Most Americans roll into retirement with less than $100,000 in their savings account — according to what the Fed tells us. This isn’t just a number; it’s a wake-up call. Your monthly expenses? Yeah, those don’t just vanish like Houdini after you hang up the work boots.

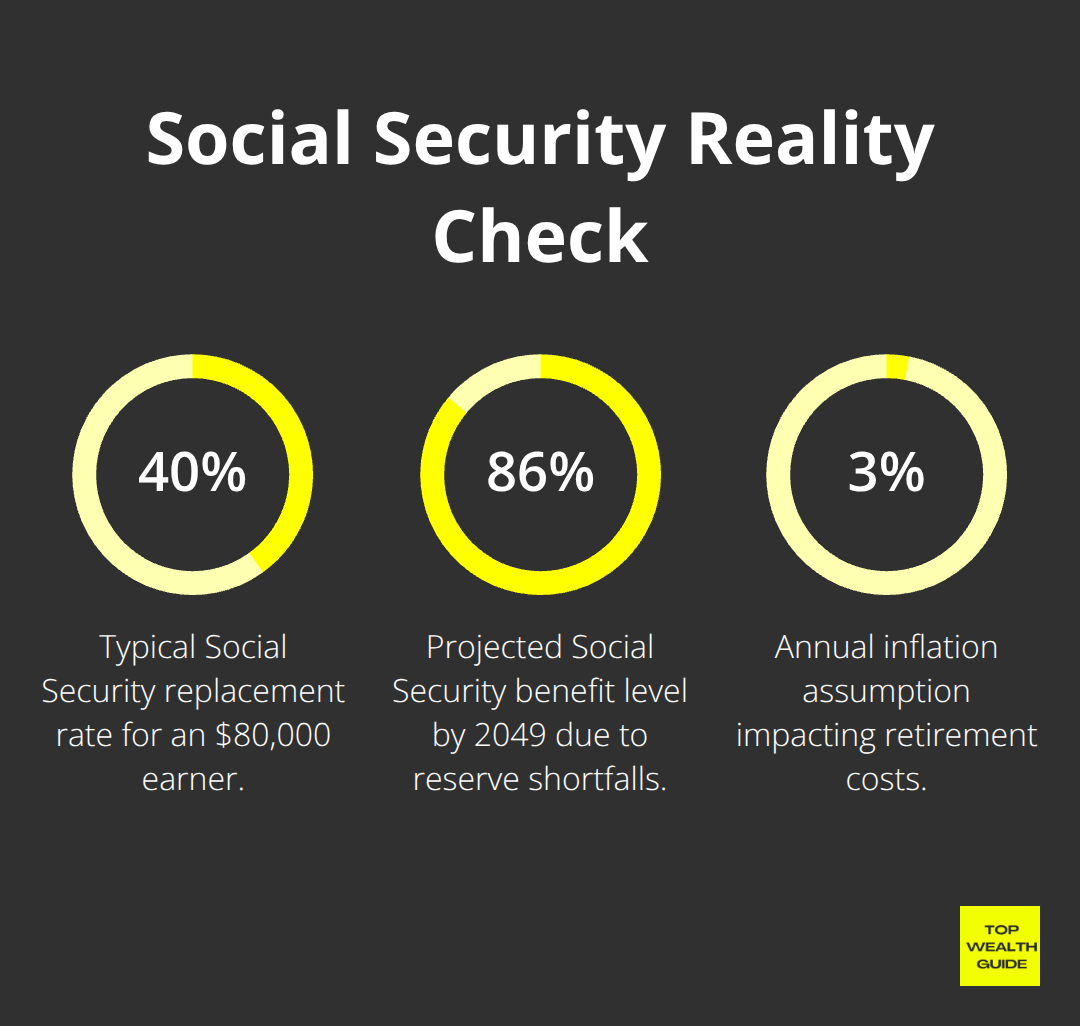

Retirement planning — it’s not just a buzzword, people. It’s your financial parachute when Social Security is handing you a meager 40% of what you made before retiring. And we’re talking real power here (courtesy of Top Wealth Guide) — the power you’re sitting on right now. Start today and watch how you can flip the script on your own financial future.

In This Guide

Why Does Starting Early Matter So Much

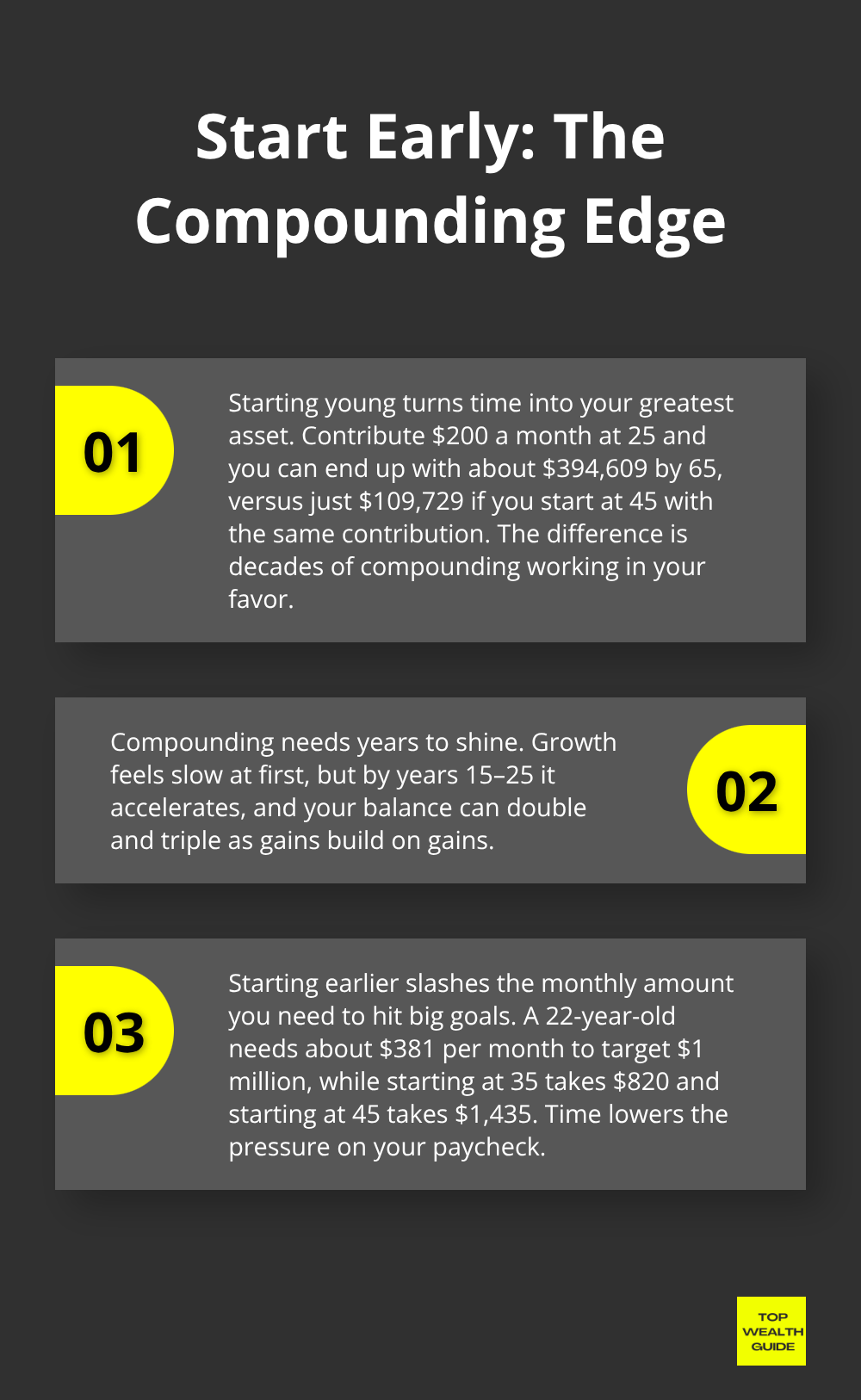

Let’s talk about the magic dust of the financial world – time. Start planning your retirement in your twenties, not your forties, and you unlock a financial gap that’s… well, enormous. Imagine a 25-year-old putting away just $200 a month with a 6% annual return. By 65, they’re sitting pretty with $394,609. Now flip it.

Start at 45 with the same $200 monthly? You end up with a measly $109,729. It’s math. Early birds end up swimming in nearly four times the cash – and they only contributed for 20 more years.

Compound Interest Works Best Over Decades

Get this: compound interest is like your financial BFF, but it needs decades to really shine. That modest $200 per month morphs into big bucks when you give it time. Basically, your money starts making money. The first decade? Yawn. Feels slow. But around year 15 to 25, it’s like stepping on the gas – your account balance doubles, triples, and you’re off to the races. According to the Employee Benefit Research Institute, folks feel more confident with their retirement plans when they’ve harnessed this power.

Market Downturns Become Opportunities Instead of Disasters

Here’s the scoop: young investors? They’re like iron men against market slumps with 30-40 years to bounce back. Remember the 2008 financial rollercoaster? BSE SENSEX plummeted from over 21,000 points to under 8,000. But if you hung in there, five years later, you were back on top. Early movers can snap up more shares at bargain prices during recessions. Folks nearing retirement? They don’t get this luxury – they’re stuck with safe, low-return investments to avoid big hits right before retiring.

Lower Monthly Contributions Create the Same Results

Time is your secret sauce for saving less while getting more. A savvy 22-year-old needs just $381 a month to hit the $1 million retirement jackpot. Wait until you’re 35? That number skyrockets to $820 monthly. Start at 45? Buckle up for $1,435 every month. See the pattern? Delaying – even a smidge in your twenties – turns into a mountain of extra work later on.

Most people hit the road to retirement sabotage before they even start the engine. Don’t be most people.

What Retirement Mistakes Are Sabotaging Your Future

Let’s get real. Most Americans are bungling retirement planning. Three massive blunders – that’s all it takes to hemorrhage hundreds of thousands of dollars. Financial experts? Yeah, they’re seeing these slip-ups time and again across age groups. Here’s the kicker – they’re all avoidable with a sprinkle of savvy knowledge.

Retirement Costs More Than You Think

Surprise, surprise – retirement isn’t the budget vacation people expect. Forget that financial textbook myth about expenses dropping 20-30%. Not happening. Just healthcare alone? It’s a chunk-eater. Try $172,500 in after-tax savings for a 65-year-old to cover health care throughout retirement, according to Fidelity’s 2025 figures.

And inflation? It’s doing its 3% per year dance. That $50,000 lifestyle? It’s morphing into $90,000 in two decades. Most need 80-100% of pre-retirement income, not the fossilized 70% advisors are peddling. Numbers don’t lie – retirement bleeds more cash than you expect.

Social Security Won’t Save You

Banking on Social Security for retirement? News flash: bad idea. The average benefit is a measly $1,500 monthly – $18,000 annually. And guess what? By 2049, benefits are shrinking to 86% thanks to shaky reserves.

Earning $80,000 annually? Expect about 40% in income replacement from Social Security. Translation? That’s a poverty-level retirement if that’s your main plan.

Social Security was never meant to be your golden ticket.

Single Investment Types Equal Financial Disaster

Stashing all your retirement money in company stock or Treasury bonds? Disaster recipe. Remember Enron? Employees watched their savings vaporize in 2001 with that collapse, all because their 401Ks were Enron-heavy.

And conservative retirees hoarding bonds since 2010? Enjoy those 2-3% returns while inflation chuckles at 2.1%. Real talk – smart diversification is key. Mix it up with stocks, bonds, real estate, and international markets to dodge disaster and maximize growth.

These missteps? They snowball. The fix? Start making moves now. The right strategy and proven savings strategies can turn your retirement story completely around.

How Do You Actually Start Retirement Planning

Stop obsessing-just do the math. First step? Pin down that retirement number. Take what you spend now in a year and multiply by 25-that’s your golden ticket, based on the whole 4% withdrawal rule. You’re earning $60,000 and spending $50,000 a year? You’re staring at a $1.25 million target. Fidelity advises socking away 15% of your income yearly, but if you came late to the party, crank that to 20%. Use those online calculators from Vanguard or Fidelity-they’re your best friends for mixing and matching scenarios, accounting for inflation, Social Security, and returns to give you a reality check.

Calculate Your True Retirement Number

People usually guess their retirement needs and, well, get it wrong. Start with your monthly expenses, multiply by 12, then hit that by 25. That’s your number for a comfy 4% withdrawal rate. Spending $4,000 a month now? You’re looking at $1.2 million. And let’s not forget about inflation-your $4,000 could morph into $7,200 in two decades at 3% inflation rate. Tack on 25% for healthcare because, spoiler alert, costs there are climbing even faster.

Pick Your Retirement Account Strategy

Ditch the analysis paralysis-hone in on three account types. First up, max out your 401k if your job offers matching-it’s essentially free cash, usually up to around 3-6%. Next, get a Roth IRA for tax-free growth if your salary is below $138,000 in 2025. For those earning more and craving immediate tax deductions, Traditional IRAs are your ticket. HSAs are like little treasure chests-triple tax advantage and no required distributions. Check out this retirement accounts comparison for the 2025 limits: $23,500 for 401ks, $7,000 for IRAs, $4,300 for individual HSAs.

Automate Everything and Increase Annually

Set up automatic transfers the day after you get paid. Even starting with just $100 monthly beats nada. Most 401k plans will automatically ratchet up your contributions by 1% yearly-kind of lulls you into that 15-20% savings sweet spot.

Research from Schwab and Fidelity shows those who automate save 3 times more than folks doing it manually. Time your annual boosts with tax refunds or post-raise-out of sight, out of mind.

Final Thoughts

Retirement planning isn’t just about money-it’s about freedom. It’s like this: start saving at 25, drop $200 a month, and by the time you hit 65, you’re looking at $394,609. Procrastinate until you’re 45? Well, the same deal nets you only $109,729.

And the biggest misstep folks make? Thinking they’ve got all the time in the world. Cliffhanger alert-Social Security is only filling in 40% of your paycheck blanks, and those coffers are drying up fast. Just paying for healthcare? You’re staring down a $172,500 requirement in after-tax savings for the average 65-year-old (per Fidelity’s latest).

So, here’s the kicker: start this week. Figure out your retirement number with the 25x rule. Open a Roth IRA, or crank up your 401k match to the max. We at Top Wealth Guide have seen it too many times: people kicking this can down the road, thinking they’ve got time, while every month delayed costs thousands in lost compound growth. Don’t be that person.