Ever notice how investors are predictable animals? Most just chase the herd — buying high when things feel all roses and rainbows and selling low when panic’s in the air. It’s a pattern as certain as your morning caffeine fix, and savvy investors know how to work it to their advantage.

Enter contrarian investing — the art of doing exactly the opposite. At Top Wealth Guide, we’ve cracked the code: real opportunities show up when everyone else is losing their minds, and those trendy investments everyone’s buzzing about? They’re usually smoke and mirrors.

In This Guide

How Does Contrarian Investing Actually Work?

Contrarian investing-yep, that’s a thing-turns the stock market game on its head. When everyone’s freaking out and hitting the “sell” button faster than they refresh Instagram, that’s your neon-lit signal to buy. And when everybody’s popping champagne and buying left and right… well, that’s when you politely excuse yourself. Sounds like a Warren Buffett motto, right? “Be greedy when others are fearful and fearful when others are greedy”-classic. But trust me, it’s not just about savvy soundbites. See, markets are like that friend who can’t handle good or bad news without overreacting. It’s that kind of predictability that lets contrarians thrive. Folks? They love to panic over the last headline they saw, pushing stocks way off their true value.

Market Psychology Creates Your Edge

Here’s a little secret: investor behavior is like clockwork-it runs in patterns that a contrarian can use like a cheat code. Fear-the kind that sparks colossal sell-offs-takes solid companies and shoves them into the bargain bin during crashes. Remember 2008? As investors were running for the hills (or, you know, looking to stash cash under mattresses), Buffett scooped up $5 billion in Bank of America stock. Spoiler alert: he laughed all the way to the bank as that stock bounced back. On the flip side, over-the-top excitement turns into dangerous bubbles. Case in point: the “Magnificent Seven”-the Apples, Nvidias, Teslas of the world-hogging more than half of Russell 1000 returns. Hints-yes, hints-of a bubble, right there for a contrarian to dodge.

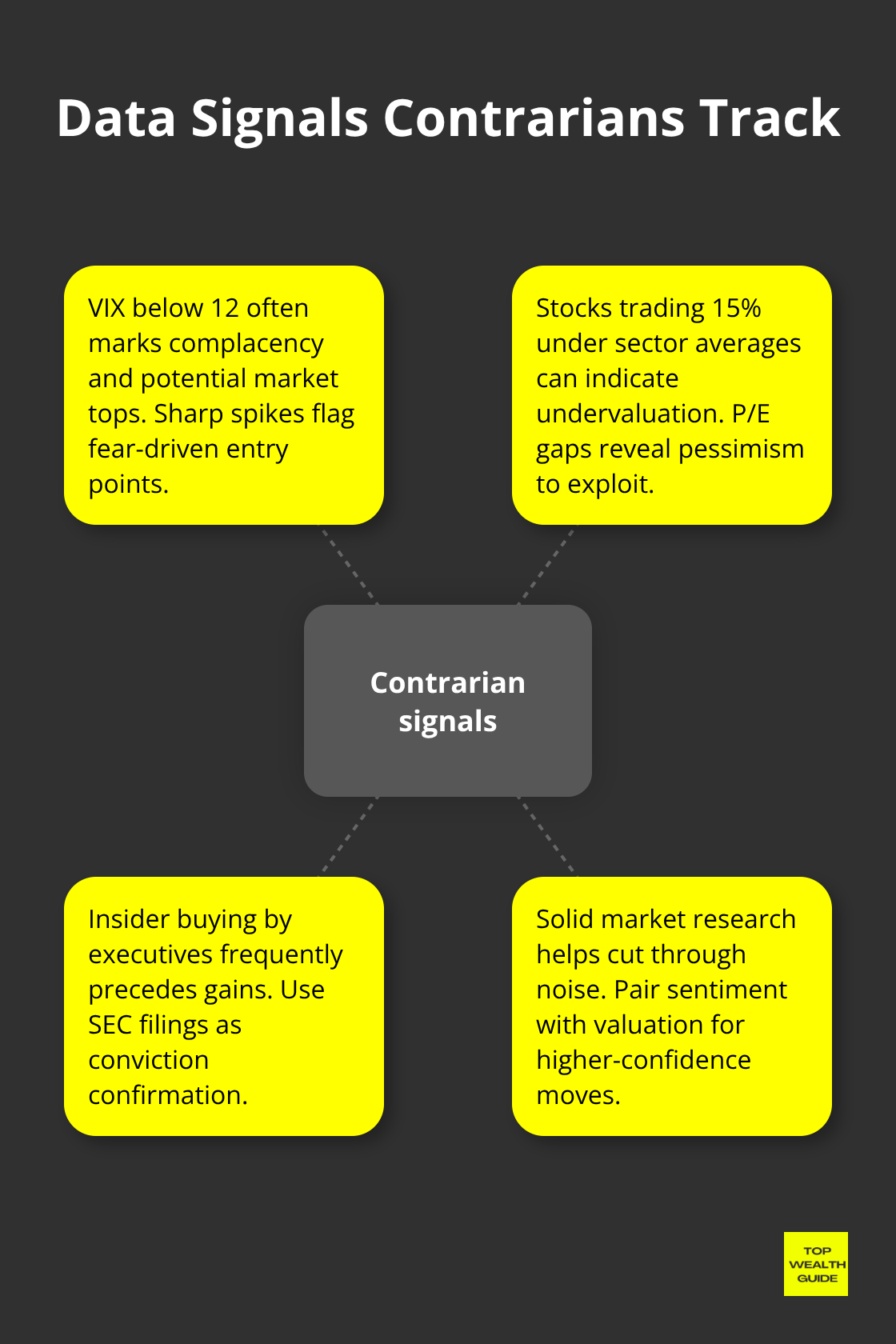

Sentiment Indicators Signal Your Moves

Contrarians in the know? They’re not seeing the world through rose-colored glasses. They’ve got metrics-cold, hard data-to eyeball market mood swings. The CBOE Volatility Index is like the weather report for market jitters; readings below 12 give away market tops-kind of like forecasting a storm. Look, price-to-earnings ratios have a story to tell too. Stocks trading 15% under sector averages? You bet-they’re often the underestimated gems buried by pessimism. Then there’s insider activity-when execs open their wallets, it usually means they smell big returns.

These metrics-they cut through the emotional clutter, giving contrarians a crystal-clear roadmap for scoring those profitable investments. A bit of solid market research can put contrarians ahead of the curve before market volatility sparks the next emotional craze.

The mechanics of contrarian investing are all laid out for you. Next up, let’s unravel what makes successful contrarians tick and separate them from the folks who just like playing the opposite game without a real playbook.

What Contrarian Strategies Actually Generate Alpha?

Market downturns – a playground for the contrarian. Think of it as the backstage pass to the biggest wins, and the numbers nod in agreement. Remember 2008? Chaos for some, opportunity for the few who dared. Back then, value stocks strutted their stuff, even when growth stocks stole the spotlight with an 11.4% annualized return over the past ten years. The secret sauce? Zeroing in on fundamentally solid companies that got dragged down with the rest of the mess.

Cue David Tepper – the guy who loaded up on distressed bank stocks in 2009 and turned heads with a 132% return. His target: institutions boasting robust capital ratios but with shares beaten to a pulp. The smart contrarian dance involves clever screens: look for companies with debts that don’t sway above equity (below 0.5), laser-focused earnings growth for the last three years, and current ratios that sit pretty above 1.5. That’s how you spot financial strength amidst temporary turmoil.

Sector Rotation Captures Outsized Returns

Sector rotation – it’s like a rhythmic move in a precisely planned contrarian tango. Flashback to 2020-2021, when energy stocks were in the doghouse, trading at a mere 0.6 times book value while tech was having its day in the sun. Enterprising contrarians who picked up energy ETFs like XLE in early 2021 rode a 54% wave as oil prices rebounded and the big guns rotated back into the fray.

History repeats, folks: small-cap value stocks now sit at a 35% discount compared to large-cap growth, creating the most massive gap since the dot-com frenzy of 2000. Typically, healthcare and utilities are the go-to sectors as cycles wind down, while materials and industrials steal the show when the economy hits the acceleration pedal.

Keep an eye out – sector P/E ratios relative to the S&P 500 average can reveal gems. When sectors drop 20% below their historical sheen, they usually bounce back within 12-18 months.

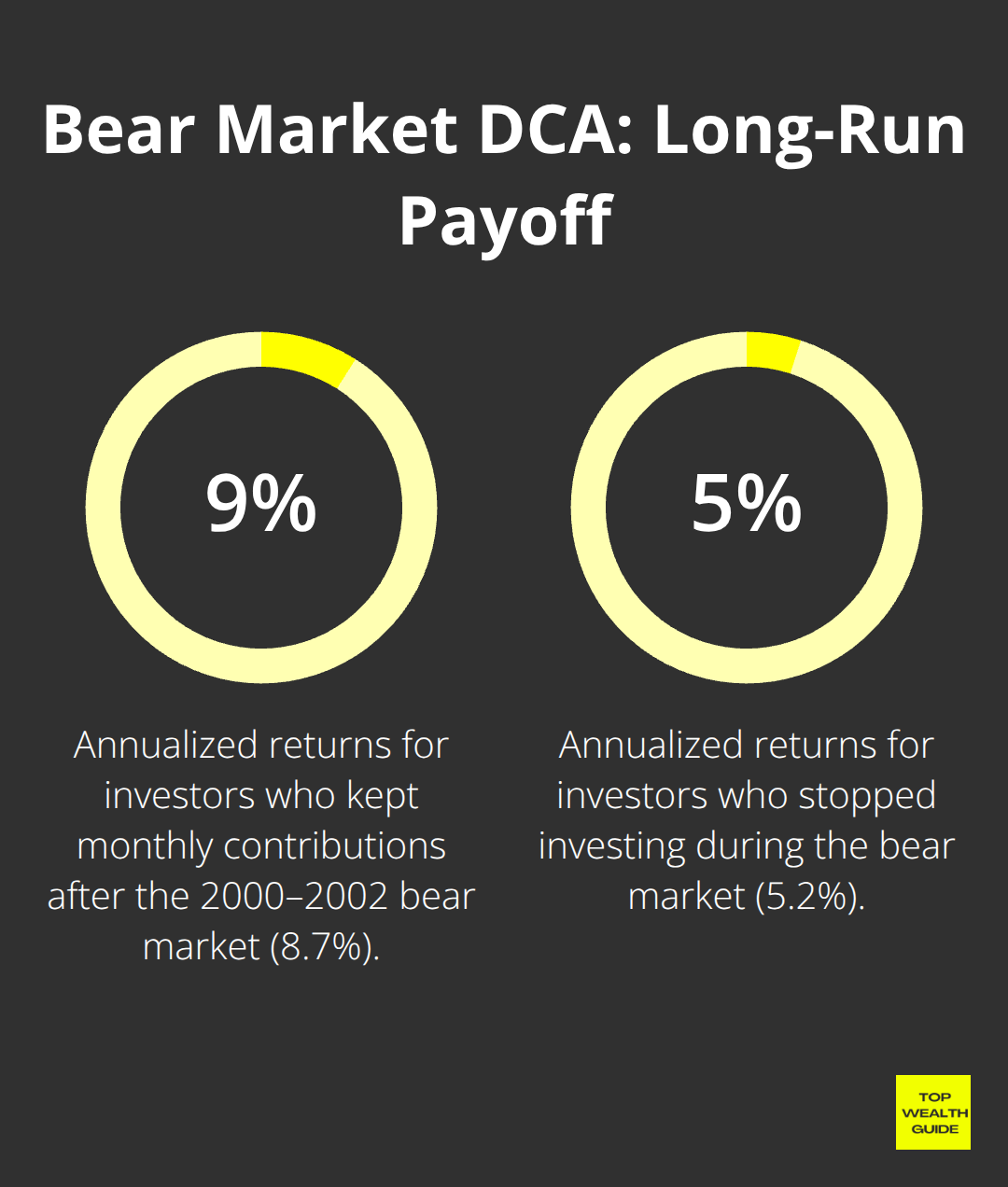

Bear Market Dollar-Cost Average Amplifies Gains

Dollar-cost averaging during a bear market – turn that turbulence into treasure. Vanguard’s wisdom shows investors keeping up with regular monthly investments during the 2000-2002 bear market snagged 8.7% annualized returns over the next decade (compared to a measly 5.2% for those who pulled the plug).

Here’s the crux: bear markets open up grand entry points at falling prices. Remember Michael Burry’s post-2008 play? A systematic buy of distressed assets every month for two years made his portfolio balloon over 489% by 2012.

Automate those investments to swell by 25% when the VIX jumps past 30 – that way, you’re snagging shares right when panic peaks. This mechanical stratagem clips emotions, letting you feast on market overreactions that tend to flip back within 6-24 months.

These strategies aren’t just promising – they show results. Success hinges on wielding the right tools and metrics to uncover opportunities before everyone else clambers onboard.

Which Tools Actually Spot Contrarian Opportunities

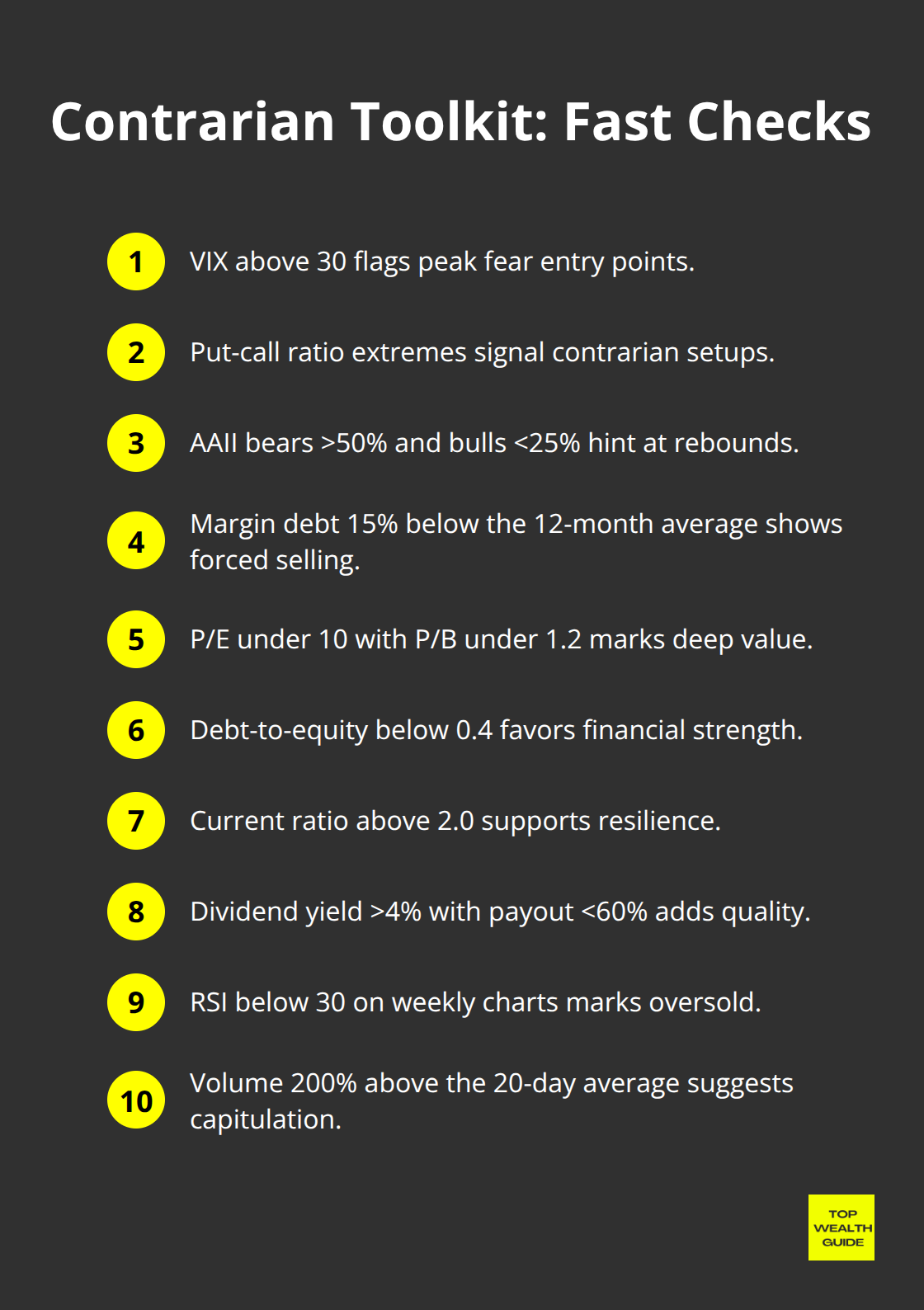

Alright, here’s the deal: smart contrarians aren’t throwing darts in the dark – they’ve got metrics that pierce the market chaos. First up, the VIX fear index… think of it as your panic siren. When it screams above 30, like it did hitting the stratospheric 82.69 in March 2020, alert investors pounced on the S&P 500… and rode a juicy 68% gain over 12 months. But wait, there’s more. Toss in the CNN Fear and Greed Index, with those sub-25 readings, and you’re looking at classic market bottom territory.

Sentiment Gauges That Signal Market Extremes

Now, let’s talk put-call ratio… your handy contrarian guide when the market’s on the edge. The AAII Sentiment Survey? Pure gold when people are freaking out – bearish vibes over 50%, bulls limping under 25%. It’s like a neon sign for a market rally brewing 2-4 weeks ahead. Keep tabs on margin debt via FINRA’s data; a drop of 15% below the 12-month average screams forced liquidation, aka opportunity knocking.

Valuation Screens That Actually Work

Get this – price-to-earnings ratios under 10 combined with price-to-book values under 1.2? That’s your treasure map to undervalued gems. The cyclically adjusted price-to-earnings ratio? It’s your reality check on stock index valuations. Hunt for companies with debt-to-equity ratios below 0.4 and current ratios above 2.0 – true value separates the temporary losers from the permanent ones. Oh, and those dividend yields over 4% with payout ratios under 60%? Undervalued company alert.

Technical Timing for Maximum Impact

RSI dipping below 30 on weekly charts? That’s your neon-flashing entry sign for contrarian plays – throw in some bullish divergences for added spice. When the 50-day average sinks below the 200-day average, grab your dollar-cost averaging gear. Volume spikes during selloffs, especially if they explode 200% above the 20-day average, typically signal capitulation – a clarion call for smart money to dive in.

Insider Activity as Your Final Confirmation

And now, for the cherry on top – the insider scoop. Watch those SEC filings like a hawk. When execs start snapping up shares on the down-low, magic happens – 67% chance of positive returns within a year. Keep your eyes peeled for buys over $100,000 and multiple execs joining the party. But steer clear of companies where insiders are selling more than buying… even when market volatility has everyone else running for cover.

Final Thoughts

Contrarian investing-yeah, it can really pay off, big time, if you execute it with discipline and data. Look at the numbers: Buffett’s been rocking a 20% annual return since 1965 … and Tepper, that guy pulled a whopping 132% gain back in ’09. Systematic bear market investments? They’ve been churning out a solid 8.7% annual return over decades. These are not just flukes-they’re strategic moves, buying when everyone’s running scared and selling when the crowd’s high on optimism.

So, your contrarian playbook kicks off with three rock-solid steps that get results. First, you need your sentiment radar-keep an eye on the VIX, put-call ratios, and what the insiders are doing. Second, get your valuation screens ready, hunting for P/E ratios under 10, debt-to-equity under 0.4, and dividend yields above 4% (flex that dollar-cost averaging muscle when the market’s throwing a tantrum). Third, when the VIX breaches 30? Yeah, that’s your signal-ramp up your buy game by 25%, cashing in on those peak fear peaks.

Right now, the market? It’s serving up chances on a silver platter for the sharp ones out there. Value stocks are cruising at a 15% discount, small-caps are down 25%, and non-US markets? Way undervalued compared to the US stock party. We, over at Top Wealth Guide, are your wingman, helping you spot and seize these market slip-ups. Dive into our wealth-building resources and turn market chaos into your edge.