Growth stocks—what’s the deal? They’re like catnip for your investment portfolio, once you crack the code. We’re talking about companies that sprint past the competition with insane revenue growth and killer market positioning. Forget traditional investments … these guys are playing a different game.

Here at Top Wealth Guide, we’re your sherpa in tracking down these high-potential gems. How do you spot them and build a killer portfolio? We’ve got you. Nail the right growth stock strategy … and watch your wealth-building timeline go from a slow crawl to rocket speed.

In This Guide

What Separates Winners from Losers in Growth Stocks?

Revenue Growth That Actually Matters

Real growth stocks? They don’t just get lucky for a quarter-they hit consistent home runs year after year. Take Mercadolibre, an absolute powerhouse, with revenue leaping from $10.8 billion in 2022 to $20.8 billion in 2024. You’re hunting for those companies with annual revenue growth rocketing above 25% for at least three years.

But hang on, earnings growth is the real game-changer-aim for companies where earnings per share (EPS) surge over 25% each year. Look at Pinterest, smashing it with EPS growth of 865.81% while keeping a cool P/E ratio of 11.81. You want outfits where earnings outpace revenue growth, hinting at better profits and killer efficiency.

Market Domination Through Smart Positioning

The best in this game grab market share in fast-moving industries. Dexcom’s got it nailed in continuous glucose monitoring, tapping just 5% of the Type 2 diabetic market-massive runway ahead. Then there’s ResMed, setting its sights on 2.3 billion people with respiration issues, with a plan to help 500 million by 2030.

These champs have built solid defensive walls-tech patents, network effects, you name it. Seek businesses expanding their total addressable market with some deft maneuvers. Lyft? They doubled their game to 300 billion personal vehicle trips per year by snagging European mobility platform FREENOW (a smart play opening fresh markets).

Innovation That Drives Real Demand

Growth stocks? They’re all about solving real-world problems. Lululemon rode the athleisure wave, boosting revenue from $8.1 billion in fiscal 2023 to $10.6 billion in fiscal 2025. Bloom Energy Corp hit a 1054.78% bump addressing clean energy needs. IREN Ltd, meanwhile, soared 710.08% with cryptocurrency mining smarts.

Zero in on companies that plow serious cash into innovation-typically 10% of revenue. These firms create stuff people actually want, not just slick ads that overpromise and underdeliver.

Financial Metrics That Reveal True Potential

Smart investors? They cut through the noise with key ratios to separate real deals from the smoke and mirrors. Chase companies with return on equity (ROE) beating the industry average, flagging sharp management and solid fundamentals. A net profit margin north of 15%? That usually screams pricing power and operational wizardry.

PEG ratios under 1.0 flash undervalued gems relative to growth potential. Uber Technologies, for instance, balances things with a P/E ratio of 15.68 and EPS growth of 545.10%. Carnival Corporation holds a P/E of 14.61 with a forecasted 61.65% earnings growth.

These financial markers help you spot the champions from the rest, and who might take a nosedive if market moods shift. Up next, diving into the exact tools and techniques for digging up these golden opportunities.

Which Numbers Actually Matter When Screening Growth Stocks?

The Core Metrics That Separate Winners from Pretenders

Start with the price-to-earnings growth ratio-yep, anything under 1.0 screams undervalued opportunity. Think Uber, with a PEG of around 0.29… this baby blends a reasonable price with fireworks-level growth potential. Revenue growth north of 25% yearly for three solid years? That’s your filter for separating the one-hit wonders from the real gems. Oh, and earnings need to outpace revenue growth by a solid 5 percentage points-signaling slick profit margins and some serious operational chops.

Return on invested capital north of 15%? You’re looking at management teams that actually know what to do with your money. Case in point: Singtel… bumped their ROIC to a shining 9.6% in fiscal 2025-from just 7.3% back in 2022, proving their transformation strategy’s straight-up legit. Net profit margins above 15% mean you’ve got strong market positions and competitive moats that’ll fend off those market downturn blues.

Industry Analysis That Actually Predicts Growth

Stop wasting time on broad economic trends. Zoom in on total addressable market expansion in niche sectors. The Latin American e-commerce market? It’s bursting at the seams with potential-set to hit $130.95 billion in revenue by 2025, which explains Mercadolibre’s insane jump from $10.8 billion to $20.8 billion in just two years. Fixate on industries where the penetration rates are still chilling below 10%-tons of room to run there.

Keep an eye on acquisition activity as a real growth kickstarter. Look at Rollins pulling off 32 acquisitions in 2024-skyrocketing their revenue from $2.7 billion to $3.4 billion. Firms that systematically scoop up fragmented industries often hit home runs. Plus, watch for regulatory shifts that could birth new market opportunities or wipe out the comp on barriers front.

The Only Stock Screening Tools Worth Your Time

Finviz? It’s the gold standard for free screens-go for revenue growth above 25%, EPS growth over 30%, and PEG ratios under 1.5 simultaneously. Meanwhile, Simply Wall St gives you comprehensive growth ratings with their star system… RenovoRx, with its 65.52% revenue growth and 68.63% earnings growth, shows up bright. Yahoo Finance? It’s all about detailed competitor profiles in sectors-helping you sort the leaders from the laggards.

Skip those overpriced platforms, at least initially. These freebie tools take care of 95% of serious growth stock research when you’re systematic about it. Set up custom screens that refresh weekly, focusing on companies trading below fair value estimates but still riding strong growth vibes.

After nailing down these research techniques, your next big question is portfolio construction-how do you juggle these high-octane picks without blowing up your entire investing game plan?

How Do You Build a Growth Stock Portfolio That Survives Market Crashes?

Smart Position Sizing Prevents Portfolio Disasters

Never put more than 5% of your total portfolio into any single growth stock, no matter how irresistible that golden goose appears. The S&P 500-steady Eddie-has churned out roughly 10% annual returns since 1926, but individual growth stocks? They can nosedive by 50% or more in just a few weeks. Our mantra? The 90/10 rule-90% in those trusty low-cost index funds, a wild 10% in individual growth picks.

This strategy is your guardian against the emotional chaos that DALBAR studies show is the kryptonite for individual investors, consistently leading to underperformance against market indexes. For the growth chunk of your pie, spread that risk across 8-12 stocks, minimum-to sidestep the concentration cliff. Sure, companies like Bloom Energy Corp skyrocket 1054.78% in a year, but others? They crash-land just as dramatically when the market mood sours.

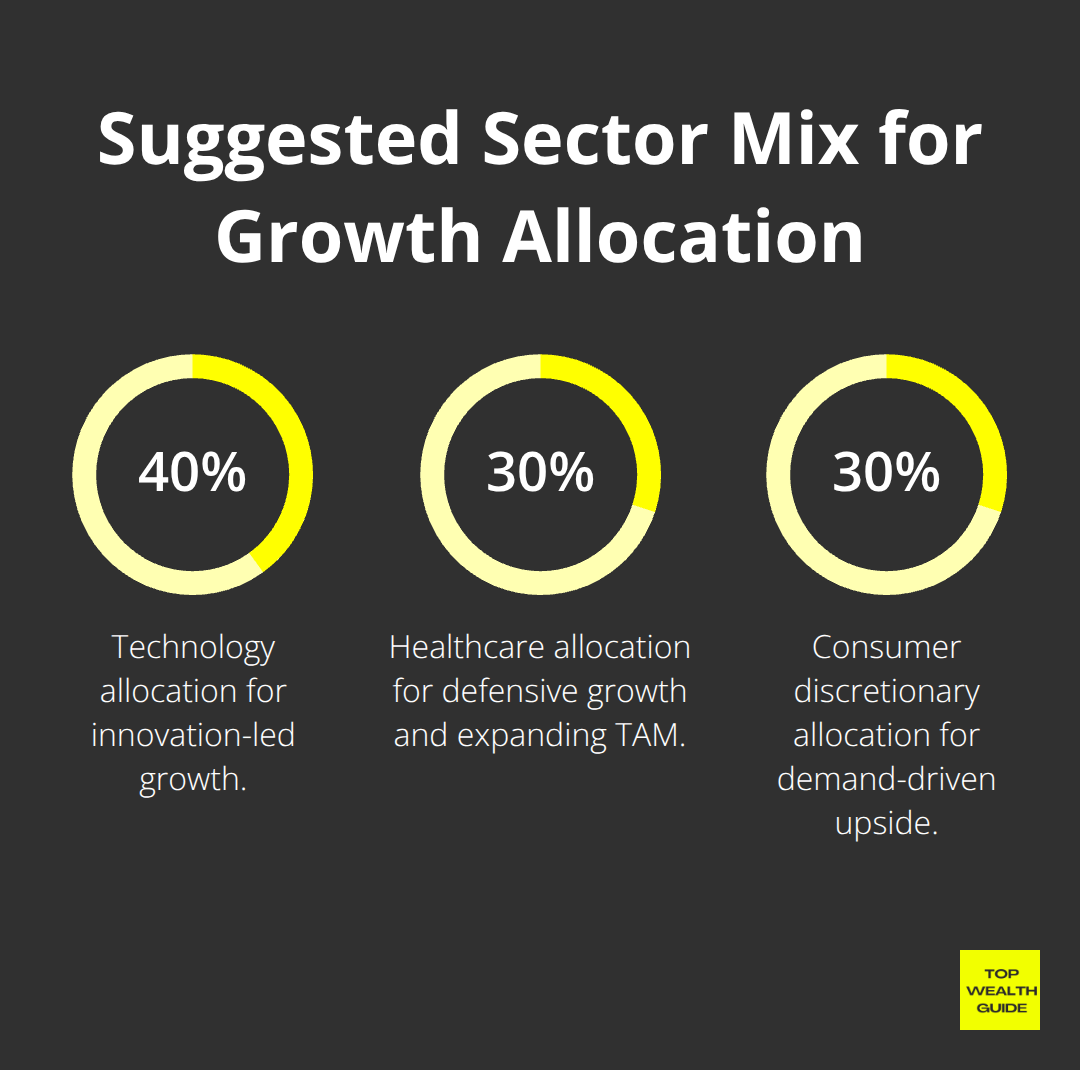

Sector Mix That Balances Growth and Stability

Zero in on three powerhouse sectors for growth juice: technology (40%), healthcare (30%), and consumer discretionary (30%). Tech is king with giants like NVIDIA and Meta at the innovation throne, while healthcare-think Dexcom-offers a defensive growth moat as they wade into underserved territories.

Don’t let any sector hog more than 15% of your mix to dodge those nasty sector-specific meltdowns. Technology stocks? They have a habit of moving in lockstep during market bumps, so a robust spread across sectors is your best armor, not a blind dive into one industry’s deep end.

Market Cap Strategy for Maximum Upside

Pour 60% into large-cap growth stocks north of $10 billion, 30% into mid-caps between $2-10 billion, and 10% into those scrappy small-caps under $2 billion for the best chance at sky-high returns. Large-caps like Amazon and Microsoft? They’re your breakwater during those choppy market seas, while small-caps are your high-flyers (but with bigger roller-coaster potential).

Mid-caps hit the jackpot-solid business foundations with a vast stretch for growth. Often, these gems become takeover targets for the bigger fish, giving shareholders a nice payday boost.

Entry and Exit Rules That Protect Your Capital

Snatch up growth stocks in the storm-when market corrections squeeze valuations-usually during a market slide of 10% or more. When fear grips, opportunities lurk, and quality growth companies tend to trade at bargain prices.

Bail out when PEG ratios breach 2.0 or if you see quarterly revenue growth slip under 15% for two straight quarters. These are your red flags-to step away from value traps. Stop-loss orders are your safety net against drastic downturns, but sidestep panic selling during that short-term turbulence which doesn’t ding the company’s core mojo.

Final Thoughts

So, growth stocks – they’re your express elevator to wealth… if you nail the strategy. Look at Mercadolibre and Bloom Energy Corp. They’ve shown us that when you spot companies boasting consistent 25%+ revenue growth, market share grabs, and fresh ideas, you’re on track for killer returns. It all comes down to disciplined digging into the details – think PEG ratios under 1.0, solid ROE numbers, and trusty tools like Finviz.

But hey – don’t forget, how you build your portfolio? Just as crucial as picking the stocks. The 90/10 rule? It’s your safety net – shielding you from market wipeouts, while your 10% growth slice turbocharges your wealth journey. Spread your bets across tech, healthcare, and consumer sectors. And for the love of diversification – stick to a 5% cap per stock (seriously, don’t exceed it).

Now, timing the market – it’s not everything, but let’s not kid ourselves. You juice your returns if you buy during dips and cash out when PEG ratios bust past 2.0. We at Top Wealth Guide have got your back with practical tools and market insights to help you land these strategies with a splash. So, go on, sift through 3-5 potential growth stocks this week using our cheat sheet, and kickstart your systematic portfolio build-out today.