The BRRRR method — yeah, it’s not just a sound — is flipping the real estate game on its head. This strategy? It’s like having a superpower, letting investors recycle the same coin over… and over… to snag multiple properties without draining the piggy bank each time.

So, what are we doing at Top Wealth Guide? We’re breaking it down — step by step — so you can grab this investment bull by the horns. From spotting that gem of a property to playing the refinancing game like a pro and ramping up your portfolio — this guide has got you covered, top to bottom.

In This Guide

What Makes BRRRR Different From Traditional Real Estate

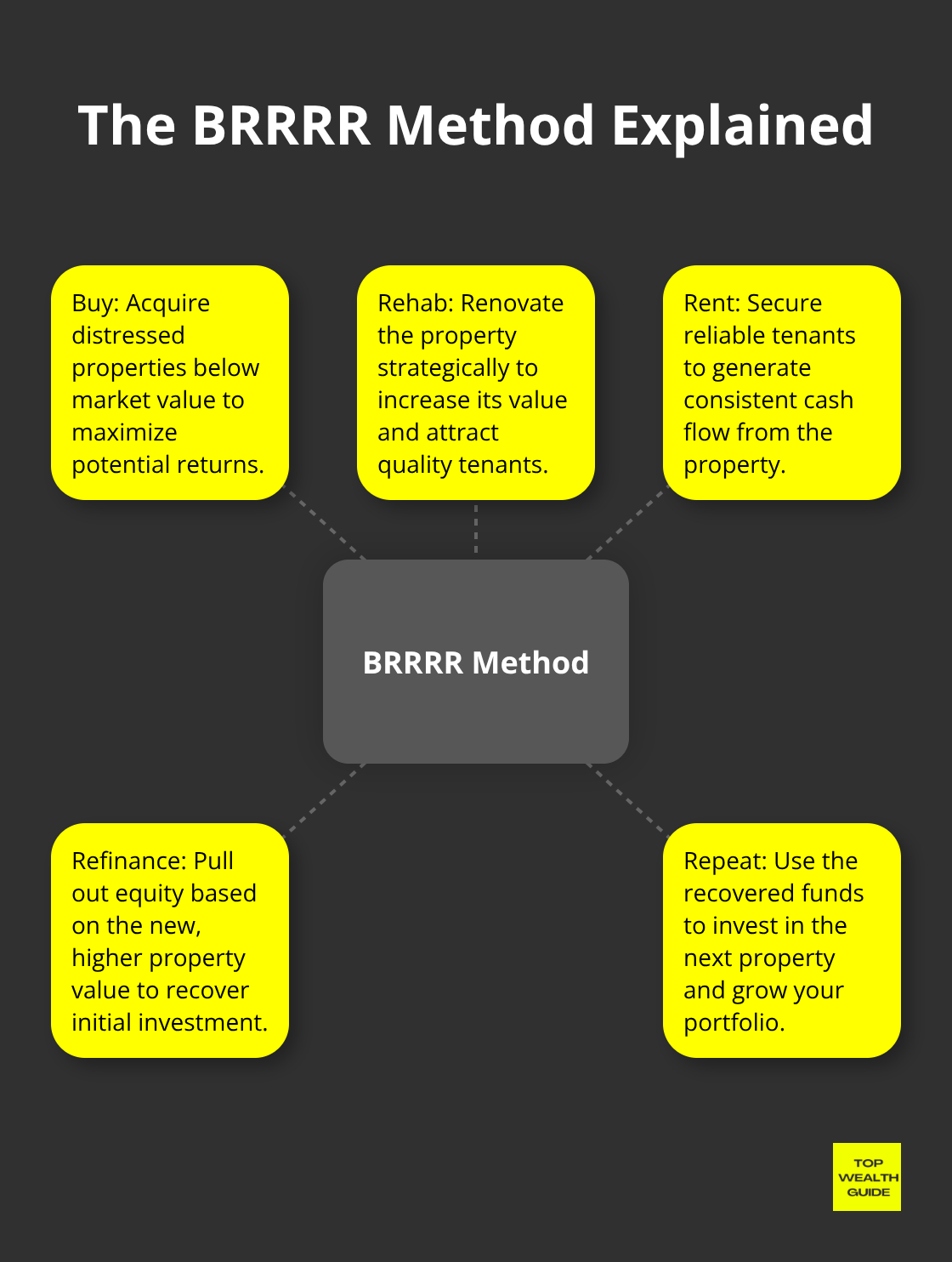

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat – this is the ultimate play in the real estate game. Think of it as the divide between your average Joe investor and the big-time players. Traditional real estate? You stash away your cash in one property, wait for what seems like a century (or two) before your next move. Enter BRRRR – where you not only get your cash back through refinancing but are ready to roll again… like right away.

The magic kicks in when you’re eyeballing distressed properties, give them a strategic makeover, and then refinance based on the shiny new appraised value. This isn’t just mixing old school with new tricks – it’s potentially pulling out a 100% cash-out refinance, meaning you’re back in the game with your initial cash in hand for the next jackpot. Boom.

The Numbers Game That Changes Everything

BRRRR is not just about playing Monopoly with real buildings – it’s a precision numbers game. We’re talking properties that spin off $200-300 monthly in cash flow after expenses, new mortgage included. The industry’s numbers? Successful BRRRR properties hit cash-on-cash returns when you toss in cash flow, appreciation, and tax perks courtesy of depreciation.

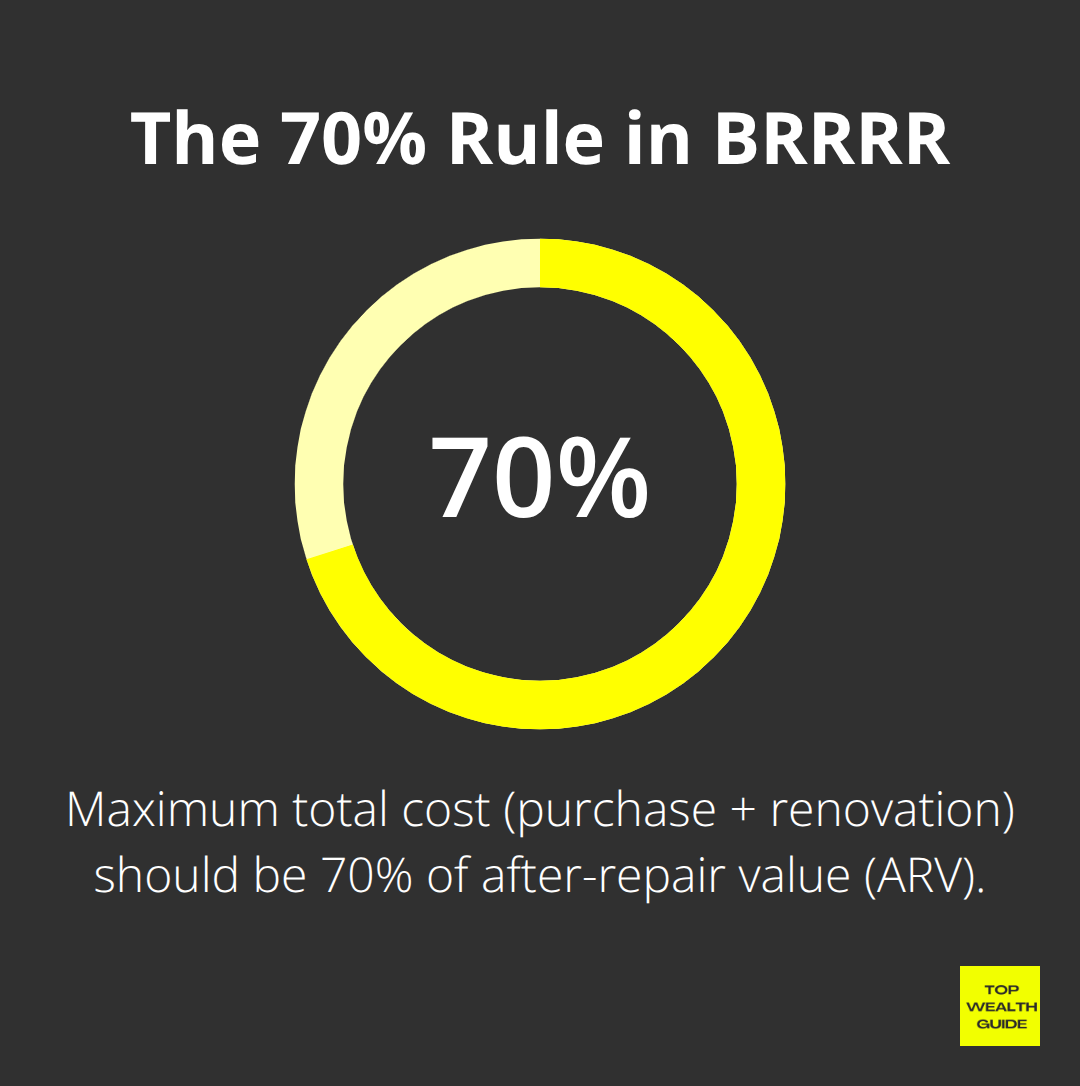

The golden rule? Keep your total costs for snagging and revamping a property under 75% of its after-repair value – that’s your ticket to a profitable refinance. Hard money lenders are your short-term pals here, offering loans for 6-12 months – if you have rock-solid credit and street cred. Spice it up with private lenders offering even sweeter deals at 6-8% if you’re established.

Who Wins With BRRRR Strategy

Who’s making the real money moves with BRRRR? Those with $50,000-100,000 at the ready, and credit scores that shine at 720 or higher. Plus, you’ve gotta either be a hands-on management wizard or know the top-notch contractor gang – renovation quality is kinda a big deal for refinance wins.

This isn’t a lazy investor’s tool – or for those who want their money doing jumping jacks right away. Patience, folks – the cycle from purchase to cash shining back typically spans 6-12 months per property. But play it smart, and you’ll level up to 10-20 properties within 3-5 years on repeat with that initial stash, while the traditionalists might scrape together just 2-3 in the same timeframe.

Now, you’re tuned into what makes BRRRR the game-changer in real estate strategies. Ready to dive deep? Let’s break down the roadmap for executing your first deal like a pro.

How Do You Execute Each BRRRR Step Successfully

Properties That Pass the Numbers Test

Let’s dive into the weeds with the 70% rule – a.k.a. your magic number for BRRRR properties. Your total tab for buying and fixing up has to stay under 70% of the after-repair value. Keep your eyes peeled for MLS listings gathering dust for over 30 days – that’s a surefire signal the seller’s itching to strike a deal. We’re talking neighborhoods where homes go for $100k-$250k. Why? Because that’s the sweet spot – affordable with a dash of rental demand.

Hard money lenders – those lovely folks – want at least $150-200 monthly cash flow post-expenses (new mortgage included). Major structural issues or foundation repairs? A big nope. They suck up cash and time like a fiscal black hole.

Renovation Budgets That Actually Work

Here’s the skinny on rehab budgets: cap it at 20-25% of what you paid for the place. That’s your ticket to keeping a nice profit cushion. Kitchens and bathrooms? Gold mines. They bump up property value by a cool 15-20% if you do it right. Always, and I mean always, stash away a 15% contingency cushion – because surprises (like a sewer line nightmare costing $8-12k) will sneak up on you.

Wrap up your renovations in 60-90 days – or else kiss goodbye profits with carrying costs of around $800-1,200 monthly (including all those lovely taxes, insurance, and loan payments). The longer it lingers, the longer you’re stuck in investing purgatory.

Refinance Timing and Lender Selection

Refinancing – the fine art of timing. Seasoning periods vary depending on the lender – some say cash-out now, others make you sweat it out for six months. Portfolio lenders are your ride-or-die partners in crime with 75-80% loan-to-value ratios for rentals.

Zero in on markets with rental mojo – places where properties get snatched up within 30 days post-renovation. If it gathers moss, your cash flow does a nosedive and your investment timeline gets derailed. Nail the refinance, and you’re set to rinse and repeat the BRRRR method. Picking the right lender and market is like setting the stage for your next blockbuster deal.

What Derails BRRRR Deals and How to Fix Them

Let’s talk about the chaos-BRRRR deals face roadblocks that vaporize your profits faster than you can say refinance. Here’s the scoop: Hard money lenders slam the brakes when your credit score dips below 680, and portfolio lenders demand 6-month holding periods that essentially put your funds in a deep freeze. The hack? Pre-load your arsenal with a lineup of lenders before you buy. Community banks outmaneuver giant institutions with their flexible terms, and credit unions woo you with portfolio loans at rates a sweet 0.5-1% lower than the usual culprits. Private money lenders? Sure, they slap you with 8-12%, but they sprint-worth it when speed outruns savings.

Renovation Nightmares That Destroy Margins

Here’s where dreams-correction, margins-go to die. Cost overruns? They’re your real estate deal’s bête noire. An electrical revamp mushrooms from $3,000 to a shocking $15,000 when ancient wires betray you at inspection time. Foundation headaches? They sip $25,000 from your wallet-basically, a financial black hole. The savvy investor keeps rehab costs capped at $25,000 per property and smartly evades anything demanding structural TLC. Get three contractor quotes, and here’s the kicker-jack up your contingency to 25%, not your run-of-the-mill 10%. Properties built pre-1980? They’re Pandora’s box with asbestos, lead paint, and sneaky foundation problems lurking inside.

Delays-the sneaky expense multipliers. Every unsolicited month devours $1,200 in excess costs while your investment snoozes. Contractors assure you of a 60-day wrap-up but forget to mention-surprise!-the actual timeline stretches to 120 days minus penalties. Insert buffer times into your plan and slap down delay penalties to keep things on the rails.

Market Shifts That Trap Capital

Valuations dance all over the place, and bad timing rusts your investment wheels for good. ARV guesstimates misfire when investors cling to peak sales instead of what recent comps whisper-overestimates jam your refinance gears. Markets-ever the fickle beast-shift during rehab seasons, drowning you under refinance woes.

The lighthouse? Lean towards the lowest reasonable comps, dodge the highest, and aim for properties where your all-in costs tap out at 65% of ARV instead of the conventional 70%. This cushion catches you from appraisal downslope and market tremors that maroon your capital. Homes nestled in rising neighborhoods? They’re your flotation devices when temporary value declines try to pull you under.

Final Thoughts

The BRRRR method – it’s changing the game. This real estate strategy isn’t just a flash in the pan; it’s about recycling capital and systematically racking up those properties. But here’s the kicker – it all hinges on three things: keeping those costs below 65% of ARV, nailing down solid contractor networks, and buddying up with a few lenders before you jump in. And guess what? Local banks and credit unions… they usually cut you some sweeter deals than those big-name banks for refinancing.

Diving into your first BRRRR gig? You better have $50K-75K ready to play with and a credit score north of 720. Target those diamonds in the rough priced at $100K-$200K in decent rental markets and keep your fix-up costs under $25K. Expect each loop to last 6-12 months, but play the long game, folks. People doubling down on this can zoom from one to 10-15 properties in five years – using the same starting pot of money (as long as you stick to tight ARV estimates and budget like a hawk).

We’re here at Top Wealth Guide to guide you through the maze of investment strategies with top-tier market analysis. Swing by Top Wealth Guide for nifty calculators and guides that turn those lofty financial dreams into reality. The secret sauce? Conservative estimates, tight budgets, and nailing the local market vibes.