pass-through arcade-income and loss tiptoeing through. But here’s where it gets juicy: elect corporate taxation to build a fortress of retained profits for the future. Family LLCs turn into wealth transfer dynamos-parents handing over membership interests to kids using valuation discounts, poof… future appreciation, gone from taxable estates. Experts see 20-40% discounts for minority interests-translate a $1 million transfer into a $600k-$800k gift tax sweepstakes.

Family Partnerships Accelerate Wealth Transfer

And then, for the pièce de résistance, Family Limited Partnerships-the zenith of estate tax maneuvering, letting affluent clans shift assets while keeping the reins. Parents stash the power-general partnership stakes giving management oomph-and hand off limited partnership interests to kids with fat discounts. Tax Court’s seal of approval is well-earned: 25-35% valuation markdowns. Translation? Major savings on gift tax exemptions. High rollers routinely move $50-100 million in assets, yet they only burn through $30-65 million of exemptions-turbocharging wealth transfers and slashing estate taxes for legacies unchained through nifty capital gains tax strategies.

Final Thoughts

So here’s the deal – the best tax shelters? They’re like a three-course meal… you gotta max out that retirement account, sprinkle in some real estate depreciation, and optimize your business entity. Wealthy folks? Yeah, they’re saving 30-50% on taxes when they stack these strategies right. At the top level, pro tax planning isn’t a luxury, it’s a need – especially when you toss in intricate maneuvers like 1031 exchanges, defined benefit plans, and family limited partnerships.

And remember, tax laws? They’re on a carousel – always spinning. One wrong move… boom, you’re facing audits or penalties that might delete your hard-earned savings. So what’s the starting line? Max out those retirement contributions. Self-employed? Maybe you wanna think about S Corporation elections. If you’re playing the real estate game, dive into depreciation benefits, even consider those 1031 exchanges. Business owners, your move is to check out those entity structures for the best tax setup.

The rich? They don’t just trip and land into tax efficiency. They craft solid strategies with experts who not only understand today’s rules but spot tomorrow’s advantages (and know the fine print that separates the two). Over at Top Wealth Guide, we lay the groundwork you need to make savvy choices about where your finances head next.