Investment fees are like those pesky termites gnawing away at your returns, little by little, while you’re too busy sipping your morning coffee to notice. These teensy percentages—barely worth a raised eyebrow at first—compound over the years like an uninvited dinner guest that just won’t leave, potentially bleeding you out of hundreds of thousands in retirement savings. Fun stuff, right?

Here at Top Wealth Guide, we’ve rolled up our sleeves and crunched the numbers on how these stealthy costs can derail your plans for rolling into the golden years with pockets lined. Yeah, the figures are gonna blow your mind, but here’s the kicker—we’re not just pointing fingers at the problem. Oh no, we’re gearing you up with the tools you’ll need to push back and reclaim control of your financial destiny.

In This Guide

Hidden Costs That Drain Your Investment Returns

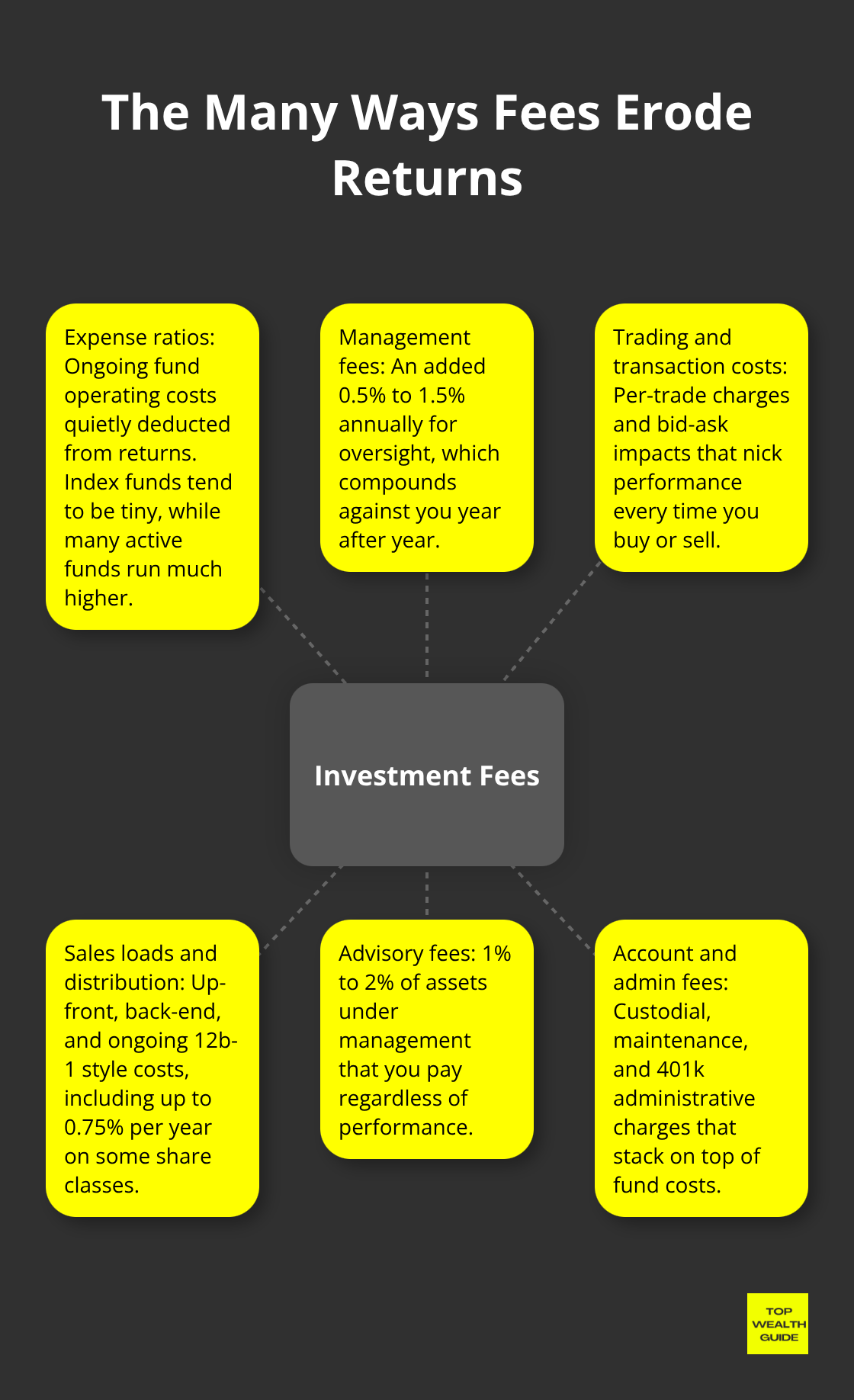

Investment companies have come up with a whole playbook of fee camouflage – burying costs so deep in fine print that you’d need a map and a magnifying glass to find them. Expense ratios? They’re the first to hit you – those annual fees stretch far and wide, like the surface area of the ocean, across different fund types. Take actively managed domestic equity funds; they are all over the place compared to our plain-Jane index funds, according to the Investment Company Institute. Then come management fees, stacking up an extra 0.5% to 1.5% every year for “professional oversight” – often as effective as asking a cat for financial advice.

Expense Ratios and Management Fees

Fund companies siphon expense ratios directly from your returns before you see a single penny. Simple index funds like the Fidelity 500 Index? They slap on just 0.015% – while actively managed funds might demand a hefty 2.5% or more annually. For perspective, around 25 percent of actively managed domestic equity funds had an expense ratio under 0.74 percent, compared to a measly 0.15 percent for index domestic funds. Management fees? Another cost layer – portfolio managers charge you 0.5% to 1.5% annually whether they make you rich or run your portfolio into the ditch. These fees keep compounding relentlessly (your money shrinks faster than ice in the Sahara while theirs balloons like it’s going out of style), leading to a wealth transfer – from your wallet to theirs.

Trading Costs and Transaction Fees

Every trade is like a fee ambush on your portfolio. Stock brokers demand $0 to $20 per transaction.

And mutual fund companies? They slap on redemption fees up to 2% if you bail early. But load fees – oh boy – they’re the worst offenders. With distribution expenses going up to 0.75% per year for Class C shares, it’s like an annual asset-based sales charge. And back-end loads? They’re just there to whack you if you even think about selling within five to seven years, keeping your money trapped in underperforming funds.

Advisory Fees and Account Maintenance Charges

Financial advisors charge 1% to 2% yearly on assets under management, regardless of whether your portfolio hits the jackpot or nosedives. Account maintenance fees? Just add more insult to injury – custodial fees range from $25 to $100 yearly, and 401k plans often slap you with administrative costs of 0.5% to 1.5% on top of the fund expenses. Minimum balance fees? They can be $50 a quarter if your account dips below minimums, and wire transfer charges take another $15 to $30 per move when you try to shift your own money.

These seemingly tiny percentages create a paradoxically massive compound effect, eroding your wealth over time, turning what should be a golden retirement nest egg into a bottomless buffet for financial middlemen. Your investment portfolio’s challenge is to crank out returns that not only outpace these sneaky costs but also stay ahead of inflation if you’re serious about building real wealth.

How Much Do Fees Really Cost You Over 30 Years?

The Math Behind Fee Destruction

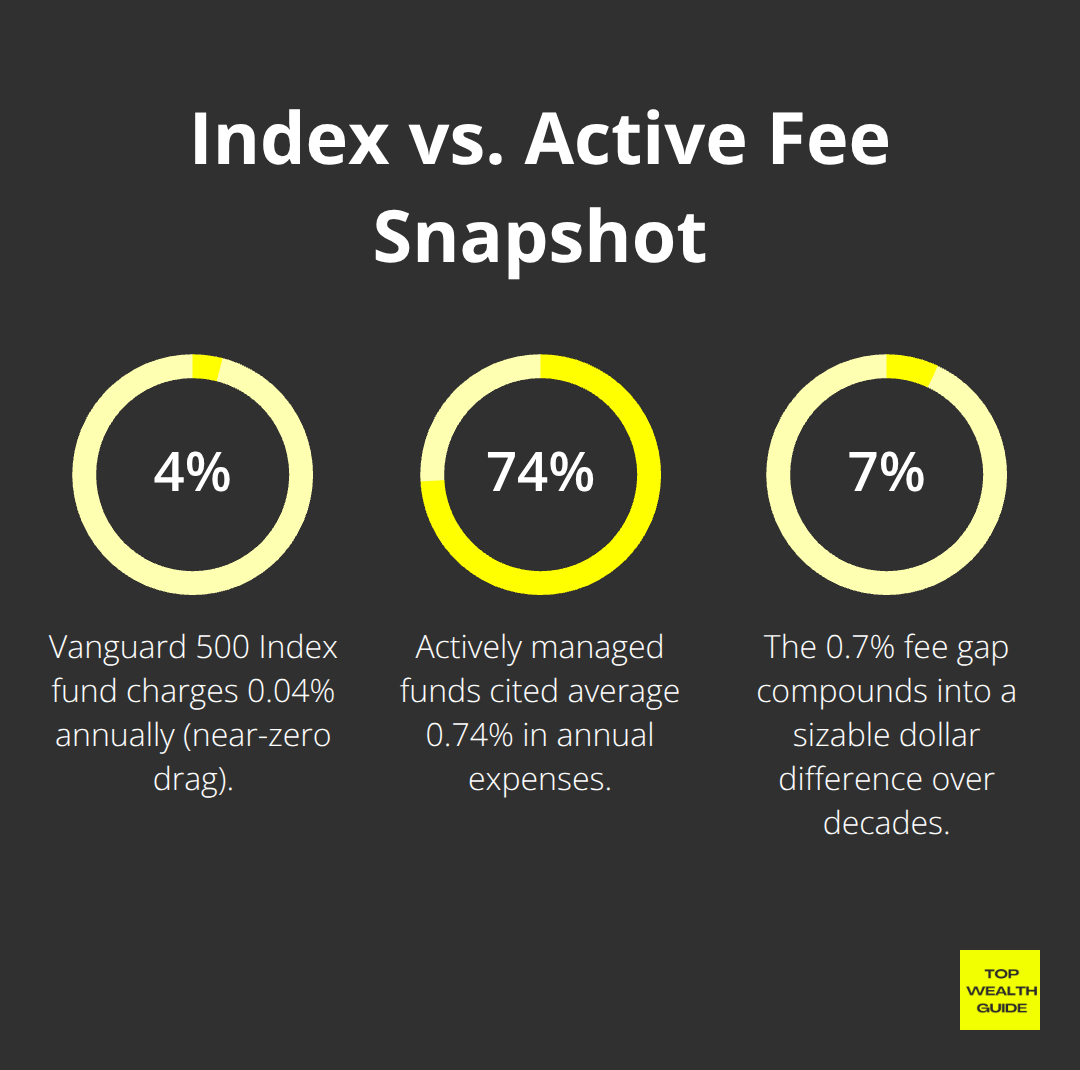

Fees are like a slow leak-tiny at first but devastating over time. Start with $100,000, expect a 7% annual return, and watch what happens if your fees are high. Spoiler alert: it’s not pretty. SEC research shows how portfolios with 4% returns over 20 years are annihilated with just a small fee tweak-from 0.25% to 1%. Look at the Vanguard 500 Index fund, charging only 0.04% annually… barely a blip. Yet those actively managed puppies? Yeah, 0.74% on average. That small 0.7% gap? It’s a $28,000 hit on your retirement fund over 30 years on a $100,000 start. Ouch.

Real Retirement Account Damage

401k participants-you’re in the crosshairs here. BrightScope data reveals fees layered in like a lasagna of costs: admin, advice, and asset-based. Someone tossing in $6,000 a year for three decades, aiming for 6% returns? Ends up with $502,000 with 0.5% fees but only $447,000 with 1.5% fees. That’s $55,000 evaporated due to fee insanity. Morningstar research dives into 9,000 funds-$24 trillion under the microscope-to see if they can keep the good times rolling.

The Wealth Transfer Reality

High-fee setups? They basically have you doing the cha-cha as your wealth dances away to someone else. A $500,000 nest egg giving up 2% annually? That’s $10,000 a year gone, poof, performance be damned. Over 25 years, see for yourself: $1.28 million with 0.2% fees shrinks to $986,000 with 2% fees. That’s a $294,000 tip to others (assuming 6% returns). And those advisors charging you 1% of assets? They pocket $5,000 yearly from your $500,000 account-while you could get the same through low-cost index funds and a DIY rebalancing.

Fee Impact Comparison Table

| Investment Amount | Fee Level | 30-Year Value | Wealth Lost to Fees |

|——————-|———–|—————|———————|

| $100,000 | 0.2% | $574,000 | $0 (baseline) |

| $100,000 | 1.0% | $432,000 | $142,000 |

| $100,000 | 2.0% | $324,000 | $250,000 |

These numbers are a cold shower on the reality of fee compounding. But here’s the upside: you’re not powerless. Armed with smart strategies, you can curb these fees, keeping that hard-earned cash exactly where it belongs-in your pocket.

How to Cut Investment Fees by 90%

Choose Ultra-Low-Cost Index Funds

So, here’s the deal – index funds and ETFs, they’re like the Swiss Army knives against the fee apocalypse. Look at the Fidelity 500 Index, charging a microscopic 0.015% annually, or the Vanguard Total Stock Market ETF, asking for just 0.03%. Compare that to actively managed funds with their bloated 0.99% average, and bang – your savings pop like a confetti cannon. Schwab’s Total Stock Market Index? Also hanging out at 0.03%, giving you the whole market spread minus the steep ticket price.

Now, target-date funds from Vanguard are clocking in around 0.13% compared to their actively managed cousins hitting a staggering 1.2% or more. Do the math: trade a 1.5% fee fund for a 0.05% index gem on $100,000, and voilà, you’re up $1,450 every year. These low-cost choices follow the same market rhythm without gouging your returns like a hungry shark.

Negotiate Advisory Fees Aggressively

Advisory fees – you can haggle these down more than most folks imagine. Robo-advisors, like Betterment, hang out at 0.25%, while the more classic advisors are trying to squeeze 1% to 2% for pretty much the same schtick. Bring $500,000 to the table, and they often settle for 0.75% instead of their lofty 1.25% standard.

Mention taking your assets to the competition, and watch your fees nosedive like a daredevil. Advisors would rather give you a deal than see you skedaddle, especially if you’re working with hefty balances. You’ve got clout (with big accounts) – wield it like a boss.

Use Fee Comparison Tools

Fee comparison tools? Make your fee-cutting efforts surgical – no joke. FINRA’s analyzer puts mutual fund costs face-to-face, while other tools unearth those expenses hiding like Easter eggs in prospectuses. Morningstar’s fee analyzer? It lays out total cost breakdowns across a whole universe of funds.

Personal Capital gives you the lowdown on fees you’ve been shelling out across all accounts, often revealing sneaky costs you never even caught. These tools peel back the layers on the true price of your investments and help you chase down cheaper alternatives that keep you right in the market action.

Optimize Your 401k Selections

When it comes to your 401k, ditch the high-fee options for the lowest-cost index funds your plan offers. Most employer setups give you at least one bargain-bin index fund (an S&P 500 fund under 0.2%). Rolling over old accounts to ultra-friendly fee havens like Fidelity or Schwab when you switch jobs? Smart move.

This single tactic can save you a fortune through your career journey. Sure, your 401k provider might sneak in some admin fees, but you can slash that damage by picking the right funds within your plan. Think about which investment accounts to spotlight for maximum tax ninja moves alongside trimming those pesky fees.

Final Thoughts

Investment fees… a silent killer of your long-term wealth. Let’s not sugarcoat it – that so-called tiny 2% annual fee? Yeah, it snowballs into a $294,000 disaster over 25 years. That’s a hefty chunk of your retirement cash funneled right into the pockets of financial middlemen, often for doing a subpar job.

So, what’s the play? It’s obvious, folks. Get on it today. Audit those accounts – every single one. Add up your annual investment fees (and do yourself a favor – swap those high-fee mutual funds out for low-cost index options that clock in at under 0.2%).

Your wealth hinges on what you do now, not later. Every month you drag your feet, you’re bleeding hundreds in pointless fees. We’ve armed you with the knowledge and tools to combat this fee erosion. Head over to Top Wealth Guide for more tactics on safeguarding your wealth through savvy financial moves.

1 Comment

Pingback: Are Robo Advisors the Future of Wealth Management? - Top Wealth Guide - TWG