The top market cap stocks are—they’re reshaping the entire landscape of global markets, it’s like a tectonic shift. And guess who’s leading the charge? Yep, those titans of technology. Apple and Microsoft, these giants, together boast over $6 trillion in market value by 2024. It’s insane.

Here at Top Wealth Guide, we’re diving deep into how these market overlords (let’s just call them that) open doors for strategic investors. Cracking the code of their dominance—it’s like studying the playbook of champions. That’s how you build a portfolio that doesn’t just survive but thrives.

In This Guide

Which Stocks Rule the $126.7 Trillion Global Market

NVIDIA – yes, NVIDIA – now wears the crown with a staggering $4.464 trillion in market cap as of December 2025, leaving Apple’s $4.165 trillion in the dust – a jaw-dropping switcheroo. Microsoft? Holding on in third place with $3.574 trillion, followed by Alphabet at $3.843 trillion, and Amazon rounding out the top five with $2.449 trillion.

These five tech behemoths aren’t just heavyweights; they rule the roost with over $18 trillion in combined market value, which is about 14% of the entire global stock market’s $126.7 trillion total capitalization. Gobsmacking, right?

The AI Revolution Drives Market Leadership

NVIDIA’s meteoric rise is all about one thing – artificial intelligence demand. They’ve rocketed from a $1 trillion valuation in May 2023 to over $4.4 trillion today. Blink, and you’ll miss it – that’s the fastest wealth creation in corporate history, folks. Apple’s slight dip? Thanks to investor jitters over iPhone sales in China – where let’s face it, local players are carving out their slice of the pie. Meanwhile, Alphabet’s riding high on AI, integrating it across search and cloud services, managing to grow steadily – even with watchdogs breathing down their neck.

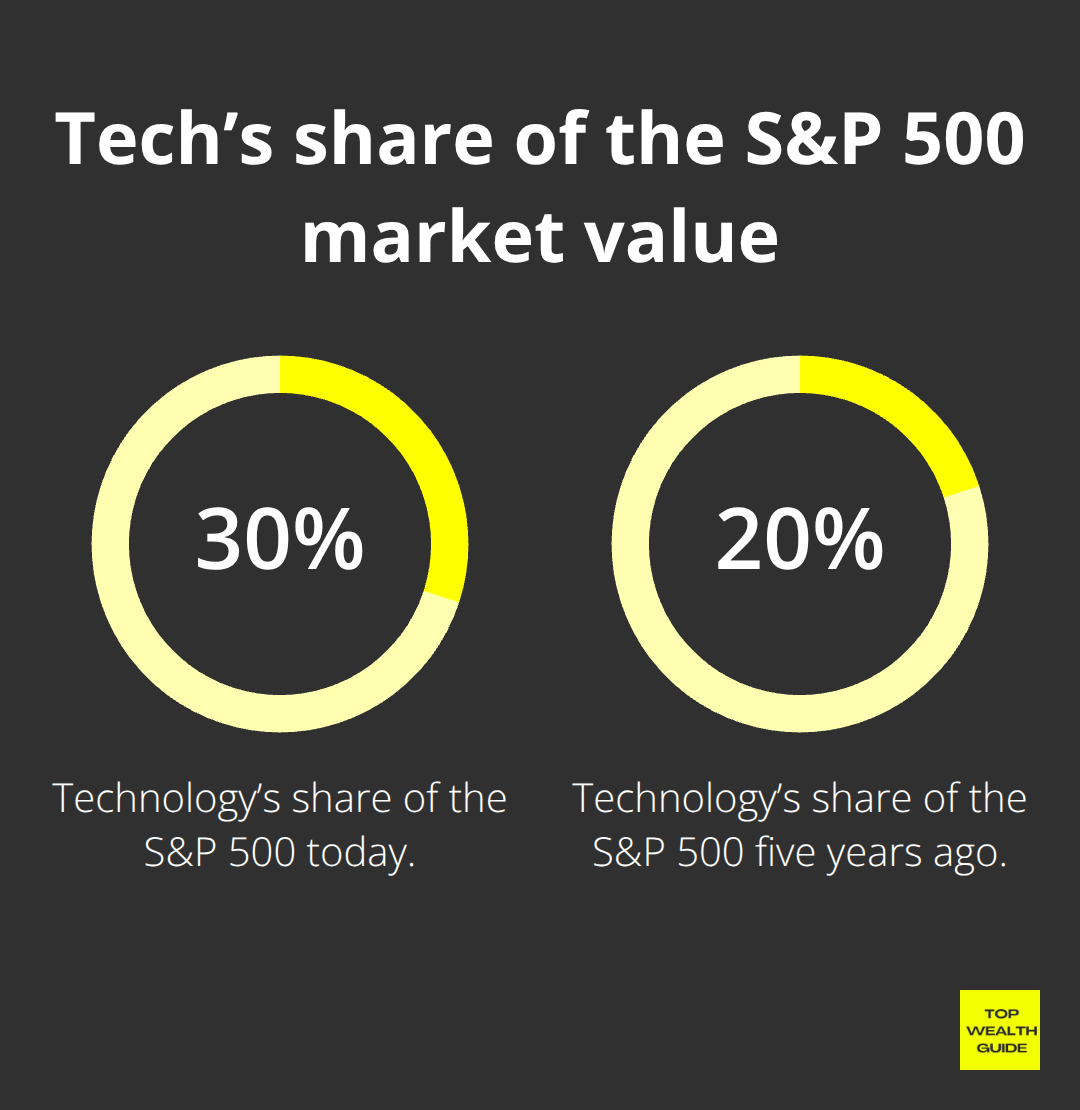

Technology Sector Concentration Reaches Extreme Levels

Tech is getting heavy – nearly 30% of the S&P 500’s total market value, up from a mere 20% five years ago. And look who’s in the trillion-dollar club now – Broadcom, at $1.799 trillion, thanks to semiconductor hunger for data centers. Tesla? Still holding the line at $1.511 trillion, despite the EV battlefield getting crowded.

This kind of concentration isn’t just interesting – it’s a double-edged sword for investors, as these seven giants can swing entire market indices alone.

Market Impact and Investor Implications

Smart money tracks these titans’ quarterly earnings with the intensity of a hawk – one bad quarter from any of them, and bam! Broad selloffs that ripple through sectors you wouldn’t even think are connected. This high concentration is making portfolio diversification trickier than ever – classic sector allocation strategies can sneak in a tech-heavy portfolio when you’re not looking. Unpacking why these giants keep their grip on the market reveals the core forces driving investment strategies today. Understanding this? That’s like having a secret map in the investment world.

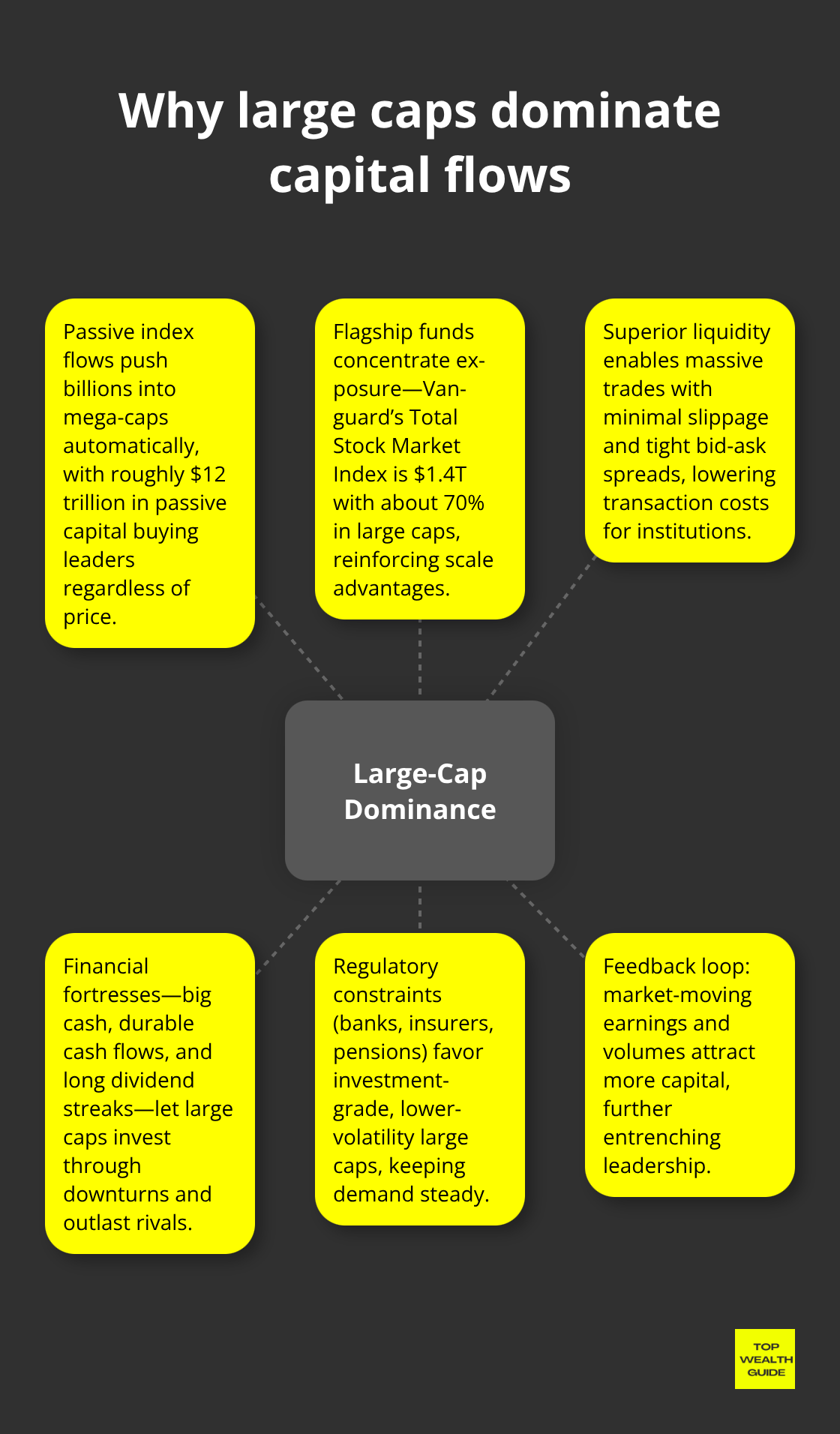

Why Large Cap Stocks Control Everything

Let’s talk cold hard cash-$63 trillion. That’s the mountain of money institutional investors manage globally (thanks, McKinsey). And here’s the kicker: they can’t sidestep the big players.

Pension funds, mutual funds, insurance companies, they’re all hustling to plunk substantial sums into liquid, stable big boys. Enter index funds tracking the S&P 500-they’re on autopilot, buying Apple, Microsoft, NVIDIA no matter the price tag. Yeah, that’s $12 trillion in passive capital flowing straight into behemoths. Take Vanguard’s Total Stock Market Index, for example, packing a whopping $1.4 trillion with 70% in large caps. Active managers? Same ride-miss Apple’s earnings, and you’re playing catch-up with the benchmark.

Volume Creates Self-Reinforcing Dominance

Apple’s got juice-serious daily volume. In contrast, some smaller stocks barely make a ripple at $1 billion. This liquidity chasm? It gives big shots the freedom to trade massive amounts without shaking the market. Try offloading $100 million of a mid-cap and brace yourself for a 15% nosedive. Large caps give you tight bid-ask spreads (we’re talking pennies), saving institutions a boatload in transaction costs. High-frequency trading loves this game-stocks with stable volumes, minimal slippage, what’s not to love?

Financial Fortress Strategy Wins Long-Term

Cash is king, and these tech giants are royalty. Their coffers? Overflowing. Whether it’s riding out economic storms, swallowing rivals, or splurging on R&D-they’ve got it covered. Ever heard of dividend consistency? Johnson & Johnson, 62 years of raises. Coca-Cola, 61 years. Large caps spin off cash flows smaller players can’t touch-Apple’s service revenue alone dwarfs many entire companies’ sales.

Regulatory Requirements Drive Capital Allocation

Bank regulations pack a wallop-institutions must hold chunks in investment-grade, read: big cap, stocks. Insurance companies, they’ve got to match those long-term liabilities with rock-solid assets, steering billions again to the tried-and-true. Fiduciaries overseeing pensions are boxed in by legal duty to avoid risky bets, making volatile small caps a no-go. These regulatory mazes keep driving demand for large cap stocks, rain or shine.

It’s a big league world. These market giants aren’t just shaping investor playbooks-they’re setting the whole field.

How to Build Winning Large Cap Positions

Alright, folks, here’s the lowdown – put your dough into large caps with dollar-cost averaging. Why? Because the numbers don’t lie. Talk about no-brainers: studies show those who made it rain on the S&P 500 month after month are sitting pretty with hefty returns. Start simple. Throw $500 into QQQ or SPY every month – these ETFs spread your bets across heavyweights in the market. Thanks to Fidelity and their zero-fee index funds, you can snatch up Apple, Microsoft, and NVIDIA sans the fee fuss. Just set up those automatic transfers for the 1st and 15th of each month to balance catching market moods – peaks and valleys.

Sector Rotation Within Tech Dominance

Now, tech… it’s not just a fad – it’s a religion. But you gotta be precise. Spread it like this: 40% into semi with SOXX, 35% into software with MGK, and 25% into cloud via WCLD. Keeps you from going all-in on one tech space. Sure, AI chips might chill, but then boom – cloud is hot. Research says sector rotation beats that lazy buy-and-hold game. Hedge your tech with healthcare tech like UnitedHealth and big pharma like Eli Lilly. Not to mention the financial beasts JPMorgan and Visa to keep those cash flows friendly, even when growth stocks hit a rough patch.

Value Meets Growth Strategy

Look at Warren Buffett – that guy is holding a $1.086 trillion fortress of value in large caps. How? Companies trading below what they’re worth with killer competitive edges. Blend in growth stars like Tesla and Meta with cash-pumping classics like Johnson & Johnson and Procter & Gamble. Research says mixed strategies are the sweet spot, bringing balance to the force… er, portfolio, while minding risks.

Stock Selection Criteria

Got criteria? You better. Hunt those large caps with P/E ratios under 25, a debt-to-equity below 0.5, and unstoppable revenue – 8% growth or more, annually. This sifts out the overpriced hype trains, letting you latch onto real wealth generators. Look for companies consistent in free cash flow (shoutout to Apple and their $100+ billion a year) with fortress-like market positions. Snag those who show solid finances and a knack for innovation – because let’s face it, economic cycles aren’t going anywhere.

Final Thoughts

Okay, here’s the deal – top market cap stocks? Yeah, they’re like the unshakeable towers in your portfolio. They offer this fortress of stability, liquidity, and growth, making smaller fry look like nimble but, let’s face it, far riskier fish. These heavyweights? They crank out cash flows like a vending machine you can’t tip over, ride out economic downturns with style, and create the sturdy base every serious investor dreams about. Institutional investors dive into these giants for a reason – and it’s not just the champagne in the executive lounge. The numbers scream their supremacy.

So, if you’re smart (and I know you are), you’d be allocating a wholesome 60-80% of your portfolio to these large caps, spreading the love (and risk) across sectors. Tech? It’s running the show, sure, but don’t put all your eggs in Mark Zuckerberg’s basket. Mix in some healthcare, financials, and the good ol’ consumer staples. Why? To dodge that nasty overconcentration bug. Meanwhile, let’s talk about dollar-cost averaging – it’s your bread and butter. It scrubs away those pesky timing errors and helps you accumulate wealth like a boss through broad market ETFs, say SPY or QQQ.

Ready to flex those investing muscles? Dive into large caps today with good ol’ automatic monthly contributions in low-cost index funds mirroring the S&P 500. But wait, there’s more – for the adventurous souls, dig deeper into individual stocks blessed with strong fundamentals. Think low debt, earnings that keep climbing like a squirrel on caffeine, and competitive moats that scream “Stay out!” We, over at Top Wealth Guide, have an eye on how these market leaders keep innovating, going global, and rolling out returns that compound like your favorite snowball… over decades.