When people talk about real estate investment strategies, they're really just talking about the different ways you can make money from property. It’s a broad field, covering everything from generating a steady monthly check from rental income to chasing quick profits by flipping houses. There's no single "best" way to do it; the right path for you will always come down to your personal finances, how much risk you're comfortable with, and what you’re trying to achieve.

In This Guide

- 1 How To Start Building Wealth Through Real Estate

- 2 Exploring Core Real Estate Investment Strategies

- 3 Comparing Real Estate Strategies For Your Goals

- 4 Unlocking Profits with Value-Add Investing

- 5 Future-Proofing Your Portfolio with Emerging Trends

- 6 Navigating Real Estate Market Cycles

- 7 Frequently Asked Questions (FAQ)

- 7.1 1. What is the best real estate strategy for a beginner?

- 7.2 2. How much money do I really need to start investing in property?

- 7.3 3. What is the difference between cash flow and appreciation?

- 7.4 4. Is real estate a liquid investment?

- 7.5 5. What is the "1% Rule" in real estate?

- 7.6 6. What are the main risks in fix-and-flip investing?

- 7.7 7. How does the BRRRR method work?

- 7.8 8. What is "house hacking"?

- 7.9 9. Are commercial and residential real estate investing different?

- 7.10 10. How important is location when choosing an investment property?

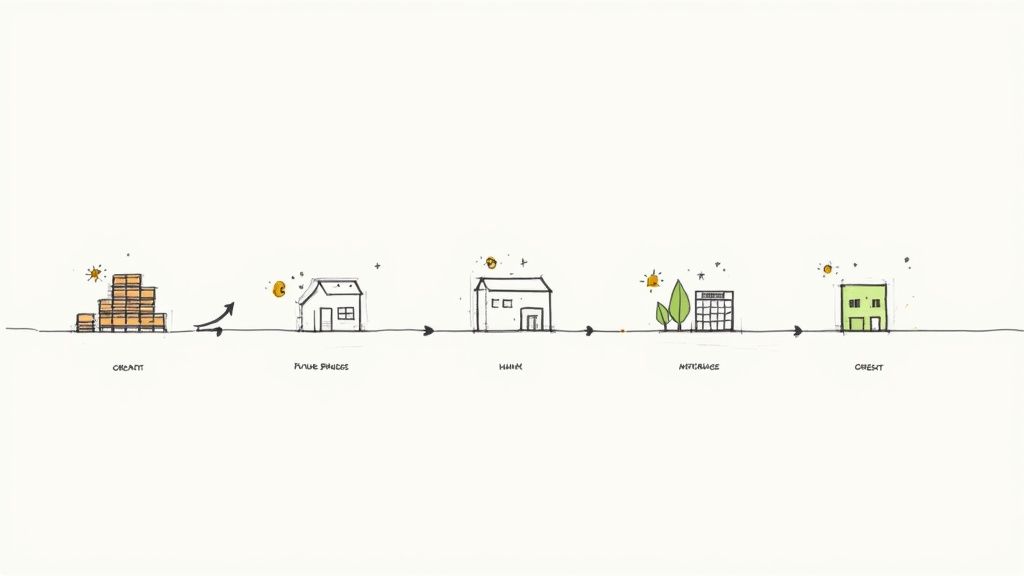

How To Start Building Wealth Through Real Estate

Investing in property isn't just about buying a house; it’s a time-tested strategy for building real, lasting wealth. It might sound like something reserved for the pros, but getting started is more straightforward than you think, with a whole menu of options available for beginners and seasoned investors alike.

At its heart, real estate investing is about making your money work for you through a physical asset. This happens in two main ways:

- Cash Flow: This is the money left over from rent each month after you’ve paid the mortgage, taxes, insurance, and any other expenses. It's the profit that hits your bank account regularly.

- Appreciation: This is the slow, steady increase in your property's value over the years. You don't see this money month-to-month, but it's quietly building your net worth in the background.

Finding Your Path in Real Estate Investing

The first step is figuring out which game you want to play. Some strategies are built for the long haul. Take the classic buy-and-hold approach, where you buy a property and rent it out for years. It's a slow-and-steady marathon designed to create a reliable income stream.

On the other hand, there are more active real estate investment strategies geared toward quicker paydays. Think of house flippers who buy a rundown property, renovate it, and sell it for a profit within months. This is more of a sprint, demanding more hands-on work but offering the potential for a big payoff in a short time. If you're looking for a complete walkthrough of getting started, our guide on how to invest in real estate breaks it all down.

Strategies for Every Investor

You don't need a massive bank account to get in the game. The world of real estate investing has expanded far beyond just buying physical properties.

Real estate investing is not just for the wealthy. With the right strategy, anyone can leverage property to build a more secure financial future. It's about finding the approach that aligns with your resources and goals.

For those who want the benefits of real estate without the headaches of being a landlord, options like Real Estate Investment Trusts (REITs) are a fantastic entry point. Buying a REIT is like buying a stock, but instead of one company, you're buying a small piece of a huge portfolio of properties. This guide will walk you through all these different avenues, giving you a clear roadmap to choose the one that makes the most sense for you.

Exploring Core Real Estate Investment Strategies

The first step into real estate investing isn't about finding a property; it's about choosing your path. Every strategy comes with its own unique blend of risk, reward, and hands-on commitment. Think of it like deciding whether you want to be a marathon runner, a sprinter, or a spectator with a stake in the race.

Let's break down the most common game plans to help you find the one that truly fits your financial goals and lifestyle.

Buy and Hold: The Classic Path to Long-Term Wealth

This is the quintessential real estate strategy, and it’s exactly what it sounds like. You buy a property, hold onto it for the long haul, and rent it out. It’s the slow-and-steady-wins-the-race approach to building wealth.

Real-Life Example: Meet Sarah, a 35-year-old marketing manager aiming for early retirement. She buys a single-family home in a growing suburb for $300,000. Her mortgage, taxes, and insurance total $1,800/month. She rents it out for $2,400/month. After setting aside 10% for maintenance ($240), her monthly cash flow is a steady $360. Over 15 years, her tenants pay down her mortgage, the property appreciates to $500,000, and she has built a significant asset providing reliable income.

Wealth creation here comes from two places:

- Monthly Cash Flow: After you collect rent and pay all your bills—mortgage, taxes, insurance, and a buffer for repairs—the money left over is your cash flow. It’s the engine that powers your investment.

- Long-Term Appreciation: While you're cashing those rent checks, the property's value is quietly climbing in the background, thanks to inflation and market demand. This is how your net worth grows while you sleep.

This strategy is perfect for investors playing the long game. It’s less about timing the market and more about having time in the market.

Fix-and-Flip: For the Hands-On Investor

If buy-and-hold is a marathon, fix-and-flip is a high-stakes sprint. The goal here is to find a diamond in the rough—an undervalued or distressed property—and polish it up with renovations. Then, you sell it quickly for a profit.

Flippers don't wait for the market to give them appreciation; they force it through smart improvements. But to succeed, you have to nail a few key things:

- Know Your Numbers: You absolutely must have a rock-solid budget for renovations. One unexpected cost can wipe out your entire profit.

- Understand the Market: You need to know what upgrades buyers in that specific neighborhood are actually willing to pay for. A high-end kitchen might be a waste of money in a starter-home community.

- Speed Is Everything: Every day you hold the property, you're paying for taxes, insurance, and utilities. These "carrying costs" eat into your profits, so a fast turnaround is crucial.

Real-Life Example: Consider Mike, a contractor. He finds a dated house for $200,000. He knows he can renovate the kitchen and bathrooms, add new flooring, and paint everything for $40,000. After three months of work, he sells the house for $310,000. After realtor fees and carrying costs ($15,000), his net profit is $55,000. This is a high-effort, high-reward game best suited for people who love a good project and have a keen eye for both construction and market trends.

Passive Investing: REITs and Crowdfunding

Let's be honest—not everyone wants to get a call about a broken toilet on a Saturday night. If you're looking for a hands-off way to get into the real estate game, passive investing is your ticket.

Real Estate Investment Trusts (REITs) are basically mutual funds for real estate. They are companies that own and operate massive portfolios of properties—think apartment complexes, office towers, or shopping malls. You can buy and sell shares of REITs on the stock market just like you would with Apple or Google. This gives you instant diversification and liquidity. Want to dive deeper? Check out our detailed guide on how Real Estate Investment Trusts work.

Real Estate Crowdfunding is a newer model where online platforms pool money from tons of individual investors to fund big projects, like building a new condo tower or buying a commercial building. It opens the door to the kind of large-scale deals that were once only available to the ultra-wealthy.

Passive investing is the ultimate gateway to real estate for anyone short on time or capital. You get to enjoy the financial benefits of property ownership without ever having to screen a tenant or fix a leaky faucet.

These passive real estate investment strategies are ideal for beginners or busy professionals who want real estate exposure without the landlord headaches.

Comparison of Core Investment Strategies

Each of these approaches is built for a different kind of person with a different set of goals. Seeing them side-by-side makes it easier to figure out where you fit in.

| Strategy | Primary Goal | Time Commitment | Capital Required | Risk Level | Best For |

|---|---|---|---|---|---|

| Buy and Hold | Consistent cash flow & long-term appreciation | Low to Medium (ongoing) | High (down payment) | Low to Medium | Long-term wealth builders seeking passive income. |

| Fix-and-Flip | Quick, lump-sum profit | High (active management) | High (purchase & renovation) | Medium to High | Hands-on individuals with construction knowledge. |

| REITs | Passive income (dividends) & liquidity | Very Low | Low (price of a share) | Low to Medium | Beginners or investors seeking diversification. |

| Crowdfunding | Access to large projects & diversification | Very Low | Low to Medium | Medium | Investors wanting access to institutional-grade deals. |

Ultimately, there's no single "best" strategy—only the one that's best for you. Whether you want the slow, compounding growth of a rental portfolio or the simple, hands-off nature of a REIT, there’s a place for you in the world of real estate.

Comparing Real Estate Strategies For Your Goals

There’s no single “best” way to invest in real estate. The right strategy for you is the one that fits your bank account, your stomach for risk, and your long-term vision. It's all about finding that perfect match between your life and your investment style.

Making that choice upfront can be the difference between a thriving portfolio and a costly mistake. To get you thinking, this chart breaks down how different goals often lead to different investment paths.

As you can see, what you want to achieve is the first and most important piece of the puzzle. Whether you're chasing steady monthly income, a big one-time profit, or just quiet, long-term growth, your goal will point you in the right direction.

Matching Your Goals To A Strategy

Every investor's situation is unique. Are you trying to replace your day job's income with rental checks? Or are you hunting for a big score from a flip to fund your next venture? Maybe you just want to park your money somewhere it can grow for the next 20 years without you having to think about it.

Think of it this way: a busy doctor with a great salary but zero free time might be drawn to passive investments like REITs. On the other hand, a skilled carpenter with a flexible schedule could see a goldmine in fix-and-flip projects. It's all about honestly assessing what you bring to the table.

A Detailed Strategy Comparison

To make the decision even clearer, it helps to see the main strategies laid out side-by-side. This table gives you a bird's-eye view of what each approach demands and what it offers in return.

Comparison of Real Estate Investment Strategies

This table compares key real estate investment strategies across critical factors to help investors choose the best fit for their goals.

| Strategy | Capital Required | Risk Level | Potential Return | Time Commitment | Required Expertise |

|---|---|---|---|---|---|

| Buy and Hold | Medium to High | Low to Medium | Steady cash flow and long-term appreciation | Low (once tenanted) | Medium (property management) |

| Fix-and-Flip | High | Medium to High | High, short-term profit | High (active project management) | High (construction, market trends) |

| REITs | Very Low | Low | Moderate dividends and liquidity | Very Low | Low (basic stock knowledge) |

| Crowdfunding | Low to Medium | Medium | Varies by project, less liquidity | Very Low | Low to Medium (deal analysis) |

| House Hacking | Low to Medium | Low | Reduced living costs and equity building | Medium (landlord duties) | Medium (tenant screening) |

Looking at the table, you can really see the trade-offs. Sure, flipping a house can bring in the biggest, fastest profits. But it also requires the most cash, expertise, and hands-on effort, carrying a ton of risk if your budget blows up or the market takes a downturn.

Real-Life Scenarios

Let's see how this plays out for a couple of different people:

- The Aspiring Early Retiree: Sarah wants to generate $5,000 a month in passive income so she can quit her job. For her, the buy-and-hold strategy is a perfect fit. By slowly acquiring a handful of cash-flowing rental properties, she can build a reliable income stream that doesn't require her to be there every day.

- The Hands-On Wealth Builder: Mark is a general contractor who loves getting his hands dirty. He wants to generate big chunks of cash to pour into new projects. The fix-and-flip model was practically made for him. His construction knowledge lets him manage costs and create value, leading to significant profits in just a few months.

Remember, picking a strategy isn't a life sentence. Plenty of successful investors start small and safe—maybe with a REIT or by house hacking—to learn the ropes before they dive into more demanding ventures like multi-family rentals or commercial buildings.

At the end of the day, the best real estate strategy is the one you genuinely understand and that fits into your life without causing chaos. Take a good, hard look at your resources—your money, your time, and your skills—and you'll find the path that leads to your financial goals.

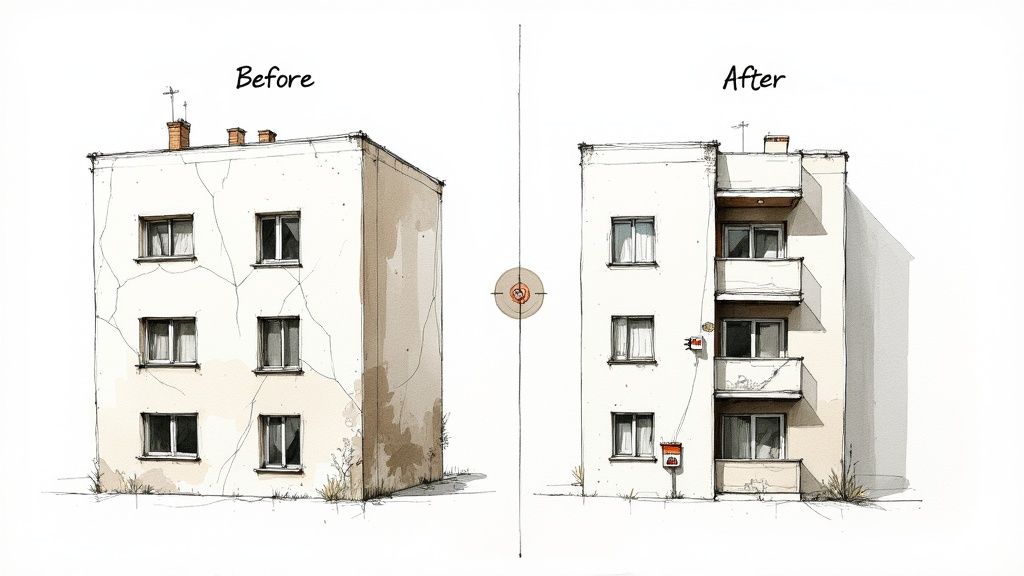

Unlocking Profits with Value-Add Investing

While some investors ride the market waves, hoping values will rise, a value-add investor prefers to make their own. This hands-on strategy is all about finding properties that are falling short of their potential and forcing appreciation through smart, targeted improvements. It’s for the investor who wants to create wealth, not just wait for it.

The concept is beautifully simple: buy a property that’s underperforming, fix what's broken—whether physical or operational—and then enjoy the rewards. We're not just talking about a fresh coat of paint; this is about fundamentally boosting a property's income and, as a result, its overall market value.

This strategy really gained traction after the 2008 financial crisis. Savvy investors scooped up distressed properties, renovated them, and installed better management. Many saw annual gains in the 15-20% range. You can see how market cycles create these kinds of openings in PwC's global outlook.

Identifying Value-Add Opportunities

The first skill you need to develop is spotting the diamond in the rough. Value-add properties often have tell-tale signs of untapped potential. The real trick is to look past the current flaws and envision what the property could become with a little work.

These opportunities typically fall into a few buckets:

- Physical Distress: Think dated kitchens, worn-out carpets, or zero curb appeal. These are often cosmetic fixes that can be handled with a reasonable budget, leading to a quick and significant bump in rent and property value.

- Operational Inefficiency: This is all about bad management. A building with high vacancy, rents well below market rates, or sloppy maintenance is an operational goldmine just waiting for a competent owner to turn things around.

- Repositioning Potential: Sometimes a property isn't being used in the best way possible. This could mean anything from converting a large single-family home into a duplex to legally adding another bedroom to boost rental income.

Real-Life Example: The Under-Managed Duplex

Let's walk through a classic example. An investor, Maria, finds a duplex where both units are rented for $1,200 a month. A little research shows the neighborhood average is closer to $1,600. The owner lives out of state, hasn't raised the rent in years, and lets maintenance requests pile up, causing good tenants to leave.

A value-add investor sees this mess and smells an opportunity.

Maria invests $20,000 in cosmetic updates—things like new paint, modern light fixtures, and updated bathroom vanities. With the units looking sharp, she can now justify raising the rents to the market rate as leases expire. This simple move adds $9,600 to her annual rental income ($400 extra per unit x 2 units x 12 months).

This increased income doesn't just mean better monthly cash flow. It dramatically boosts the property's sale price, since the value of multi-family buildings is tied directly to the income they produce.

Value-add investing is the art of seeing future potential where others see current problems. It's about turning operational headaches and physical flaws into profit through vision and execution.

This proactive approach is a cornerstone of many successful real estate portfolios. It’s also a key ingredient in powerful wealth-building strategies. You can see how this works in our step-by-step guide to the BRRRR method. By forcing appreciation, you create your own equity that can be tapped to buy the next property, putting your journey to financial freedom on the fast track.

Future-Proofing Your Portfolio with Emerging Trends

A savvy real estate investor doesn't just focus on what's working right now. They're always looking ahead, trying to figure out what will be in high demand tomorrow. The property market is always changing, and if you want to build lasting wealth, you need to position your portfolio to ride the next big wave.

This means looking past the usual suspects—like residential homes and office buildings—and into sectors that are being supercharged by huge shifts in technology and our economy.

Tapping into these emerging trends is a great way to diversify and create a more durable portfolio. By adding asset classes that don't move in lockstep with the broader economy, you can build a buffer against market swings. The aim is to build a collection of properties that can thrive not just today, but in the market that's taking shape right around the corner.

Riding the Waves of Tech and Commerce

Two of the most powerful forces reshaping our world are the explosion of digital data and the unstoppable rise of e-commerce. These aren't just abstract ideas; they're creating very real, very lucrative opportunities in real estate.

Think about it. We're moving from housing people to housing the very infrastructure of our modern lives.

- Data Centers: With the boom in AI, cloud storage, and streaming, data centers have basically become the new utility. They are absolutely essential, which makes them an incredibly stable, high-demand type of property.

- Industrial and Logistics: Every single time you click "buy now," you're setting a massive supply chain in motion. This has fueled an almost bottomless need for warehouses, sprawling distribution centers, and those smaller "last-mile" hubs that get packages to your door.

This overlap between real estate and essential infrastructure is a powerful play for the long haul. In fact, the 2025 market outlook pinpoints sectors like data centers as some of the most profitable opportunities on the planet, showing just how big of a deal this is. You can dig into the full report for more insights on global real estate trends at ULI.org.

Exploring Niche and Recession-Resistant Sectors

Beyond the big, headline-grabbing trends, you'll find other niche areas that offer steady growth. These sectors often cater to needs that don't disappear when the economy gets rocky, making them fantastic for diversification.

You might want to look into areas like:

- Life Sciences Facilities: As our population gets older and medical research advances, the demand for specialized labs and R&D facilities is soaring.

- Self-Storage: People always need a place to put their stuff. Whether they're moving, downsizing, or running a business out of their garage, the need for storage holds up remarkably well, even during a downturn.

The smartest investors look for opportunities driven by deep, long-term shifts in society and technology. By understanding these undercurrents, you can position your portfolio for growth that is both substantial and sustainable.

The Growing Importance of ESG

Finally, there's a huge trend reshaping the entire real estate market: a focus on Environmental, Social, and Governance (ESG) principles. It’s no longer a fringe idea. Today’s tenants and big-money investors are demanding buildings that are not just profitable but also sustainable and socially responsible.

Properties with green certifications, top-notch energy efficiency, and a focus on wellness are fetching higher rents and locking in stable, long-term tenants. This isn't just about feeling good; it's about smart business. Ignoring ESG is simply not an option anymore if you're serious about building a portfolio that will stand the test of time.

As you start exploring these more advanced strategies, technology can be a huge help. To keep everything organized, check out our guide on the best real estate investment apps available to manage your growing portfolio.

Getting real estate investing right is about more than just finding a great property. It's about timing. Think of the market like the four seasons—it has a natural, predictable rhythm. Understanding which "season" you're in tells you when to be aggressive, when to sit tight, and when it’s the right time to cash out.

Trying to invest without knowing the market cycle is like setting sail without checking the weather. You might catch a lucky break, but you’re just as likely to get caught in a nasty storm. Learning to spot the signs of each phase gives you a massive advantage over investors who are just reacting to the latest headlines.

The Four Phases of the Real Estate Cycle

The market typically flows through four distinct phases. The real pros know how to spot the signs of each one and adjust their real estate investment strategies accordingly. They're always looking at where the market is going, not just where it's been.

Getting a handle on this flow is fundamental, and timing your moves can make or break your returns. If you want to go deeper on this, our investment timing guide for maximum wealth growth is a great next step.

Here’s a simple breakdown of what to look for and how to play your cards in each stage:

| Market Phase | Key Indicators | Investor Strategy |

|---|---|---|

| Recovery | Occupancy is ticking up, vacancies are falling, and there's almost no new construction. | Buy aggressively. This is the time to scoop up undervalued properties before everyone else catches on. |

| Expansion | Demand is strong, rents are climbing, and you see new construction projects everywhere. | Hold and manage. Focus on maximizing the cash flow from your current properties as their value rises. |

| Hyper-Supply | Vacancy rates start creeping up, new buildings are everywhere, and supply is outpacing demand. | Sell strategically. It might be a good time to sell off properties that aren't central to your long-term goals. |

| Recession | Rents and occupancy rates are falling, construction grinds to a halt, and foreclosures are on the rise. | Hold with reserves. Batten down the hatches, focus on keeping your tenants happy, and get ready for the next round of buying opportunities. |

How Global Trends Fit In

Of course, these cycles don't happen in a vacuum. They’re pushed and pulled by big-picture economic forces like interest rates, job growth, and population trends. Even after major downturns, the market has a history of bouncing back.

For instance, over the last five quarters heading into 2025, global private real estate values have been on a steady climb, mostly thanks to solid rental income. In 2024, European commercial real estate transactions jumped 13.7% year-over-year, and Asia saw a 13.4% increase. This signals that many major markets are firmly in a recovery phase. You can dig into the numbers in this in-depth analysis of global real estate trends from Nuveen.

Understanding market cycles transforms you from a passive participant into a strategic player. It allows you to anticipate change and position your portfolio to capitalize on the inevitable ebb and flow of the real estate economy.

When you align your strategy with the market phase, you stop making classic mistakes like buying at the peak or panic-selling at the bottom. This is what separates seasoned investors from the rest of the pack.

Frequently Asked Questions (FAQ)

Here are answers to some of the most common questions investors have about real estate strategies.

1. What is the best real estate strategy for a beginner?

For most beginners, the safest and most accessible strategies are House Hacking or investing in REITs. House hacking minimizes your personal living expenses while you learn the ropes of being a landlord. REITs offer a low-cost, hands-off way to get market exposure and diversification without the complexities of property management.

2. How much money do I really need to start investing in property?

This varies widely by strategy. You can start investing in REITs with as little as the price of a single share, often under $100. For physical property, a strategy like house hacking using an FHA loan can require as little as 3.5% down. For a traditional investment property, you'll typically need a 20-25% down payment plus closing costs and cash reserves.

3. What is the difference between cash flow and appreciation?

Cash flow is the profit you have left over each month from rental income after paying all expenses (mortgage, taxes, insurance, repairs). It's your immediate, spendable return. Appreciation is the increase in the property's market value over time. A good investment ideally provides both: cash flow for today and appreciation for long-term wealth.

4. Is real estate a liquid investment?

Generally, no. Physical real estate is considered an illiquid asset because it cannot be converted into cash quickly. Selling a property can take months. However, publicly traded REITs are highly liquid, as their shares can be bought and sold instantly on the stock market like any other stock.

5. What is the "1% Rule" in real estate?

The 1% Rule is a quick screening tool to gauge if a rental property has the potential for positive cash flow. It suggests that the gross monthly rent should be at least 1% of the property's purchase price. For example, a $200,000 property should ideally rent for at least $2,000 per month. It's not a definitive rule, but a useful starting point for analysis.

6. What are the main risks in fix-and-flip investing?

The biggest risks are underestimating renovation costs, overestimating the final sale price (After-Repair Value), and taking too long to complete the project. Every month you hold the property, carrying costs like loan payments, taxes, and insurance eat into your potential profit. A sudden market downturn during the project can also erase your profit margin.

7. How does the BRRRR method work?

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. It's a value-add strategy where you buy a distressed property, renovate it to force appreciation, rent it out to a tenant, and then do a cash-out refinance based on the new, higher appraisal value. This allows you to pull your initial investment back out to "repeat" the process on another property.

8. What is "house hacking"?

House hacking is a strategy where you purchase a multi-unit property (like a duplex or triplex), live in one unit, and rent out the others. The rental income from your tenants can significantly reduce or even completely cover your mortgage, allowing you to live for free while building equity in an appreciating asset.

9. Are commercial and residential real estate investing different?

Yes, very. Residential real estate involves properties where people live (single-family homes, small multi-family). Leases are typically shorter (one year), and values are based on comparable sales ("comps"). Commercial real estate includes office buildings, retail spaces, and industrial warehouses. Leases are much longer (5-10+ years), and property values are primarily determined by the income the property generates (Net Operating Income).

10. How important is location when choosing an investment property?

Location is arguably the single most important factor. A good location in an area with strong job growth, good schools, low crime, and desirable amenities will attract quality tenants and drive long-term appreciation. You can change almost anything about a house, but you can never change its location.

Ready to take the next step in your financial journey? The experts at Top Wealth Guide provide exclusive insights and proven tactics to help you build and manage your wealth. Subscribe today to enhance your investment portfolio and secure your financial future.