Most folks believe they’re killing it with their money management skills, but lurking beneath the surface are sneaky financial planning blunders that slowly siphon away their wealth year after year. It’s those pesky errors that, bit by bit, snowball into colossal financial drama.

Here at Top Wealth Guide, we’ve pinpointed the major culprits—the money missteps that ensnare millions in the hamster wheel of financial blah. The silver lining? Every single one of these goofs can be undone with the right game plan.

In This Guide

Why Most People Stay Broke Despite Earning More

Sixty percent of Americans – that’s right, over half the nation – are living paycheck to paycheck. Yep, it’s not just the folks earning minimum wage; high earners are in the same boat. Why? It’s not rocket science. They skip the no-brainer step that separates the financially savvy from the financial train wrecks: a written financial plan. No road map (or in this case, financial plan)? You’re basically playing blindfolded darts with your money. The Federal Reserve’s 2022 Survey of Household Economics showed one in three adults say their financial situation got worse. Why? Unplanned expenses and zero direction… go-figure.

The Silent Wealth Killer Called Lifestyle Inflation

This is where people nosedive into financial doom without realizing it. You earn more, then you spend more. That new job? Yeah, suddenly you’re living in a pricier apartment and eating out every night. And poof – your $75k salary requires an $85k lifestyle to keep up. And this is how folks pulling six figures still end up feeling broke. Their spending balloons with income, leaving zilch for saving. Federal Reserve stats back it up: 55 percent of adults tuck away enough for three months of expenses. Translation? Making more cash doesn’t mean saving more unless you plan – for real.

High-Interest Debt Destroys Wealth Faster Than You Think

Credit card debt… the silent killer. Federal Reserve data paints a grim picture. Carry a $5,000 balance at high rates and you’re bleeding money annually in interest. Here’s a reality check: make minimum payments on $10k and it’s going to take you over 30 years to pay off – costing more than $20k in interest alone. Yikes. Delay paying off debt aggressively, and compound interest is your enemy, not your friend.

The Budget Trap That Keeps You Poor

People who dodge budgets claim they’re on top of their finances (spoiler alert: nope). Without an actual budget, minor leaks soon morph into financial tsunamis. Your daily $5 Starbucks addiction? That’s $1,825 a year. Those forgotten subscription services? Say goodbye to another $1,300 each year.

These little charges compound – next thing you know, they’re major wealth destroyers left unchecked.

And then there’s investment blunders, costing you thousands in lost opportunities and bad market moves. Understanding this can make or break your financial future.

Investment Blunders That Sabotage Your Wealth

The Devastating Cost of Late Starts

Here’s the math – and spoiler alert, it ain’t pretty: start investing at 35 instead of 25, and boom, you’re on the hook to save almost twice as much every month just to hit the same retirement targets. Picture this: a 25-year-old tosses $200 a month into the investment pot at a cozy 7% annual return, and by the time they’re hitting 65, they’re sitting on a comfy $525,000. Now switch that start to age 35 – guess what? You’re topping out at just $245,000. That jaw-dropping $280,000 gap is the price tag for procrastination.

Research from Vanguard throws more light on the issue: delay your 401k enrollment by a single year, and bam, that’s a whopping 25% less wealth by the time you hang up your boots. The clock is your best buddy when it comes to making compound interest really sing.

Market Timing Destroys More Wealth Than Market Crashes

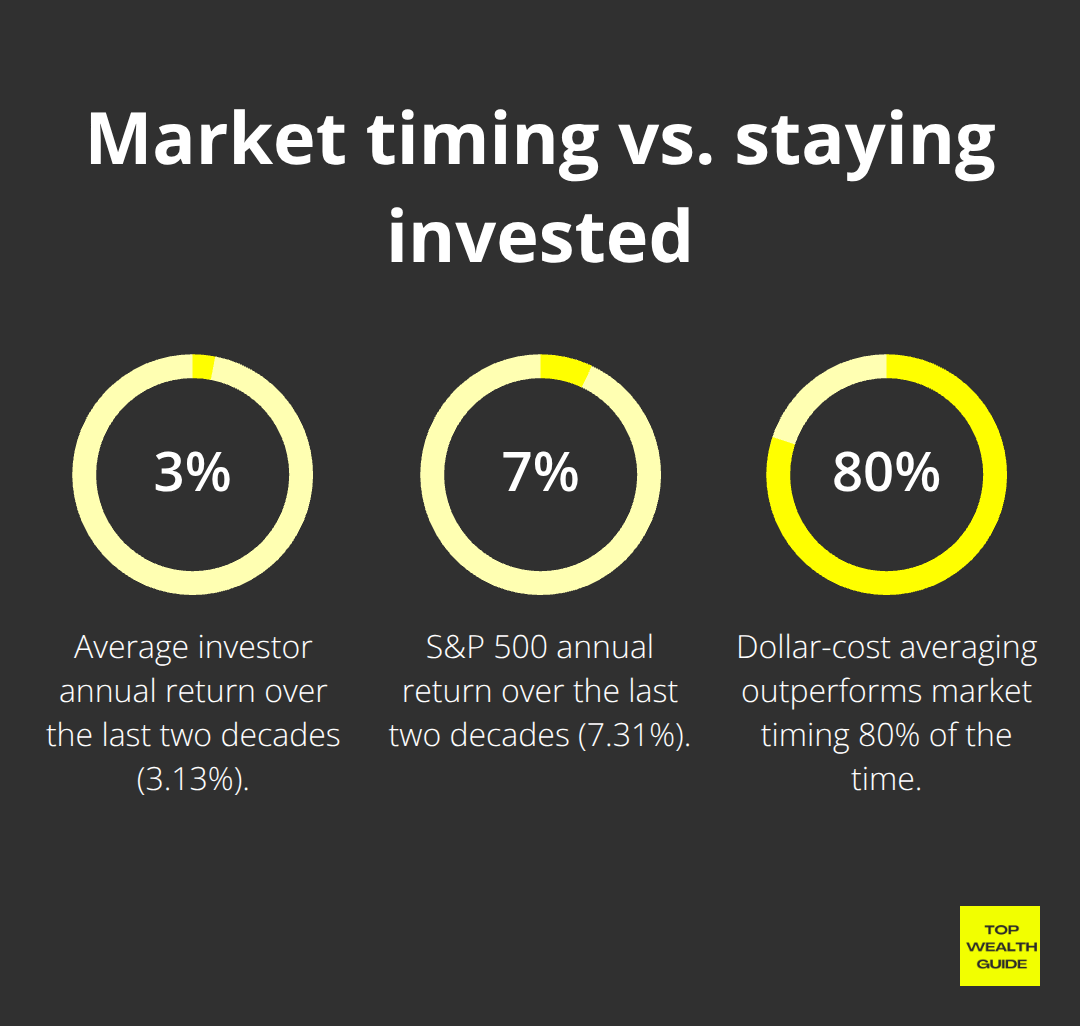

Even the pros – with fleets of analysts at their beck and call – can’t consistently nail market timing, yet many everyday folks convince themselves they’ve cracked the code. Reality check: the average Joe investor raked in just 3.13% annually over the last two decades while the S&P 500 strutted around with 7.31%.

Why? ‘Cause folks love to panic and sell low or buy high.

Skip just the 10 best days over 20 years, and poof, your gains are sliced in half. Morningstar backs this up: stick with dollar-cost averaging and you’re likely to come out ahead 80% of the time. Steady Eddie always outshines Slick Rick.

Cash Savings Guarantee Wealth Loss Over Time

Leave your cash lounging in savings accounts at a paltry 0.5% return while inflation gallops ahead at 3%, and you’re watching your purchasing power slip away at a clip of 2.5% a year. A $50,000 emergency kitty bleeds $1,250 in real value annually just chilling in regular savings. Even the so-called high-yield savings accounts? They’re barely treading water with inflation – if that.

The stock market’s dance card has boasted a 10% average return since way back in 1926. Conservative 60/40 portfolios? They clock in around 8% annually. So that opportunity cost? It burns: $10,000 sitting in growth investments versus cash over 30 years means you’re waving goodbye to roughly $150,000 in missed growth.

These blunders in investing are a hot mess, but they pale next to the financial nightmares from inadequate emergency funds and insurance blind spots – those can wipe out decades of financial groundwork in the blink of an eye.

Emergency Fund and Insurance Gaps That Create Financial Risk

Why Emergency Funds Beat Credit Cards Every Time

So here’s the deal-financial gurus are all about that rainy day fund magic: three to six months of expenses tucked away. But-hold on-only 55% of adults can handle a $400 curveball without hitting up the plastic. That’s straight from the Federal Reserve. What’s the rub? Relying on those shiny little cards during a crisis.

It takes a rainy day and turns it into a monsoon of high-interest debt. Case in point-median credit card interest rates soared to 24.62% in June 2024. A $5,000 emergency turns into $6,231 of ouch within a year if you’re just making minimum payments. It’s like giving your future a black eye.

The Real Cost of Skipping Disability Insurance

Get this-Social Security Administration stats say one in four workers hits a disability road bump before hanging up the work boots. Yet, 52% of folks flying private-sector don’t have disability insurance. No insurance? Get ready for short-term disabilities that burn $15,000 in lost income and medical bills faster than you can say, “Ouch!” And long-term disability? That’s the monster under the bed. A 35-year-old pulling in $50K misses out on $1.2 million of lifetime earnings without coverage. Yikes.

Life Insurance Gaps Leave Families Vulnerable

Here’s a scary thought-42% of American adults aren’t covered in the life insurance department according to LIMRA. Imagine the breadwinner checking out and leaving the fam juggling mortgages, childcare, and debts alone. Cashing out assets, moving to smaller digs, or taking on more debt just to get by isn’t a pretty survival strategy. Plus, an average funeral hits the wallet for $7,848 (shoutout to National Funeral Directors Association). Not having that coverage? It’s a financial horror show.

Credit Cards Create Compound Financial Disasters

Credit cards as your crisis sidekick? Yep, they’ll turn that bump in the road into a financial black hole. Zap a $10,000 medical bill onto the credit card with the usual rate, and behold-$300 monthly payments for more than four years, burning $4,500 in interest along the way. Now, imagine that $10,000 lounging in a money market account earning you a cool 4.5%-that’s $450 in your pocket every year. The kicker? That lost opportunity adds up. Emergency fund cash grows; credit card debt yanks your net worth down 25% annually in interest and missed investment gigs. Feel the squeeze? That’s the brutal side of playing with credit fire.

Final Thoughts

Here’s the thing – flubbing financial planning? It’s bleeding Americans dry… like millions evaporating into the ether each year. The math is unforgiving: avoid budgets and whoosh, $3,000+ evaporates annually, thanks to sneaky subscriptions and those late-night Amazon binges. Push back investment start from 25 to 35? Boom – you’re down $280,000 when it’s time to retire. And leaning on credit cards during a crisis? That $10,000 oh-no moment balloons to $14,500 after interest does its thing.

Solution? Easy. It starts now. Jot down your monthly inflow and outgo – yep, every single buck. Get those automatic transfers rolling to beef up that emergency stash, even if it’s a mere $50 a month (small steps, but just step). Crack open an investment account and ease in with $100 per month into some low-cost index funds.

Smart financial planning? It flips the script, turning compound interest into a mighty wealth engine, not a debt-ravaging beast. A savvy 25-year-old stashing $200 monthly can see it swell to $525,000 by the time they hang up their working boots. Over here at Top Wealth Guide we’re privy to this magic trick – fiddling with financial habits can morph into monumental life shifts.