Have you ever been staring at a financial report, a spreadsheet, or even a chart and seen the number '000'? It can be a little confusing at first, but it's usually just a simple, space-saving trick. In the world of finance, '000' is common shorthand for "add three zeros." So, a number like $500 on a report suddenly becomes $500,000.

It's a powerful way to make massive, complex documents easier to read and digest.

In This Guide

- 1 Decoding the Meaning Behind 000

- 2 Reading Large Numbers in Finance and Investing

- 3 How Accountants Use 000 in Daily Practice

- 4 Avoiding Common 000 Mistakes in Spreadsheets

- 5 000 Beyond Finance: Other Meanings and Uses

- 6 Frequently Asked Questions About '000'

- 6.1 1. Why do financial reports use '000' instead of writing out full numbers?

- 6.2 2. If a report shows $5,000 in thousands, what's the real number?

- 6.3 3. Does '000' always mean thousands?

- 6.4 4. How can I avoid making mistakes with '000' in Excel?

- 6.5 5. Is it a red flag if an accountant uses '000'?

- 6.6 6. Why would '000' show up on my bank statement?

- 6.7 7. Does '000' affect a company's stock price?

- 6.8 8. How is '000' used in government and economic reports?

- 6.9 9. What is a "triple-zero" flour?

- 6.10 10. Are '000' and a single '0' interchangeable?

Decoding the Meaning Behind 000

Think of '000' as a tool for efficiency. It’s a way for professionals to communicate huge numbers without cluttering up a page, which helps prevent data entry mistakes and keeps dense reports scannable. While you’ll see it most often in finance to represent thousands, the real meaning always boils down to context.

Getting comfortable with this little symbol is a surprisingly important step in boosting your financial literacy. It’s like learning a new word in the language of money. For instance, an accountant might use it as a placeholder for a figure they're still waiting on. A programmer, on the other hand, might see it as a default value in a piece of software. We'll break down these different uses with real-world examples.

Why This Symbol Matters

The whole idea behind '000' is only possible because of the invention of zero itself—a massive mathematical breakthrough. The concept traveled from ancient India to Europe centuries later, eventually replacing clunky systems like Roman numerals. That one innovation paved the way for the kind of complex calculations that make modern finance work.

Understanding how pros use numerical shorthand is a must for anyone serious about making informed decisions and building wealth. When you interpret these symbols correctly, you can accurately gauge a company's health, manage your own budget, and avoid some pretty expensive misunderstandings.

Mastering these small details really does give you an edge.

Reading Large Numbers in Finance and Investing

When you dive into the world of finance, you quickly realize that professionals have a kind of shorthand for dealing with massive numbers. Clarity is king, and wading through endless zeros isn't just tedious—it’s a recipe for mistakes. That’s why 000 is so common; it’s a quick, clean way to say "thousands."

It works just like the letter "K" in everyday language. If you see an ad for a job paying $80K, you instantly know it means $80,000. The financial world applies the same logic. On annual reports, press releases, or market data tables, look for a small note at the top or bottom that says "(in thousands)" or "(000s omitted)." That little phrase is your signal to mentally tack three zeros onto every number you see.

Real-Life Example: Analyzing a Company Report

Let's make this real. Imagine you're scanning a tech company's quarterly income statement. You see a line item for "Net Revenue" reported as $250,000. If you miss the small footnote at the bottom of the page that reads "All figures in thousands USD", you might think it's a small startup.

But with that context, the picture changes completely. You add three zeros, and $250,000 suddenly becomes $250,000,000. Fifty million dollars. This simple abbreviation saves space on the page and dramatically cuts down on the risk of typos from typing long strings of digits. It lets analysts and investors scan and compare financials in a heartbeat.

Key Takeaway: Always, always check the footnotes and headings on financial documents. A tiny disclaimer like "(amounts in thousands)" can shift your understanding of a company's health by a factor of 1,000.

Overlooking this detail can lead to a spectacular miscalculation. You might dismiss a company as a small-cap stock when it’s actually a multi-billion dollar giant. This is a fundamental skill, especially when you calculate net worth or size up a potential investment.

Comparison Table: Abbreviated vs. Full Financial Figures

The best way to let this sink in is to see the numbers side-by-side. The table below shows just how different the abbreviated figure is from its true value. It’s a stark reminder to always look for that "(in thousands)" note.

| Abbreviated Figure (in thousands) | Full Numerical Value | What It Represents |

|---|---|---|

| $1,500 | $1,500,000 | 1.5 Million Dollars |

| $250,000 | $250,000,000 | 250 Million Dollars |

| $1,000,000 | $1,000,000,000 | 1 Billion Dollars |

The difference is staggering, isn't it? A figure like "$1,500" might look like pocket change at first glance, but in this context, it represents well over a million dollars. This isn't some obscure practice; it's standard operating procedure on trading platforms, market data feeds, and corporate filings. For any serious investor, being vigilant about this one detail is non-negotiable.

How Accountants Use 000 in Daily Practice

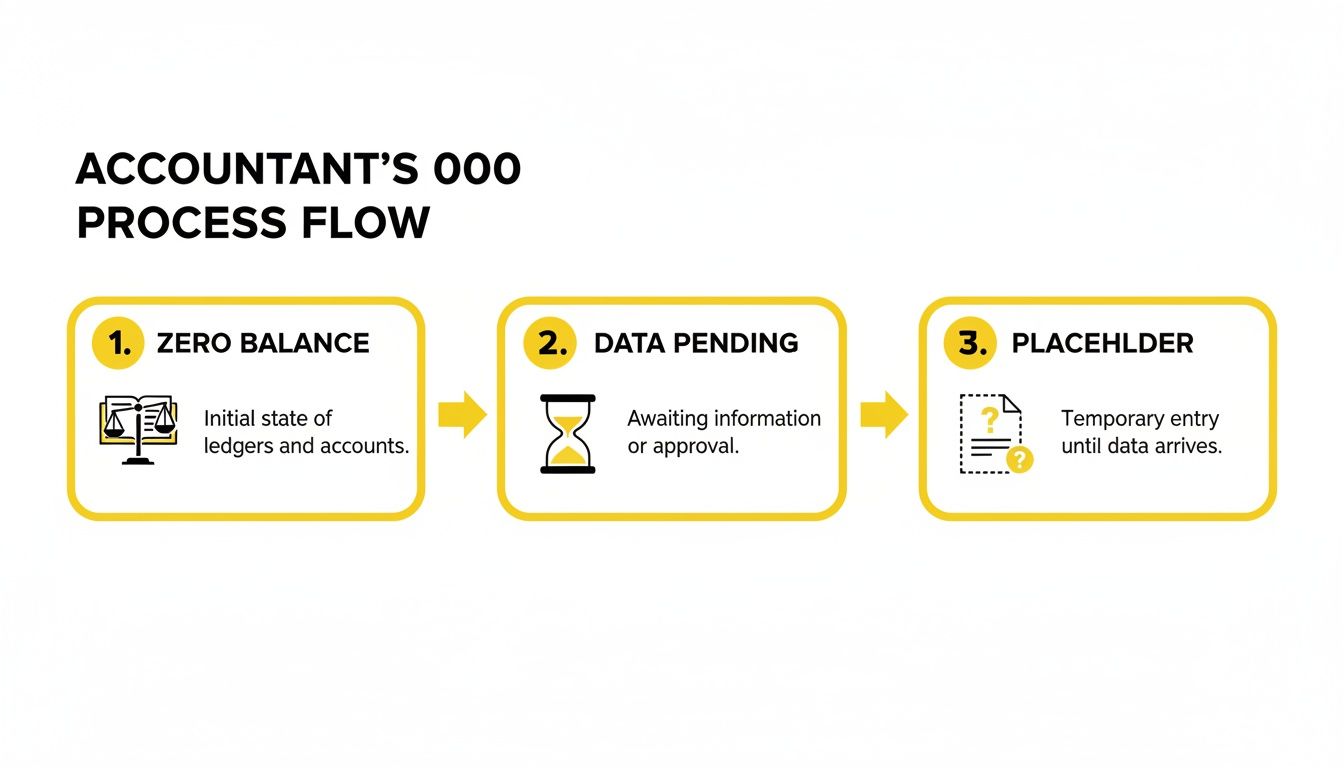

Beyond just being a handy shortcut in big-picture financial reports, the "000" notation plays a much more practical, hands-on role in the daily grind of accounting. For the bookkeepers and accountants in the trenches, these three zeros aren't about saving space; they're about maintaining control and accuracy. Think of them as intentional placeholders that reinforce the integrity of financial records and help head off expensive mistakes.

It’s really a deliberate signal. Instead of leaving a field blank—which could easily be mistaken for an oversight or just missing data—an accountant might enter '000'. This is a clear, unambiguous way of saying a value has been checked and is confirmed to be zero, or that a field is being intentionally left empty until more information comes in.

The Role of Placeholders in Accuracy

In the world of accounting software and spreadsheets, every single cell matters. Using '000' helps accountants create a clear distinction between different kinds of "zero." A single '0' might simply mean a confirmed zero balance, but '000' can be an internal code, a flag that says "this entry needs another look later."

This level of detail is absolutely critical when you learn how to analyze financial statements, because the quality of that raw data is everything. A simple placeholder can stop a formula from breaking or ensure an automated report runs smoothly without flagging a bunch of false errors for empty cells.

Expert Insight: During a complex audit, a '000' entry is a clear communication tool. It tells the next person who looks at the books, "I've reviewed this line item, and the value is either zero for now or is awaiting final figures." A blank cell, on the other hand, just creates questions and uncertainty.

This practice instills a vital discipline in bookkeeping. It forces a decision for every line item in a general ledger or trial balance, leaving no room for the kind of ambiguity that can turn into a major headache during month-end reconciliation.

Comparison Table: Interpreting Zeros in Accounting Documents

To really get bookkeeping right, you have to understand the subtle language of zeros. A simple dash, a single zero, or the '000' symbol can each carry a distinct meaning based on the accounting system or a company’s own internal rules. The context is what tells you what to do next.

| Symbol / Notation | Common Meaning in Accounting | Real-Life Scenario | Action Required |

|---|---|---|---|

| 0 | Confirmed Zero Balance | An invoice has been paid in full, leaving the accounts receivable balance at exactly zero. | None. The account is settled and requires no further action at this time. |

| – (Dash) | Not Applicable | A sales tax line item on an invoice for a tax-exempt organization. | Verify that the item is correctly marked as not applicable and document the reason. |

| 000 | Pending or Placeholder Value | A budget line for a project expense that has been approved but not yet incurred. | Monitor the entry and update it with the actual figure once the transaction is finalized. |

| Blank Cell | Missing or Unverified Data | An entry in a ledger that was overlooked during data input from source documents. | Investigate immediately to find the correct value and prevent errors in financial totals. |

As you can see, what might look like a simple zero can have several different interpretations. Knowing the difference between a settled account and missing data is fundamental to keeping accurate and reliable books.

Avoiding Common 000 Mistakes in Spreadsheets

A tiny formatting error in a spreadsheet can spiral into a massive financial headache. A modest budget item can look like a colossal expense, or worse, a huge liability can appear deceptively small. More often than not, these blunders come down to how "000" is handled, especially in programs like Microsoft Excel or Google Sheets.

The root of the problem is that these tools let you change how a number looks without changing its actual value. You can set a cell to display numbers "in thousands," which handily lops off the last three zeros. For instance, the number 500,000 might be formatted to display as just 500. If you're not paying close attention, you can see how this leads to serious miscalculations.

Real-Life Example: How Hidden Zeros Cause Errors

Let’s walk through a common scenario. An analyst is building a financial model for a client. They copy a revenue figure from a report that shows $1,500. Without thinking twice, they plug that number into their projection formulas. But here’s the catch: the original cell was formatted to display in thousands, and the real value stored in that cell is $1,500,000. Suddenly, every single calculation that pulls from that cell—from profit margins to growth rates—is off by a factor of a thousand. The final report is completely wrong, leading to flawed investment advice.

In professional accounting, using 000 is often a deliberate choice—a placeholder to maintain data integrity and prevent ambiguity. It's a controlled process, not an accident.

This intentional use of placeholders is the complete opposite of the accidental errors that trip up so many people.

To stay out of this trap, you just need a few good habits. First, always click on an important cell and glance up at the formula bar. The formula bar is your source of truth; it shows the raw, unformatted number, giving you an instant reality check.

Second, be extra careful when you copy and paste data from other places. Formatting often tags along for the ride. The best way to combat this is by using the "Paste Special > Values" command. This simple step strips away all the fancy formatting and gives you just the pure, unadulterated numbers. That kind of diligence is critical, especially when you're projecting long-term growth with a tool like our compound interest calculator.

A Quick Troubleshooting Guide

Think your spreadsheet numbers are lying to you? Run through this quick checklist to hunt down the problem:

- Check the Formula Bar: Does the number in the formula bar match what you see in the cell? If not, you've found your culprit.

- Review Cell Formatting: Right-click the cell, select "Format Cells," and check the "Number" tab. See if a custom format is hiding the real value.

- Test with a Simple Formula: In a new, blank cell, just type

=and then click on the cell you're suspicious of (e.g.,=A1). The result it spits out will be the cell's true value.

By making these quick checks part of your routine, you can make sure your spreadsheets are a source of clarity, not a minefield of costly mistakes.

000 Beyond Finance: Other Meanings and Uses

While the number "000" is a familiar shorthand in finance, its meaning isn't always about money. Step outside the world of balance sheets, and those three zeros take on entirely different roles. In technology, manufacturing, and online retail, "000" often acts as a placeholder, a test signal, or even a blank slate.

Knowing how to read this symbol in different contexts is key. It’s the difference between seeing a thousand dollars and seeing a system reset. For instance, a brand-new user account in a database might start with the ID ‘000’. This isn't a number with value; it's a flag for administrators, telling them the profile is fresh and needs to be fully configured. This kind of nuanced data interpretation is important, whether you're managing a server or learning to define wealth beyond money and possessions.

Real-Life Examples: Technical and Commercial Meanings

Ever spotted an order with the transaction ID #000 in an e-commerce backend? That’s not a real sale. It’s almost always a test purchase made by a developer or a voided transaction that never went through. This clever trick keeps test data from polluting actual sales reports and lets programmers check out the payment system without moving real money.

You’ll see a similar idea at play in manufacturing. A production run labeled 'Batch 000' is likely a pilot batch—the very first units off the line. These products are earmarked for quality control and testing before the factory goes into full swing, ensuring they don't get mixed in with inventory headed for store shelves.

Real-World Application: When a software system crashes hard and can't recover, it might spit out an error log with the code '000'. This often points to a 'null' state or a forced reset, signaling to a technician that the system essentially wiped the slate clean and went back to its most basic starting point.

Comparison Table: 000 Across Different Fields

The context is everything. What means "thousands" in a financial statement might mean "start over" in a technical log. To clear things up, this table shows just how much the meaning of "000" can change from one industry to the next.

| Field | Primary Interpretation of 000 | Real-World Example |

|---|---|---|

| Finance | A shorthand for "thousands" to simplify large numbers. | A company report shows revenue of $250,000 (in thousands), meaning the actual figure is $250,000,000. |

| Technology | A default value, system reset code, or placeholder. | A new user is assigned a temporary profile ID of user_000 until their registration is complete. |

| E-Commerce | A test transaction or a voided, incomplete order. | A developer runs a test purchase that generates Order ID #000 in the sales dashboard. |

| Manufacturing | A pre-production or quality control batch number. | The first batch of a new product is labeled LOT-000 for internal testing and review purposes. |

By understanding these different uses, you can accurately read the story behind the numbers, whether you're looking at a company's P&L, fixing a software bug, or checking on a factory's inventory.

Frequently Asked Questions About '000'

1. Why do financial reports use '000' instead of writing out full numbers?

It all comes down to readability and space. Writing out every digit for figures in the millions or billions would create a cluttered, hard-to-read document. Using '000' shorthand makes reports cleaner, easier to scan, and reduces the risk of data entry or interpretation errors.

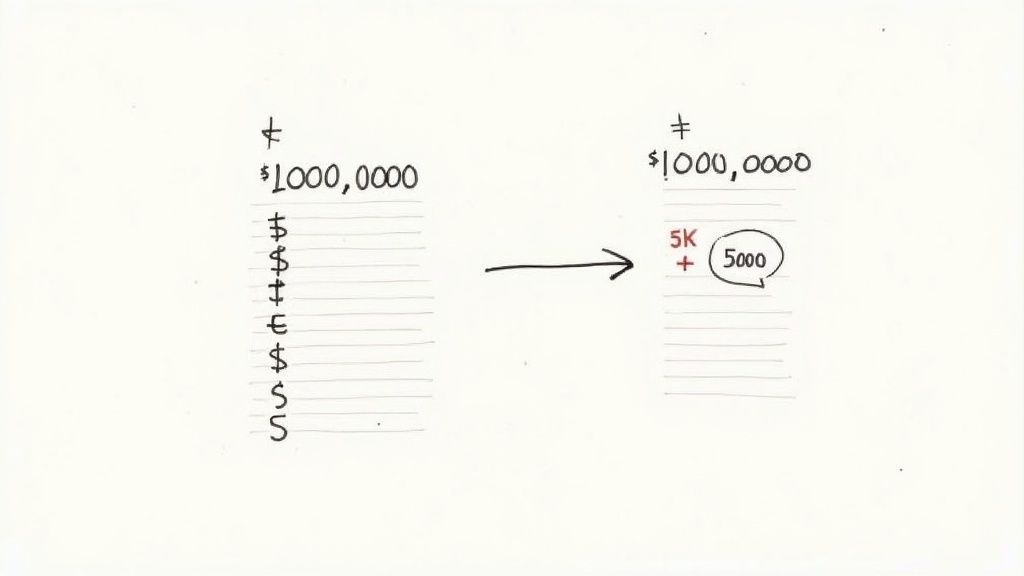

2. If a report shows $5,000 in thousands, what's the real number?

The actual number is $5,000,000. The note "(in thousands)" is your instruction to multiply the number by 1,000. Simply add three zeros to the end: $5,000 becomes $5,000,000.

3. Does '000' always mean thousands?

No. While "thousands" is its most common meaning in finance, the context is critical. In accounting, it can be a placeholder for pending data. In technology, it might be a default value or reset code. In e-commerce, Order ID #000 is often a test transaction.

4. How can I avoid making mistakes with '000' in Excel?

The best defense is to always check the formula bar. The formula bar at the top of the spreadsheet shows the true, raw value of a cell, ignoring any display formatting. Also, when pasting data, use "Paste Special > Values" to strip away any formatting that might hide the real numbers.

5. Is it a red flag if an accountant uses '000'?

No, it's usually a sign of good practice. An intentional '000' entry is a clear signal that a line item has been reviewed and is either awaiting a final figure or has a confirmed zero value. It's much better than a blank cell, which is ambiguous.

6. Why would '000' show up on my bank statement?

On a bank statement, '000' might appear as part of a reference or transaction ID for a voided purchase, a fee reversal, or a temporary authorization hold that was released. If you're unsure, it's always best to contact your bank for clarification.

7. Does '000' affect a company's stock price?

Directly, no. Indirectly, a misunderstanding of it certainly can. If an investor mistakenly reads a company's revenue as $200,000 instead of the actual $200,000,000, they will dramatically undervalue the company, potentially leading to a poor investment decision.

8. How is '000' used in government and economic reports?

Government agencies use it for the same reason corporations do: to manage enormous numbers. Reports on national debt, GDP, or agency budgets often present figures "(in thousands)," "(in millions)," or even "(in billions)" to make the data comprehensible.

9. What is a "triple-zero" flour?

Unrelated to finance, "triple-zero" (000) flour is a term used in some countries, particularly in South America, to grade flour. It refers to a highly refined, finely milled white flour with a specific protein content, ideal for making bread. It's a great example of how context defines the meaning of '000'.

10. Are '000' and a single '0' interchangeable?

No, they are not. In accounting, a single '0' typically represents a confirmed, final value of zero. In contrast, '000' is often used as a placeholder, a signal that data is pending, or an intentional marker for an item that is currently zero but might change.

This article is for educational purposes only and is not financial or investment advice. Consult a professional before making financial decisions.

Ready to take control of your financial future? At Top Wealth Guide, we provide the expert insights and practical strategies you need to build lasting wealth. Explore our articles and resources today!