The old-school 60/40 stock-bond portfolio? Yeah, it tanked 16% in ’22. So, the age-old wisdom of spreading your chips between stocks and bonds? It’s not cutting it anymore. Your traditional diversification — supposedly your safety net — now looks more like a tired story of yesteryear.

Enter us, Top Wealth Guide. (Okay, here’s the deal.) Smart investors, the ones who actually get it, are looking past just stocks and bonds. It’s time to get creative, people. Real estate, commodities, and all those sexy alternative investments? They’re your new BFFs against the financial mood swings and crazy inflation.

This guide? It’s your new roadmap. We’re spilling the secrets on all those tried-and-true alternatives, the ones the big players have been doubling down on for decades.

In This Guide

Why Traditional Portfolios Need Alternative Investments

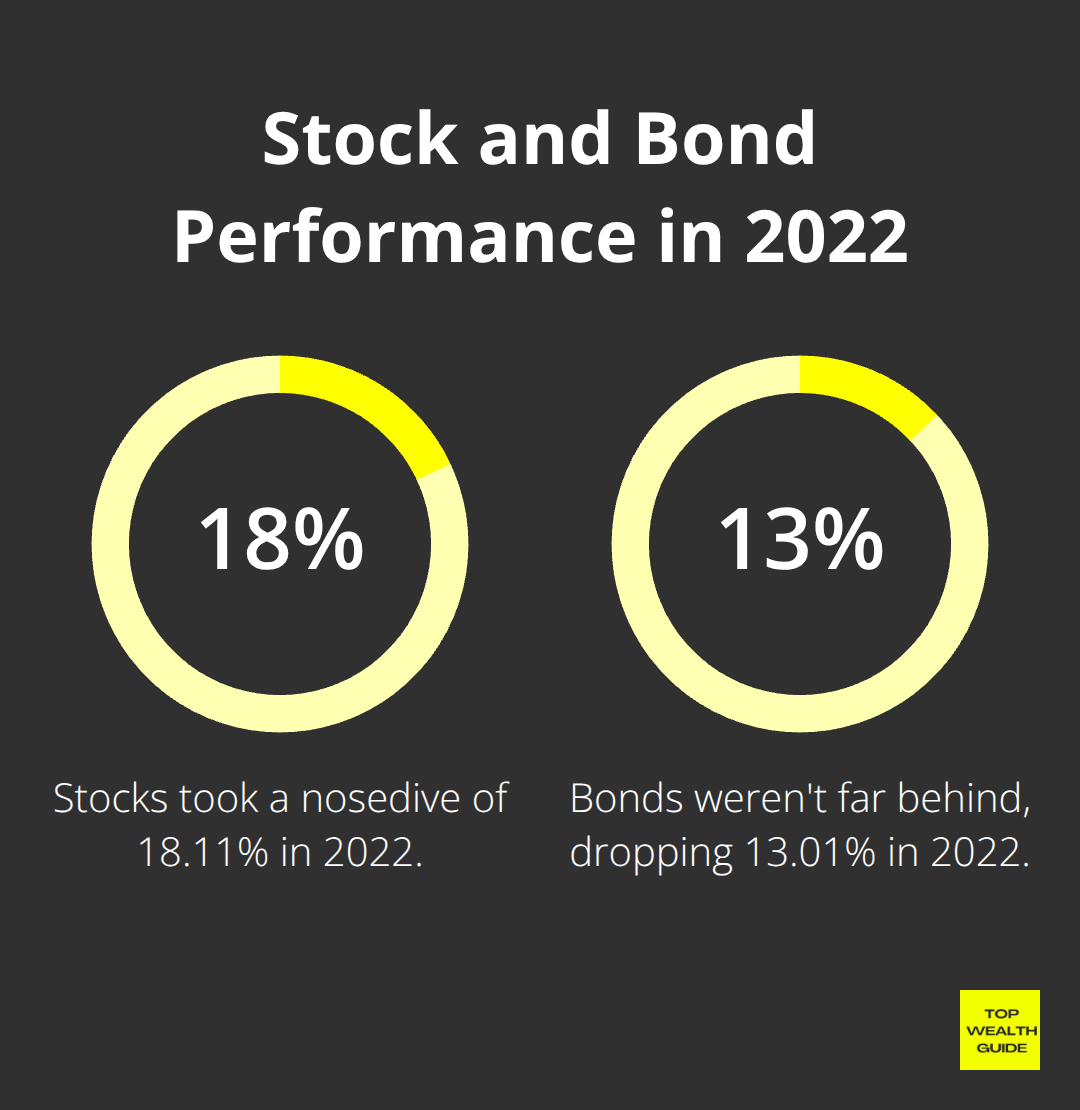

Here’s the scoop – the data isn’t sugarcoating anything. In 2022, when stocks took a nosedive of 18.11%, bonds weren’t far behind, dropping 13.01% (thanks, Morningstar). This double whammy highlighted a glaring issue with the time-honored approach of diversification – stocks and bonds are now like synchronized swimmers in a storm, moving together when things get rough. The correlation between the S&P 500 and 10-year Treasury bonds hit a fever pitch during the 2022 plunge, going bananas compared to what history usually shows us. Your so-called safety net? Yeah, it turned into a coordinated crash landing.

When Everything Falls Together

Since 2008, the Federal Reserve’s quantitative easing shenanigans have flipped the asset script. So now, stocks and bonds are like drama twins, reacting the same way to changes in interest rates and inflation panic. Flashback to March 2020 – even top-tier corporate bonds crumbled 13.6% while stocks fell off a cliff, down 34%. Classic diversification? Poof, gone when investors really needed a lifeline. The 2022 mess was the first instance in decades – since 1977, to be precise – where both stocks and bonds ended the year in the red simultaneously.

The Inflation Reality Check

In 2022, inflation strutted in at a cool 6.5%, while the 10-year Treasury had a lukewarm showing with a yield of just 3.88% for most of the year. That negative real return was like a silent wealth bulldozer. Stock dividends? Averaged out at 1.8% – not exactly keeping up. But wow, look at real assets – commodities shot up 16.1%, and real estate investment trusts basked in a 25.3% gain during the same time. The takeaway? Traditional assets are about as effective at guarding wealth during currency value meltdowns as a leaky umbrella in a monsoon.

The Shrinking Public Market Problem

Over the last 25 years, the number of publicly traded companies has shrunk by more than 40%, says the World Bank. This contraction means investors are squabbling over scraps, with fewer public investments driving up market valuations and dragging down returns. Meanwhile, private markets, sitting on trillions, are where all the cool kids are trading these days – once public domain, now exclusive. The sharp players have already cut loose from the old-school portfolio restrictions.

The lifeline? It’s the assets doing their own thing, not keeping in step with stocks and bonds. Alternative investments? They offer the sort of freedom your portfolio is crying out for. Spreading your wealth across different asset types is the secret sauce for managing risk and smoothing out the roller-coaster ride.

Alternative Investment Options Worth Considering

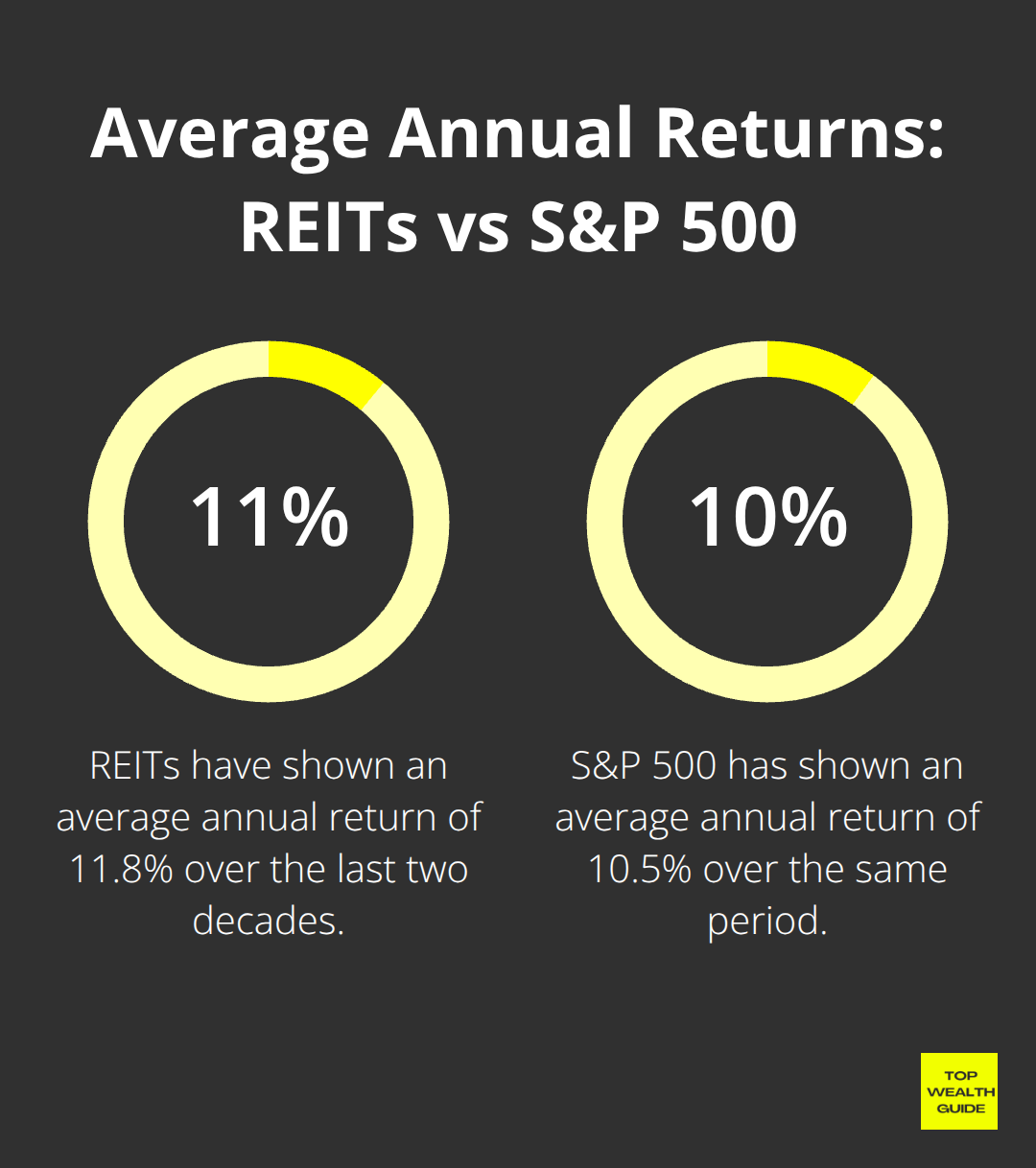

So, here we go-real estate investment trusts (yeah, those REITs everyone talks about) have been sitting pretty with an average annual return of 11.8% over the last two decades. Nareit data, folks, showing up the S&P 500’s 10.5%.

Some REITs, like the stalwart Realty Income Corporation, have this killer track record of dividends… proving they’re no fluke. Then there’s direct property ownership-more control, more gains. Think Austin, Nashville, rental properties pulling 15-20% from 2019-2023. Sprinkle in some rental income and appreciation, and it’s a cash cow. House hacking, anyone? Live in one unit, rent out the others… suddenly you’re covering 70-80% of that mortgage. Brilliant, right?

Commodities Beat Inflation Every Time

When inflation raged in 2021-2022, commodities-oh, they didn’t just stand there. They clobbered traditional assets. Oil futures up 103% in 2021, copper jumped 26%, and wheat, well, it just rocketed 80%. And then there’s gold-steady Eddie with 7.8% annual returns since Nixon pulled the gold standard plug in ’71, a real inflation bulwark. Agricultural commodities? Through ETFs like DBA, beating bonds by 3.2% annually this past decade. Timing’s the name of the game; commodity cycles have legs-15-20 years of them. And guess what? We’re just cracking open a new supercycle fueled by all that supply chain hullabaloo and green energy buzz.

Private Markets Dominate Returns

Let’s chat private equity-what a journey. Cambridge Associates rolls out the red carpet with data showing these returns aren’t a fluke. Then, venture capital steps in… top quartile funds, 25% annual returns during that wild 2010s tech ride. Want in? Most funds start at $250,000, but with platforms like EquityZen and Forge, pre-IPO company shares are your oyster for just $10,000. And don’t overlook private credit funds; talking 12-15% yields (public bonds, eat your heart out). Liquidity’s the trade-off-brace for 7-10 year lock-ups. But with returns this juicy, patience isn’t just a virtue, it’s a game plan.

Digital Assets Enter the Mix

Enter Bitcoin… cue the fireworks. 160% average annual returns over the last decade, even with volatility knocking around. Ethereum? How does 1,300% from 2020 to 2021 sound? Sure, there’s the crypto winter, but these digital assets… they’ve got zero traditional market ties most of the time. Bitcoin even soared 300% during the March 2020 stock plunge. With cryptocurrency ETFs like GBTC and those slick spot Bitcoin ETFs rolling out, you get regulated exposure minus the direct wallet headache. Highly speculative, yes. But a cheeky 1-5% allocation? That’s some serious diversification fun.

And don’t forget the real estate investment apps making property investment as easy as pie… fractional ownership starting at $100. They handle property management, tenant screening, and maintenance-dividends delivered monthly. Crack this puzzle and you’ve got investment strategies that mesh well with your risk tolerance and timeline. Time to put it all into action.

Building Your Diversified Investment Strategy

So, the old 60/40 portfolio? Yeah, toast. What now? Enter the 40/30/20/10 model – 40% stocks, 30% bonds, 20% real estate, and 10% alternatives.

Yale’s endowment fund – pioneers of this smart move – left traditional portfolios in the dust. If you wanna spice it up, there’s the 30/30/20/20 split. That’s your balanced diet of stocks, bonds, real estate, and alternatives. And guess what? Vanguard says more diversity equals less volatility. Young and bold? Push alternatives to 30% and slash bonds to 10%. Your magic number? Keep portfolio correlation under 0.7 across major assets.

Asset Allocation Models Beyond 60/40

Need flexibility for today’s market? Check this – the 50/25/15/10 breakdown for the cautious folks: 50% stocks, 25% bonds, 15% REITs, and 10% commodities. Less volatility, great returns. Growth junkies, go for the 45/15/25/15 combo (stocks, bonds, real estate, alternatives). BlackRock backs it up: smart allocation equals long-term gains and less pain when things drop.

Risk Assessment and Investment Timeline

Here’s a nugget: age subtracted from 100? That’s your alternatives percentage. A 35-year-old? 35% alternatives, no ifs, ands, or buts. Retirement accounts? Stick to liquid stuff, like REITs and commodity ETFs. Taxable accounts? Go for the big guns – private equity and direct real estate. Folks with a 10-year-plus view who lean heavy on alternatives usually crush standard portfolios. And rebalancing sweet spot? Every six months or when anything veers 5% off target.

Performance Monitoring Systems

Three metrics, once a month – total return, Sharpe ratio, maximum drawdown. Your diversified mix should avoid over 15% drawdown in any year. Use portfolio tracking like Personal Capital or Morningstar’s X-Ray to catch drifts. If stock-bond correlation hits 0.5+, crank up alternatives fast. Auto rebalance kicks in when REITs beat stocks by 10%+ – sell 25% of those REIT wins and scoop up lagging assets.

Rebalancing Frequency and Triggers

Quarterly tweaks? Nah, they’re draining with costs and bad timing. Semi-annual is the name of the game, unless the market dives (remember March 2020?). Set robotic rules – move when any asset is 7% off target. This method ditches emotions and nails mean reversion wins that active managers miss. High volatility times? Peep monthly, but stick with that six-month rebalancing plan.

Final Thoughts

So, we’re staring down the barrel of a post-2022 world where just tossing your cash into stocks and bonds (like it’s 1999) doesn’t cut it anymore. The once-touted 60/40 portfolio? Yeah, it got a reality check. Enter the, ahem, alternatives. REITs? They’ve been serving a healthy 11.8% annual return over twenty years. Commodities? Yep, they laughed at inflation and posted triple-digit wins. And private equity funds? Averaging 25% in the go-go 2010s tech era. Alternatives aren’t just a trend, they’re the life raft when the traditional ship’s sinking.

Starting out, maybe set aside 10% of your stash for alternatives and pop open some REIT positions right from your brokerage account. Toss in some commodity ETFs like DBA if you’re feeling the agricultural vibe. And for the bold ones, platforms like EquityZen grant access to the private market (if you’ve got a cool $10,000 minimum to play with). As you get comfy with alternatives, maybe nudge that allocation to 20-30%, and remember to think long-beyond five years.

Look, Yale’s endowment model isn’t just flexing ivory tower muscles; it’s proving that when individuals echo institutional moves, magic happens. Alternatives? They bring lower volatility and boost risk-adjusted returns more than the plain-vanilla stock-bond duo. Over at Top Wealth Guide, we’ve got the practical tools and market insights ready for you. Let’s build some serious wealth with smart diversification strategies that actually work.

![Investment Diversification Beyond Stocks and Bonds [Guide] Investment Diversification Beyond Stocks and Bonds [Guide]](https://topwealthguide.com/wp-content/uploads/emplibot/investment-diversification-hero-1760145236-1024x585.jpeg)